Forex traders, big week ahead! Potential rate cuts from the Bank of Canada and ECB, and the US Non-Farm Payroll report.

Watch the video to learn more.

Forex Trading Week Ahead: Key Rate Decisions and Economic Data

This upcoming week is set to be a pivotal one for forex traders, with significant central bank decisions and economic data releases on the horizon. Here's what to watch:

Bank of Canada Rate Cut: What to Expect

The Bank of Canada (BOC) is in the spotlight as it deliberates on a potential rate cut. Currently, the market is pricing in a 61% chance that the BOC will reduce rates by 25 basis points, bringing the rate down to 4.75%. This decision will be keenly awaited, as it could set the tone for future monetary policy moves.

Should the BOC decide to cut rates, it is expected to accompany this with cautious guidance, indicating that further rate cuts will be approached prudently. This cautious stance is crucial to monitor, as it will affect market sentiment and the Canadian dollar's performance. Forex traders should be prepared for potential volatility around the announcement as the market reacts to both the rate decision and the BOC's forward guidance.

European Central Bank Rate Decision: Inflation Concerns

The European Central Bank (ECB) is also on the radar this week, with a rate cut decision expected on Thursday. Forecasts suggest a 25 basis point reduction, mirroring the potential move by the BOC. This decision comes against the backdrop of rising inflation in the Eurozone, which saw an increase from 2.4% to 2.6% – the first rise this year.

The ECB's decision will be particularly influential given the recent inflation data, and traders will be scrutinizing the central bank's statements for any hints about the future direction of monetary policy. The euro's response to the rate cut and accompanying statements will be a key focus for forex market participants.

US Non-Farm Payrolls: Critical Data for Forex Traders

Rounding out the week, the US Non-Farm Payroll (NFP) report on Friday will be a critical data point. While the market is no longer anticipating a rate cut by the Federal Reserve in July, the labor market's health could bring a September rate cut into the picture. Currently, market sentiment is split 50/50 on whether the Fed will cut rates or hold steady in September.

A weakening labor market could increase the likelihood of a September rate cut, making the NFP report essential for traders to assess. The data will provide insights into the US economy's strength and help shape expectations for the Federal Reserve's next moves.

