Forex trading raises questions of permissibility in Islam. Some deem it haram due to interest, uncertainty, and speculation, while others find it halal with adherence to immediate settlement, ownership, and swap-free accounts. Ensuring Islamic practices by adhering to Islamic laws, using compliant brokers, and prioritizing ethical transactions is possible.

This article will discuss whether forex trading is halal or haram.

What are halal and haram in forex trading?

Halal trading in forex involves trading with certain conditions adhering to Islamic principles, whereas Haram trading involves elements such as interest (riba) or uncertainty (gharar) that are considered prohibited in Islamic finance.

In Islamic finance, the concepts of halal (permissible) and haram (forbidden) are crucial in determining the compliance of financial activities with Sharia, the Islamic law.

Example of halal trading: Spot transactions with an immediate cash settlement and those with a clear and legitimate purpose, such as exchanging goods and services, are generally permissible. The key is to ensure that trading activities align with Islamic ethical and legal guidelines, promoting fairness and avoiding exploitation.

Example of haram trading: Engaging in forex trades with overnight interest payments, participating in highly speculative and uncertain transactions, or those that resemble games of chance would be considered haram.

What are the principles of halal forex trading?

Avoidance of riba (Interest)

Halal forex trading strictly prohibits transactions involving interest (riba). Earning or paying interest is considered exploitative and goes against Islamic finance principles.

Immediate settlement (T+0)

Halal forex trading encourages immediate settlement, ideally on the same day (T+0), to avoid any delays or the accrual of interest.

Clear contract terms

Halal trading emphasizes the importance of clear and transparent contract terms, ensuring that all parties involved understand the terms and conditions of the trade.

Avoidance of speculation (maisir)

Halal forex trading discourages excessive speculation, which involves high levels of uncertainty and resembles gambling (maisir).

Real economic activity

Transactions in halal forex trading should be linked to real economic activities, such as exchanging goods and services, to contribute positively to the economy.

No leverage with payable interest

Halal forex trading avoids excessive leverage, especially when it involves paying interest. High leverage can amplify risks and lead to speculative practices not permissible under Islamic trading laws.

Immediate exchange of currencies

Halal forex trading promotes the immediate exchange of currencies to avoid uncertainty, interests, or delayed settlement.

Avoidance of unethical practices

Halal forex trading adheres to ethical business practices and prohibits dishonesty, fraud, and unethical behavior, such as insider trading, front running, price manipulation, and more.

No riba swap or overnight interest

Halal forex trading avoids engaging in transactions with overnight interest payments, commonly known as Riba Swap, to ensure compliance with Islamic finance principles.

Halal income verification

Participants in halal forex trading verify the halal nature of their income, ensuring that it comes from permissible sources and aligns with Islamic principles.

No excessive risk (israf)

Halal trading discourages excessive risk-taking (israf) and promotes prudence and responsible financial behavior to prevent undue financial harm.

No late payments (dayn)

Halal forex trading emphasizes timely payments and settlements to avoid any unjust delays, as late payments (dayn) are discouraged in Islamic finance.

When will trading be considered haram?

There are different instances when trading can be considered haram:

Hoarding and monopoly

Engaging in hoarding or creating a monopoly to manipulate prices and unfairly control the market, which goes against the principles of fair competition and just economic practices in Islam, is considered haram.

Deceptive practices (tadlis)

Participating in deceptive practices, such as providing false or misleading information about a product or service, compromising the integrity of transactions, and harming other market participants, is not allowed in Islamic trading.

Uncertainty (gharar)

Involving excessive uncertainty or ambiguity in transactions (gharar) is prohibited. This includes contracts with unclear terms, hidden risks, or transactions that resemble gambling due to their speculative nature.

Gambling/speculation (maisir)

Engaging in excessive gambling or speculative practices (maisir) in trading, where the outcome is uncertain and gains are based more on chance than on legitimate economic activity, is considered haram.

Prohibited goods/services

Trading in goods or services that are explicitly prohibited in Islam, such as those related to alcohol, pork, gambling, or any other activities, is considered haram.

