MT4 vs MT5: Which is Better?

MetaTrader is one of the most popular online trading platforms used globally and its two main versions are MetaTrader 4 and MetaTrader 5. But between MT4 vs MT5, which is truly better? Both MT4 and MT5 are built to enable seamless trading of forex, stocks, futures and CFDs. Offering high flexibility and real-time access to market prices, they allow you to trade multiple orders simultaneously. Using MetaTrader can be beneficial whether you are a beginner or an expert at trading. But, to make the most of MetaTrader, you need to know when to use MT4 and when to use MT5. In this article, we discuss the differences between MetaTrader 4 vs MetaTrader 5.

What is MetaTrader 4 or MT4?

MetaTrader 4 is an online trading platform preferred by forex traders. You can also trade commodities and index instruments through a Contract for Difference (CFD). With MT4, you view real-time currency prices, perform technical or fundamental analysis, automate trades through custom algorithms, and open or adjust orders. You can also customize charts, orders, and more through MT4 as per your own trading preferences.

What is MetaTrader 5 or MT5?

MetaTrader 5 is a multi-asset trading platform that enables you to trade stocks, forex and futures. It offers advanced tools for price analysis, algorithmic trading (Expert Advisor and trading robots), and copy trading. Launched in 2010, five years after the launch of MetaTrader 4, MT5 is considered more improved and diverse with better charting, exclusive indicators, and its widespread ability to trade over 500+ markets including forex, indices, commodities, cryptocurrencies, and stocks -- all through one platform.

MT4 vs MT5: Comparing key features

Algorithmic trading

Algorithmic or automated trading basically means you automate the entire trading process and allow you to place successful trades even when your machine is off and you are sleeping. Both MT4 and MT5 offer algorithmic trading but in different ways.

- MT4 executes automated trading based on an order system. However, MT5’s automatic trading function is designed to implement a positional system that allows traders to hold and carry a position for a longer period of time.

Purpose

Neither MetaTrader 4 or MetaTrader 5 is an upgrade of each other since they both serve a different function altogether. While MT4 is specifically focused on forex trading, MT5 allows you to trade in stocks, futures and forex. However, there are a few things that MT5 is better at when compared to MT4 –

- MT5 has faster backtesting as compared to MT4, which allows traders to see how well an investment/trading strategy would have performed considering the actual results through historical data.

- MT5 has a depth of market functionality that helps in measuring the supply and demand for the assets on the basis of all the open buy and sell orders.

Analytics

Analytics in both platforms is built to place more successful trades. The analytics helps in forecasting the asset price change and assists traders in deciding profitable trades for themselves.

- Both MT4 and MT5 allow custom analytics to suit individual trading needs.

- MT4 includes interactive charts with 9 timeframes, whereas MT5 includes charts with a total of 21 timeframes.

- MT4 offers 30 in-built technical indicators, while MT5 offers 38 in-built technical indicators.

- Some indicators like the Fibonacci and Elliot tools are available only on MT5 and not MT4.

- MT4 includes 31 graphical objects, whereas MT5 brings 44 of them.

- Both platforms include an alert functionality and provide traders with ongoing financial news.

- MT5 also has an economic calendar that MT4 does not. This helps MT5 deliver macroeconomic news from across the globe to the trader that might impact their financial trading decisions.

- Only MT5 offers a multithreaded strategy tester that enables traders to use all the computer resources to test and optimize the trades.

- An embedded community chat and fund transfer between different accounts is also offered by MT5 and is not a part of the MT4 platform.

- MT4 comes with over 2000 custom indicators and 700 paid indicators.

- MT5 has an unlimited number of charts.

Interface

Both MT4 and MT5 have an easy-to-use interface with a few differences:

- MT4 is comparatively simpler and easier to use, especially for forex traders. It allows traders to customize the interface of the platform as per their individual trading needs.

- MT5 is a little more complex as it consists of more trading features and enables traders to trade the stocks and futures market as well.

