Avoiding stop-loss hunting allows forex traders to protect their investments and have more control over their trading strategies. It also helps in navigating the market with confidence.

In this article, we dive deeper into how to avoid stop-loss hunting.

What is stop-loss hunting?

Stop-loss hunting occurs when market participants, often large players or market makers, intentionally manipulate forex prices to trigger stop-loss orders placed by retail traders. They drive prices to levels just beyond common stop-loss placements, causing these orders to be executed. This manipulation aims to induce forced exiting or purchasing by retail traders, generating liquidity for the manipulators' positions. Traders can mitigate the impact of stop-loss hunting by placing their stop-loss orders at less obvious levels and practicing prudent risk management.

Tips to avoid stop loss hunting

Use mental stops

Mental stops are predetermined exit points in a trader's mind, but they may not be actual stop-loss orders yet. These offer flexibility and aren't visible to other market participants, making them less susceptible to manipulation. They act as an effective way to guard against stop-loss hunting and also allow for flexibility in adapting to changing market conditions.

It is important to adhere to the predefined mental stop, however, as deviating from the plan can expose traders to increased risk.

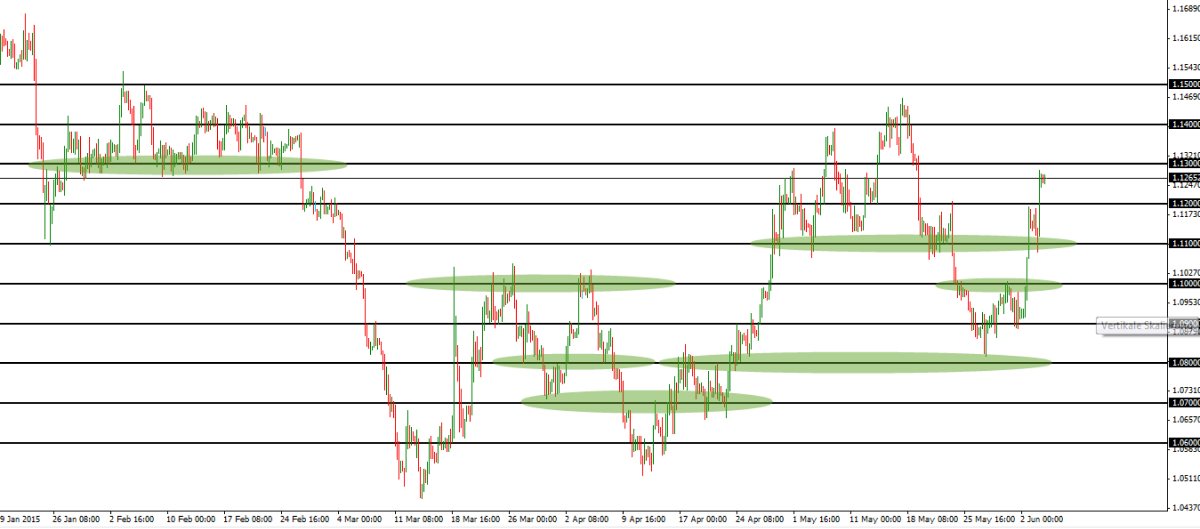

Set stop-losses at key levels

Placing stop-loss orders at key technical levels like support and resistance zones, trendlines, or moving averages can strengthen risk management. When a trader sets stop-loss levels based on these technical factors, they are less likely to fall victim to arbitrary price fluctuations or stop-loss hunting. This approach aligns the risk management strategy with market dynamics, protecting forex trades.

Avoid obvious round numbers

Avoid placing stop-loss orders at round numbers or psychologically significant levels in the market. Manipulative traders often target these levels due to their easily identifiable nature. Instead, consider placing stop-loss orders slightly beyond these levels. This practice makes it more challenging for stop-loss hunting to be triggered prematurely.

Adjust position size

In volatile markets, consider reducing position size. Smaller positions are less vulnerable to rapid price fluctuations and are more likely to withstand market noise without getting stopped prematurely. By properly sizing positions relative to the account size and risk tolerance, traders can protect their capital while maintaining flexibility in their trading approach.

Use hidden stop-loss orders

Some brokers offer the option of hidden or non-displayed stop-loss orders. These orders are not visible in the order book and are, therefore, less susceptible to manipulation by other market participants. Utilizing hidden stop-loss orders can provide an additional layer of protection for the trades, as they do not reveal the stop-loss levels to potential manipulators.

Trade with reputable and diversified brokers

It is crucial to select well-regulated and reputable brokers with a history of fair practices. Reputable brokers are less likely to engage in or tolerate stop-loss hunting since it can damage their credibility and regulatory standing. By conducting thorough research and choosing brokers known for their ethical conduct, traders can significantly reduce the risk of falling victim to manipulative actions.

Furthermore, using multiple brokers can also reduce the risk of a single broker's platform being manipulated or targeted by stop-loss hunting. Diversifying the trading accounts can provide added protection.

