Weekly Forex Trading Ideas: 29th July

Last week the Volatility Index (VIX) rose by 14% causing the market to move into what is known as a 'risk off' environment. This occurs when markets become 'fearful' and we see the US stock markets decline and safe haven currencies such as the Japanese Yen and Swiss Franc rise.

Will this sentiment continue or will we see a relief to last week's changes? This is the question we hope to answer this week.

In terms of data releases this week we have a packed calendar full of high impact or red folder news. The top news to watch will include three central bank decisions coming from the UK, US and Japan. We will also see the release of inflation data out of Australia and Switzerland. To round off the week we will see the latest Non-Farm Payroll figures from the US which is forecast to come in lower.

Consumer Price Index

The consumer price index measures the change of prices in goods and services purchased by consumers. A rise in inflation can lead to a central bank hiking interest rates to prevent inflation getting out of control. On the contrary if inflation decreases a central bank could cut rates to encourage consumers to spend again. In Australia the quarterly number is forecast to remain the same as the previous quarter at 1.0%. However the annual inflation figure is forecast to come in at 3.8 down from the previous 4.0%. This figure is still considered to be higher in the grand scheme of central bank inflation gauges, as 2% is more desired. In Switzerland the CPI month on month is forecast to come in at -0.2% down from 0.0% the previous month. This could prompt traders into considering whether the Swiss National Bank or SNB will cut interest rates in their next meeting in September.

Three Central Bank Decisions

Bank of Japan (BoJ)

Many believe the Bank of Japan is forecast to hike interest this week after the CPI in Tokyo rose to 2.2%. Although this rise could fuel speculation the central bank will be looking to hike interest rates, the BoJ is known for moving at a snail's pace and a rise in rates may be premature. The Japanese central bank has been cautious to raise rates in the past and I don't see this changing in this meeting. If the CORE CPI in Tokyo moved above 3% then the central bank may consider hiking interest rates. The Japanese Yen has been one of the strongest currencies of recent times driving USD/JPY prices lower towards 152.00. This level has been a tough level to trade through in the past both as support or resistance and could be an area traders are watching closely.

Federal Open Market Committee (FOMC)

The Federal Funds Rate is forecast to remain the same at 5.50%, with traders pricing in a cut by the Fed coming in September instead. Federal Reserve Chairman Jerome Powell has been defiant in his statements about keeping a close eye on the data and not being too premature when it comes to the fight with inflation. A cut in interest rates next week would come as a shock to the markets despite the data being supportive of a shift in monetary policy. Inflation rates in the US fell to 3.0% annually which is in line with the expectation from the central bank. However the chairman has been vocal about their desire to see inflation 'comfortably' below 2%. The labor market is now feeling the brunt of higher interest rates with Non-Farm Payrolls forecast to fall this week to 177k in June down from 206k jobs created in May. Unemployment is a statistic that has been trending higher over the year with rates being at a yearly high of 4.1%. If this number continues to climb, market participants will see a cut from the Fed in September more and more likely.

Bank of England (BoE)

Across the Atlantic the Bank of England is forecast to cut interest rates by 25 basis points to 5.00%. Monetary policy committee members voted 0-2-7 in the previous meeting meaning that 2 members voted to cut interest rates whilst 7 voted to hold. In the latest release it is forecast the 6 members will now vote to cut rates whilst only 3 vote to hold. If this is true then a cut from the Bank of England will happen. However, this cut is considered 50/50 in terms of probability, this is mainly down to some comments from the BoE's chief economist who stated earlier in the month that inflation pressures could still be felt by the rising wages.

USD Index

- The USD Index weekly chart shows the price hovering above the $104.00 support.

- A break below this support could put further pressure on the greenback with sellers targeting the support at $102.50.

- Alternatively, if price trades above the weekly highs of 104.50 then we could see USD strength in the short term.

GBP/USD

- The GBP/USD price closed bearish on the week above the support of 1.2860.

- This market could continue lower this week as the BoE is forecast to cut rates whilst the US Federal Reserve is forecast to hold rates higher.

- A break below support could influence selling pressure on cable.