- MT5 has a simpler interface layout, but it comes with 11 types of minutes charts, 7 types of hourly charts and 365 daily, weekly and yearly timeframes, which are not available on MT4.

Mobility

The mobility function on both platforms allows you to always be near your trading system by enabling you to access all your buy and sell orders through a mobile phone.

- MT4 and MT5 offer mobile versions in both iOS and Android smartphones and tablets. Through this functionality, you can access the markets from anywhere in the world, throughout the day.

- The mobile version includes charts, all trading orders, analytics tools and also allows you to monitor your account statuses. You can also buy and sell all your financial instruments just as you would with a computer system.

- Both MT4 and MT5 are compatible with Mozilla Firefox, Google Chrome, Apple Safari, Microsoft Edge, Opera, and Internet Explorer.

Trading and Orders

Both MT4 and MT5 platforms have almost the same execution method. You place your orders on MT4 and MT5 through a third-party platform, and the trades are executed in real-time.

- MT4 includes the execution on request mode, instant execution and execution buy market.

- MT5 offers an additional execution mode known as an ‘exchange execution,’ where you can send orders to an external trading exchange as well.

- MT4 includes four types of orders, buy stop order, buy limit order, sell stop order and sell limit order.

- MT5 offers the four orders offered by MT4 and two others, the buy stop limit order and the sell stop limit order.

Internal mailing systems

An internal mailing system enables a trader to receive important and relevant information from the broker. The information includes platform features, information about open accounts and orders, upcoming events and much more. The information is received in the form of emails and shown in the Mailbox tab on the platform.

- Both platforms have an internal mailing system, but MT5 offers an attachment feature with it.

- You can only send emails to the admins of the trading server through MT4 and MT5’s internal mailing system.

