The shiny commodity yet again claims the headlines in the trading world as the price soars above the previous highs. But why?

Traders and investors used to flood into Gold in times of uncertainty and that could be considered the case, however the risk sentiment is very much bullish at the moment. The Volatility Index (VIX) is back to levels pre Monday mayhem at the beginning of August. So why is the previous metal rallying?

It could come down to multiple factors including USD weakness, CoT reports and seasonal analysis.

USD Weakness

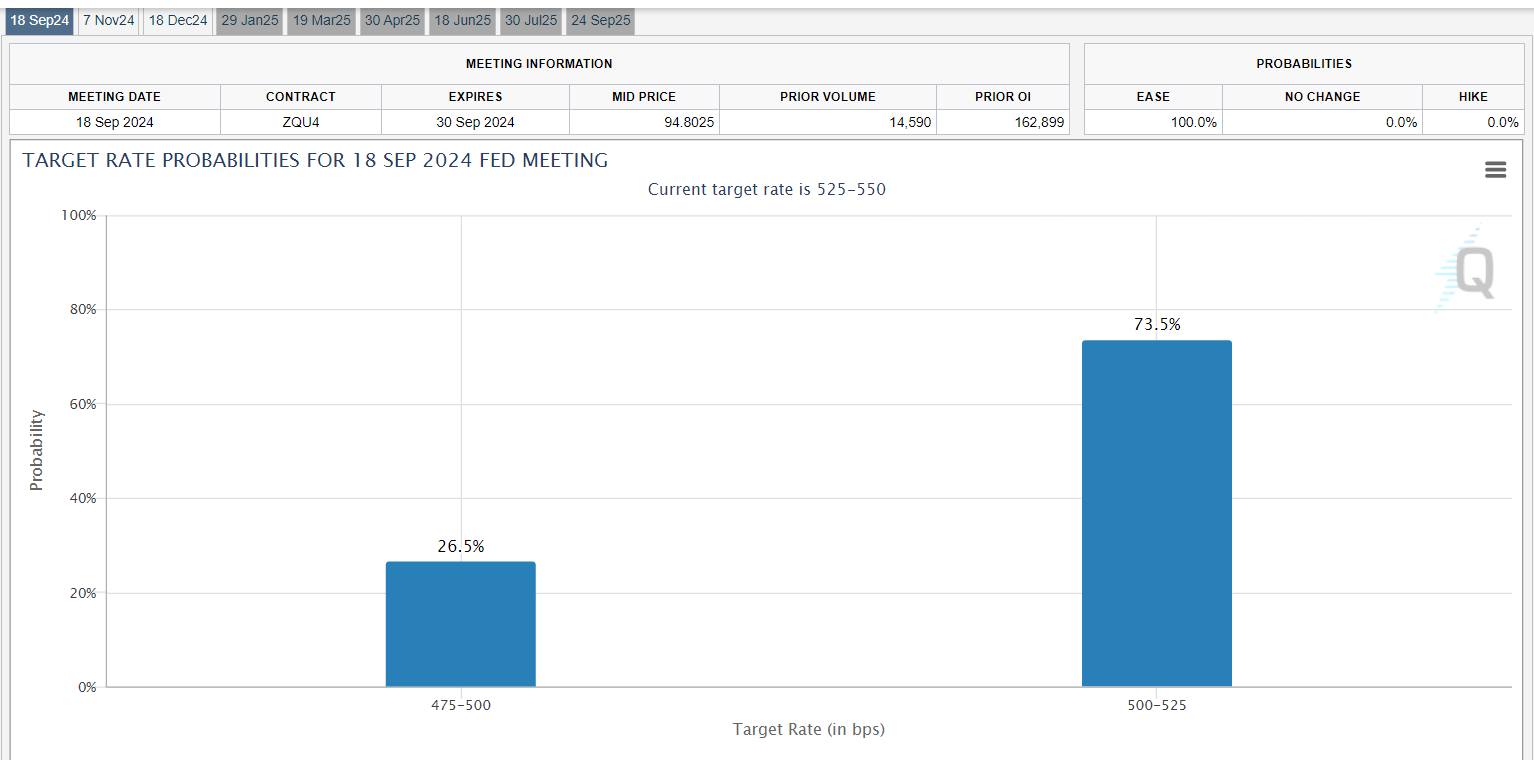

The USD has been driven by the high probability of a cut by the Federal Reserve in their upcoming meeting in September. The CME Fed Watch Tool which tracks the probabilities of interest rate cuts by the Federal Reserve shows a 75% chance of a 25 basis points cut in September. More interestingly a 25% chance of a 50 basis point cut. When a central bank plans to cut rates we can often see the currency devalue. The USD Index has turned bearish with the index price approaching $101.50.

