Catch the latest insights on the forex market's pulse! 📈💼 From surprising job numbers to upcoming CPI releases, stay ahead with our analysis. #Forex #MarketAnalysis #EconomicIndicators

Watch the video to learn more...

Forex Week Ahead Highlights

- Last week saw US job numbers surge by 275k, surpassing estimates, but with a concerning drop in Average Hourly Earnings.

- Weakness in the USD was compounded by the revision of January's job numbers from 353k to 229k.

- This week, focus remains on the US with the release of the Consumer Price Index (CPI) m/m, expected to rise to 0.4%.

- In the UK, Gross Domestic Product (GDP) m/m is forecasted to rebound from -0.1% to 0.2%, potentially affecting the strength of the GBP.

- Gold prices surged through the all time highs, further USD weakness could continue to drive prices higher for the precious metal.

Forex Week Ahead: A Look at Key Data Points

Last week's unexpected surge in job numbers in the US, surpassing estimates by a significant margin of 275k, initially suggested strength in the economy. However, this positive outlook was dimmed by a concerning drop in Average Hourly Earnings from 0.5% to 0.1%. Furthermore, the revision of January's numbers from 353k to 229k compounded the weakness in the USD.

As we step into the new week, all eyes remain on the US as more data is set to be released. One of the significant indicators to watch is the Consumer Price Index (CPI) month-on-month (m/m) figure. Forecasts anticipate a rise to 0.4% from the previous 0.3%. However, given the recent streak of lackluster economic data from the US, any decrease in this figure could exacerbate the ongoing weakness in the USD.

Across the pond, the United Kingdom is also in focus with the Gross Domestic Product (GDP) m/m forecasted to rebound from -0.1% to 0.2%. This potential uptick in GDP suggests a possible improvement in economic activity, which could have implications for the strength of the British pound (GBP) in the forex market.

Overall, this week's data releases, particularly from the US and the UK, are poised to influence forex trading strategies. Traders will closely monitor the CPI and GDP figures for insights into the health of the respective economies and their currencies' potential trajectories. With lingering uncertainty and volatility in global markets, informed decision-making based on the latest economic indicators will be paramount for navigating the forex landscape ahead.