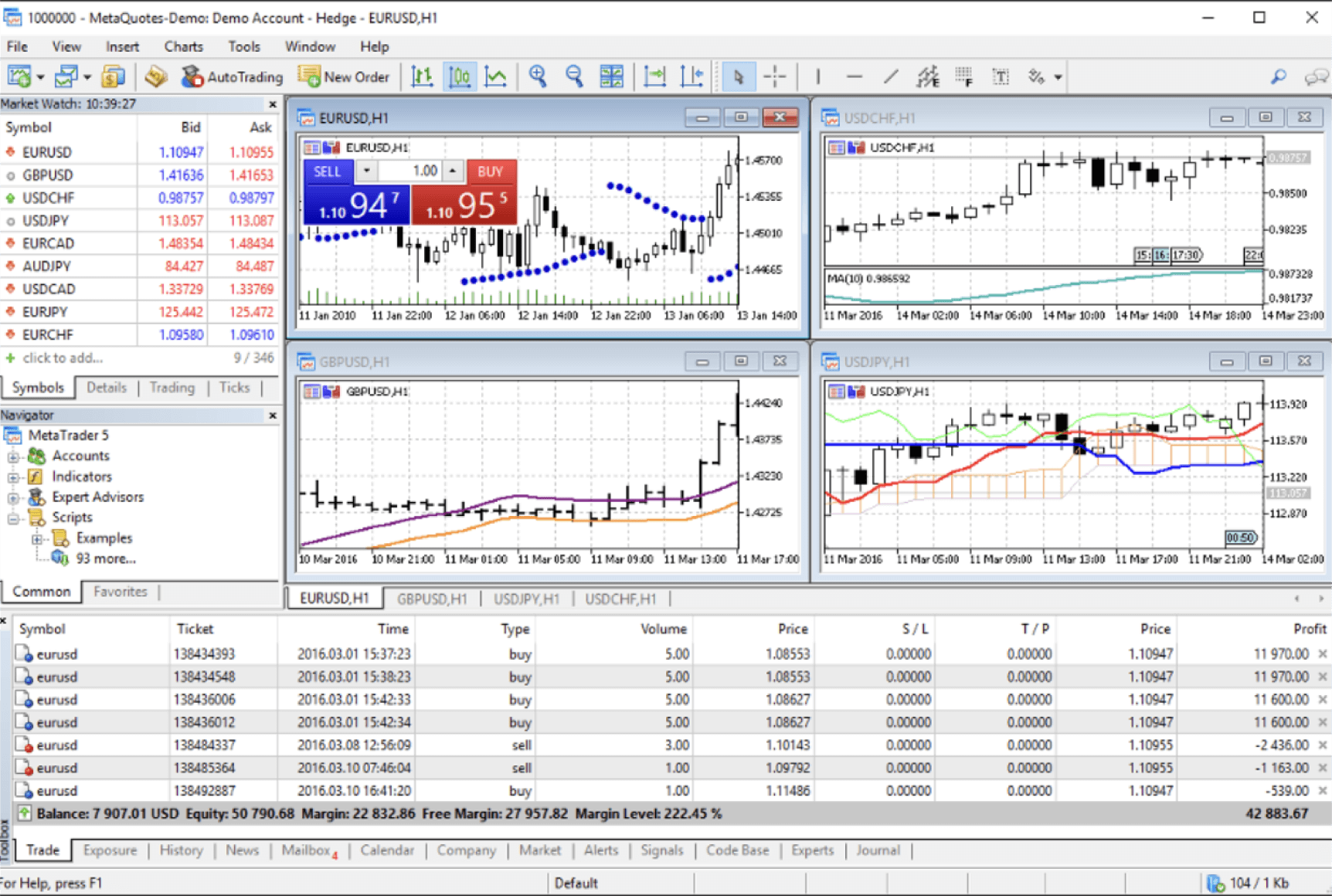

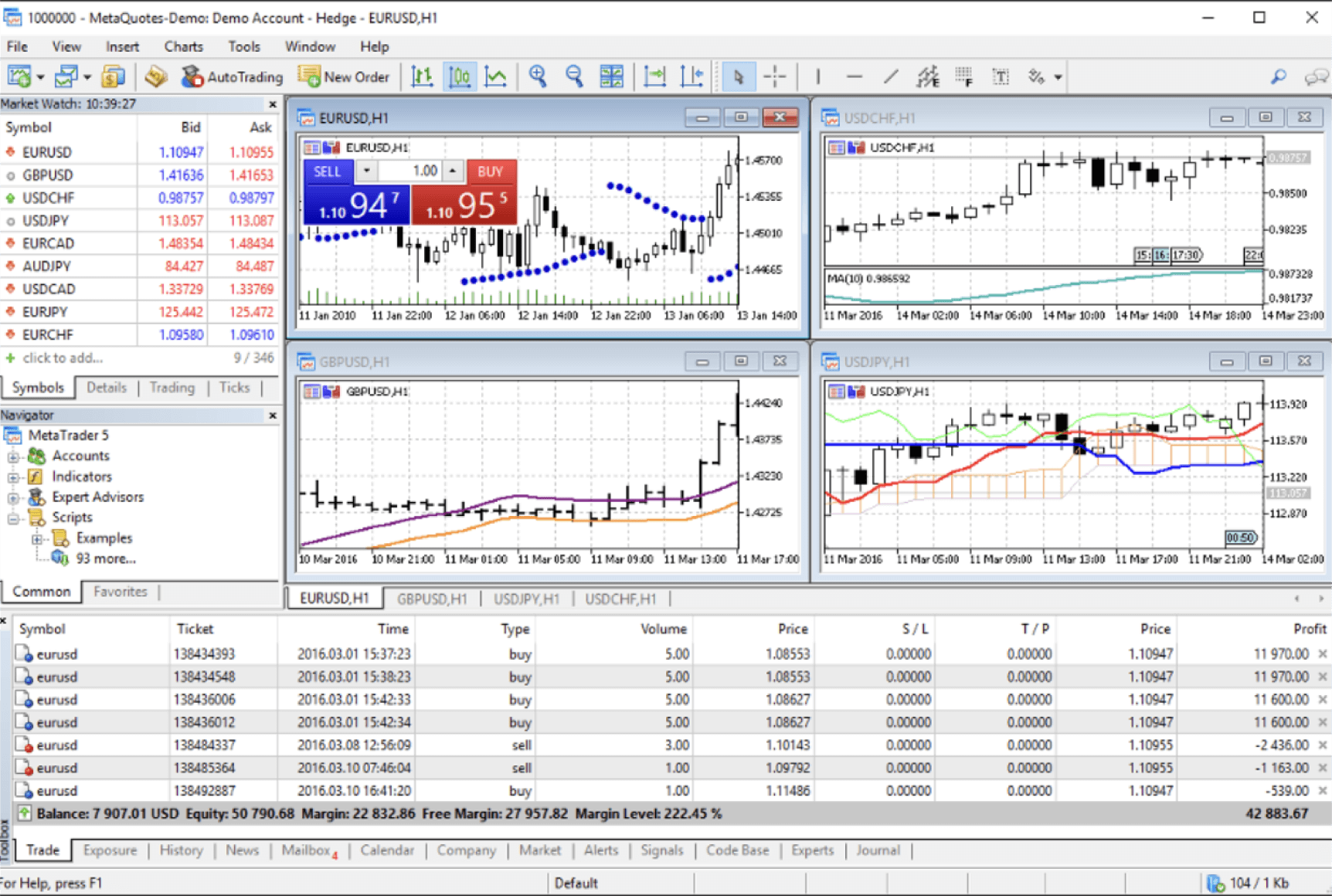

Hedging and Netting

Hedging is a type of risk management strategy that allows you to offset any potential losses by opening a position opposite to your current position. On the other hand, netting is the process of reducing financial risks in contracts by combining several financial obligations and reaching a net obligation amount.

- MT4 allows you to hedge your trades and protect yourself from potential losses.

- MT5 allows you to hedge and net your trades, protecting you against potential losses and also reducing your financial risk.

Brokers

Even though both MT4 and MT5 come with several research tools, indicators and analysis tools, the difference in the number of brokers for the two platforms is huge.

- There are more than 1,200 MT4 brokers in the market, as online brokers prefer this platform over MT5.

- MT5 brokers are only a handful in comparison with MT4.

- There are a few brokers that support both platforms, enabling you to switch between MT4 and MT5 as you please.

FIX API Access

Traders use the Financial Information Exchange API (FIX API) to get real-time financial securities information in the financial markets. Traders and market regulators use the FIX API and share related information before a trade takes place and after it is executed. The information confirming executed traders and new orders is also shared through FIX API.

- MT4 offers the FIX API integration, enabling you to create strategies and private algorithms that help you in analysing the forex trades.

- MT5 does not offer a FIX API integration to its traders.

Programming language

A programming language is a computer language that is created by software developers to interact with the computer. This helps in producing machine code output and helps platforms function seamlessly. Both MT4 and MT5 are built on their own custom programming languages with different customizations and trading capabilities.

- MT4 is built on a programming language that makes it suitable for beginner traders who are not very much included in creating their own algorithms for their trading strategies.

- MT4’s programming language is more straightforward and requires only a few steps to develop the trading program.

- MT 5, on the contrary, is built on a much more complex programming language that enables traders to write their own trading strategies, alter scripts and conduct advanced trading analysis.

- Trades on MT5 can be executed with only a single function which is not the case with MT4.

Demo Trading

Demo trading allows traders to experiment with the platform by putting in demo trades without investing real money. It works in the same way as real trading does, except that there is no involvement of money, and it gives you a realistic look and feel of how you can utilize different features of the platform.

- Both MT4 and MT5 offer demo trading, providing the trader with a completely risk-free environment.

