Gear up for a dynamic week ahead in the forex market as central bank rate announcements take the spotlight! 🌟 From the Fed to the BOJ, stay tuned for potential market movers and be ready to navigate the waves of volatility. #Forex #CentralBanks #Trading

Watch the video to learn more...

As we approach the trading week ahead, the forex market is poised for significant activity driven by a series of pivotal central bank rate announcements. Among the key players are the US Federal Reserve, Bank of Japan, Swiss National Bank, Bank of England, and Reserve Bank of Australia, each expected to deliberate on their respective monetary policies.

The imminent rate decisions hold paramount importance for currency traders, who eagerly await indications of any shifts in interest rates or monetary policy stances.

Key Announcements to Watch

- The release of the FOMC's economic projections and the 'dotplot' for clues to potential timings of future rate cuts.

- Will the BoJ put an end to its negative interest rate policy?

- The Reserve Bank of Australia is likely to maintain interest rates steady for a third straight meeting, despite concerns of slowing growth.

- In the UK, the Bank of England is expected to hold rates steady at 5.25%, could the BoE discuss when cuts will come?

A recurring theme during such high-stakes periods is the propensity for the market to adopt a 'risk-off' stance. This flight to safety typically results in the strengthening of safe-haven assets like the Japanese yen (JPY) and gold, as investors seek refuge amidst uncertainty surrounding central bank decisions.

Traders should brace themselves for heightened market volatility and the potential for abrupt price movements.

