Trade history in forex provides insights into past achievements and failures, helping traders identify patterns, refine strategies, and learn from mistakes. Examining trade history enhances risk management and allows traders to make more accurate predictions based on historical performance.

In this article, we discuss how traders can check their trade history on MT5.

What is trade history?

Trade history is a comprehensive record of executed trades in a financial market, such as forex. It includes entry and exit points, transaction sizes, gains or loss outcomes, and timestamps. Analyzing trade history is crucial for traders as it provides insights into past performance, helping refine strategies, identify patterns, and make informed decisions. It is a valuable tool for learning and continuous improvement in the dynamic world of financial trading.

Different ways to leverage trading history in MT5

Refine strategies through detailed analysis

Leveraging the trade history of MT5 provides traders with a valuable tool for refining their trading strategies. By meticulously analyzing past trades, traders can pinpoint specific entry and exit points. This detailed examination allows for a comprehensive assessment of the strategy's effectiveness under various market conditions. The insights gained from historical data empower traders to make informed adjustments, enhancing the overall precision of their trading approaches.

Get precise risk management insights

The historical data available on MT5 is a tool for gaining precise insights into risk management. Traders can delve into the details of past trades to analyze historical drawdowns and evaluate how different risk levels impacted overall performance. This deep understanding of risk dynamics facilitates more accurate risk management strategies, ensuring that traders can navigate volatile markets with a clear understanding of potential downside scenarios.

Backtest strategies for the future

MT5's backtesting feature allows traders to simulate the performance of their trading strategies using historical data. This functionality is a powerful tool for testing strategies under various market scenarios. By backtesting, traders can optimize and fine-tune their approaches, identifying weaknesses and strengths.

Develop psychological discipline

Trade history on MT5 offers a unique window into the emotional aspects of past trades. By reviewing historical trades, traders can identify patterns in their emotional responses during different market situations. This self-awareness is a crucial step in developing psychological discipline.

Modify strategies in real-time based on live trading data

MT5's integration of live trading data allows traders to adapt their strategies in real-time based on historical insights. This dynamic approach involves continuous monitoring and adjustment of trading strategies during live trading sessions. The ability to seamlessly integrate historical knowledge with live data sets the stage for adaptive and proper trading in the fast-paced world of financial markets.

Step-wise guide to check trade history on MT5

1- Open MetaTrader 5 platform

Launch the MetaTrader 5 platform on the computer. The trader must ensure they have a trading account set up and logged in.

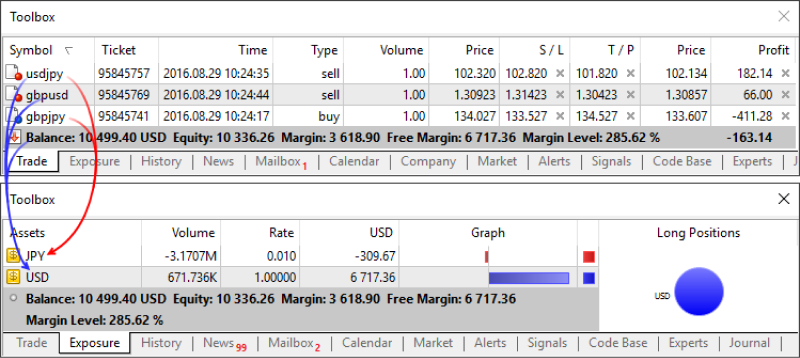

2- Click on the Trade tab

Look for the Trade tab at the bottom of the platform. Click on it to access the trading-related features.

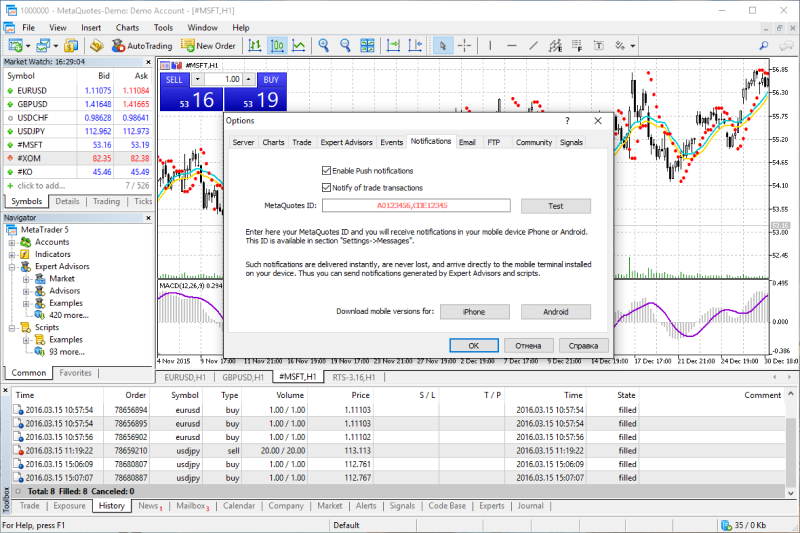

3- Access the Account History tab

Within the Trade tab, find and click on the Account History tab. This is where traders can view their trade history.