- The only thing required to use an MT4 or MT5 demo account is to open a real account with an actual financial broker.

MT4 vs MT5: Summed up

| Feature | MT4 | MT5 |

|---|---|---|

| Hedging | ||

| Netting | ||

| Symbols | 1,024 | Unlimited |

| Exchange trading | ||

| Markets supported | Forex market |

Forex, Futures, Stocks, bonds, and options market |

| Timeframes | 9 | 21 |

| Economic calendar | ||

| Internal email system | Allowed but without attachments | Allowed but with attachments |

| Graphical objects | 31 | 44 |

| Technical indicators | 30 | 38 |

| Fund transfer between accounts | ||

| MQL5 community chat | Not embedded | Embedded |

| Multilingual Unicode | Does not exist | Exists |

| Strategy tester | Single thread strategy tester | Multi thread strategy tester, real ticks strategy tester and multi-currency strategy tester |

| Depth of market (DoM) | ||

| Time and sales exchange data | ||

| Order fill policy | Fill or kill only | Fill or kill, return, immediate or cancel |

| Pending order types | 4 | 6 |

| Partial order filling policy | Does not exist | Exists |

| Computer bits version | 32-bit version | 64-bit version |

| Programming language | Simple | Complex |

| Security groups | 32 | Unlimited |

| Types of transactions | Balance and credit | Balance, credit, bonus, commission agent, correction, charge and interest |

| Reports | Only tables | Charts and tables |

| Accounting groups | 512 | Unlimited |

| Types of order execution | 3 | 4 |

| File ZIP compression | Not allowed | Automatic |

MT4 vs MT5: Pros and Cons

Pros

| MT4 | MT5 |

|---|---|

| MT4 is ideal for new Forex traders | It offers many more technical indicators, timeframes, graphics, chart drawing tools and more when compared to MT4 |

| Majority of online brokers supports MT4 | Supports non-forex CFDs as well |

| Most Expert Advisor providers opt for MT4 | Includes extremely advanced execution modes and order types |

|

Several chart drawing tools and technical indicators exist in MT4 |

It fits well with seasoned technical traders |

Cons

| MT4 | MT5 |

|---|---|

| Less features than MT5 | Not suitable for the beginner traders |

| Only supports Forex assets | Very few brokers support the MT5 platform |

| In comparison with mT4, much fewer expert advisor developers opt for the MT5 platform |

What is the main difference between MT4 and MT5?

The most significant difference between MetaTrader 4 vs Metatrader 5 is that the former has been designed only for forex trading, whereas the latter also focuses on other trading instruments like futures, stocks and CFDs. MT5 offers many more advanced technical indicators, graphics, charting tools, and timeframes as compared to MT4. It also has several advanced execution modes and order types. MT5 is the right tool for expert technical traders, whereas beginner traders can make use of MT4 as it is much less complicated and beginner-friendly.

Is MetaTrader 5 good for beginners?

MetaTrader 5 platform offers flexible and seamless trading of forex stocks, futures and CFDs. It provides beginner traders with real-time access to the asset prices. However, it can take some time to learn how to trade with MT5, and hence, it is best to start with MT4 first.

What is the minimum deposit for MetaTrader 5?

The deposit for MT5 for a standard account is minimal and the exact amount can depend on your forex broker. With this account, the trader gets access to the entire range of available assets like CFDs, cryptocurrencies, indices, stocks, futures and more. One can easily add funds to their live MT5 account by logging into the trader’s room dashboard, scrolling down to the account in which you want to deposit the funds and clicking the ‘deposit’ button.

Is MetaTrader 5 better than Metatrader 4?

Yes, MetaTrader 5 is better than MetaTrader 4 because MT5 offers a more varied range of features for trading. Additionally, it offers a greater number of tools that can be used to predict market movement and a faster processor that makes trading a more efficient process. MT5 is also better than MT4 because it allows traders to manage all types of assets like CFDs, stocks and forex in their portfolio through a single platform together.