Trade during liquid hours

Market hours and liquidity play a significant role in the vulnerability to stop-loss hunting. Low-liquidity periods are more prone to manipulation, and traders should avoid trading during such times. Instead, it is advisable to trade during peak market hours when liquidity is higher and the likelihood of manipulation is reduced. This simple adjustment in timing can enhance the protection of the trades.

Diversify trading strategy

Relying solely on a single trading strategy can make traders an easy target for manipulative actions. By diversifying trading strategies and techniques, traders reduce the risk of being consistently vulnerable to stop-loss hunting. If one strategy faces challenges, others may still be beneficial, creating a balanced and resilient trading approach.

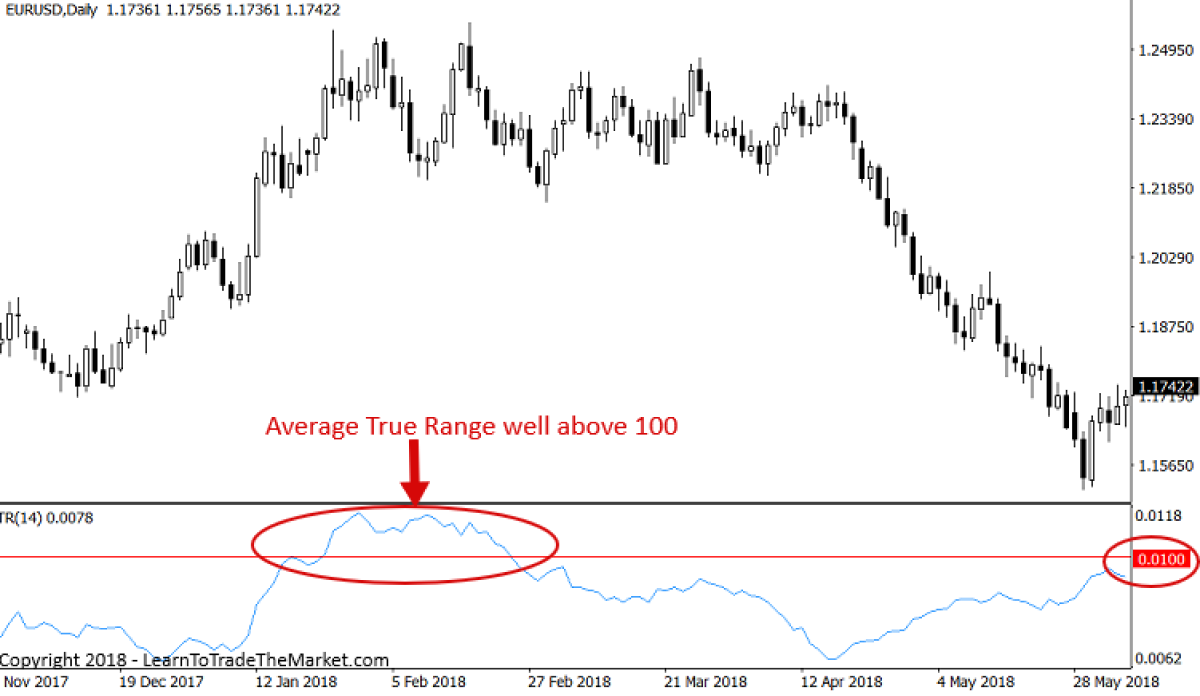

Understand market volatility

Highly volatile markets can experience wider price swings, increasing the likelihood of stop-loss orders being triggered. Traders should adjust risk management and stop-loss placement to account for this volatility. In such conditions, it is important to be cautious and consider using wider stop-loss orders to accommodate the larger price fluctuations and reduce the risk of premature stop-outs.

Avoid panic

If a stop-loss order is triggered, it is vital to remain calm and avoid making impulsive or emotional decisions. Panic selling or re-entering the market without a well-thought-out plan can lead to further losses. Instead, evaluate the situation rationally and consider re-entering the market only if the initial trade thesis remains valid and aligns with the overall strategy.

Avoid overleveraging

Excessive leverage can result in larger position sizes, making stop-loss levels more vulnerable to quick stop-outs. To minimize this risk, traders should avoid overleveraging their trades. Responsible use of leverage helps control potential losses and prevents manipulative actions from causing significant damage to trading accounts.

Use wider stop-loss placement

To guard against stop-loss hunting, traders can set stop-loss orders at levels that are less likely to be hit by temporary price fluctuations. Avoiding the placement of stops at obvious or round number price points is essential, as manipulative traders commonly target these levels. By providing a buffer against short-term market noise, wider stop-loss placement helps ensure that stop-loss orders are not prematurely triggered.

Avoid stop-loss hunting for better risk management

Avoiding stop-loss hunting in forex is a vital aspect of risk management and preserving capital. To safeguard their investments and maintain control over their trading strategies, it may be wise for traders to adhere to a set of safe trading practices such as using mental stops and setting stop-loss orders at key technical levels. Additionally, trading during liquid hours, diversifying trading strategies, understanding market volatility, and avoiding panic in the event of a triggered stop-loss order are key precautions to consider.

By implementing the tips discussed, traders can enhance their resilience against manipulative actions and maintain confidence in their trading strategies.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account