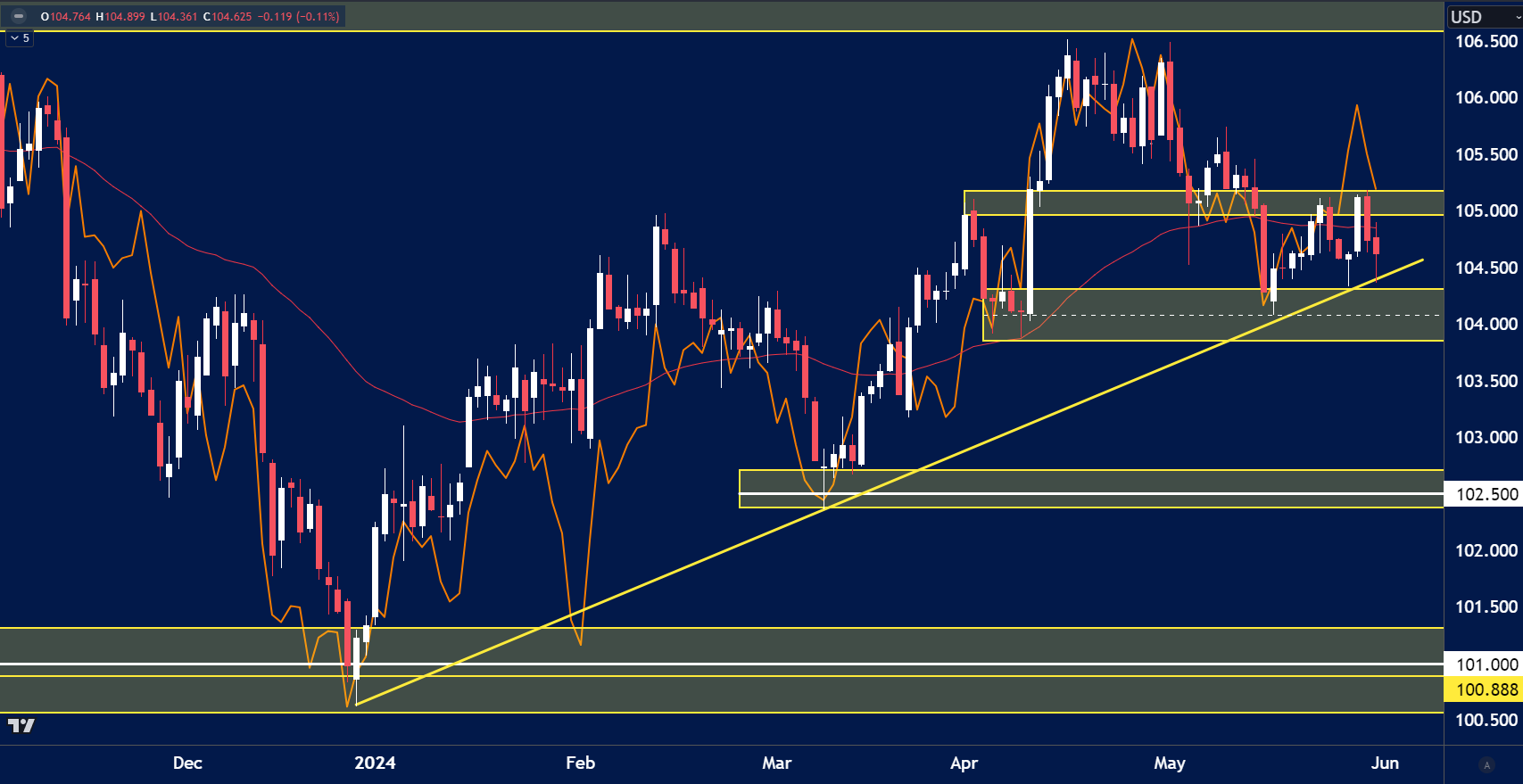

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USD Index remains between the all important $105.00-104.00 levels last week.

- For clearer options traders would need to await a clean break of either support or resistance levels.

- US 10YR Government Bonds rose slightly last week which could see the USD strengthen.

AUDUSD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the AUDUSD found support around the key lows of 0.6600.

- If price trades higher this week we could see a move towards the resistance of 0.6700.

- The price being above the daily 50 moving average suggests buyers are more in control here.

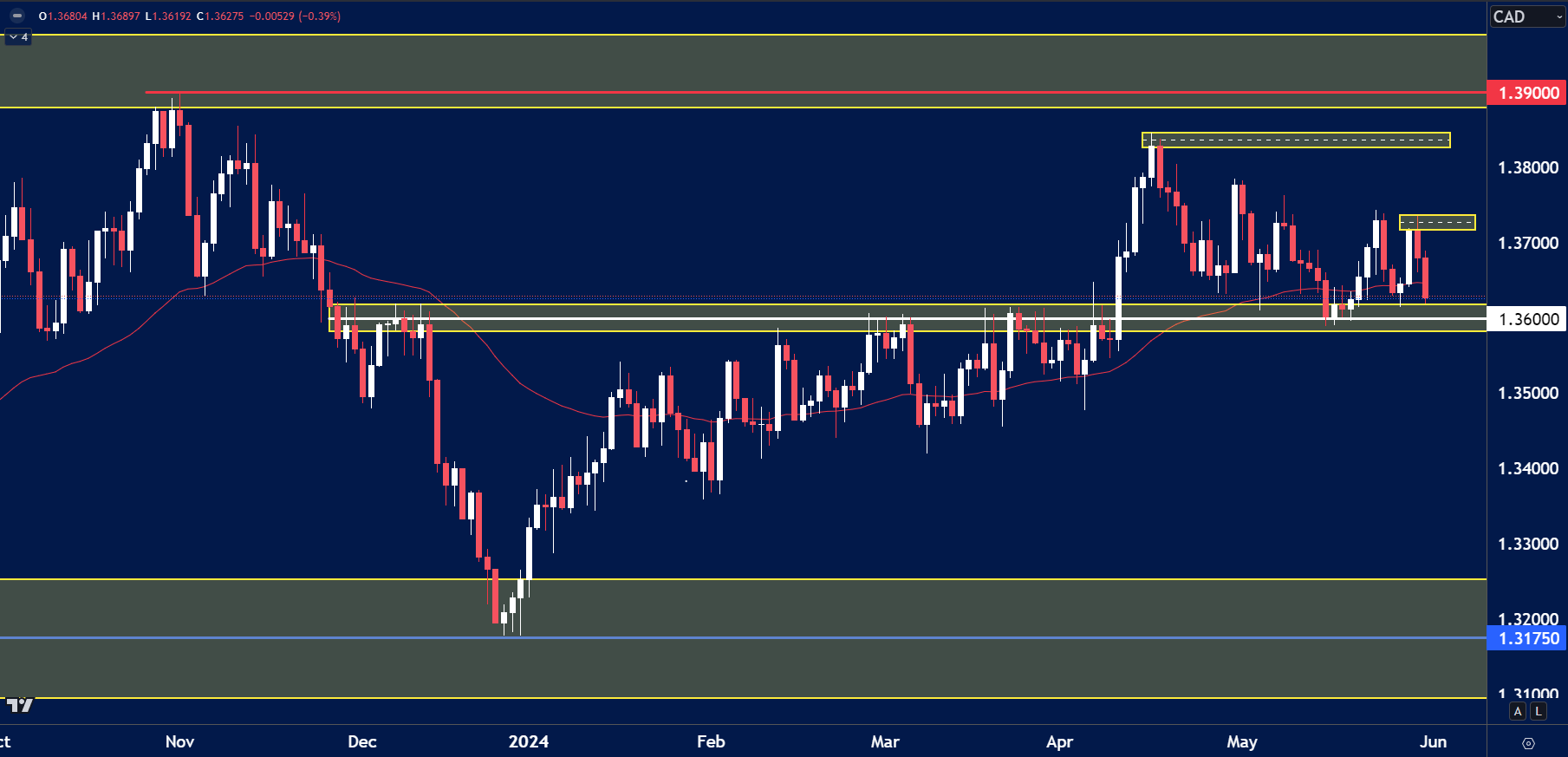

USDCAD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USDCAD could swing significantly this week as we have important data from both the US and Canada.

