Global stock markets fluctuated in the last week of August, with the S&P 500 and Nasdaq closing lower. The Dow Jones Industrial Average rose slightly. Investors digested potential US interest rate cuts and rising oil prices due to Middle East tensions.

The Japanese Yen strengthened against the US Dollar, reaching a three-week high. However, the USD recovered some of its losses, ultimately closing slightly higher. The Dollar index, which measures the greenback against a basket of currencies, rose by 0.24%. The Euro weakened by 0.28% against the Dollar. Gold prices continued their upward trend, approaching recent record highs as investors sought less risky assets. Spot gold prices increased by 0.31%, while US gold futures gained 0.28%.

Source: Reuters

Key points:

-

Investors are anticipating potential US interest rate cuts soon, based on Federal Reserve Chair Jerome Powell's recent comments

-

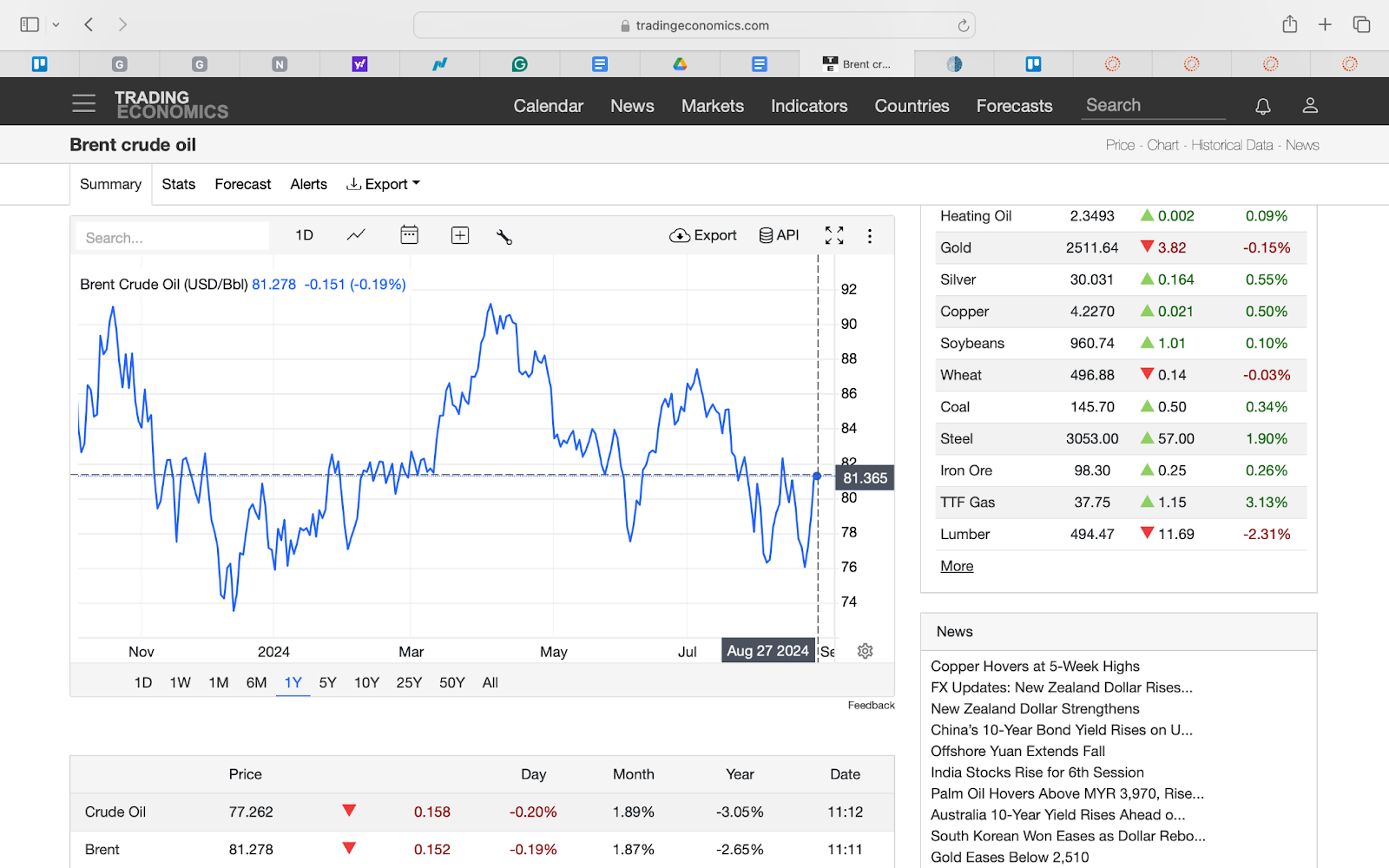

Oil prices increased amid rising tensions in the Middle East and production cuts in Libya

