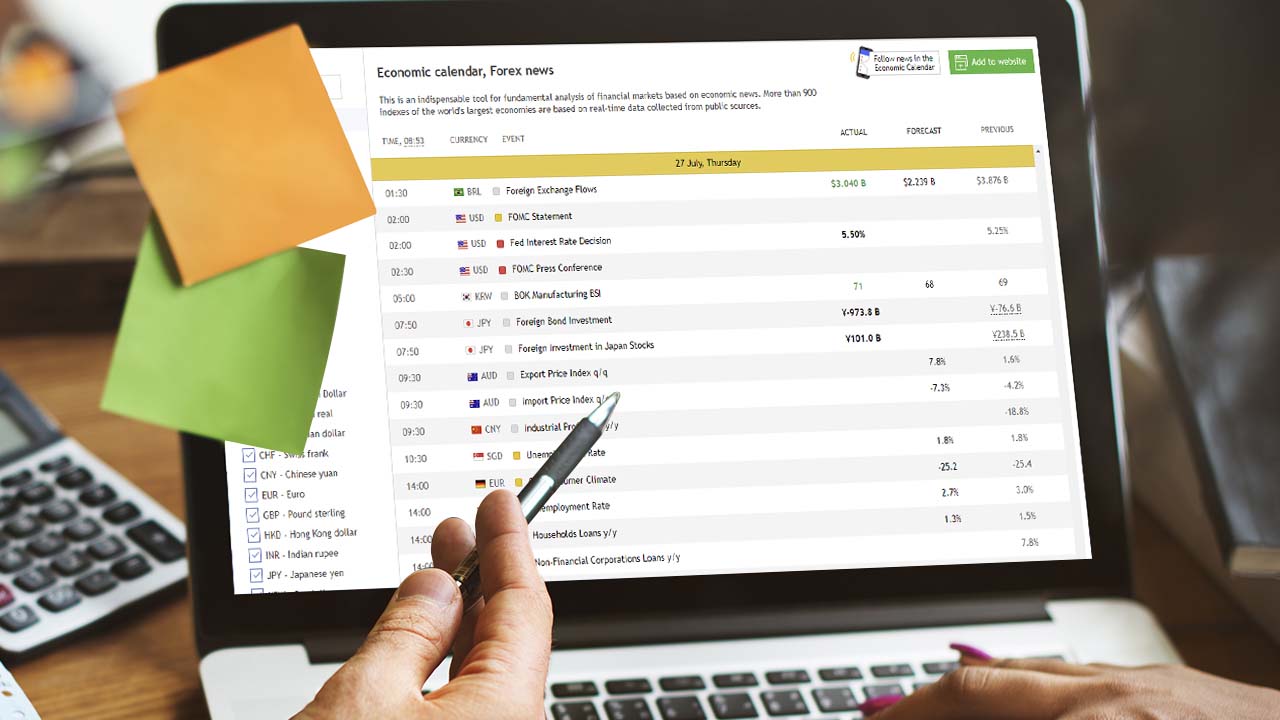

Understanding the interplay between economic events and currency movements is crucial for forex traders. One tool that aids in this analysis is the Forex Economic Calendar, a comprehensive schedule of economic releases, speeches, and other events that can influence the forex market.

In this article, we delve into the Forex Economic Calendar for 2023, shedding light on key events and their potential impact on currency valuations.

Top events as per the Forex Economic Calendar for 2023

Non-Farm Payroll (NFP) Report

The NFP report is released on the first Friday of each month, making 4th August, 1st September, 6th October, 3rd November and 1st December, 2023 the upcoming release dates. This report is a monthly economic indicator released by the US Bureau of Labor Statistics. It provides data on job gains or losses in the non-farm sector, excluding agriculture, household, and non-profit employees. Forex traders closely watch the NFP report as it indicates the health of the US labor market.

Positive NFP data, showing higher job gains, can strengthen the US Dollar (USD) and increase the likelihood of interest rate hikes by the Federal Reserve and vice versa. Additionally, other major currencies can be affected by the NFP report due to their correlation with the USD.

