📈 Forex Week Ahead: All eyes on FOMC! Will they hold rates at 5.50%? 🤔 NFP expected to dip to 177k. UK's BoE faces a dilemma with CPI at 4.0%. Brace for market moves and stay tuned for insights! 💹 #Forex #FOMC #MarketWatch #TradingStrategies

Watch the video to learn more...

Forex Week Ahead Analysis: FOMC Focus and Economic Indicators

The forex markets are gearing up for a pivotal moment with all eyes fixed on the Federal Open Market Committee (FOMC). The central bank is widely expected to maintain interest rates at 5.50%, but it's the accompanying statements and press conference that will be under intense scrutiny.

Investors and market participants will be parsing every word for clues about the FOMC's stance on future rate movements in 2024. The question on everyone's mind is whether the central bank is signaling a potential shift towards rate cuts, a move that could significantly impact currency valuations and market dynamics.

Shifting our focus to the United States, another key economic indicator to watch this week is the Non-Farm Payrolls (NFP) report. Forecasts suggest a decline to 177,000 from the previous month's figure of 216,000. The NFP data is crucial for gauging the health of the labor market and can influence the Federal Reserve's monetary policy decisions. A lower-than-expected NFP figure may fuel speculation about economic slowdown, adding to the intrigue surrounding the FOMC's statements.

Meanwhile, across the pond in the United Kingdom, the Bank of England (BoE) is set to announce its interest rate decision. Forecasts anticipate that the BoE will keep rates unchanged at 5.25%. However, a potential cause for concern arises from the Consumer Price Index (CPI), which rose to 4.0% in December. The elevated inflation figure could pose a challenge for the UK central bank as it navigates the delicate balance between supporting economic growth and curbing inflationary pressures.

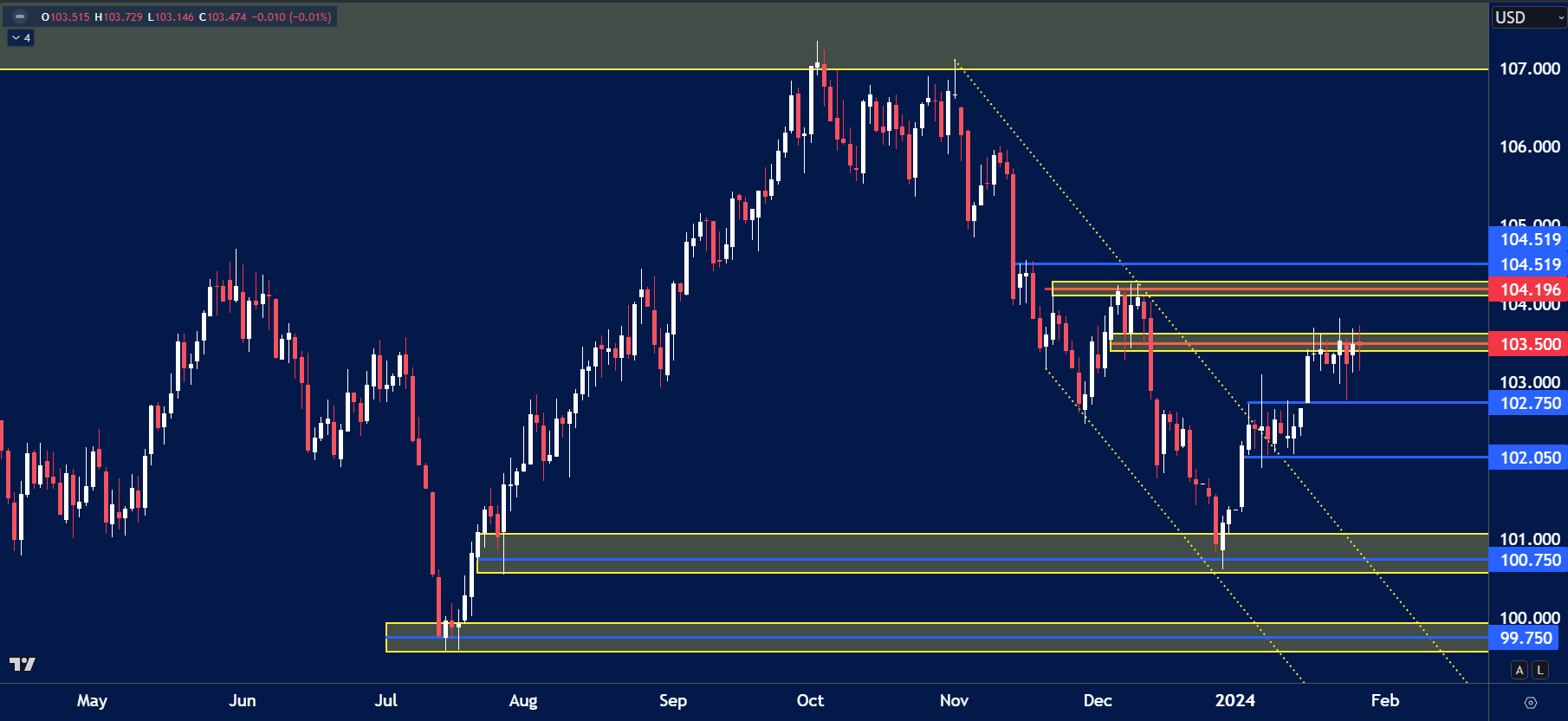

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- Price remains at key resistance of 103.50.

