The data out of the UK continues to pour out this week but the underlying inflation data today could point to the Bank of England cutting rates again. And when central banks cut rates, we often see the currency devalue. In this case the GBP could be bearish in the short term.

Today, we saw the release of multiple CPI announcements not only in the US but in the UK too. Headline CPI (Consumer Price Index) came in higher than previous at 2.2%, but this wasn’t necessarily the number the market reacted to. CORE CPI which removes volatile food, energy, alcohol and tobacco items, came in lower than expectations at 3.3% down from 3.5%.

But the big surprise was the services inflation, which came in much lower than expected. With the United Kingdom (UK) being a serviced based country this fall could show some underlying pressure in the services sector.

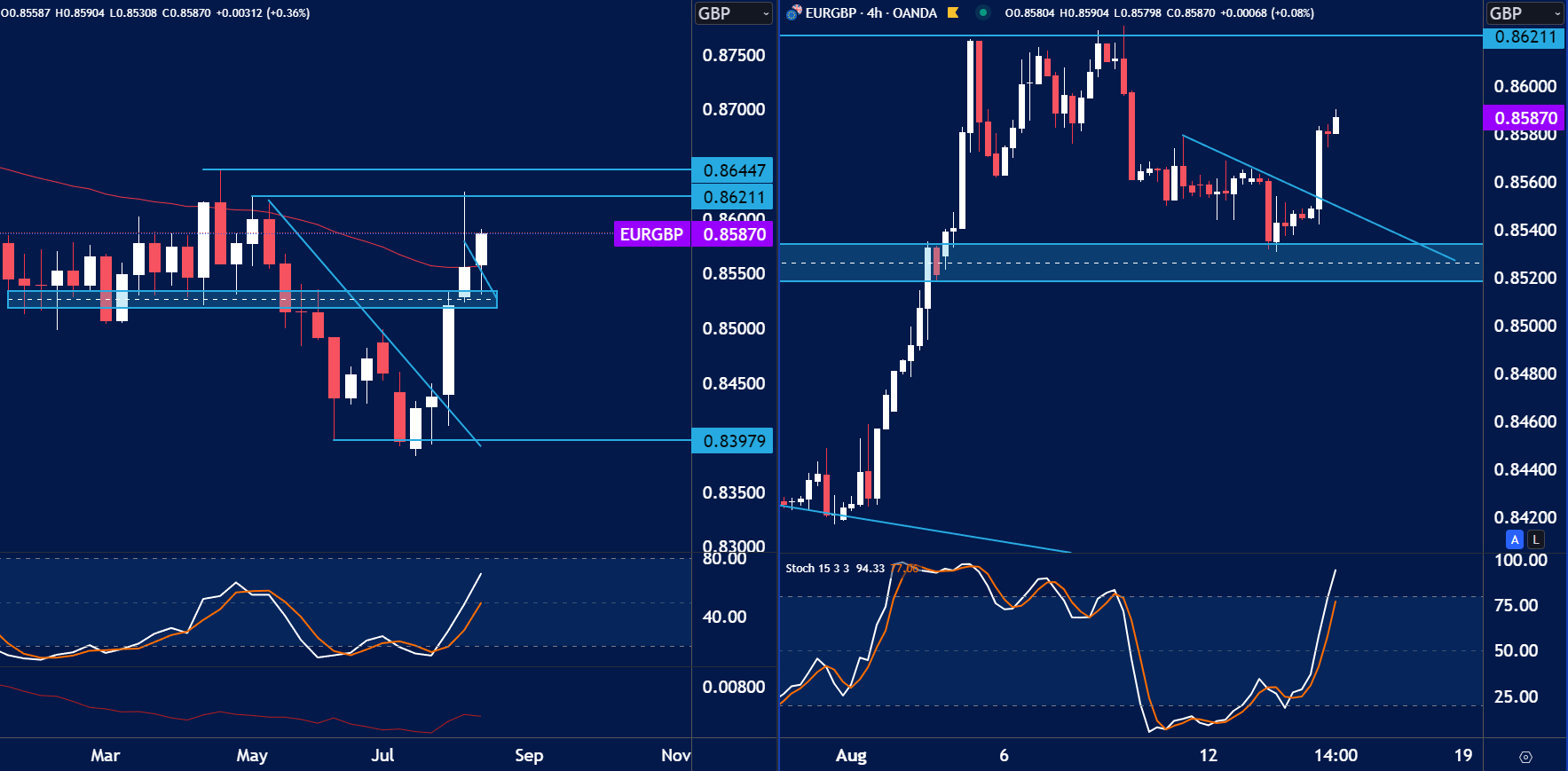

We recently covered EUR/GBP using seasonal analysis as over the past 20 years on average August has been a positive month for the forex pair. On August 1st the price of EUR/GBP found support at 0.8400 and since the price has traded to 0.8620.

But will this sentiment continue?

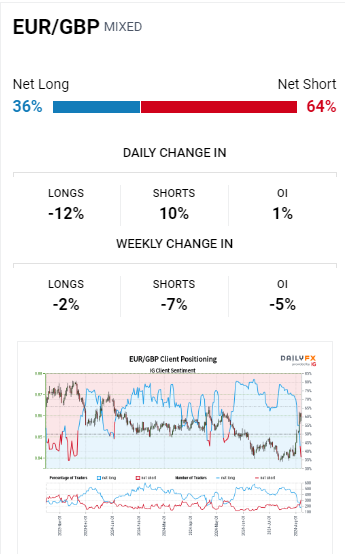

One indicator we can point to is retail sentiment. Unfortunately the stats on retail investors isn’t great with over 80% of retail traders losing money. This isn’t because of anything but the fact they tend to not have a significant understanding of the financial markets.

Let’s change that here!

An indicator I look into when researching a forex pair in the retail sentiment indicator. This shows me where retail is positioned and in the case of EUR/GBP as I’m writing this 64% of retail is short. Today on the 14th August they have added to their short positions and decreased long positions. This is a sign that they are shorting this forex pair.

To recap the information:

- Services inflation fell, CORE CPI fell in the UK. Could prompt further cuts from the Bank of England.

- Seasonally over the past 20 years EUR/GBP on average has a positive month in August.

- Retail sentiment shows a build up of shorts coming in, this can be a contrarian signal.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.