Forex Weekly Trading Ideas: 12th August

Markets took a breather last week after weathering the storm of volatility on Monday. The combination of BoJ rate hikes, US unemployment rate rises and US recession fears spiked the volatility hurricane into a cat 5 superstorm. But with many storms we can often see calmness, but are we in the eye of the storm or is it over?

This week we see the release of inflation data out of the US. And depending on how this releases we will soon know if the volatility is back. Thursday Core CPI (Consumer Price Index) that excludes food and energy is forecast to rise to 0.2% up from the previous 0.1%. If this comes in higher then it could cause some volatility as markets have been pricing in the chance of a 50 basis points cut over a 25 basis points move. This could see some of the exaggeration we have seen in the markets of late taper back slightly.

Another inflation number to keep an eye on in the US is the annual CPI. The last reading showed a sharp decline from 3.3% to 3.0%, which investors will want to see again. A break of this 3.0% sticking point in inflation will be all that’s needed I feel for investors to sell US dollars in line with the coming cuts from the Federal Reserve.

In other central bank news the RBNZ is forecast to leave interest rates in New Zealand higher at 5.50%. This meeting for the central bank will be a pivotal one, in the previous meeting their language shifted more dovish citing interest rates could fall in line with inflation. Wage growth and non-tradable CPI has remained elevated above the central banks expectations, and with the focus solely on inflation this may be a sticking point for them to cut in this meeting. Expectations are to see a 50 basis point cut in October instead.

Heading across the pond to the UK, we expect to see the release of CPI y/y and retail sales data. The Annual Consumer Price Index was at the desired target of 2% for the Bank of England, but forecasts show we could see a slight rise to 2.3%. Retail sales month on month is forecast to rise from -1.2% to 0.6%.