- Consolidation at this level could see price trade higher if 103.50 resistance breaks.

- The next level of resistance rests at December highs of 104.20.

GBPUSD

The price on the chart has traded through multiple technical levels and some observations included:

- GBPUSD daily time frame shows a trading range between 1.2800 and 1.2600.

- If price breaks the range lows, cable could trade down to 1.2500.

- A break above 1.2800 could see the price trade to resistance of 1.2950.

AUDUSD

The price on the chart has traded through multiple technical levels and some observations included:

- Price remains below minor resistance of 0.6600, this could see price trade lower beyond 0.6525 lows.

- A break above the 0.6600 highs could fuel buying pressure to 0.6650.

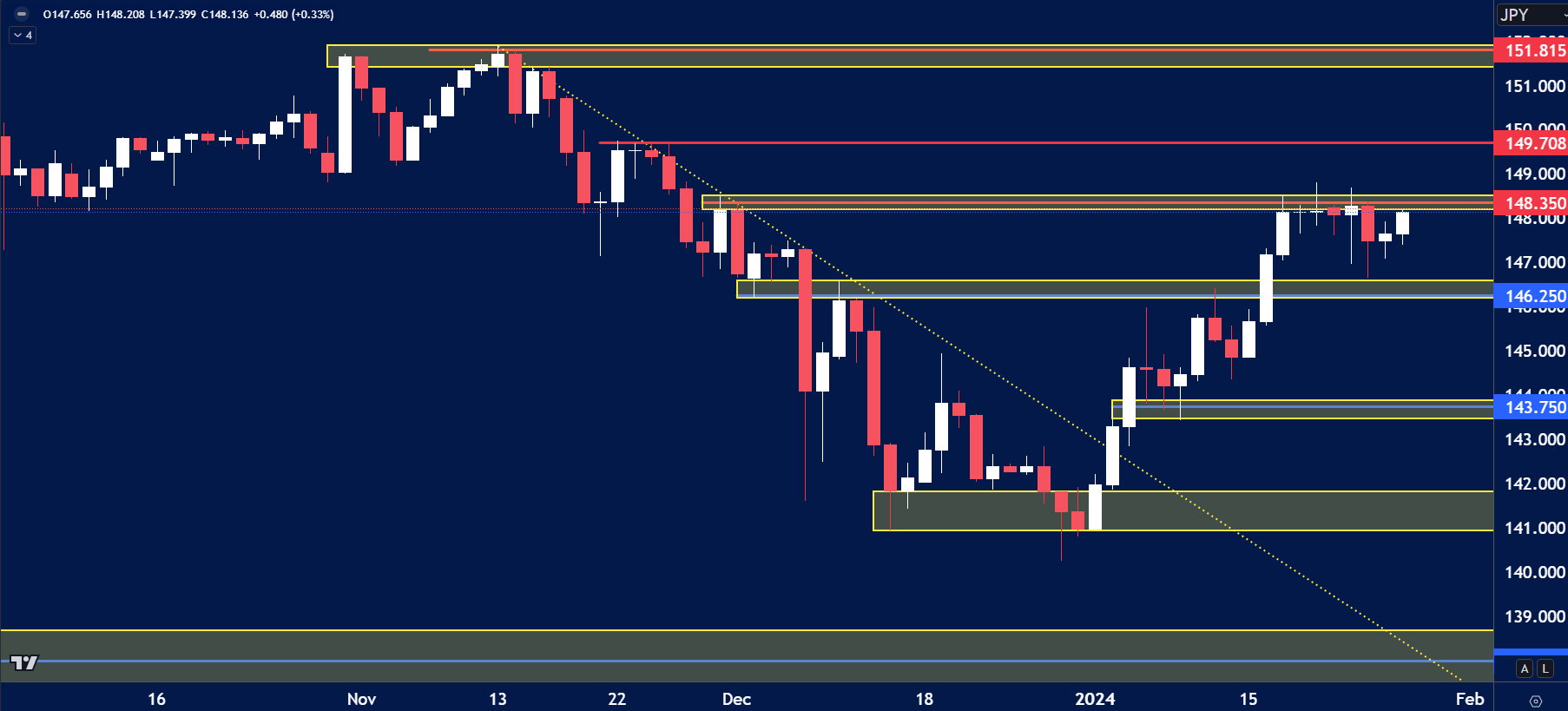

USDJPY

The price on the chart has traded through multiple technical levels and some observations included:

- The upward trend continues, with price trading at 148.50 resistance.

- A break of this resistance could see price trade to highs of 149.70.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.