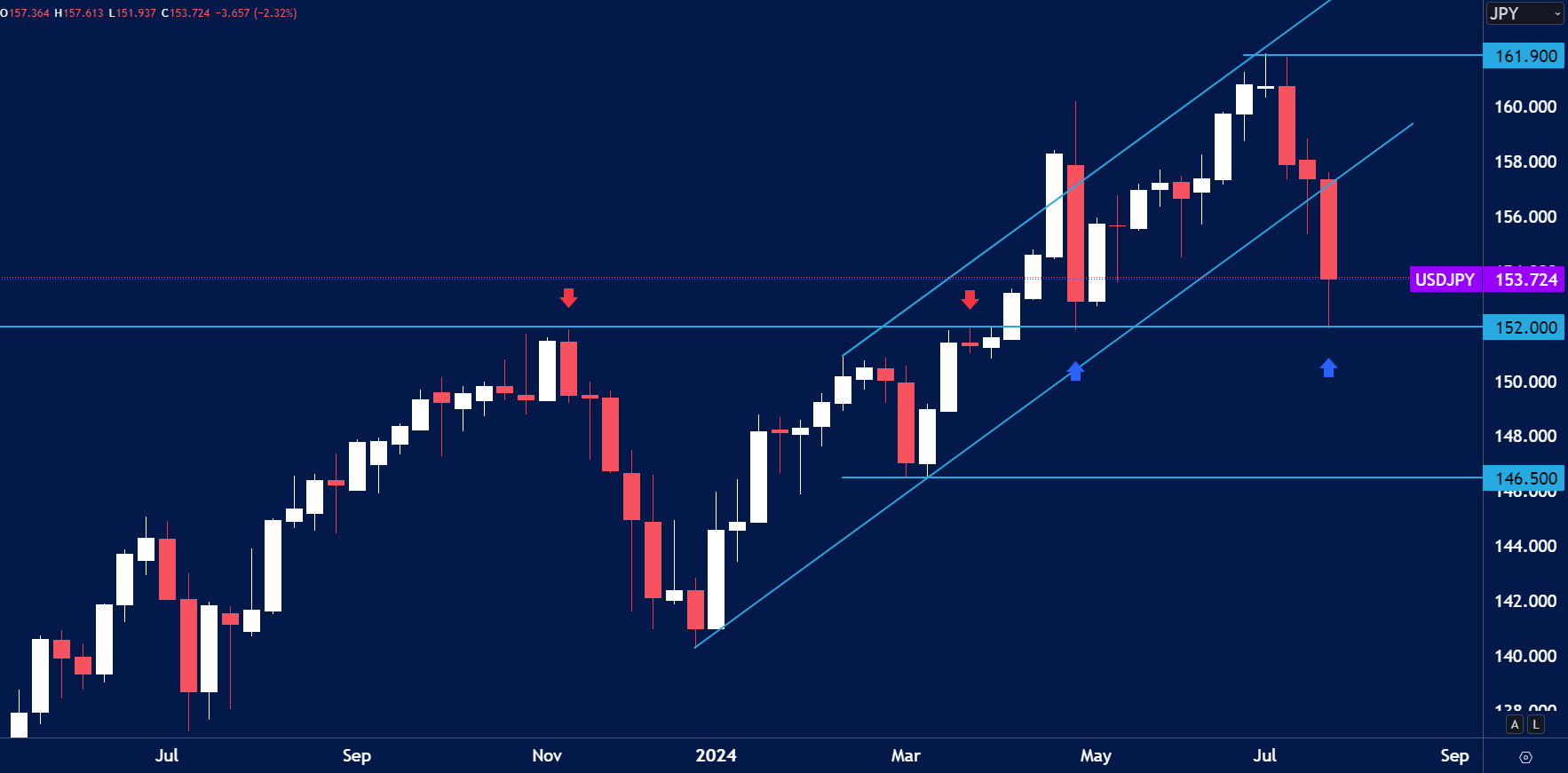

USD/JPY

- The USD/JPY price continued lower last week with the price testing support of 152.00.

- This level has been a strong level for price in the past and could offer traders a chance to take some profits on short positions. A hold at this level could see sellers move away and offer long opportunities to buyers.

- A break below 152.00 could open the door to a move into 156.50.