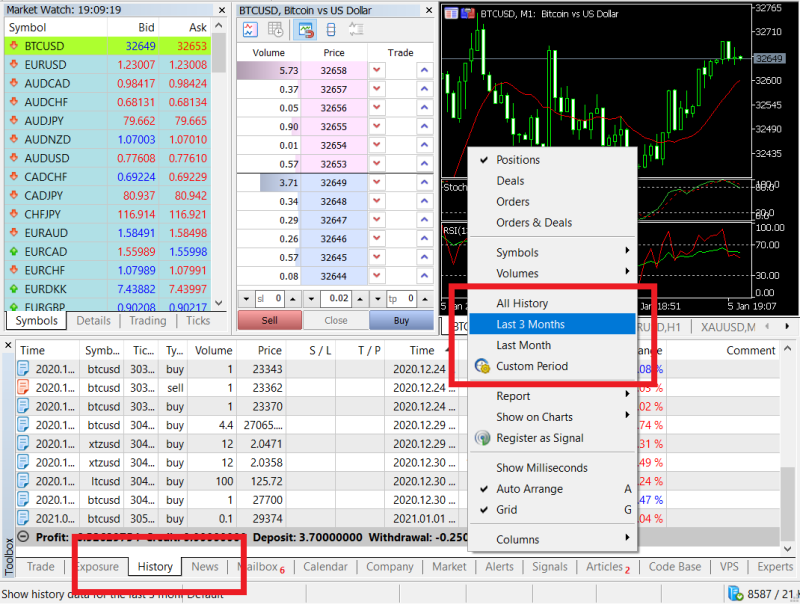

4- Choose the time period

Right-click within the Account History tab to bring up a context menu. From the menu, traders can choose the time period for which they want to view trade history, such as a day, week, month, or custom range.

5- Filter by instrument

Customize the view further by filtering trades based on specific financial instruments. It can be particularly useful for traders managing diverse portfolios.

6- View trade details

The platform will display a list of past trades with details like ticket number, time of execution, type of order, volume, symbol, entry and exit prices, and gain/loss.

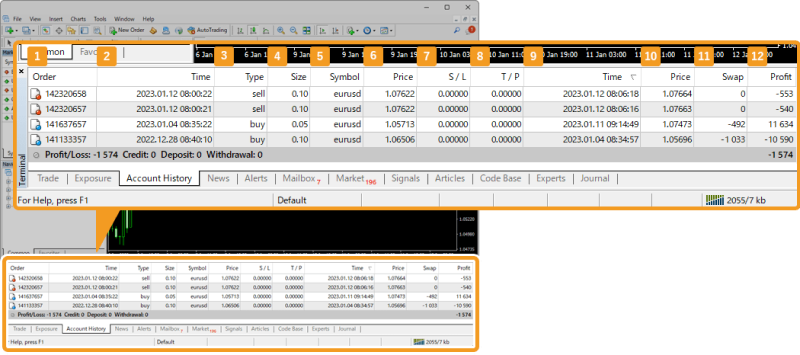

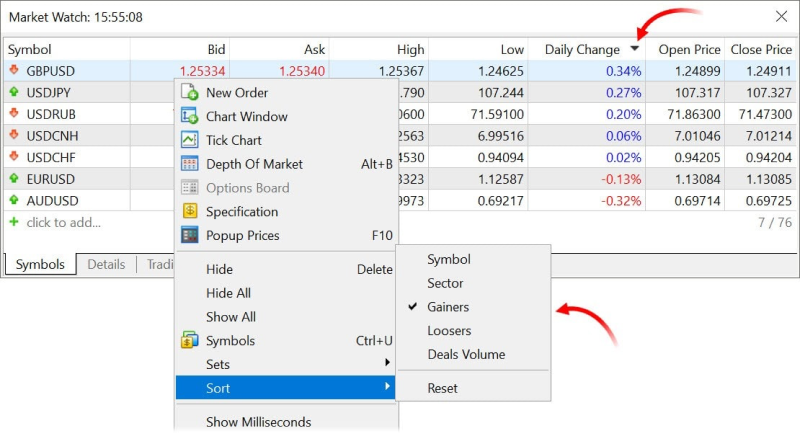

7- Sort trades by criteria

Take advantage of the sorting functionality on MT5 to arrange trades based on different criteria, such as gain, loss, or execution time. This feature facilitates a more organized and targeted analysis of historical data.