Insider trading

Using non-public information to gain an unfair advantage in trading and violating the principles of transparency and fairness in the marketplace is not allowed in Islamic trading and is considered haram.

Non-sharia-compliant contracts

Engaging in contracts that do not comply with Sharia principles, such as those involving interest (riba) or unjust terms, which undermine the ethical foundation of Islamic finance, is considered haram.

Pyramid schemes

Participating in pyramid schemes or fraudulent investment schemes that promise unrealistic returns and rely on the recruitment of new investors rather than legitimate business activities is not permissible in Islamic trading.

Non-Islamic insurance practices

Involvement in insurance practices that do not follow Islamic principles, such as conventional insurance that involves interest or speculative elements, is also considered haram in Islamic trading.

Dealing with excessive debt

Trading in a manner that involves excessive debt or leverage, leading to financial instability and potential harm to the trader or other parties involved, is considered haram.

Trading during prohibited times

Engaging in trading activities during times considered sacred in Islam, such as the Friday prayer, a special congregational prayer day, is prohibited.

Islamic Laws governing Financial Instruments

1- Currencies

In Islamic finance, spot forex trading, involving the immediate exchange of currencies, is generally considered permissible as long as it adheres to the principles of avoiding interest (riba) and ensures immediate settlement. This means engaging in transactions where the exchange of currencies occurs on a spot basis without any delay or interest payments.

2- Stocks

Equity investments

Investing in stocks of companies that operate in compliance with Islamic principles is generally considered halal. This involves selecting companies that avoid involvement in industries such as alcohol, gambling, and pork, aligning with ethical and Sharia-compliant business practices.

Dividends and interest

Earning money from dividends is typically considered permissible in Islamic finance, as it represents a share in the company's gains. However, earning from interest-bearing investments is not allowed, and investors need to be cautious about investing in companies with high debt ratios or those involved in interest-based activities.

3- CFDs (Contracts for Difference)

Halal aspects

The permissibility of CFDs in Islamic finance depends on various factors. Some scholars view CFDs as halal, especially if they are based on tangible assets and avoid elements such as interest and speculation. However, some consider it haram since it does not involve the actual ownership of the asset. It is crucial to assess the specific terms and conditions of the CFD contract to ensure compliance with Islamic finance principles.

Avoidance of riba

CFDs that involve interest payments or leverage with payable interest are generally considered impermissible in Islamic finance. Traders must be cautious about the financial terms associated with CFDs to ensure they align with the prohibition of riba.

Short selling in any asset, whether currencies, stocks, or CFDs, is typically not considered halal in Islamic finance due to the potential for speculative practices and uncertainty. Short selling involves selling an asset the trader does not own, which may introduce elements of gharar (excessive uncertainty) that go against Islamic finance principles.

