Support and resistance (S&R) levels in the Forex market are more than just theories. Most forex trading strategies incorporate S&R analysis as it is one of the most popular technical analysis techniques traders utilize.

What do support and resistance mean?

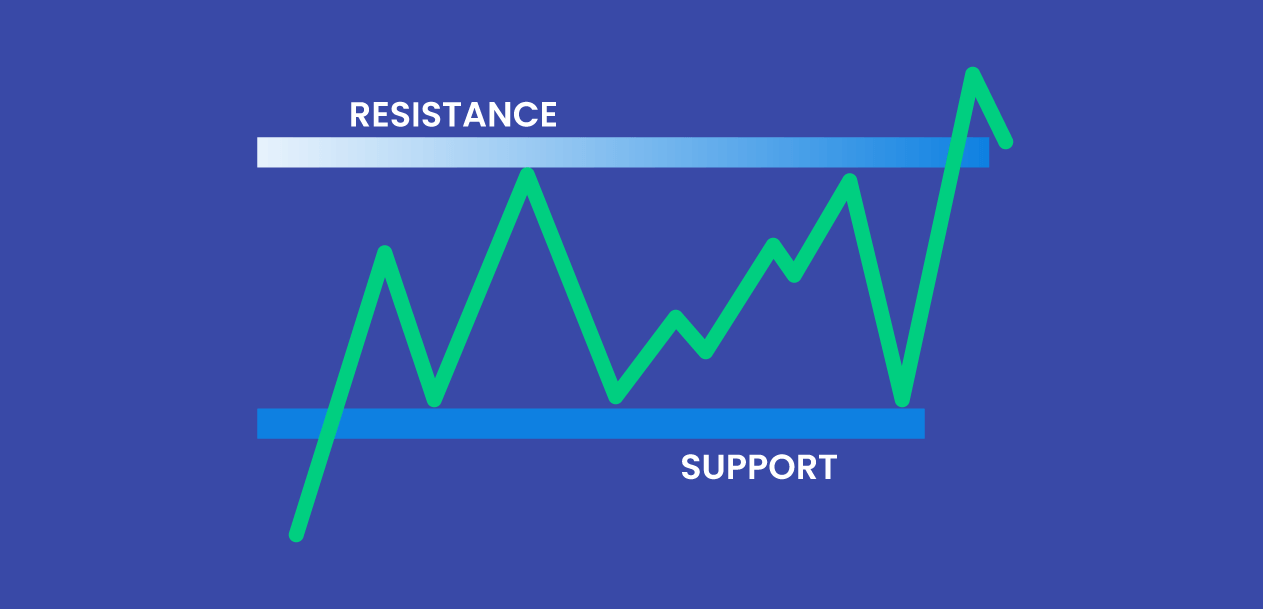

A support level is characterized by a falling price that struggles to break below until it has no other option but to bounce back. An area of support has an asset price that tends to stop falling. In theory, the price level where the buying power is so strong that prices are prevented from declining further is referred to as support. The reason is that prices closer to the support level become cheaper eventually. Hence, buyers get a better deal than sellers. This explains why buying power is stronger and tends to prohibit the prices from falling below the support level.

On the contrary, resistance level is characterized by a rising price that struggles to break above until it fails to. As a result, it is forced to downtrend. Selling power is stronger in this case. Hence, prices are prohibited from rising further. With a price that’s closer to resistance, it is expected to be more expensive, causing sellers to overcome buyers because the likelihood of selling will be higher than buying. This scenario will ultimately prohibit prices from going above resistance.

As S&R levels can be marked on price charts, one must understand how the prices typically move to interpret these areas better. There are also two types of support and resistance that you should be aware of: major or strong levels, which more likely hold and cause prices to move in the opposite direction, and minor levels, or those that break along the way.

How to trade using S&R levels?

Now that we’ve discussed the main concepts of S&R levels, we must now learn how to apply these in our trades. There are two ways to trade using S&R levels: using the bounce method and trading with breakouts.

Using the bounce method

As literal as its name, this method seeks to trade right after the bounce. While there are Forex traders who commit the error of directly using respective support and resistance levels in setting orders, the waiting period to materialize their trades is quite difficult. It assumes that the level will hold for you, even if the price has not actually reached that level yet. This might work in certain circumstances, but it doesn’t mean that it will always work for you. While the S&R level can mean the best possible price, its actual occurrence remains uncertain.

In applying the bounce method, we are just tilting the odds for our benefit while looking for a signal that the support or resistance will hold. Two things can happen under this approach: we will only go long when the price bounces off the support level, or we will enter a short position as the price bounces off resistance. Prices will disregard your support and resistance levels in its movements. The idea of using the bounce method as an entry basis is for you to avoid moments when the price moves fast and then breaks through your S&R levels.

Trading with breakouts

Because the Forex trading world isn’t perfect, it is difficult to jump in and out anytime prices hit the S&R levels. In reality, these levels often break, so playing with bounces won’t be enough. Traders should be prepared to deal with support or resistance levels that suddenly give way. Breakouts can be applied in two ways: the aggressive or the conservative way.

Playing with breakouts aggressively means buying or selling when the price passes through a support or resistance level. This is appealing to traders since we want to enter only when the price passes through a certain S&R level with ease. Meanwhile, the conservative way of trading considers the reality of fluctuating prices and the decision to hold on to trades, as prices may rise again. As much as possible, we do not want to close positions since we are automatically taking the opposite side of trading. This approach is executed by waiting for a price pullback to the broken resistance or support level then entering after the price bounces.

Trading off support and resistance levels is helpful. But just like any other strategy, it takes time and practice. Once you get familiar with the process and gain confidence that you are ready for live Forex trading, that’s when you begin to invest real money.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.