-

US personal consumption and core inflation data, along with a flash reading on European Union inflation, are expected to be released on Friday, 30 August 27, 2024

-

The release of US durable goods orders data provided some support for the Dollar, while the Canadian Dollar benefited from rising oil prices and the resolution of a labor dispute in Canada

-

The escalating crisis between Israel and Hezbollah led investors to seek less-risky currencies, driving up the value of currencies like the Yen and Swiss Franc

Market impact

Increase in USD

The Dollar index rose by 0.24% on 26 August 2024, strengthening the USD against a basket of currencies. A stronger USD can negatively impact countries that import goods and services denominated in USD, increasing the cost of imports. It can also put pressure on emerging market currencies, which may depreciate against the USD.

Rally in CAD

The Canadian Dollar strengthened to a five-month high against USD by 0.3%, indicating a positive outlook for the Canadian economy. A stronger CAD can advantage Canada's economy by making exports more competitive and reducing the cost of imports. However, it can also negatively impact industries that rely on exports to the US, as a stronger CAD makes Canadian goods more expensive for US consumers.

INR falls weak

The Indian rupee is expected to struggle due to a decline in Asian currencies, weak risk appetite, and higher oil prices. Weaker Asian currencies can make exports from these countries more competitive, boosting their exports and potentially improving their trade balances. However, if imported goods become more expensive, this can also lead to higher inflation.

Oil jump impacting the CNY

Brent crude futures closed up 3.05% at $81.43 a barrel, suggesting that rising oil prices may put downward pressure on some currencies. A rise in oil prices can disadvantage countries that import oil, such as China, as it increases their import costs. This will lead to a weaker CNY.

What do experts say about the oil price rally?

Analysts and investors are cautiously optimistic about the future but are also aware of the potential risks associated with a rate cut. They comment, "The stock market is digesting a lot of news: obviously there was a rally on Friday following Powell's comments, and we thought durable goods orders came in good. Historically, rate cuts have actually preceded equity market weakness because rates are being cut for a reason.

Analysts also mention that "the Canadian Dollar continues to perform well in the aftermath of USD-CAD breaking and closing below strong support at 1.3590" and that "oil prices rallied pretty significantly about 3%. They were down last Friday so that recovery has benefited some currencies such as the yen, Swiss franc, and the Canadian Dollar". This might pressure Canadian exports as a stronger Canadian Dollar makes them more expensive abroad and increases market volatility as investors react to shifts in oil prices and currency movements, affecting global trade and investment decisions.

Future outlook:

-

Oil price impact on energy stocks: Rising oil prices due to Middle East tensions may support energy stocks but increase costs for other sectors, potentially adding volatility to global markets

-

Global equity market vulnerability: With major indices like the S&P 500 and Nasdaq declining, especially tech-heavy sectors, global equities may face headwinds as economic uncertainties persist

-

USD volatility due to rate cut expectations: The US Dollar may experience fluctuations as the market reacts to anticipated interest rate cuts, impacting its strength against other major currencies like the euro and Yen

-

Commodity currency strength from oil rally: Rising oil prices could further support currencies like the Canadian Dollar, as higher commodity prices typically boost currencies tied to natural resources

-

European market sensitivity: European markets might remain subdued, especially with uncertainties around the ECB’s rate policy. This could potentially lead to cautious trading and limited growth in the short term.

Insights for traders

Market Caution

As US interest rate cuts loom, expect equity market weakness; traders should monitor tech giants like Nvidia, as their performance may influence broader market sentiment.

Interest rate watch

The rise in the US two-year note yield suggests traders are pricing in more aggressive Fed rate cuts. Stay alert to rate announcements, which could trigger significant forex market movements.

Oil influence

The surge in oil prices due to Middle Eastern tensions is impacting currency pairs like USD/CAD. Traders should watch for further volatility in oil-sensitive forex pairs.

Insights for inventors

Equity market vulnerability

With the S&P 500 down 0.32% and Nasdaq down 0.85%, investors should be cautious about tech stocks like Nvidia, which face high expectations but potential volatility.

Interest Rate Cuts Impact

Anticipated US rate cuts might not fully boost markets; historically, cuts precede equity market weakness, so investors should manage exposure accordingly.

Global equity weakness

The 0.20% decline in MSCI's World Index suggests caution for global equity investors. Consider diversifying into less risky assets or sectors less impacted by geopolitical risks.

Conclusion

Global equity markets ended mixed as the S&P 500 and Nasdaq fell due to Nvidia's dip and persistent geopolitical tensions. Oil prices surged over 3%, and the USD index rose to 100.84, while gold approached record highs. This reflects a market in flux, with rising less-risky demand amid ongoing uncertainties.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.