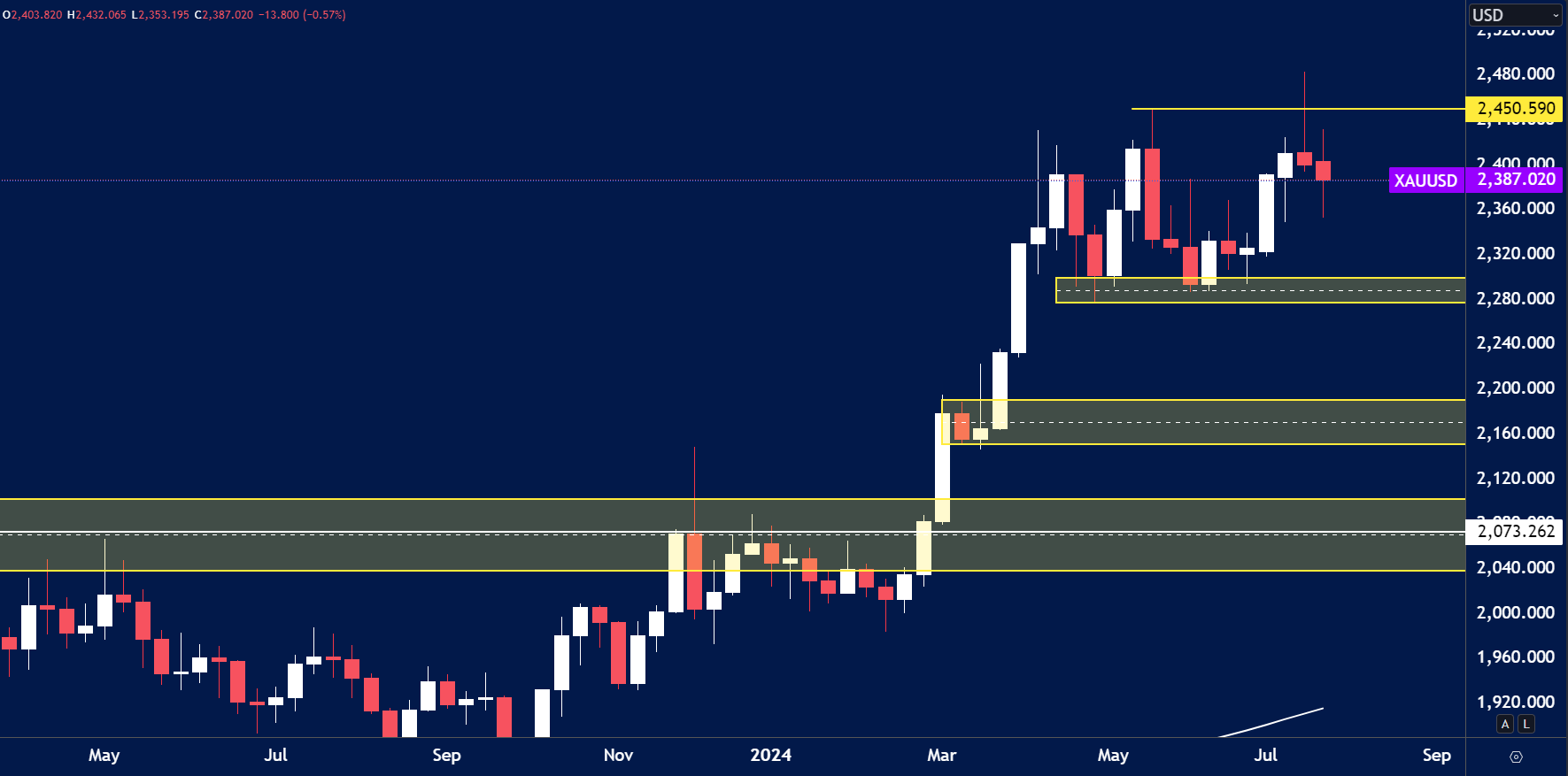

GOLD

- The Gold price closed bearish this week after prices topped out at $2450.00 the previous week.

- In periods of higher risk news events we can often see the market buy Gold, so we could expect some bullishness this week.

- CoT reports are showing selling but still not at levels I want to see before seeing a market top.

Have you watched our latest video update? You can see it here.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.