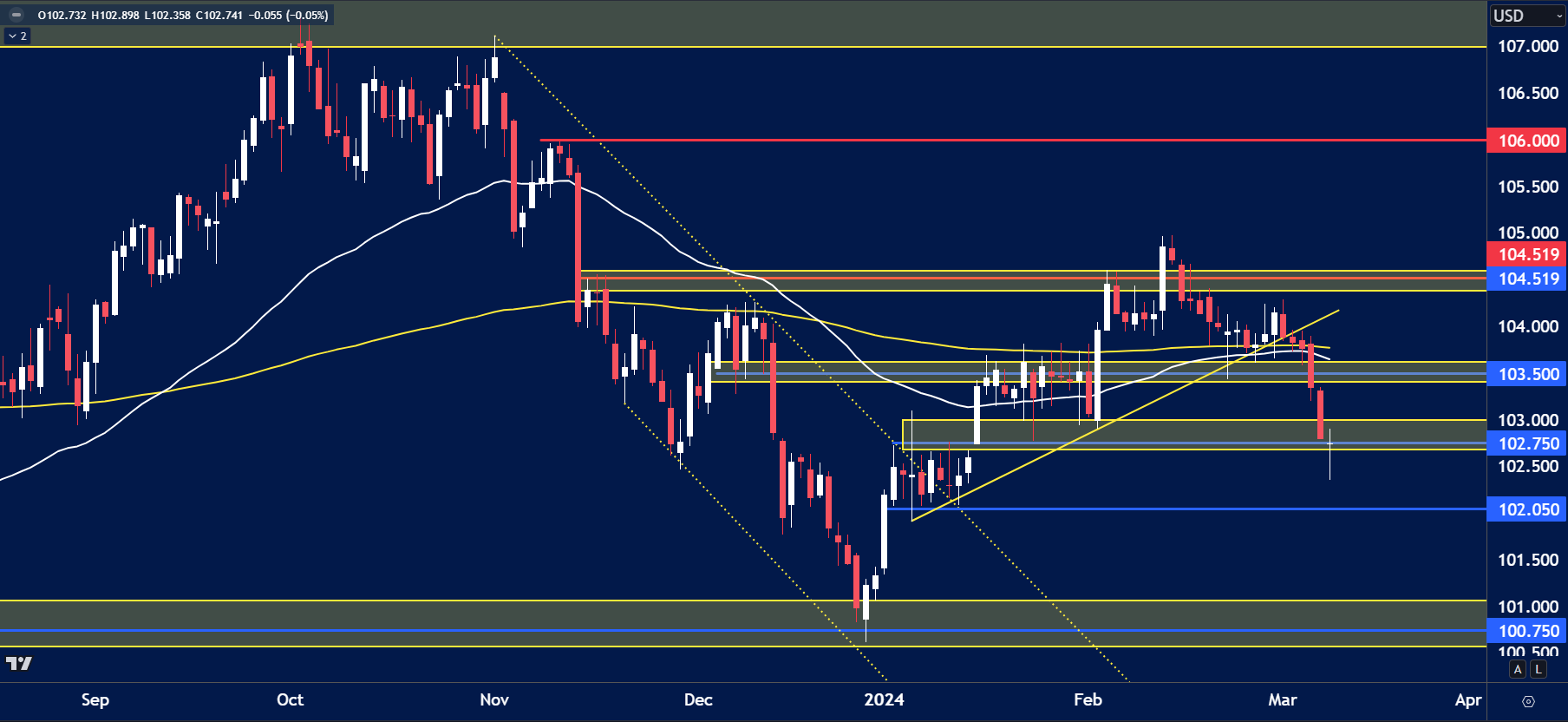

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- USD Index price fell through the support of 103.50 formed from the lows the week prior.

- Price now sits just above the support of 102.75. USD weakness could take a small break this week if price remains above this level.

- A break back below could invite further selling pressure towards 102.00.

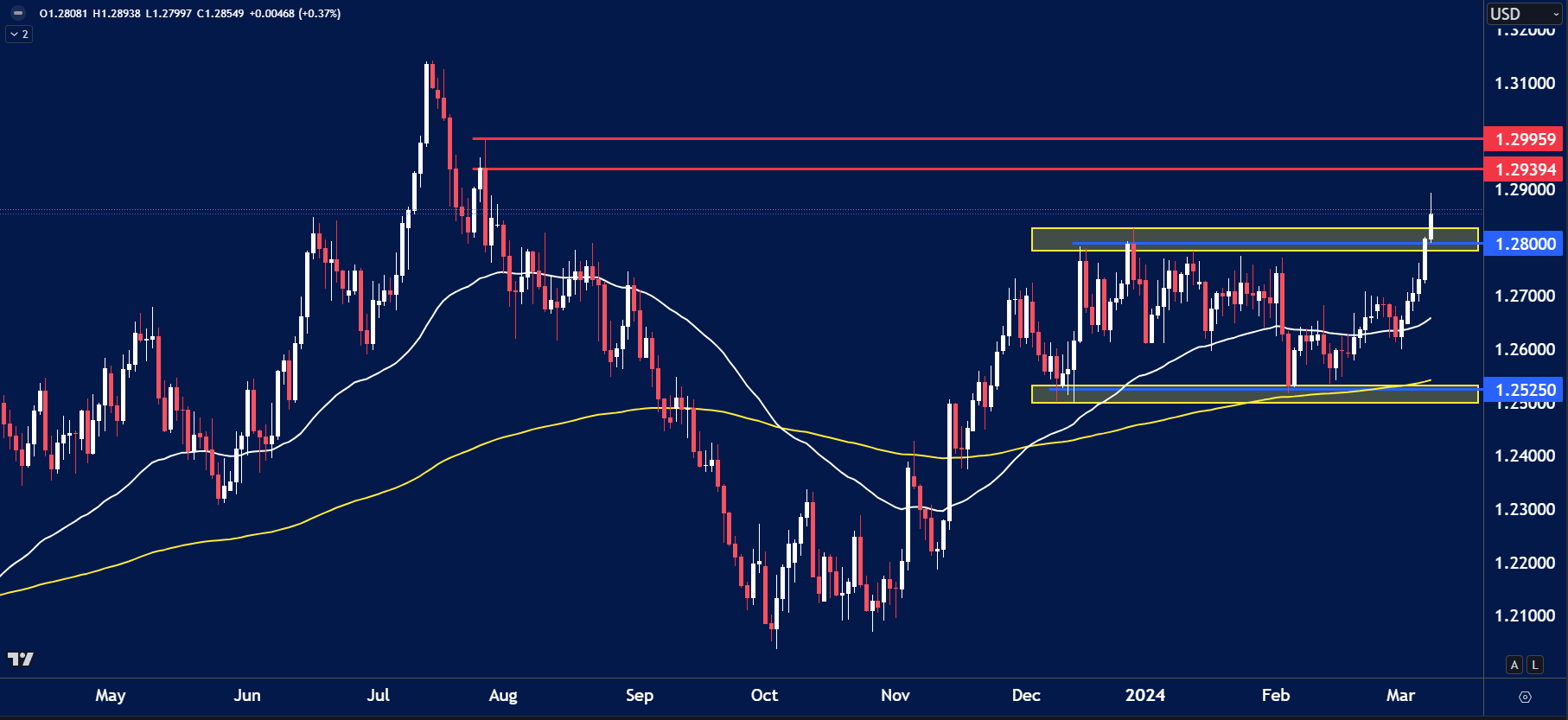

GBPUSD

The price on the chart has traded through multiple technical levels and some observations included:

- UK Budget and USD weakness helped cable trade through the range highs of 1.2800.

