📈📉 Navigating the waves of the Gold market: hot CPI data, Fed policy shifts, and plunging prices. Where do we stand? Dive into the discussion! #GoldMarket #TradingTalk

Watch the video to learn more...

Will Gold Prices Fall Further?

Hey everyone, let's chat about what's been happening in the world of gold prices. It's been quite the journey lately, with some significant shifts shaking up the markets.

You know how gold has always been that reliable safe haven when things get rocky in the economy? Well, recent developments have some of us wondering if that trust still holds up. The latest US Consumer Price Index (CPI) data threw us a curveball, coming in much hotter than anticipated. This unexpected turn has led to a lot of rethinking about what the Federal Reserve might do next. Previously, many of us were betting on a possible interest rate cut in March, but now it seems like the chances of that happening have dwindled significantly. The CME Fed Watch Tool now puts the probability of the Fed holding rates steady at a staggering 91.5%, compared to just 40% earlier this year.

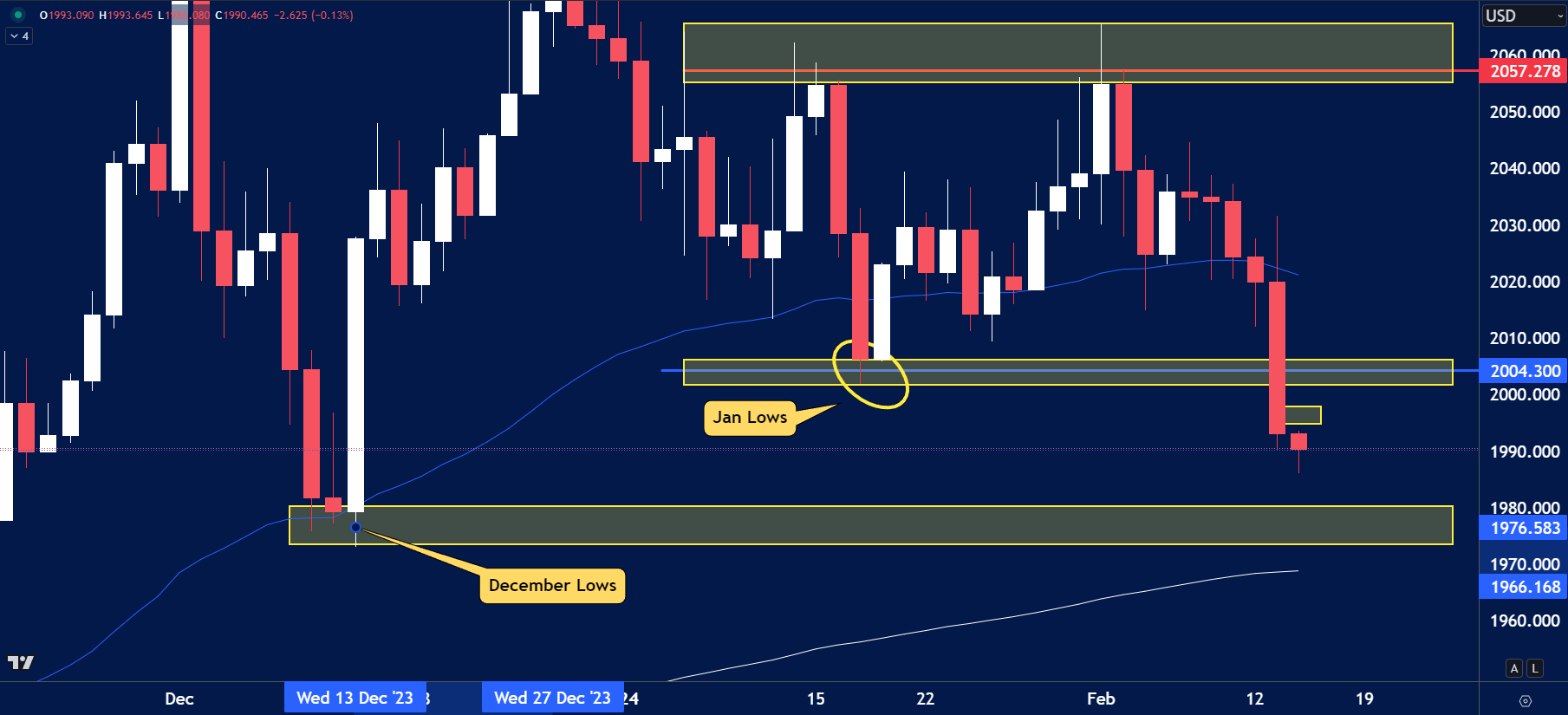

Now, let's talk about the numbers. Gold prices have taken a hit, breaking through the floor of the January 2024 lows and setting their sights on the December 2023 lows. We're looking at figures like $2004.00 and wondering where the bottom might be.

But amidst this uncertainty, there are opportunities for those keeping a close watch. If gold prices start to rebound, there's bound to be some significant movement. However, it's essential to remember that with every rally, there's a risk of encountering selling pressure. It's a delicate balance, and staying vigilant is key.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.