Commitment of Trader Reports

When using CoT reports we want to focus on extremes that have been formed by the commercials. This often leads to turning points especially when looking at commodities such as Gold. Currently they commercials who are in the business of Gold are selling contracts at levels that aren’t indicative of a market top. Current short contracts held by the commercials sit at 380k this is near but not at an extreme with the previous extreme being held at 448k. This tells us that the rally may not be over just yet.

Seasonality

Seasonally specifically through the period of August 16th to September 2nd we can see a rally in the price of Gold. Interestingly this year’s price action holds an 85% correlation with the past 20 years of data. Seasonal analysis with strong correlations can be very effective in markets.

Technical Analysis

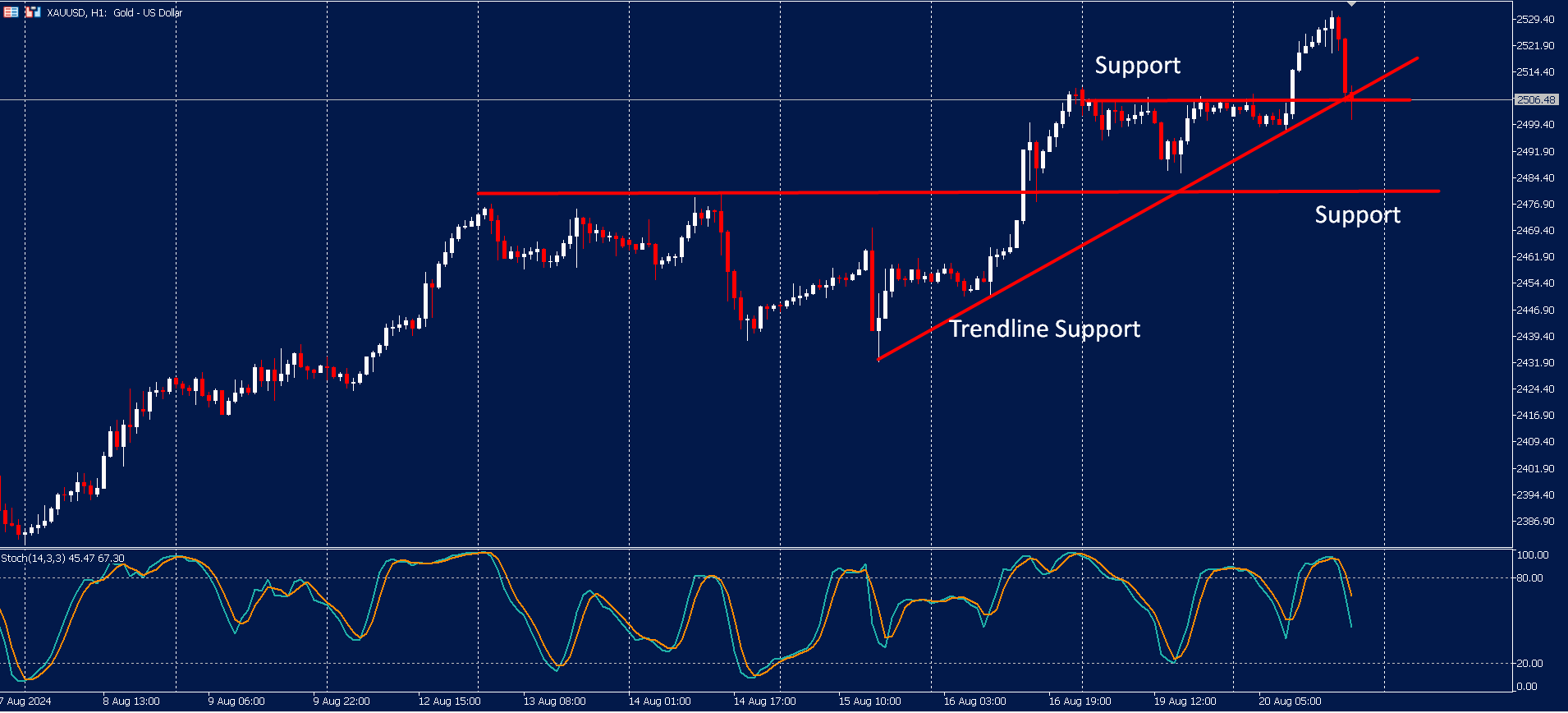

The price of Gold topped at $2531 highs today before settling towards the open of the day around $2500. If prices hold here it could signify that buyers are happy to be involved with price to the upside again.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.