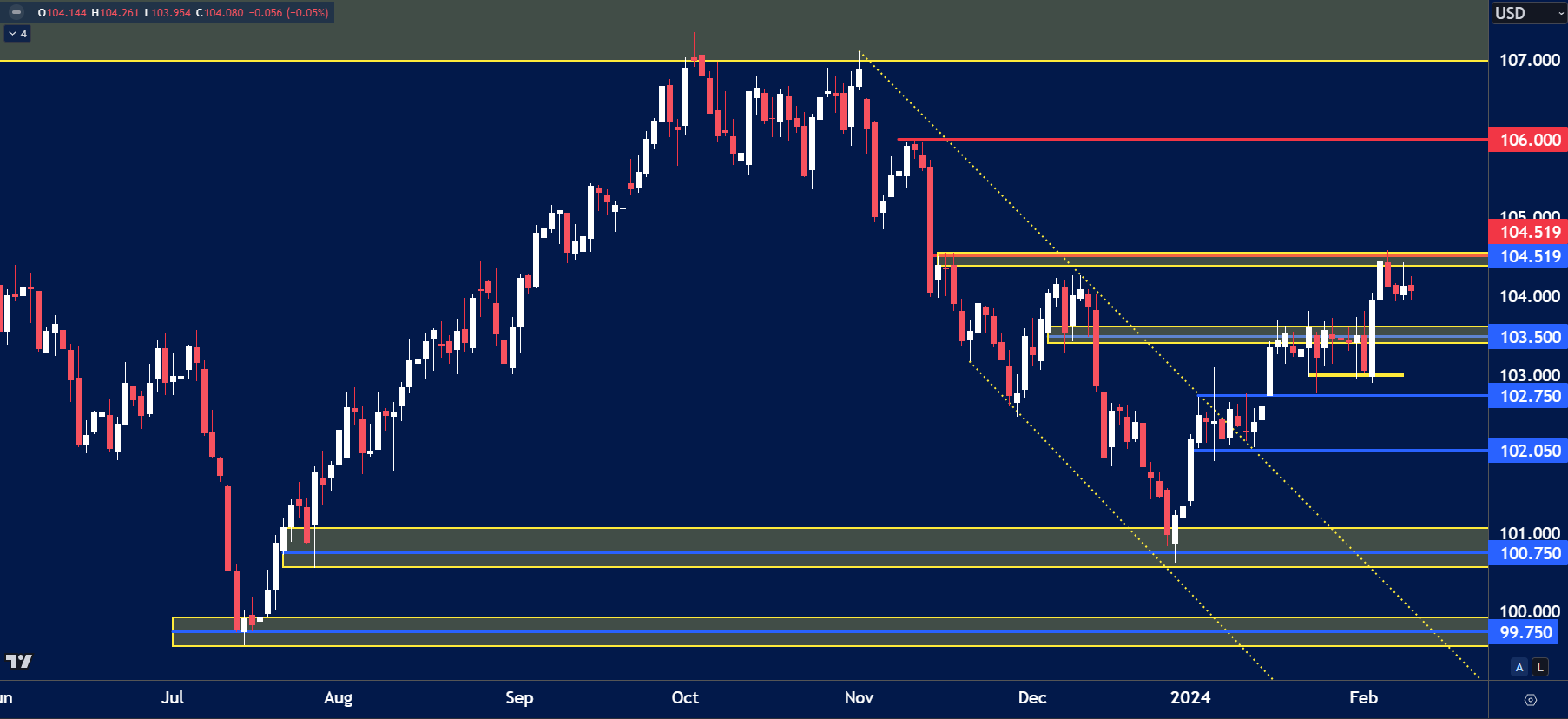

USD Index

- The USD Index weekly chart shows the price closing above the support of $102.50.

- If we were to see a rebound in the US then price may begin to trade higher towards the resistance of $104.00.

- However, further downside could see the $102.50 tested again this week.

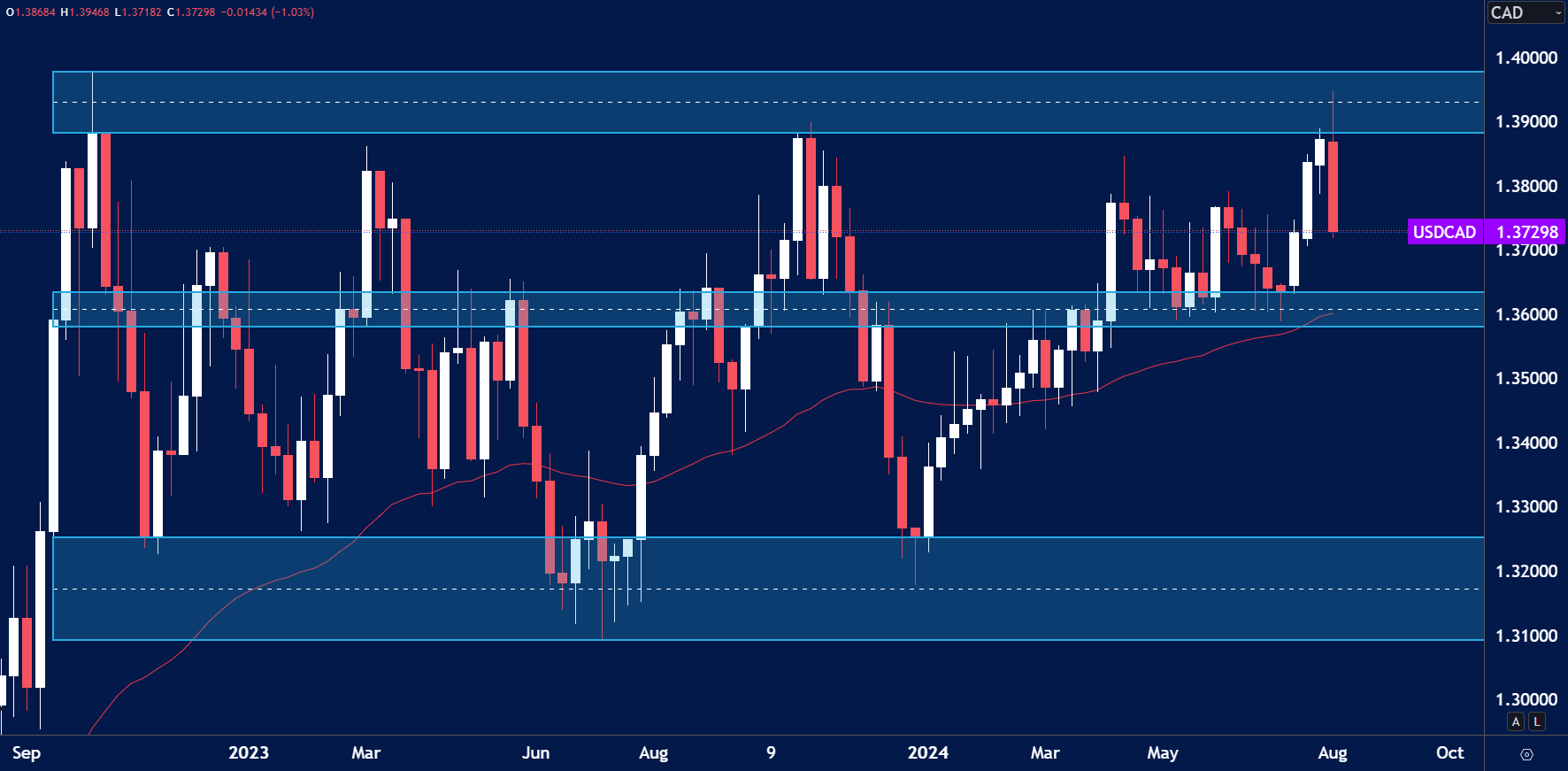

USD/CAD

- The price of USD/CAD rejected the high of 1.3900’s last week as expected.