8- Identify trade patterns

Look for recurring patterns in the trade history. Identifying patterns, whether in winning trades or losses, provides valuable insights into one's trading style and areas for improvement.

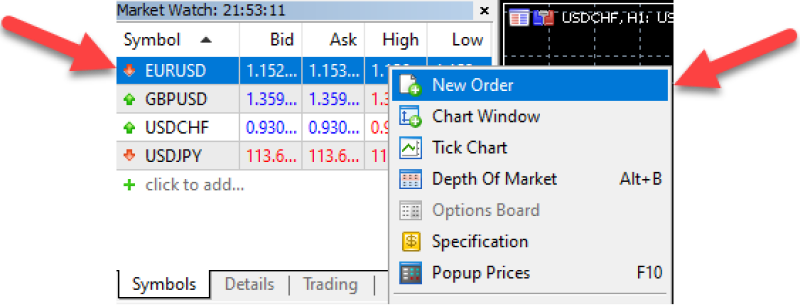

9- Check order details

For more detailed information on a specific trade, traders can right-click on the Trade in the history tab and select Details. This will provide a breakdown of the order.

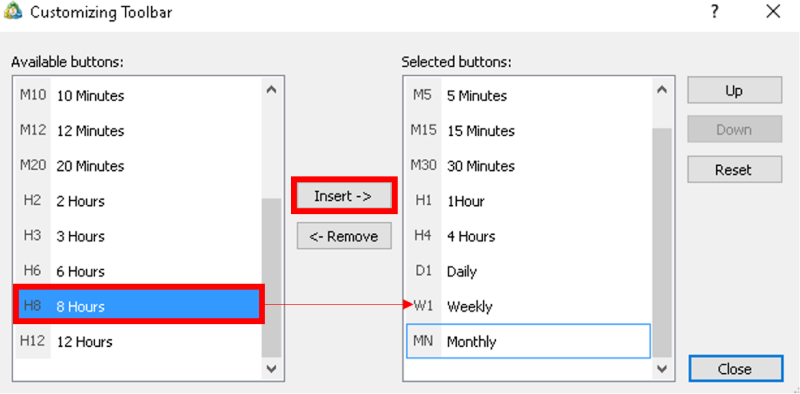

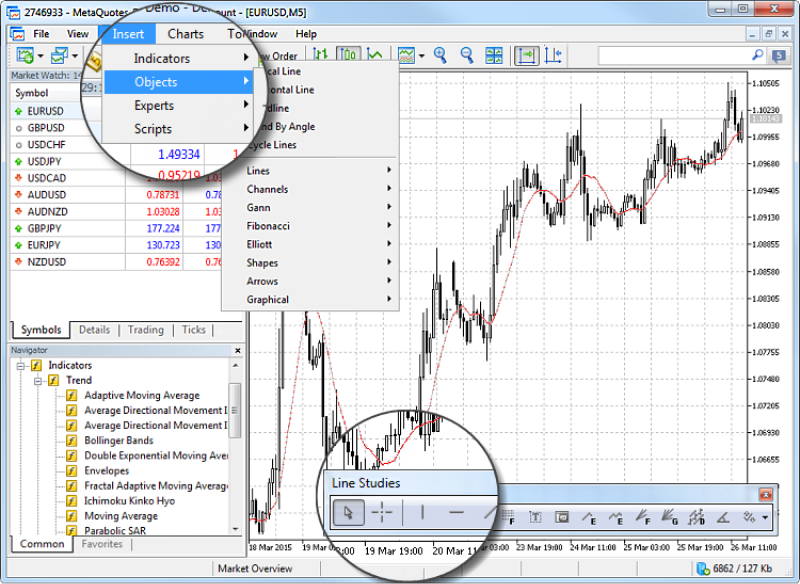

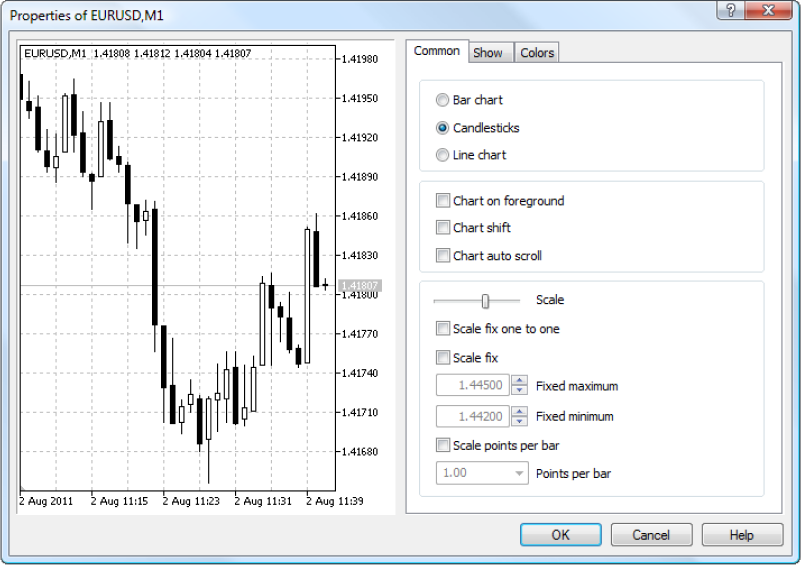

10- Utilize MT5's analytical tools

Explore the analytical tools within MT5 to enhance trade analysis. Features like trendlines, indicators, and chart patterns can be applied directly to historical trades for more in-depth technical analysis.

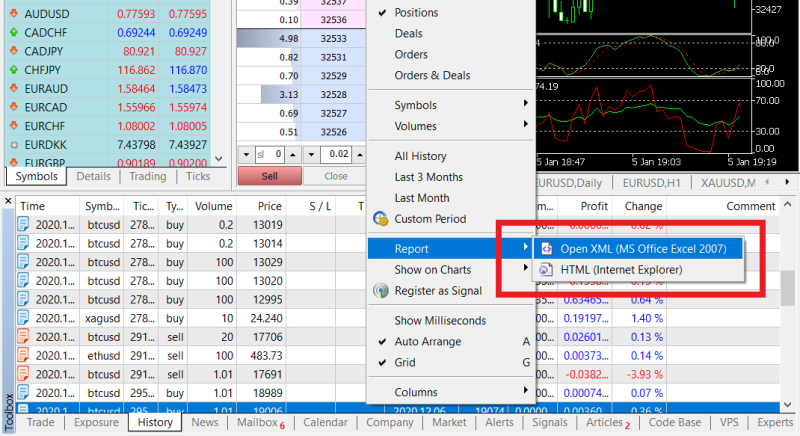

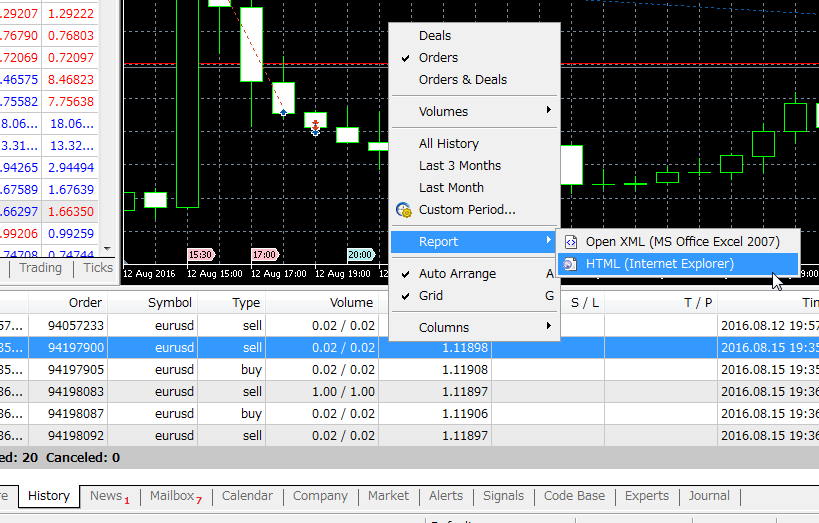

11- Analyze and export

After analyzing the trade details for patterns or insights, traders can also export the trade history by right-clicking and selecting Save as Report for further analysis outside the platform.

12- Consider exporting to Excel

Besides the platform's native export feature, consider exporting trade history to Excel for additional flexibility in data manipulation and presentation.

13- Use graphical analysis

MT5 allows traders to perform a graphical analysis of their trade history. Right-click on a trade and select Chart. This will show the entry and exit points on the chart for better visualization.

14- Track changes over time

Use the graphical representation of historical trades to observe changes over time. Tracking the evolution of trading performance can reveal trends and areas where adjustments have been made.

Reveal trading insights with trade history

Analyzing trading history allows traders to refine their strategies, optimize risk management, and enhance decision-making. The historical knowledge equips traders to adapt in real-time, fostering resilience and agility.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.