- This could open up long opportunities towards 1.2950.

- A break back within the range would be concerning for traders long.

EURUSD

The price on the chart has traded through multiple technical levels and some observations included:

- EURUSD also benefited from the USD weakness. Price traded through the recently formed highs of 1.0900.

- Price reached the resistance highs formed in January at 1.0975. This level of resistance could be tested again this week.

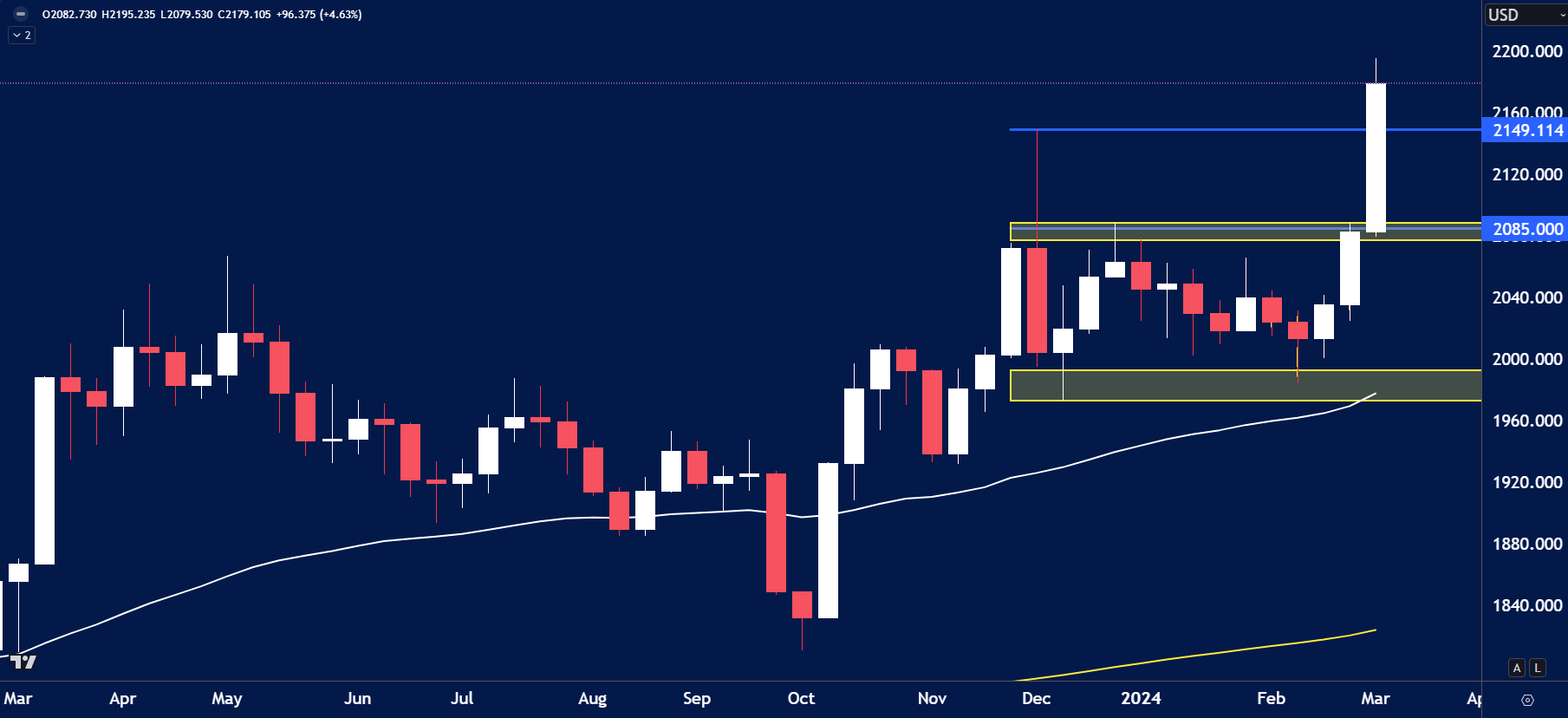

GOLD

- Gold prices surged higher grabbing all the headlines last week.

- The price traded to highs around $2,200.

- Somewhat surprisingly the COT reports show selling but not at levels expected with prices being so high, volumes in Gold are also at all time highs.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.