Hey traders, I’m breaking with tradition to share some market thoughts this week. We’re in for a wild ride with a bunch of big economic data and central bank decisions. Here’s the rundown.

https://youtu.be/BaRI5TQp1A0

A Busy Week

This week is filled with red folder data, 3 central bank decisions, 2 inflation reports and the NFP report to top it off. Let’s get into the details and what it means for us as traders.

The Australian Dollar (AUD)

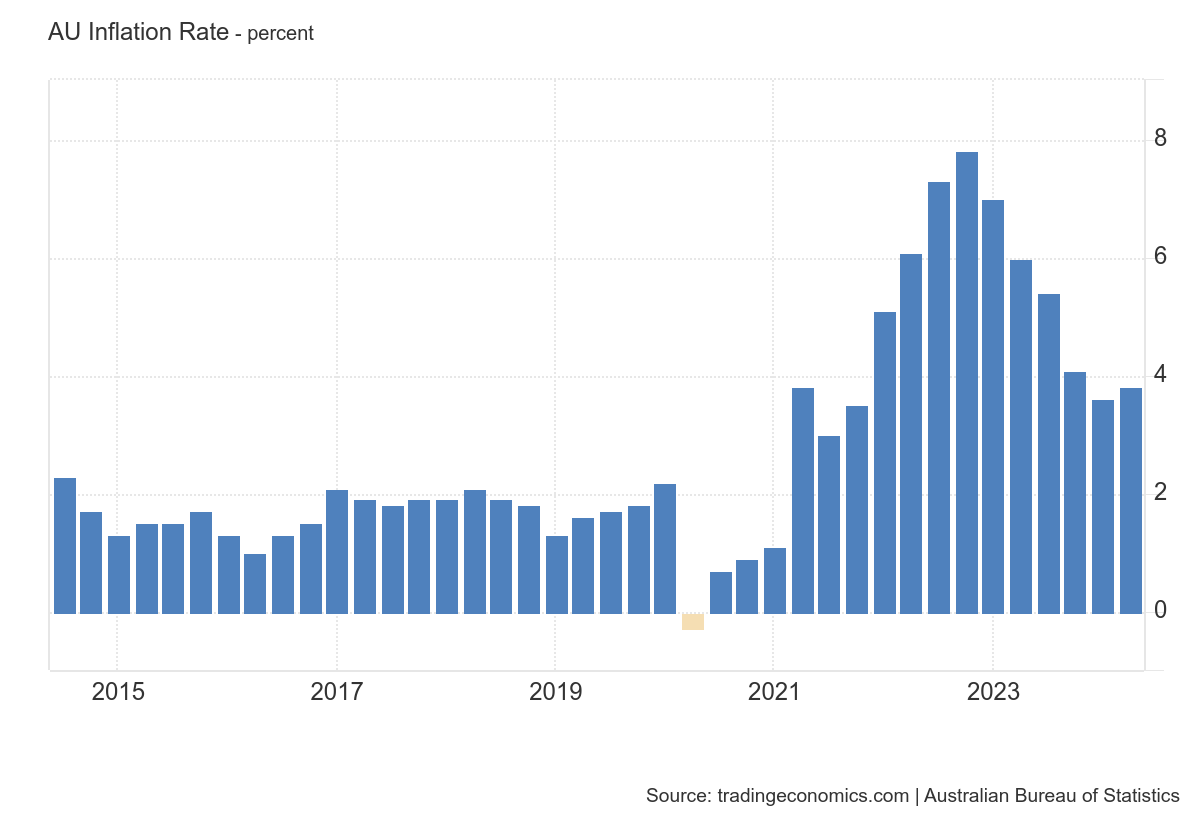

First up, the Australian Dollar. The AUD has been weak lately due to a risk off market. Investors are favouring the Japanese Yen (JPY) and the Swiss Franc (CHF) over the AUD and the New Zealand Dollar (NZD). This has been made worse by the recent Consumer Price Index (CPI) report.

The CPI showed Core CPI fell to 0.8% and Headline CPI fell below 4% to 3.8%. While this is still high inflation, it does raise the question, could this reduce the chance of a rate cut by the Reserve Bank of Australia (RBA)? The market will be watching the RBA’s response to these inflation numbers.

The Bank of Japan (BoJ)

Next up, the Bank of Japan (BoJ). I think the carry trade is over for now. The BoJ has hiked rates to 0.25% due to underlying inflation pressures which is driven by rising wages in the private sector. This has led to JPY strength and the USD/JPY pair is below 152.00.

