Traders can customize indicators to fit their trading strategies in every market condition. Custom moving averages are one such indicator that help traders identify trends and generate signals customized to the trader’s trading approach. Traders can analyze the market in whatever number of periods is suitable to them and improve the moving average indicator’s responsiveness.

In this article, we will discuss why traders should use custom moving averages and how they can incorporate this into their trading strategy.

What are custom moving averages?

The customized version of a traditional moving average (MA) is called a custom moving average. They are used by traders for market analysis and to predict market direction based on a particular time frame that suits the trader’s trading strategy. Custom moving averages can have adjusted time periods to meet specific trading needs unlike standard moving averages which are set for fixed periods like 10, 50, 200 and more.

Risks and advantages of using custom averages in forex

Risks

Overfitting

Custom moving averages are usually overly optimized to fit a past price chart too closely. Parameters are set to past market conditions which may not indicate future performance accurately. This can result in custom averages that perform well when backtested but poorly when applied to real markets.

Higher complexity

Custom moving averages can also involve complicated calculations compared to traditional moving averages due to changing time periods. This makes custom moving averages harder to understand and interpret in a volatile market.

Misalignment risk

Custom moving averages sometimes do not align well with broader market trends if their parameters are not calibrated properly. This leads to false signals and also a conflict with other indicators if there is a calibration or calculation error.

Advantages

Tailored to market conditions

Custom moving averages are designed to suit the unique market conditions of any currency pair. When analyzed for a particular currency or market situation, this provides traders with a more relevant market trend.

Better signal accuracy

Customized moving averages have a unique time period selected by each trader according to their own trading strategy. This customized time period allows traders to fine-tune their moving average to capture a market trend more accurately, leaving them with better long and short signals.

Control over the indicator’s responsiveness

With a custom moving average, traders can adjust how slowly or quickly a moving average responds to the changing prices in the forex market by tailoring the parameters. This provides traders with higher control on moving average indicator’s sensitivity which is different for different trading styles.

How to create a custom moving average trading strategy?

Define trading goals

The first step to create a custom moving average trading strategy is to outline what the trader wants to gain from the custom moving average. It could be specific targets like better gains, minimizing risks or just improving moving average indicators’ accuracy to better time the trades.

Choose a trading platform

Traders should then move forward to select a trading platform that allows them to create a custom moving average and backtest it.

Select the moving average type

There are three major types of moving averages -

-

Simple moving averages (SMA) that average the historical prices

-

Exponential moving averages (EMA) that give more weight to newer prices

-

Weighted moving averages (WMA) apply different weights to different prices within the time period

Traders can choose the type of moving average they want to customize based on the speed of the indicator’s reaction. EMAs are more fast-reacting, whereas SMAs and WMAs are smoother and suit less volatile markets.

Customize the moving average parameters

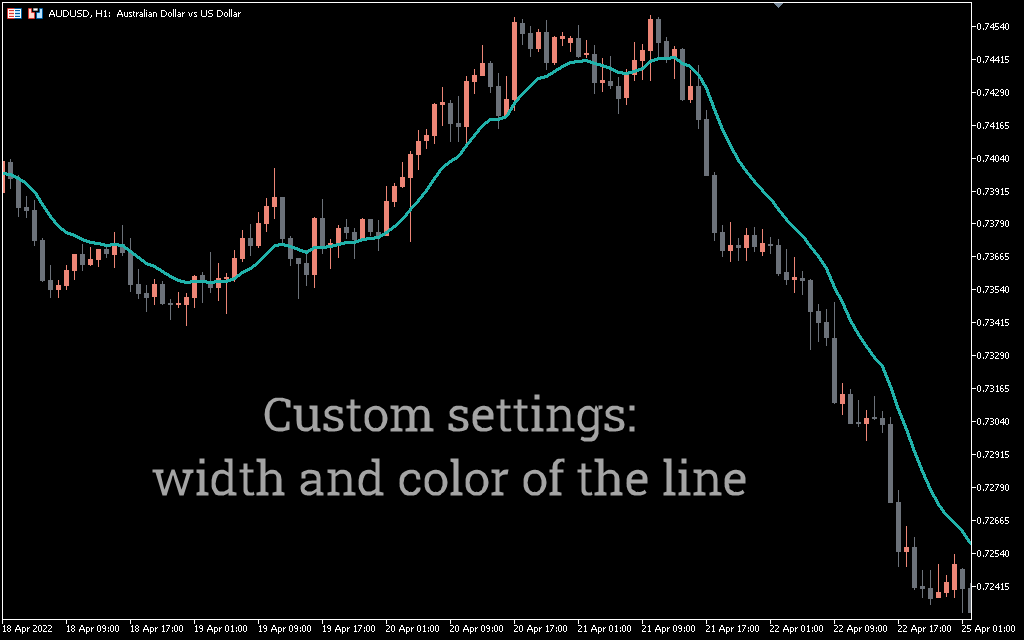

Traders can customize the moving average parameters, such as time period, weighting scheme, formulas, and more, based on their specific strategy and the market they are trading.

Backtest the custom moving averages

After customizing the parameters, traders should test the effectiveness of their custom moving average by analyzing it on past prices. To do the same, a trader can –

-

Choose past prices that match the market condition and time frame of the currencies the trader is willing to trade

-

Test the custom moving average through these past prices to see how the indicator would have performed

-

Assess the performance of the indicator via metrics like gains, signal accuracy, drawdowns, and more

Integrate with the strategy

Ensure that every element of the trading strategy, such as currency pairs to target, indicators to use, approach to follow, etc., is combined with the custom moving averages. Traders can also specify how the moving average signals will be used, clear entry/exit rules based on the custom moving averages, and more.

Implement in live trading

Apply the custom moving average to real-time trading by using it in actual forex markets. Trading platforms can be configured for these custom averages to monitor the market regularly.

Tailoring market entries with custom moving averages

Custom moving averages provide traders with the flexibility to tailor an indicator according to their trading goals. This improves signal accuracy and benefits individual goals. However, custom moving averages also come with risks, which may lead to poor performance of the indicator in the market. Hence, traders should balance the risks and advantages of custom moving averages to trade the forex market properly.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.