For beginners interested in automating forex trades, the MetaTrader 4 (MT4) platform is an excellent place to start. MT4 is a user-friendly and widely used trading platform that traders can access on desktop, web, and mobile devices.

This guide walks traders through the basics of MT4 trading, from setting up an account to executing the first trade.

What is MetaTrader 4?

MetaTrader 4, often shortened as MT4, is a widely used online trading platform for forex traders to place orders with brokers. MetaQuotes Corporation released MT4 in 2005.

The platform is popular primarily because of the features it offers, including the ability to trade forex, as well as contracts for difference (CFDs) on indices, shares, bonds, commodities, and cryptocurrencies.

Additionally, the platform has its own in-built scripting language, MQL4, with which users can create custom indicators and Expert Advisors (EAs). An EA is a program designed to automate online trading, such as forex trading. It monitors the market and signals the trader upon identifying trading opportunities based on set conditions.

Another selling point of MT4 trader is that it is compatible with different operating systems, including Windows, Mac, and Linux. This makes it accessible to a wide range of users. MetaTrader 4 has numerous benefits to it, including:

- Trade currencies and CFDs on indexes, securities, and cryptocurrencies

- Create custom indicators and EAs

- A neat and uncluttered user interface, making it easy to navigate

- Advanced charting tools

- Web and mobile app to access allows users to trade on the go

How to use MetaTrader 4

Downloading MT4

You cannot trade forex markets with MetaTrader 4 directly. You need to have an account with a forex broker to trade with MetaTrader 4.

That is why, once the trader has decided to use MT4, the first step is registering with a forex broker offering access to the MT4 platform. The following steps mirror the process a trader will undergo to register and download the trading software onto their computer:

Step 1: Choose a forex broker. At the minimum, the trader should ensure the broker offers the MT4 trading platform, has a reasonable and competitive fee structure, complies with

regulations, has responsive customer support, and offers sufficient trading instruments.

Step 2: Choose the type of account to open and register.

Step 3: Download the MT4 setup file or access it through a web browser

Installing MT4

The trader can now install the software after a successful download. For Windows PC users, the installation involves opening the executable file downloaded from the broker's website.

For installing on MacOS or Linux, the process will be similar. You will just have to download the respective installation files.

For Android users, download the MetaTrader 4 app directly through Google Play Store. Click the Install button; that is all; the software is on the device.

Creating an account on MT4

It is worth noting that traders cannot open MetaTrader 4 live trading accounts from the platform directly. Instead, one should register with the broker of choice on the broker’s website.

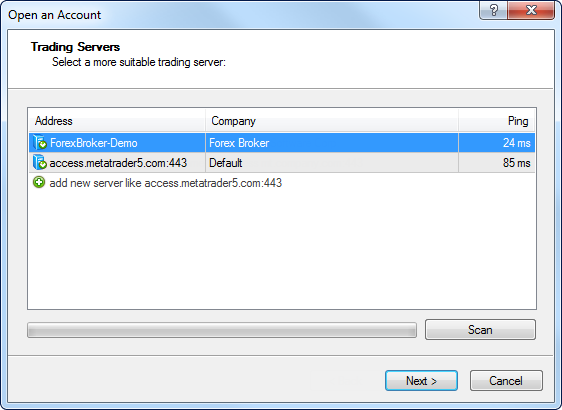

Though the traders can open demo accounts through the terminal. All they have to do is select the demo server, provide the required details if there is already an existing account, or create one.

To connect to the live server, the trader must provide the MT4 login details specified when opening the live trading account.

Source: MetaTrader 4 Help

Step-by-step guide for trading on MetaTrader 4

Step 1: Choose a currency pair

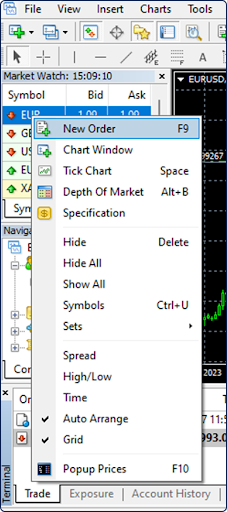

Traders can find the currency pairs available for trading on the extreme left of the trading platform under the Market Watch tab. Right-click on the currency pair and select New Order.

Alternatively, the trader can also use the dedicated New Order tab at the top section of the platform.

Step 2: Open a trade position

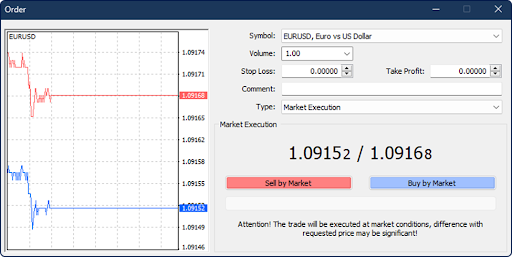

If one uses a demo account, clicking the New Order button will open another window. Here, the trader will specify the volume, which for many brokers ranges from 0.01 to 8.00 – but typically, the default value is 1.00. The trader will also specify the order type, market execution, or pending order.

A broker typically executes the market order quickly against the provided price. On the other hand, the broker executes the pending order at a later time at the price the trader specifies. With everything done, click the Sell by Market to open a sell position and Buy by Market to open a buy position. The broker will then confirm the order execution, and the trader can print this information for record-keeping or just save it online.

