In the week ahead, the Forex market will be closely monitoring several key economic indicators that will shed light on the health of major global economies. These data points will be pivotal in understanding inflation trends and economic growth, influencing currency movements and market sentiment. Here's a detailed look at what forex traders should focus on in the United States, Canada, and Australia.

Forex Week Ahead Analysis

United States: Core PCE and Final GDP Data

Core PCE Price Index

The United States’ Core Personal Consumption Expenditures (PCE) Price Index is set to be a significant highlight for traders. This index, a preferred measure of inflation for the Federal Reserve, is forecasted to show a slight decline of 0.1%. This projected decrease aligns with recent trends observed in other inflation indicators, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), which have both indicated a moderation in inflation.

A lower Core PCE reading would suggest that inflationary pressures are easing. This development could be crucial for the Fed’s monetary policy decisions. A softer inflation figure may bolster the argument for a pause or reduction in future interest rate hikes, potentially affecting the strength of the US dollar in the Forex market.

Final Quarterly GDP

In addition to inflation data, the final quarterly Gross Domestic Product (GDP) figures will be under scrutiny. Forecasts suggest a modest increase from 1.3% to 1.4% for the second quarter. This slight rise would signal steady economic growth and resilience in the US economy.

GDP growth is a fundamental indicator of economic health. Even a small upward revision can enhance market confidence in the stability of the US economy, likely providing some support to the dollar.

Canada: Consumer Price Index (CPI)

Monthly CPI

In Canada, the release of the monthly Consumer Price Index (CPI) data is highly anticipated. The forecast indicates a decrease in the month-over-month inflation rate from 0.5% to 0.3%. This expected decline suggests a softening of inflationary pressures, which could significantly influence the Canadian dollar.

Lower inflation rates might prompt the Bank of Canada to adopt a more dovish stance on monetary policy. Should the data confirm a trend towards easing inflation, it could diminish the likelihood of further interest rate hikes, potentially weakening the Canadian dollar in the Forex market.

Australia: Consumer Price Index (CPI)

Yearly CPI

In Australia, the year-over-year CPI is expected to remain high at 3.5%. This persistence of elevated inflation reflects ongoing challenges within the Australian economy.

With inflation remaining elevated, the Reserve Bank of Australia (RBA) might maintain or even increase interest rates to manage rising prices. Such a policy stance could provide support for the Australian dollar, as higher interest rates typically attract investors seeking better returns.