How do I open an MT5 trading account?

You can create a new MetaTrader 5 account by simply registering for one with us in less than a minute on the MT5 page available on our website. You can download the MT5 trading platform from there in a few minutes with one click and launch it on your computer. Enter your real or demo account details to log in that you must have received in your emails at the time of registration. Once you have logged in, you can access all the tools and features MT5 platform has to offer without any hassle.

Why trade with us through MetaTrader 4 or MetaTrader 5?

- Our platform is an entirely regulated MT5 brokers platform and is registered with the Australian Securities and Investments Commissions.

- We have strong industry experience covering hundreds of assets that you can trade seamlessly.

- Our services are available in several countries outside of Australia, enabling traders from overseas to use our services as well.

- Our platform provides you with advanced charting tools and technical analysis instruments that help you determine the market’s future trend and also back-test MT4 platform results.

- Our trading platform uses Expert Advisors for automated trading and places trades on your behalf based on the assumptions you feed in. You can use our strategies to trade multiple assets at once and develop or purchase existing trading robots that make your automatic trading experience even more seamless.

- You can trade with MT5 on your phone, laptop, tablet or even desktop with both Android and iOS supporting devices.

- We offer competitive trading spreads for all the asset classes.

- With our platform, you can get a 360-degree support system, daily market analysis, educational and informative material along with multilingual customer care around the clock at no additional cost.

Is the newer MT5 version better than the MT4 version?

The new MT5 version is a powerful software with superior tools for stock trading and related order management processes. On the other hand, the MT4 platform has more powerful features and tools that can be used for forex trading. The little difference between MT4 and MT5 makes MT5 a stronger and more efficient software altogether. The new MT5 version is definitely more powerful and efficient than MT4, but it cannot replace MT4 entirely since both of these platforms are used for different purposes. While MT4 is solely meant for forex trading, MT5 provides you single account access to trade multiple financial instruments, including forex, stocks, commodities, cryptocurrencies, and indices.

MT4 vs MT5 – The final verdict

Both MT4 and MT5 are built with different individual purposes. Since they are not interdependent on each other and are not an upgraded version of one another, both of them are suitable for different kinds of traders. If you are a beginner trader who only wants exposure in the forex market, MT4 is the right pick for you. However, if you are an experienced trader who wants to trade other markets as well, MT5 is the right choice. Blueberry Markets is a forex broker that gives you access to both MetaTrader 4 and MetaTrader 5 platforms. You can start using MT4 and MT5 by signing up for a live account or a demo account.

Recommended Topics

-

Habits of Forex Traders

Forex trading requires discipline, focus, and a strong understanding of market trends.

-

Forex Trading Opportunities When Markets are Closed over Weekends

The forex market can be operated 24/7 Monday to Friday.

-

How to Calculate Forex Position Sizing

Each trader in the forex market defines their position size before moving forward with a trade.

-

Understanding Forex Risk Management

The forex market is the most liquid and largest market in the world. However, like any other financial market, the forex market can also be risky during times of high volatility.

-

Hedging in Forex: How to Hedge Currency Risk

Forex hedging or currency hedging allows you to open multiple trade positions to offset any possible currency risk associated with your current position

-

What Is PIP in forex trading?

PIPs are essential in forex as they tell the traders about the size of profits or losses that can be made from a particular currency pair.

-

What Is Gap Trading?

Gaps in the Forex market help traders identify price movement clues, entry and exit signals, and trend reversals.

-

Top Swing Trading Indicators

Swing trading is all about profiting from market swings. It is a popular speculative strategy where traders tend to buy and hold their assets hoping to profit from expected market movement.

-

What are Support and Resistance Levels

Support and resistance levels in the Forex market allow traders to understand the market direction and predict future prices to consider in making trade decisions.

-

What is Forex?

