Further focus will be needed by traders this week as the trade tariff war between the United States and China is set to continue. Last week’s bond auction in the US didn’t go to plan with central banks not comfortable with buying US debt, instead favoring Gold instead as the price makes new highs. Consumer data in the US will be in focus again this week, with retail sales coming out on Wednesday. Traders should also remember this is a short trading week with the markets closed on Friday for public holidays.

Forecast for April 14, 2025

Key events to watch includes:

Monday: Nothing noteworthy will immerse on this day, however we will be watching for any new updates to the trade tariff narrative.

Tuesday: The UK’s job market will be in focus, as the claimant count change is expected to fall to 30.3k. In Canada we will see the latest release of CPI.

Wednesday: In the early hours traders will watch the latest GDP, Industrial Production and Retail Sales out of China. We also have Retail Sales out of the US. This data may overshadow the Bank of Canada interest rate decision, the central bank is forecast to leave rates unchanged.

Thursday: The ECB (European Central Bank) is forecast to cut interest rates by 25 basis points, bringing the rates lower to 2.40%.

Friday: Most markets will be closed for the bank holidays.

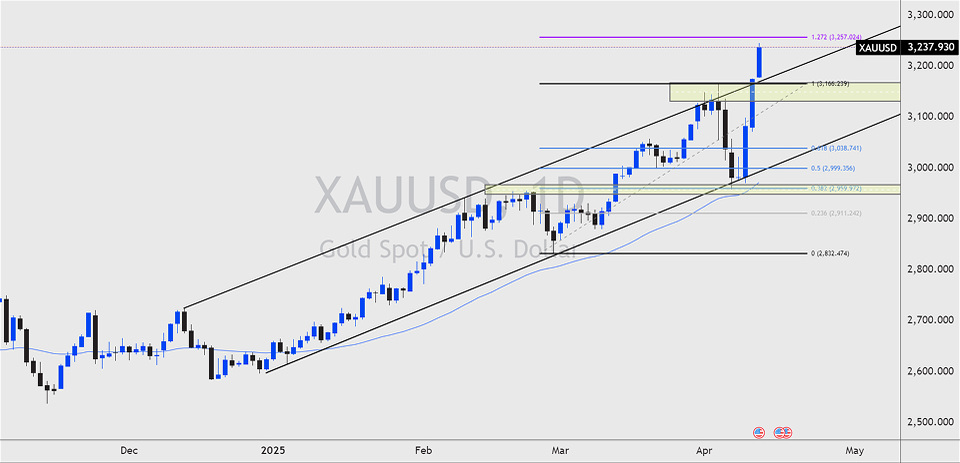

GOLD Outlook

The price of Gold continued to trade higher last week, breaking into fresh highs of $3,237. We can see that the market still sees value in buying Gold, with the price now heading towards the 127.2 Fibonacci extension level of $3,257. If the market continues to buy Gold it could be a sign of further uncertainty to come. Traders will need to be careful, if we see escalations in the trade war and stock markets get impacted negatively, then Gold could be sold to cover any liquidity issues. This means we could see sharp movements lower in correlation with stock markets.

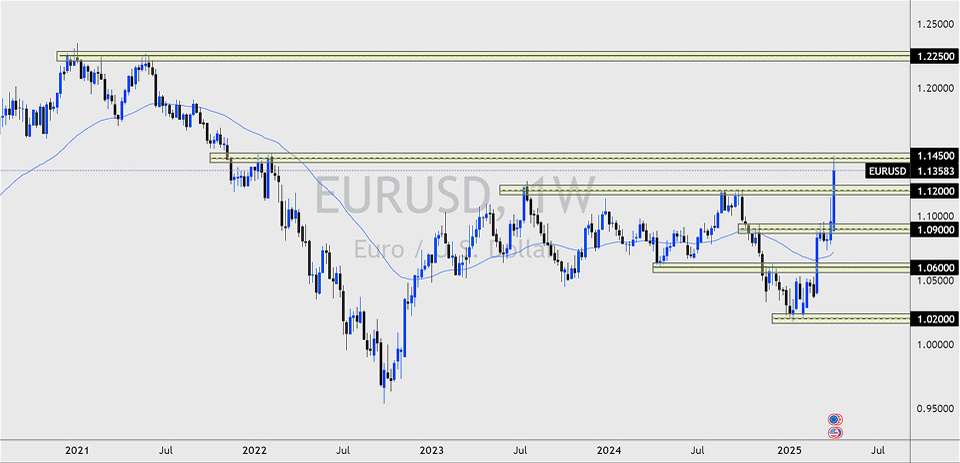

EURUSD Outlook

USD weakness remains the highlight of the market with EURUSD breaking through the 1.1200 resistance highs. This is a significant break of the overall downward trend formed since 2021. Currently, the price is holding at the 1.1450 resistance, but this level could be broken as the ECB is set to announce further stimulus to the Euro Area via a 25 basis point rate cut.

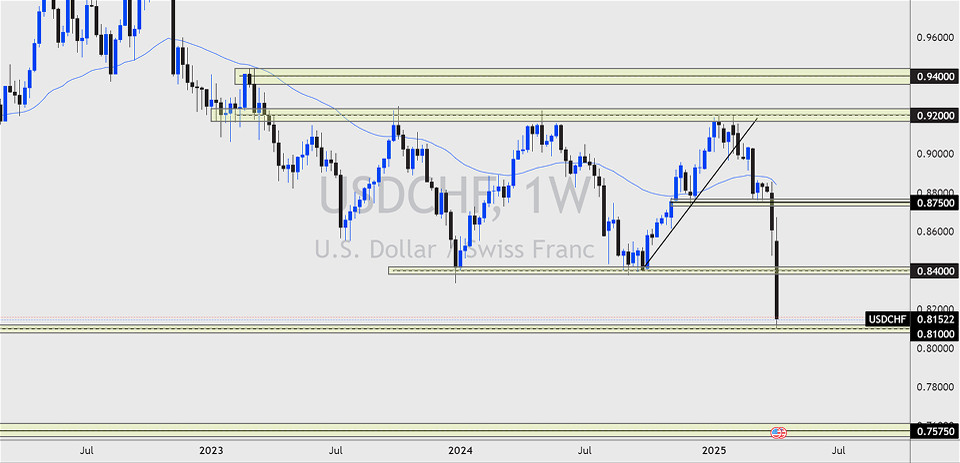

USDCHF Outlook

A lot of eyes have been on the Japanese Yen through the recent market uncertainties but the Swiss Franc has been the stronger of the two safe havens. Why? Well the Swiss National Bank has been cutting rates heavily and are in a position to potentially head into negative rates once again. On the other hand the Bank of Japan is being vocal of their intentions to hike interest rates. So, the carry trade is continuously unravelling and investors tend to flock to a currency that has a lower interest rate, which would be the Swiss France in this case.

The price of USDCHF has fallen 8.54% since the beginning of this month, a substantial move for this forex pair. The price now trades at the support of 0.8100 which is formed from the minor highs in August 2011. A short trading week could be an opportunity for the price to pull back slightly from these levels.

Crude Oil Outlook

The price of oil briefly breached the $56.00 before rebounding towards $62.50. The market narrative surrounding oil prices at the moment hasn’t changed too much, and if the oil price continues lower we could expect to see lower inflation rates coming out of the US. Ideally, traders would like to see the price trading back towards $67.00, before seeing the downward trend continue.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account