For example, currencies that have a direct proportion with the USD, like the CAD, due to the strong trade relations between the US and Canada, the CAD will also increase after a positive NFP report like the USD. On the other hand, currencies inversely proportional to the US Dollar, like the EUR or JPY (as both are also major currencies, making up the majority of the forex market), decrease after a positive NFP report as USD strengthens.

Consumer Price Index (CPI) Report

The CPI report will be released on 10th August, 13th September, 12th October, 14th November and 12th December, 2023. This report measures changes in the average prices of goods and services and serves as an inflation indicator. It influences central bank policies and market expectations. Higher-than-expected CPI figures may lead to expectations of tighter monetary policy, attracting investors and strengthening the related currency, while lower-than-expected figures can suggest looser monetary policy, potentially weakening the related currency. Traders closely analyze the CPI report for insights into inflation trends and adjust their strategies accordingly in response to its findings, which means traders invest more in the currency when the inflation is low as per the CPI report and vice versa.

Core Personal Consumption Expenditures (PCE) report

The Core PCE report is typically released on the last Friday of each month, making 25th August, 29th September, 27th October, and 24th November the upcoming release dates. This report is a vital indicator of inflation and consumer spending in the US. Forex traders closely watch this report as it affects monetary policy decisions, particularly by the Federal Reserve. The report's impact on the forex market lies in its ability to gauge inflation levels, influence interest rates, and shape market expectations and future projections.

Traders analyze the Core PCE report to anticipate currency movements and adjust their strategies accordingly. The Core PCE report can have a positive impact on the forex market if it indicates higher-than-expected inflation, leading to expectations of tighter monetary policy and currency appreciation and vice versa.

Federal Open Market Committee (FOMC) meetings

Eight FOMC meetings are conducted every year, scheduled on 19th-20th September, 11 October, and 12-13th December in 2023 (subject to change as per economic projections). The Federal Open Market Committee (FOMC) meetings are gatherings held by the Federal Reserve in the United States to determine monetary policy. These meetings impact the forex market through their decisions on interest rates, future projections, and assessments of the economy. Interest rate changes announced by the FOMC can lead to currency appreciation or depreciation.

The FOMC's statements and guidance shape market expectations, affecting investor sentiment and currency valuations. Forex traders closely monitor the FOMC meetings to analyze their impact on monetary policy and make informed trading decisions based on the outcomes and market reactions. FOMC meetings can (negatively) positively affect a currency through interest rate (cuts) hikes, a (negative) positive economic outlook, and (not) meeting market expectations. These factors can (distract) attract investment and (weaken) strengthen the currency.

RBA Interest Rate Decision

The Reserve Bank of Australia (RBA) interest rate decision will be released on 5th September 2023. This announcement refers to their regular meetings to determine the official cash rate, which affects short-term interest rates. This decision impacts the Forex market by influencing the valuation of the Australian Dollar (AUD). A higher interest rate or a hawkish stance can attract investors, leading to AUD appreciation, while a lower interest rate or a dovish stance may weaken the AUD. Additionally, interest rate differentials and carry trade strategies play a role in determining the demand for the AUD.

Bank of Japan Reports

Scheduled to release on 7th August, 2023, Bank of Japan reports include the Monetary Policy Meeting minutes, Tankan Survey, Financial System Report, and Economic Outlook of Japan. These are regular publications that provide valuable insights into Japan's economic conditions and overall policy decisions. These reports can impact the forex market by shaping market expectations regarding monetary policy, influencing market sentiment through assessments of the economy's health, and guiding investors' decisions.

Positive assessments strengthen the Japanese Yen, while negative reports can weaken it. Additionally, the Tankan Survey reflects business sentiment, impacting overall market sentiment and potentially leading to capital inflows or outflows.

UK Employment Change Report

The UK Employment Change report will be published next on 15th August 2023, by the Office for National Statistics (ONS). This report provides crucial information on shifts in employment levels and labor market indicators in the UK. Hence, the report has a notable impact on the forex market as it reflects the economic health of the UK. Positive employment data can boost confidence, attracting investors and strengthening the British Pound (GBP), while negative data can lead to market uncertainty and potential depreciation of the currency.

Navigate through the Forex Economic Calendar 2023

The following economic events are some of the most significant ones occurring in the year 2023. Follow these events to gauge forex market sentiment, as each of them will impact the market in one way or another.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.