The Forex market offers high liquidity and margin opportunities for you to trade and potentially profit off of exchange rates of currencies. With a daily volume of more than $6.6 trillion in 2019, it is the largest financial market in the world.

-

What is Margin trading?

Margin trading is one of the most common derivative strategies used in financial markets. It can also be considered tax-efficient as it allows you to choose the size of your wager and exempts profits earned from stamp duties and taxes.

-

What is Leverage in Forex

Leverage allows traders to hold large positions in the Forex market with fewer capital. With leverage trading, traders can borrow money from a broker and hold larger positions, which in turn could magnify returns or losses.

-

How To Set a Stop Loss Order in Forex Trading

A stop loss order is used to prevent extensive losses, especially during severe market dip situations. By placing a stop loss order, you can automatically close your position if the market moves against you.

-

MetaTrader 5: The Complete Guide

MetaTrader 5, the powerful automated trading platform, offers advanced tools for successful trading analysis and trades in the financial markets. Aside from Forex, the MT5 platform helps you trade Stocks, CFDs, and Futures.

-

What is MetaTrader 4: The Complete Guide to MT4

An advanced trading platform, MT4 has become a norm for seasoned Forex traders as it helps them execute their trades even when their machine is off. It comes with a user-friendly interface, numerous technical analysis tools for forecasting market patterns, real-time currency price data, and much more.

-

What are Long and Short Positions in Forex?

In Forex trading, you can take long or short positions based on expectations of the market rising or falling. Long or buy positions are maintained when traders expect currency pair prices to increase in the future.

-

What is a Spread in Forex?

A spread is a cost built into the buying and the selling price of all the currency pairs. In most cases, Forex spreads depend on your Forex broker.

-

What is a Currency Pair in Forex?

The foreign exchange (Forex) market is the largest financial market in the world. With a daily average volume of about $6.6 trillion and worth over $2.4 quadrillion as of 2021, Forex is a decentralised global market for trading currencies.

-

How do you trade forex?

Many people want to get into Forex trading and make quick profits, but only a few even know how to start. While trading Forex online has now become easier than ever because of powerful platforms like Blueberry Markets, it can still feel incredibly overwhelming to get started with it.

-

When Can You Trade Forex?

In case you are wondering is Forex trading profitable, the short answer is yes. But many opt for Forex traders to make fast profits since Forex markets are operational 24 hours for five days a week.

-

Who trades forex?

Major players in the Forex market are financial institutions including commercial banks, central banks, money managers along with hedge funds. Many global corporations also trade in Forex to hedge currency risk.

-

Why trade forex?

As the largest financial market globally, Forex trading is one of the most popular investment avenues for many. The liquidity and huge trading volume make Forex trading an option worth exploring.

-

Forex Margin & Leverage

Forex trading usually provides much higher leverage compared to other financial instruments like stocks. This is one of the primary reasons why so many people are attracted to Forex, and more and more people have started to enter the Forex trading market.

-

Key steps to making your first trade in Forex

Making your first trade in Forex successfully requires in-depth knowledge about trading basics and Forex trading strategies. The learning curve to trading currencies can seem overwhelming and complex, but when you have the right information by your side, it can make the entire process all the more easier.

-

How is Forex regulated?

There are several Forex brokers in the Forex market, and amidst those thousands of Forex brokers, it can become nothing less than challenging for traders to find the best brokers.

-

Rollover rates

When you hold a currency spot position overnight, the interest you either earn or pay is the rollover amount. Each currency has a different overnight interbank interest rate, and because you trade Forex in pairs, you also deal with two different interest rates.

-

Tips for Forex trading beginners

In terms of trading volume, the Forex market is the largest financial market in the world. It is also the only financial market that operates round the clock every day.

Intermediate

Have a basic understanding of

Forex? Ready to level up? Move on

to the intermediate course.

Guide to Forex

Trading indicators.

Enter your details to get a copy of our

free eBook

Start a risk free

demo account

News & Analysis

Catch up on what you might

have missed in the market.