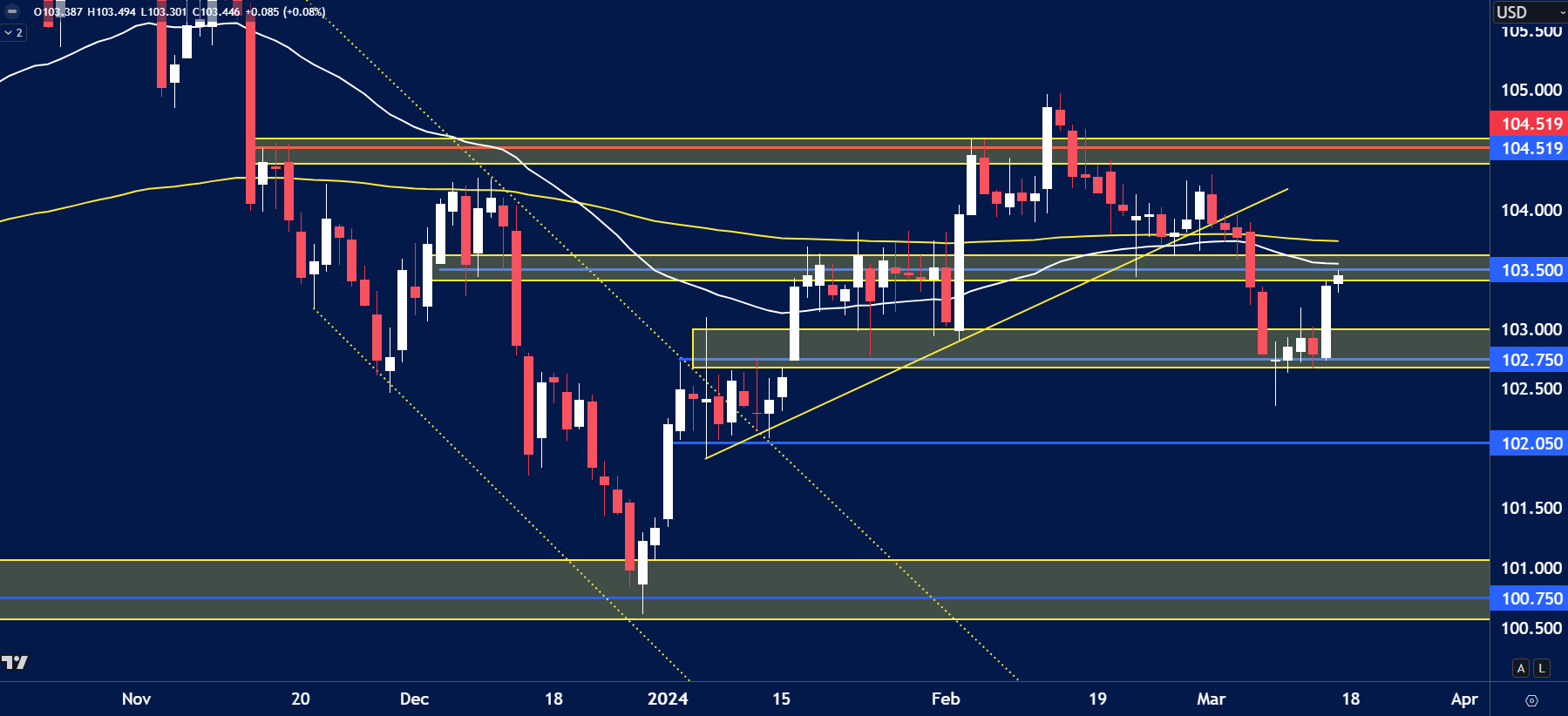

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- The USD Index rallied from the supporting levels of 102.75 last week.

- The Index that is heavily weighted to the EURO now approaches resistance of 103.50.

- Any disappointment from the Fed could cause the USD to weaken, on the other hand we could see a break above 103.50.

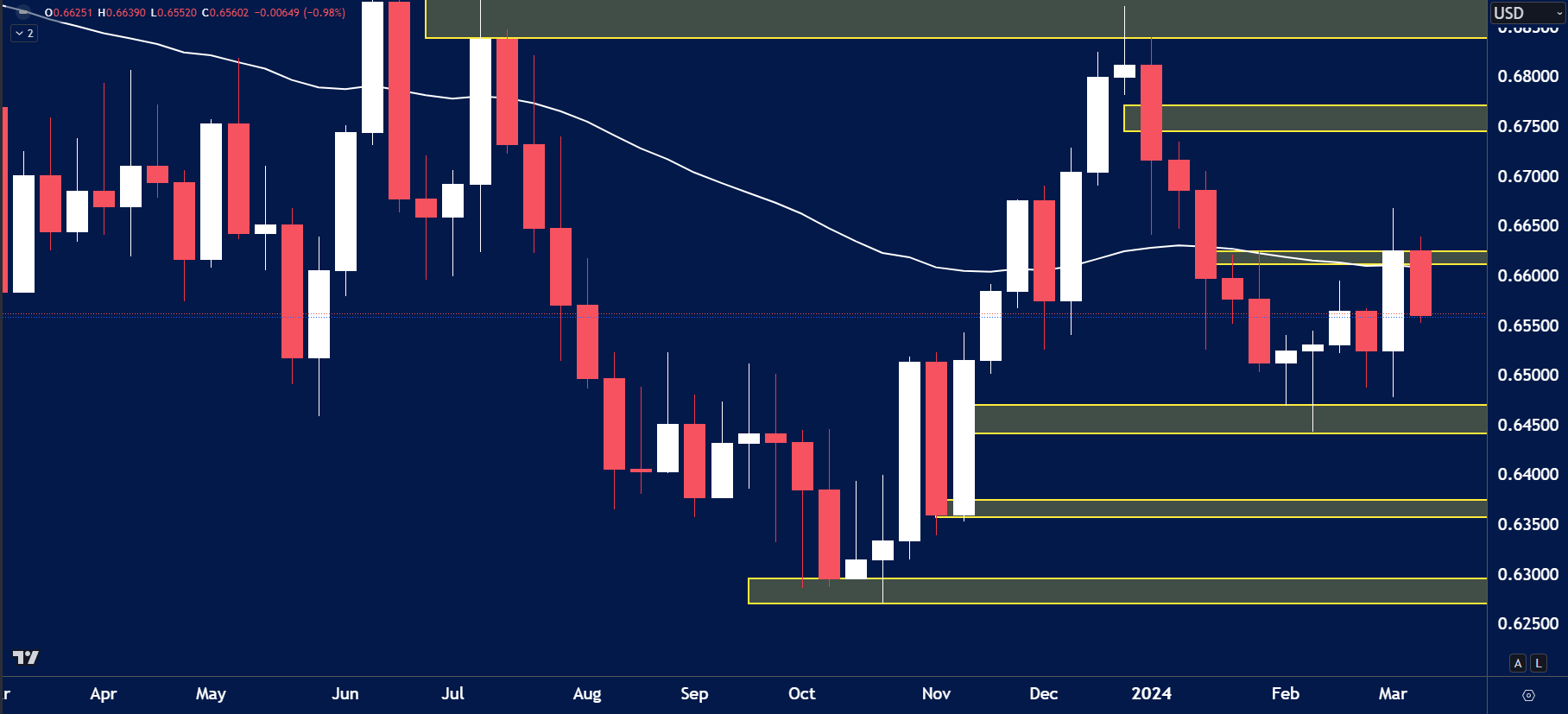

AUDUSD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of AUDUSD remained below the key resistance of 0.6650 last week closing bearish.