- The CoT report highlights a significant amount of buying from commercials which makes the Canadian Dollar a currency to watch this week.

- Traders may look to target the 1.3600 levels this week.

USD/JPY

- The price of USD/JPY found support at the weekly demand zone around 142.50.

- Is this a place for sellers to get back involved with the JPY or will the momentum continue?

- This week could reignite the volatility within the markets and JPY could remain slightly stronger in the near term.

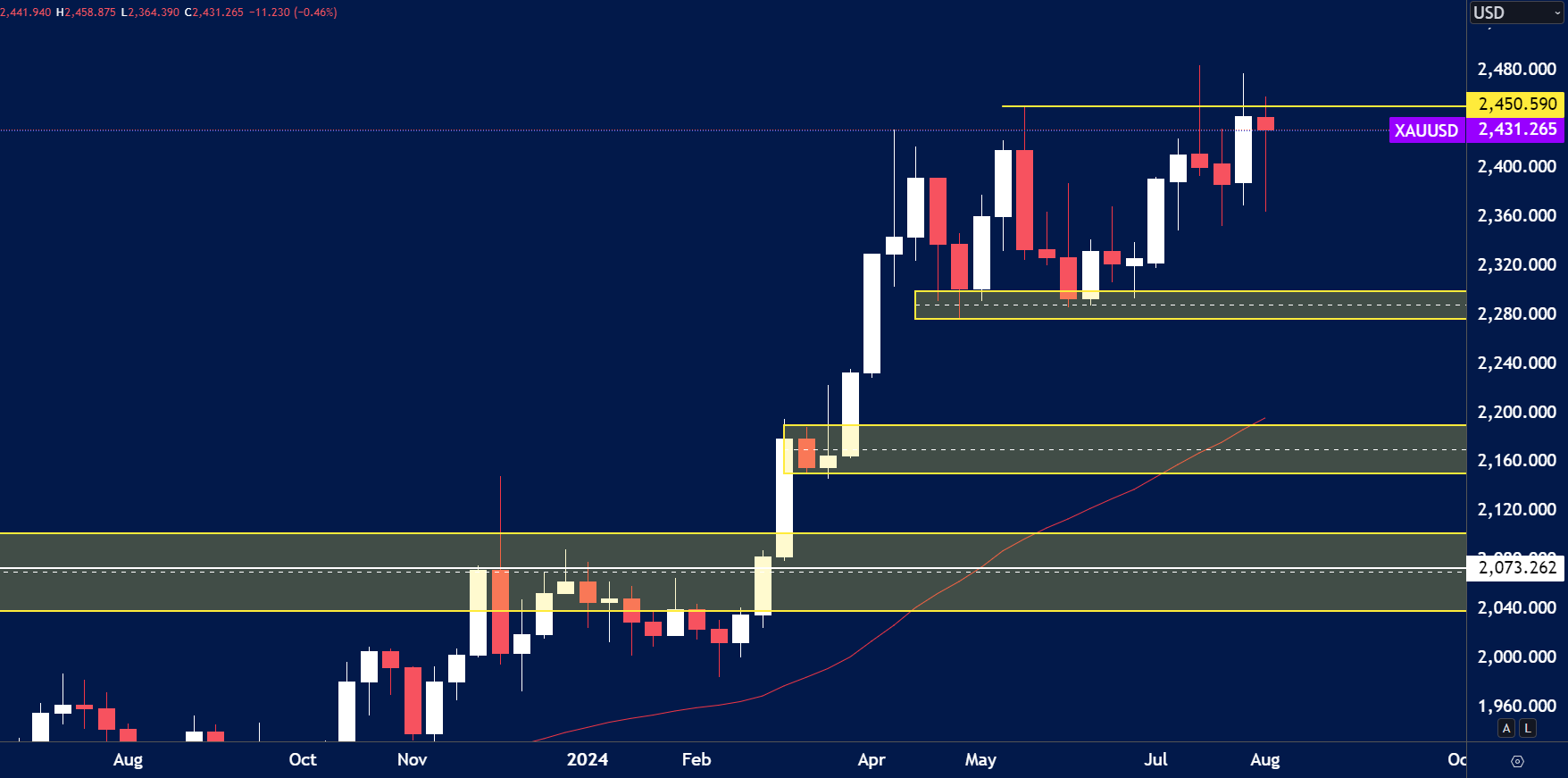

GOLD

- The Gold price traded closed lower than last weeks close but still remained fairly bullish.

- Buyers are still active at lower levels and the momentum could continue again with buyers targeting previous higher around $2450.00 again.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.