US inflation dropped significantly between June 2022 and September 2024, falling from 9.1% in June 2022 to 2.4% by September 2024. The Federal Reserve responded to this by raising its interest rate regularly, reaching 5.33% in August 2023, its highest level during this period.

After keeping the rate unchanged until September 2024, the Fed implemented its first rate cut since 2021. This move followed a series of rate hikes in early 2022, with the August 2023 increase marking the 11th consecutive rise.

Similarly, the European Central Bank (ECB) began cutting rates in 2024 after a long period of hikes, reducing its rate from 4.5% in December 2023 to 3.4% by October 2024—the first time in eight years. These adjustments reflect broader shifts in economic conditions across the US and Europe. Let’s discuss the top interest rate predictions for 2025.

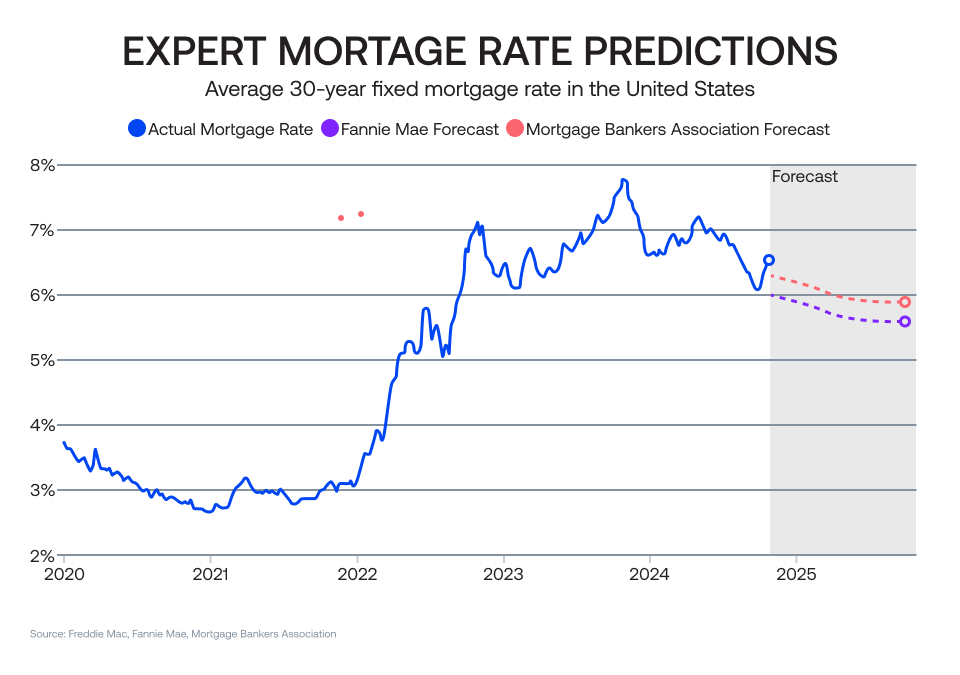

Fannie Mae predicts 30-year mortgage rate at 5.6% by Q4 2025

In early November 2023, the 30-year fixed rate was 7.50%, and the 15-year fixed rate stood at 6.81%. Both rates have since fallen over 70 basis points. However, despite Fed rate cuts, mortgage rates have not uniformly declined and have even risen at times. Typically, shorter-term rates have increased while longer-term rates have decreased more notably.

Fannie Mae's October 2024 forecast projects a 30-year mortgage rate of 6% by late 2024 and 5.6% by Q4 2025. The organization anticipates that economic growth will moderate, easing inflationary pressures and allowing for gradual rate reductions. This prediction is based on expected stabilization in financial markets and continued efforts by the Fed to support economic activity while maintaining inflation control.

Meanwhile, the Mortgage Bankers Association (MBA) has a slightly more conservative outlook, forecasting the 30-year rate to be 6.3% by the end of 2024 and 5.9% by Q4 2025. The MBA's analysis suggests that while economic conditions may improve, persistent geopolitical uncertainties and labor market fluctuations could accelerate rate reductions. Both forecasts hinge on broader economic factors such as inflation trends, employment data, and global financial stability.