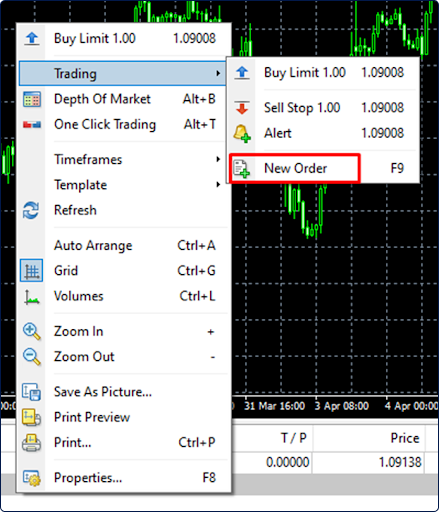

For a live account, one must first fund their trading account's wallet. Then, back to MT4, the trader must log in to the live trading account → right-click anywhere on the screen → click on the Trading tab→ then select New Order.

Alternatively, one could press F9 on their keyboard, and a trading window will open. The trading window is similar, as explained previously, and the process is the same.

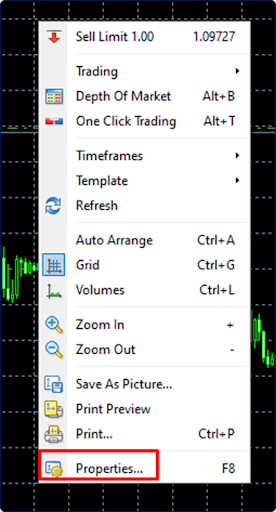

While here, traders can also customize the MT4 interface to suit their preferences. For example, one could remove the grid and change the color of the candles. To do this, right-click anywhere in the chart and open Properties.

Step 3: Modify an open position

When one opens a position with a live account, it is important to protect themselves against risk. It means modifying the open position: place a stop-loss order for a sell position and a take-profit order for a buy position. Before submitting the order, the trader must specify the stop-loss/take-profit values.

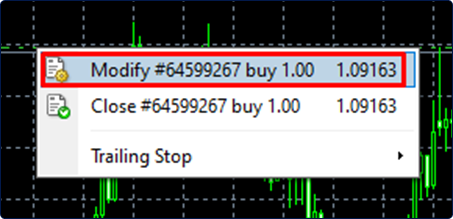

Alternatively, one can right-click on the open position in the chart and click Modify #… to perform the modifications. While here, traders may also want to modify MT4 trading strategies in case of material changes that may affect how well the initial strategy performs.

Step 4: Close a trade position

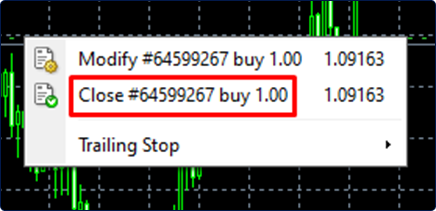

Open positions can close either automatically (on the activation of stop-loss/take-profit price level) or manually by the trader. Right-click on the open position and select Close #… to close manually. Traders can also set up expert advisors (EAs) to close positions automatically under specified conditions.

Top features of MetaTrader 4

The following are MT4's main features:

Built-in and custom indicators

MT4 has over 30 built-in technical indicators that help traders analyze the markets. These indicators include Moving Averages, Bollinger bands, and Relative Strength Index (RSI). Additionally, traders can create their own custom indicators or download indicators from the MetaTrader Market, a marketplace for trading tools and indicators.

Expert advisors (EAs)

EAs are automated trading algorithms that can execute trades based on predefined rules. Traders can create their own EAs using the MQL4 scripting language or use existing EAs from the MetaTrader Market.

One-touch transactions

MT4 allows traders to execute trades quickly using one-touch transactions. Traders can trade assets with a single click, which can be especially useful in fast-moving markets.

Timeframes

The platform offers several timeframes, including one minute, five minutes, 15 minutes, 30 minutes, one hour, four hours, one day, and one week. As such, traders can analyze the markets on different timeframes to expand the horizon for trading opportunities.

Historical database management

MT4 stores historical price data, which traders can use to analyze the markets and develop trading strategies. Traders can also import and export historical data from other sources.

Internal email system

Traders can use a bundled email system to communicate with their brokers and other traders. This can be useful for receiving alerts and notifications and staying up-to-date on market news and events.

Signals and copy trading

Traders can subscribe to trading signals from other traders and copy their trades automatically. All it takes for copy trading is a single click on a specialized button at the trading platform's top section.

Cross-platform availability

Traders can access the software across any device, mobile phone, tablet, and desktop. MT4 mobile trading is possible through an MT4 app available in the App Store and Play Store. For laptop and desktop users, the software is accessible through the MT4 web trading website or by downloading the executable file to local storage.

Final words

Overall, MetaTrader 4 is an essential tool for online forex traders. Whether a beginner or an experienced professional, one will find MT4's features helpful, from connecting to the most liquid market in the world to leveraging its profit potential.

Blueberry Markets offers access to the MT4 platform through its live and demo accounts. Sign up for a live account or try a demo account.

FAQs

Is MetaTrader 4 good for beginners?

Yes, MetaTrader 4 is suitable for beginners because it has a user-friendly interface, various charting tools, and a large community of traders to seek assistance.

Does MetaTrader 4 cost money?

No, MetaTrader 4 is a free platform. However, traders must fund their trading accounts before they use the software to trade.

What is the purpose of MetaTrader 4?

The primary purpose of MetaTrader 4 is to provide a platform for trading financial instruments like forex, CFDs, and futures. It also allows traders to analyze market data, use various trading tools and indicators, and automate trading through expert advisors.

What can I trade on MetaTrader 4?

MetaTrader 4 provides access to financial instruments like currency pairs and contracts for differences (CFDs) on commodities, stocks, and indices. However, the available trading instruments may vary depending on the broker.

Can I use MetaTrader 4 on a Mac?

Yes, MetaTrader 4 is available for MacOS. Traders can download and install the software easily. Alternatively, one can use it on a web-based platform or virtual private server (VPS).

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.