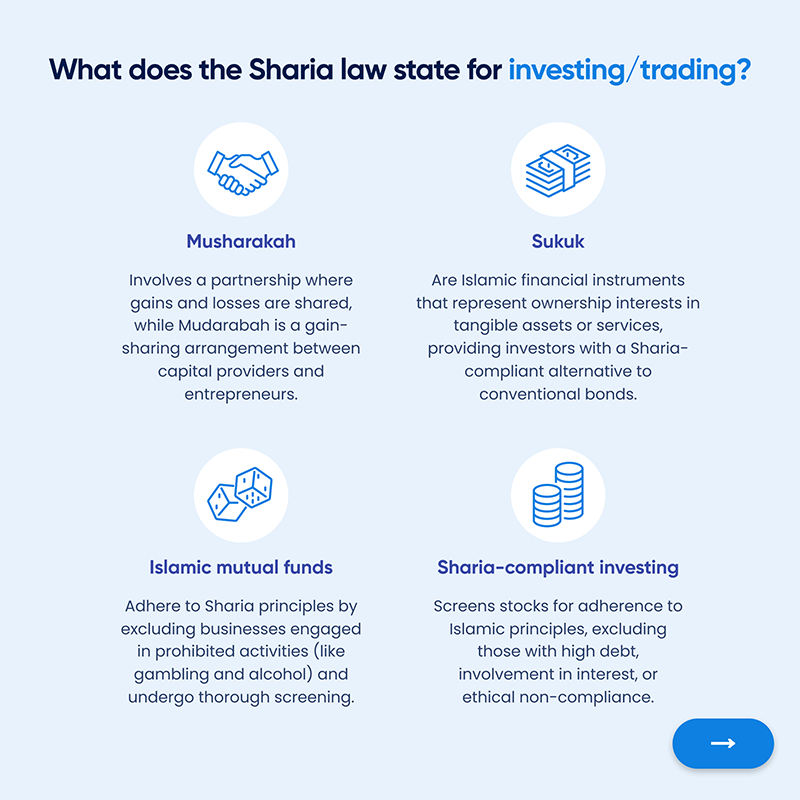

What does the Sharia law state for investing/trading?

- Musharakah and Mudarabah are partnership structures in Islamic finance. Musharakah involves a partnership where gains and losses are shared, while Mudarabah is a gain-sharing arrangement between capital providers and entrepreneurs. Both Musharakah and Mudarabah comply with Islamic finance principles by promoting risk-sharing and avoiding fixed, predetermined returns that resemble interest.

- Sukuk, or Islamic bonds, are financial instruments that comply with Sharia principles. They represent ownership in tangible assets and share risk and gains rather than interest-bearing debt. Investing in Sukuk is generally considered permissible in Islamic finance.

- Islamic mutual funds invest per Sharia principles, avoiding businesses involved in activities like gambling, alcohol, and interest-based transactions. These funds typically undergo screening to ensure compliance with Islamic ethics.

- Sharia-compliant investing involves screening stocks to ensure they adhere to Islamic principles. Companies with high levels of debt, involvement in interest-bearing activities, or non-compliance with ethical standards may be excluded.

- Investing in real estate is generally allowed in Islam, provided the transaction adheres to Islamic financing principles. Interest-free financing and avoiding speculative practices are essential considerations.

- Takaful is an Islamic alternative to conventional insurance. It operates on mutual cooperation and shared responsibility, avoiding interest and uncertainty. Takaful is considered a Sharia-compliant form of insurance.

- Exchange-traded funds (ETFs) adhering to Islamic finance principles are available, allowing investors to gain exposure to Sharia-compliant assets. These ETFs typically follow specific screening criteria to ensure compliance.

- Investments in educational ventures that align with ethical and Islamic values are generally encouraged. Supporting initiatives that promote knowledge and ethical conduct is consistent with Islamic finance principles.

How to create an Islamic trading account?

Here are the steps to create an Islamic trading account:

1- Choose a Sharia-compliant broker: Look for brokers explicitly offering Islamic or Sharia-compliant trading accounts.

2- Check for Sharia compliance: Verify that the broker's Islamic trading accounts adhere to Sharia principles, avoiding interest (riba) and other elements inconsistent with Islamic finance.

3- Open an account: Visit the broker's website and navigate to the account opening section. Look for an option to select an Islamic or Swap-Free account. This type of account is designed to avoid interest payments (swap) and is structured to comply with Sharia principles.

4- Deposit funds: Once the account is approved and verified, the trader can deposit funds into their trading account. Islamic trading accounts typically do not involve interest payments, so be aware of the broker's funding options and select those that align with Sharia principles.

Carefully review the terms and conditions associated with the Islamic trading account. To ascertain an understanding of the rules and guidelines for trading within the framework of Islamic finance.

5- Start trading: Once the account is funded, the trader can start trading in accordance with Islamic finance principles. Be mindful of the permissibility of the assets one can trade and ensure that the activities align with ethical and Sharia-compliant standards.

Disclaimer: It's important to note that the specific steps and requirements in opening an account may differ among brokers. This information is presented solely for informational purposes and should not be regarded as personalized advice.