- Any USD strength could push prices towards the recently formed lows around 0.6500.

- Traders looking to long this market should consider a close above resistance of 0.6650.

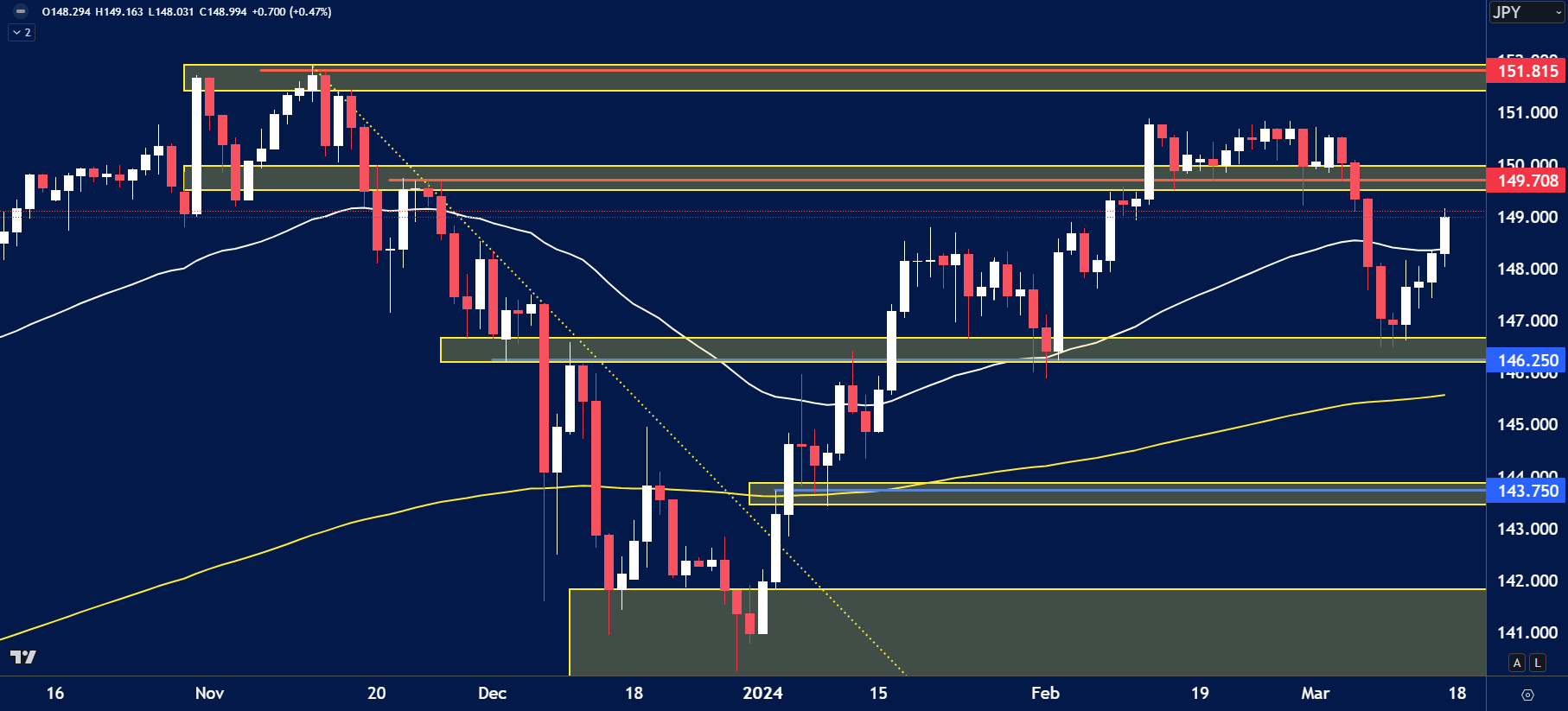

USDJPY

The price on the chart has traded through multiple technical levels and some observations included:

- Volatility of USDJPY should be high this week considering the announcements from the Fed and BoJ.