Will this continue? This is where the FOMC rate decision comes in.

The Federal Reserve (Fed)

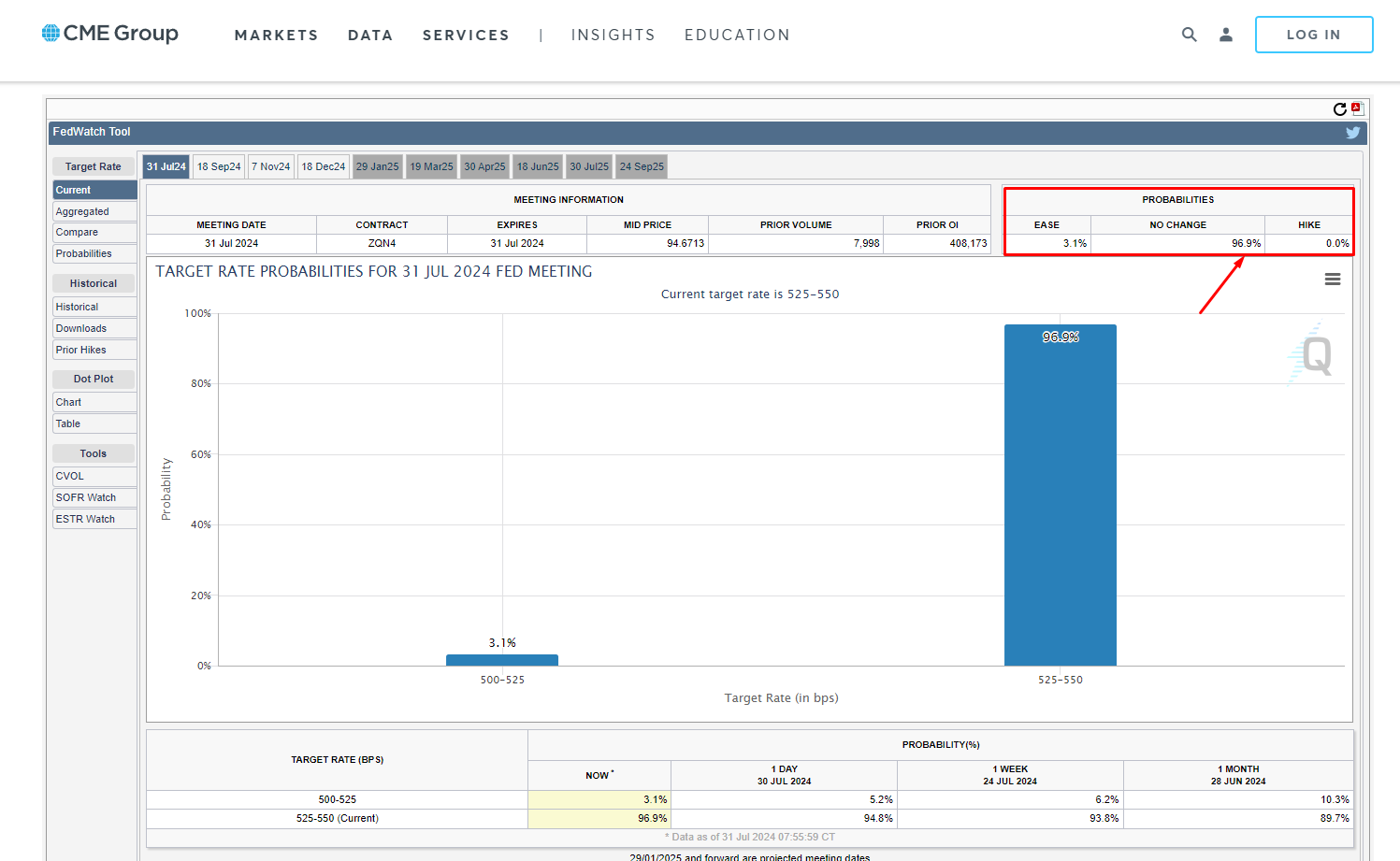

Now onto the Federal Reserve. The Fed is expected to leave rates unchanged so the rate decision itself will be a non-event. But the press conference will be the market mover.

If Federal Reserve Chairman Jerome Powell says a rate cut is on the horizon (which is 100% priced in by the CME FedWatch Tool) then we could see USD weaken and a rally in stocks and gold. But there’s a small chance he could disappoint the market if he says inflation is still above target at 3%.

One of the things the Fed will be looking at is the labour market. We’ve covered this before. If the labour market is still tight then they might cut in September and then leave them higher for longer.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry Markets.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.