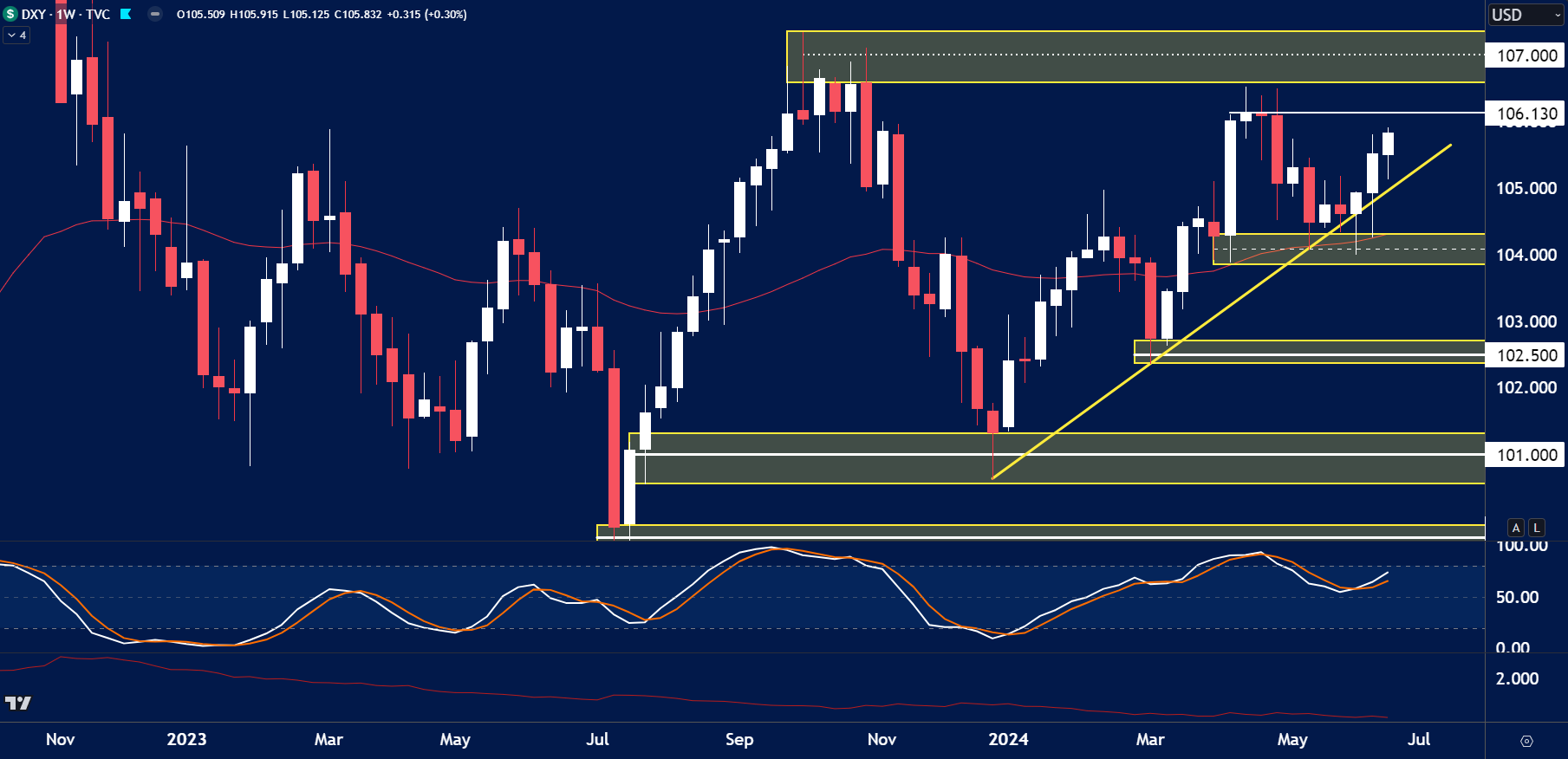

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USD Index continues to trade higher off the back of the weakness in the Euro.

- USD buyers could be looking to push the USD Index into the weekly highs around $106.13.

- Price remains supported above the $104.00 levels.

EUR/USD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of EUR/USD remains in a downward trend on the daily chart, with the prices moving towards the key swing lows of 1.0625.

- The volume profile this week shows high volumes of resistance around 1.0700 and above with confluence of the anchored VWAP from the swing highs formed on the 19th June.

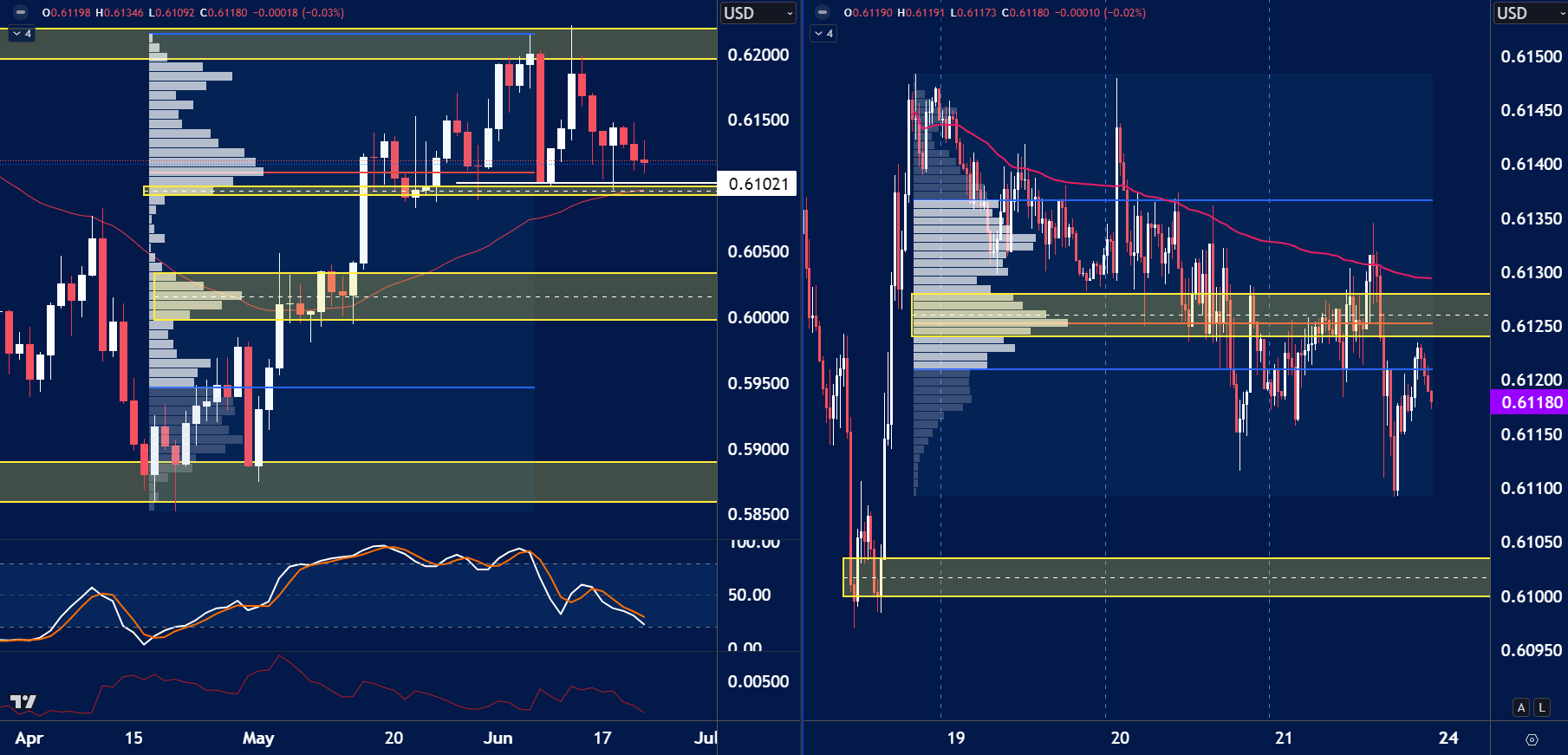

NZD/USD

The price on the chart has traded through multiple technical levels and some observations included:

- The New Zealand Dollar (NZD) finished the week as the weakest currency. The United States Dollar (USD) is one of the stronger currencies. This could see the NZD/USD price break lower this week.

- Price on the daily time frame is currently finding support around the lows of 0.6100.

- If the price breaks this level we could see a sharp move towards the 0.6050 level of higher volume.

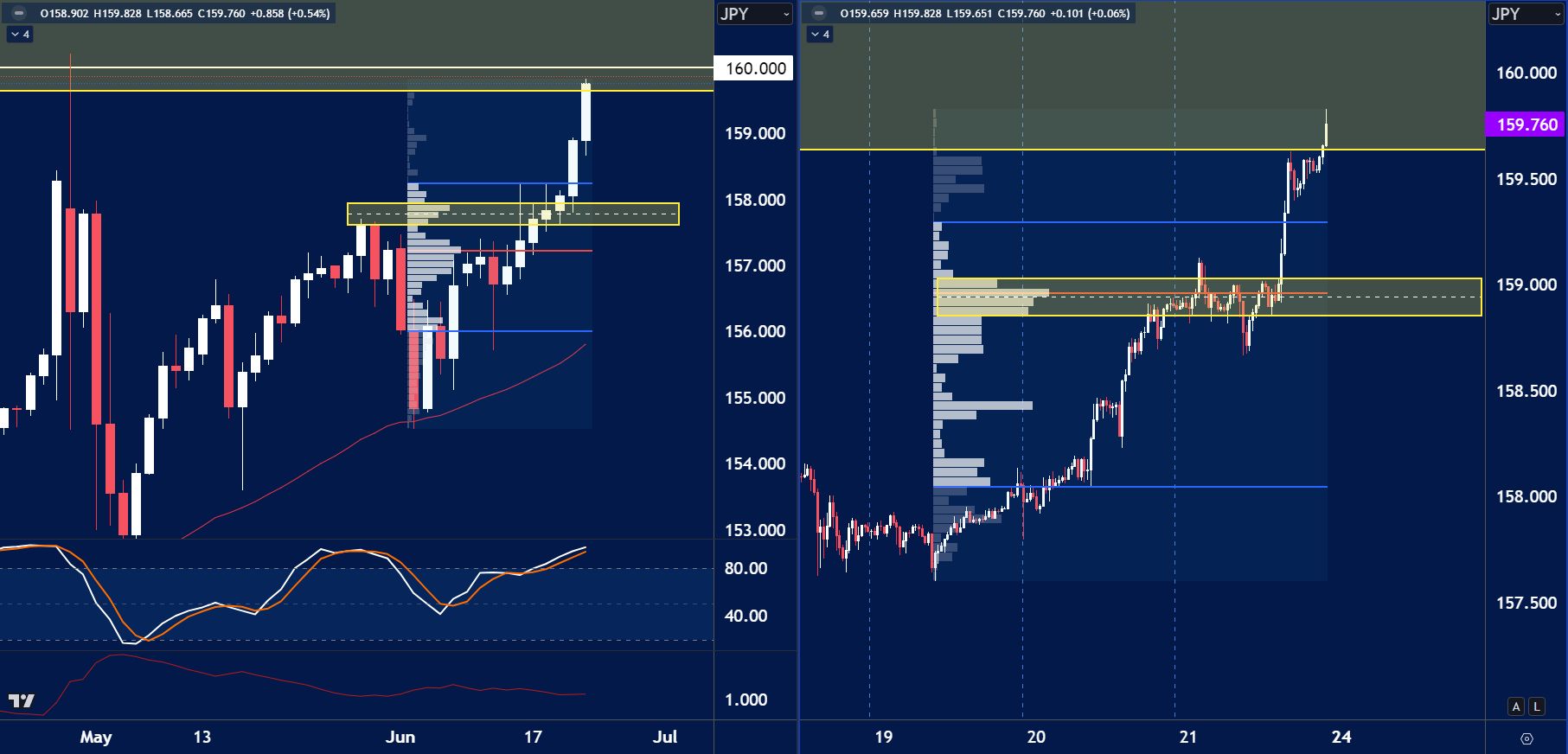

USD/JPY

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USD/JPY is approaching the previous suspected intervention levels of 160.00. Will the price rebound from here again?

- The BoJ and Japanese officials have said they will look to intervene if needed. This level may get defended again.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.