Short-term rates to average just above 3% in 2025

Interest rates are projected to trend downward in 2025, but the extent of these reductions remains uncertain. The Federal Open Market Committee (FOMC) has two key reasons for lowering rates: achieving price stability and sustaining full employment.

The first factor, inflation, appears mainly under control. To combat high inflation, the FOMC raised rates from 0%-0.25% in early 2022 to 5.25%-5.5% by mid-2023. By August 2024, inflation dropped to 2.2%, closer to the FOMC's 2% target, as tracked by the Personal Consumption Expenditures Price Index. This decline has paved the way for the FOMC's initial rate cut in September 2024 and could signal further rate easing.

However, the job market poses a more complex challenge. Unemployment rose to 4.3% in mid-2024, sparking concerns of a recession. Subsequent employment data showed improvement, reducing recession fears. The FOMC remains vigilant, balancing rate adjustments against labor market shifts.

For 2025, the FOMC forecasts short-term rates to average just above 3%, with a median estimate of 3.4%, as noted in its September 2024 meeting. Predictions vary, ranging from 2.75% to 4.25%. Fixed income markets align closely with these forecasts, expecting rates between 3.25%-3.5% by year-end 2025.

69% chance of Fed funds rate falling to 3.50%-3.75% by 2025

The federal funds rate, set by the US Federal Reserve, significantly influences mortgage, credit card, loan rates, and savings yields. If inflation remains stable, interest rates are projected to decrease in 2025 and 2026.

The current fed funds rate is 4.75%-5%. Projections for late 2025 estimate a drop to around 3.4%, with a 69% chance of settling between 3.50%-3.75%, assuming inflation stays close to 2% and the economy remains stable. The prime rate set 3% above the fed funds rate, would adjust accordingly, impacting consumer loans and savings rates.

Goldman Sachs forecasts six consecutive rate cuts till June 2025

Goldman Sachs predicts a transformative shift in US monetary policy, foreseeing a sequence of six 25-basis-point cuts in the federal funds rate from December 2024 through June 2025. This prediction follows the Fed's initial rate cut in September 2024, which marked the first reduction since the pandemic's onset. Goldman Sachs' forecast aligns with the Federal Open Market Committee's (FOMC) projections, which also suggest a cautious rate reduction.

By the end of 2024, the federal funds rate is expected to range from 4.25% to 4.50%, dropping further to 3.25%-3.50% by mid-2025. These rate cuts respond to ongoing economic pressures, including slowing inflation and maintaining growth without exacerbating price instability.

Fed's cautious approach to rate cuts to continue through 2025

The Federal Reserve's cautious rate cuts aim to balance maximum employment with price stability, adjusting policy gradually to avoid inflation. As the Fed reduces rates, short-term savings products like CDs and money market accounts adjust quickly, leading to lower returns for savers.

Mortgage rates, influenced by bond yields, may not immediately follow but tend to decrease over time in 2025, benefiting homebuyers and refinancers. Similarly, borrowers with student loans may find opportunities to refinance at lower rates, locking in better terms for long-term savings.

BoE also expected to cut rates

The Bank of England (BoE) is anticipated to cut interest rates moving into 2025, following the Monetary Policy Committee's meeting in November 2024. The consensus has already forecasted a reduction from 5% to 4.75%, marking the second rate cut in the current cycle.

Several European central banks, including the European Central Bank (ECB) and the Swiss National Bank (SNB), have already made multiple cuts this year. However, recent fiscal developments in the UK, particularly the Labour government's first Budget, have influenced future rate cut expectations.

Looking ahead to 2025, after the first week of November's meeting, the BoE is likely to adopt a quarterly rate-cutting approach. Expectations are now adjusted to two or three cuts in 2025, down from initial predictions of four or five. The outlook remains uncertain, with inflation projections for 2025 now higher than previously expected due to fiscal policies, suggesting a more cautious approach from the BoE in the future.

Looking ahead to interest rate outlook in 2025

In 2025, interest rates are expected to gradually decline, though the pace may vary. The Federal Reserve's cautious approach could bring the federal funds rate to around 3.25%-3.50% by mid-2025, while the Bank of England is likely to implement two to three rate cuts. Inflation and economic growth trends will guide these adjustments.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.