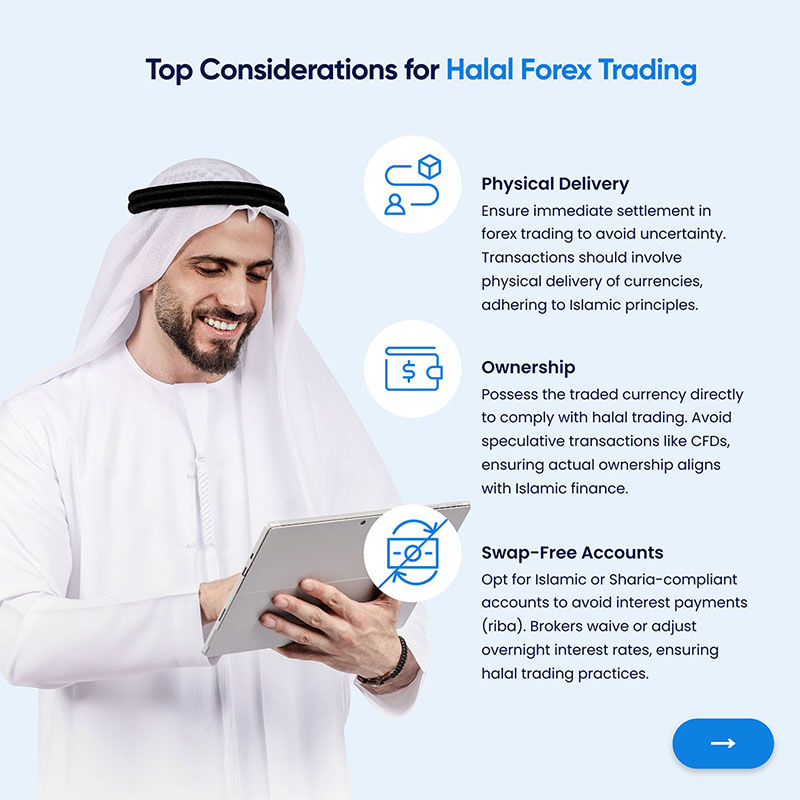

Top considerations to ensure forex trading is halal

Physical delivery

Islamic finance generally requires the exchange of currencies to be done on a spot basis with immediate settlement, ensuring no delay in the exchange. This aligns with the principles of avoiding excessive uncertainty (gharar) and ensuring a clear and transparent transaction. In halal forex trading, the exchange of currencies should involve actual physical delivery, avoiding any elements of deferred settlement that might resemble interest-based transactions.

Ownership

Ownership is essential in determining the permissibility of forex trading in Islam, as in halal forex trading, the trader should have ownership of the currency being traded. The exchange should involve the direct ownership and possession of the currencies rather than engaging in speculative transactions without the transfer of ownership, such as in CFDs. This ensures that the trading activity is grounded in actual possession and ownership of the traded currencies, aligning with Islamic principles.

Swap-free accounts (avoidance of riba)

Another crucial consideration is avoiding interest payments (riba) in forex trading. Interest-bearing transactions are not allowed in Islamic finance. Traders looking to ensure halal forex trading should opt for swap-free accounts. In these accounts, also known as Islamic or Sharia-compliant accounts, brokers typically waive or adjust overnight interest rates (swap rates) to comply with Islamic finance principles. This ensures that traders are not involved in transactions that accrue interest, halting the trading activity.

The verdict: is forex trading halal or haram

The permissibility of forex trading in Islam hinges on adherence to Islamic finance principles. In Islam, forex trading is considered haram when it involves interest payments, high uncertainty, or speculative practices resembling gambling.

On the other hand, forex trading is deemed halal in Islam when transactions are conducted on a spot basis with immediate settlement, avoiding interest, ensuring actual ownership, and utilizing swap-free accounts to comply with Islamic finance principles.

Traders entering the Forex market, particularly those adhering to Islamic principles, should conduct thorough research to determine the permissibility of their trading activities.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.