- The price is approaching the recent consolidation zone lows of 149.70.

- This level could prove to be a sticking point for buyers.

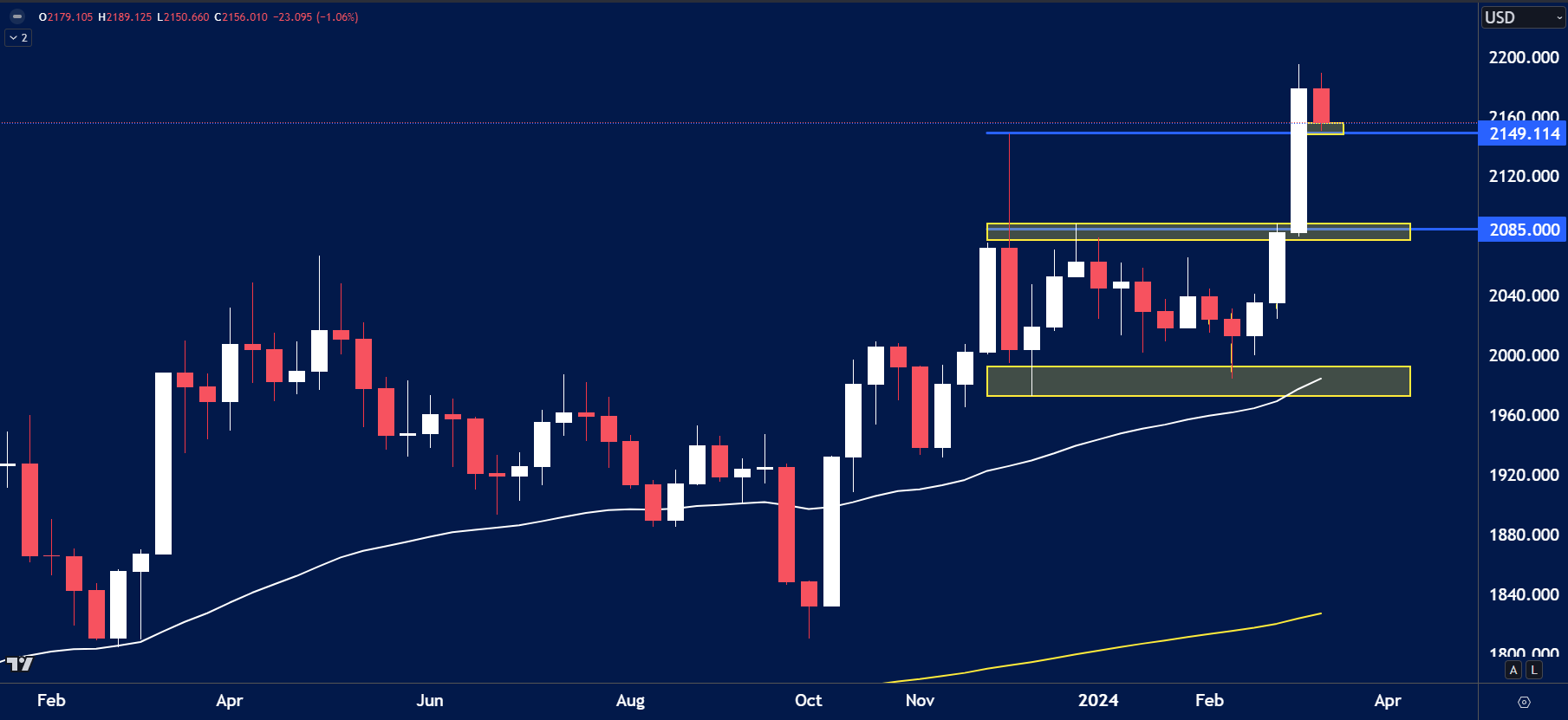

GOLD

The price on the chart has traded through multiple technical levels and some observations included:

- Gold prices retraced lower last week after a record breaking week previously.

- Sellers could fade this week if the market sees a ‘risk off’ environment.

- Support at $2149.00 would be crucial for buyers this week, a close below could invite selling pressure, a hold could make sellers give up.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account