- A break below 1.3600 support could trigger some selling in the market with volumes seen below 1.3500.

- A break however above 1.3700 could see the price trade towards recently formed highs of 1.3800.

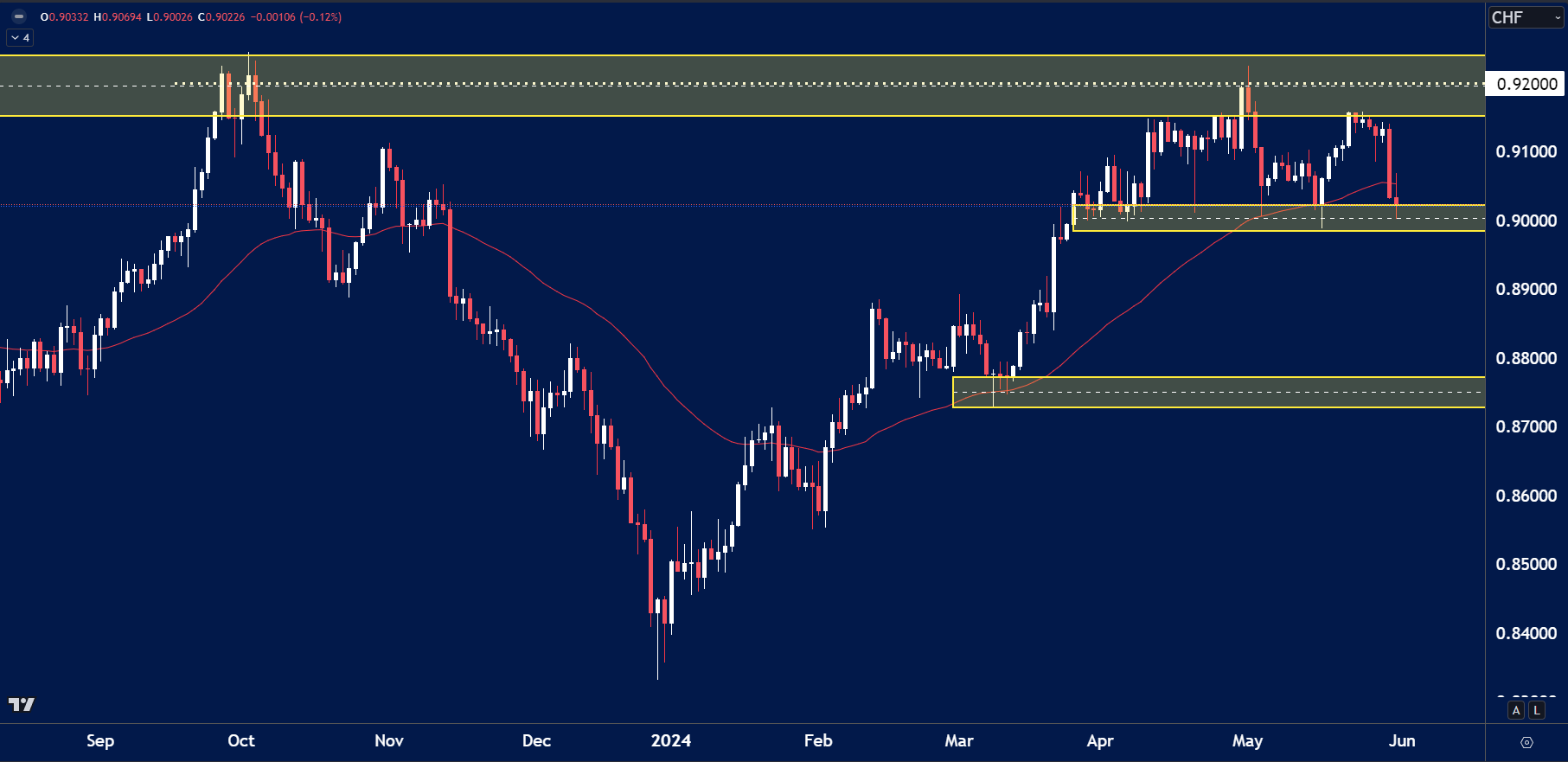

USDCHF

The price on the chart has traded through multiple technical levels and some observations included:

- The price of USDCHF remains at a key level of 0.9000. If price holds above this level it could see a move towards 0.9200.

- However a break below the 0.9000 support opens the floor up for a move towards previous volume found towards 0.8800.

Have you watched our latest video update on how to trade CAD/JPY?

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.