Dive into our latest forex market insights for the week ahead! From central bank decisions to key economic data, discover the strategies that can help you navigate the shifting tides of the forex market. Don't miss out on expert tips and analysis to stay ahead in your trading game!

Week Ahead Analysis

‘Risk Off’ Sentiment

Another volatile week is expected for the markets as we see a noticeable shift towards safe-haven assets, a trend that began to solidify at the close of last week. This shift is largely influenced by growing ‘risk-off’ sentiment among investors, after political turmoil through Europe and FOMC rate cut risks. This week will be shaped by critical central bank decisions from Australia, Switzerland, and the UK.

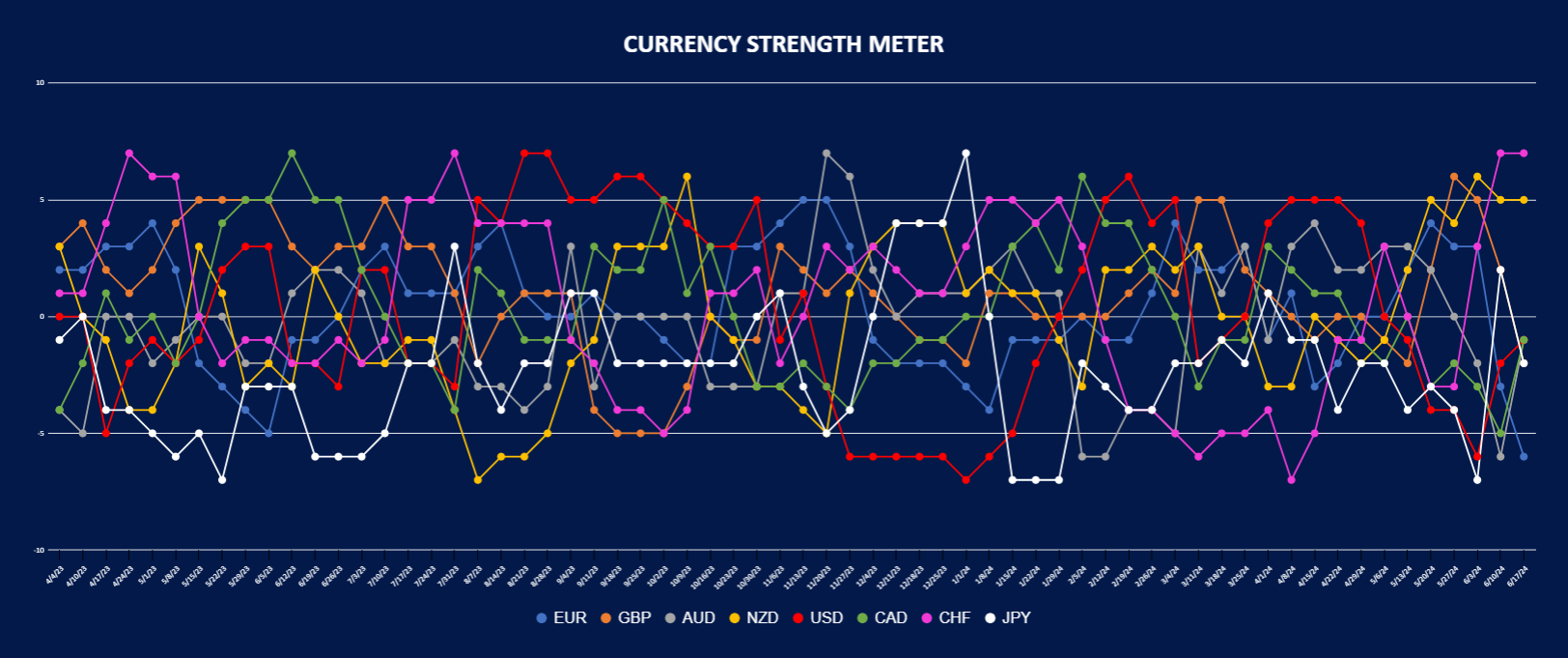

Currency Strength Meter

The currency strength meter highlights the ‘risk off’ sentiment the market is moving towards with CHF, USD and JPY finding strength. The NZD and CHF remain the strongest overall with the EUR, JPY and CAD being significantly weaker.

UK Inflation

In the UK, all eyes are on the Bank of England (BoE) as it approaches its rate announcement. With inflation predicted to align with the BoE’s target of 2%, there's a general consensus that the central bank will maintain its interest rate at the current 5.25%. A change in the MPC vote will further influence ideas that the BoE is ready to cut rates. The vote currently stands at 0-2-7, however a change in members that see a cut could influence the GBP this week.

RBA To Hold Rates

Across the globe in Australia, the Reserve Bank of Australia (RBA) is also expected to hold its interest rates steady at 4.35%. The RBA’s decision to keep rates unchanged reflects a broader strategy of sustaining higher rates for an extended period to manage economic stability. However, in the context of the market's preference for safe-haven assets, this dovish outlook might not bode well for the Australian Dollar. As traders shy away from riskier assets, the AUD could face downward pressure.

PMI Data

Adding to the week's volatility, Friday brings significant economic data with the release of Purchasing Managers' Index (PMI) reports from Europe, the UK, and the US. These indicators are crucial for gauging economic health and can heavily influence market sentiment. In the Euro area, forecasts suggest a slight uptick in growth, which could be a welcome development after last week’s market sell-off spurred by political unrest. Positive PMI figures could provide a much-needed boost to the Euro, potentially reversing recent bearish trends.

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USD Index remains bullish, after the price held the supporting lows around $104.00, which held confluence with a trendline support.

- Buyers of the USD could be looking to target the April highs around $106.00.

- The ‘risk off’ sentiment in the market could help influence USD strength this week.

EURUSD

The price on the chart has traded through multiple technical levels and some observations included:

- Political unrest could continue to influence EUR weakness within the forex market this week. EURUSD closed the week as a strong bearish candle.

- Weekly support can be seen towards the lows of 1.0625.

- Traders looking to participate in shorts this week could look for the price of EURUSD to find resistance around 1.0740 where significant volume levels are present.

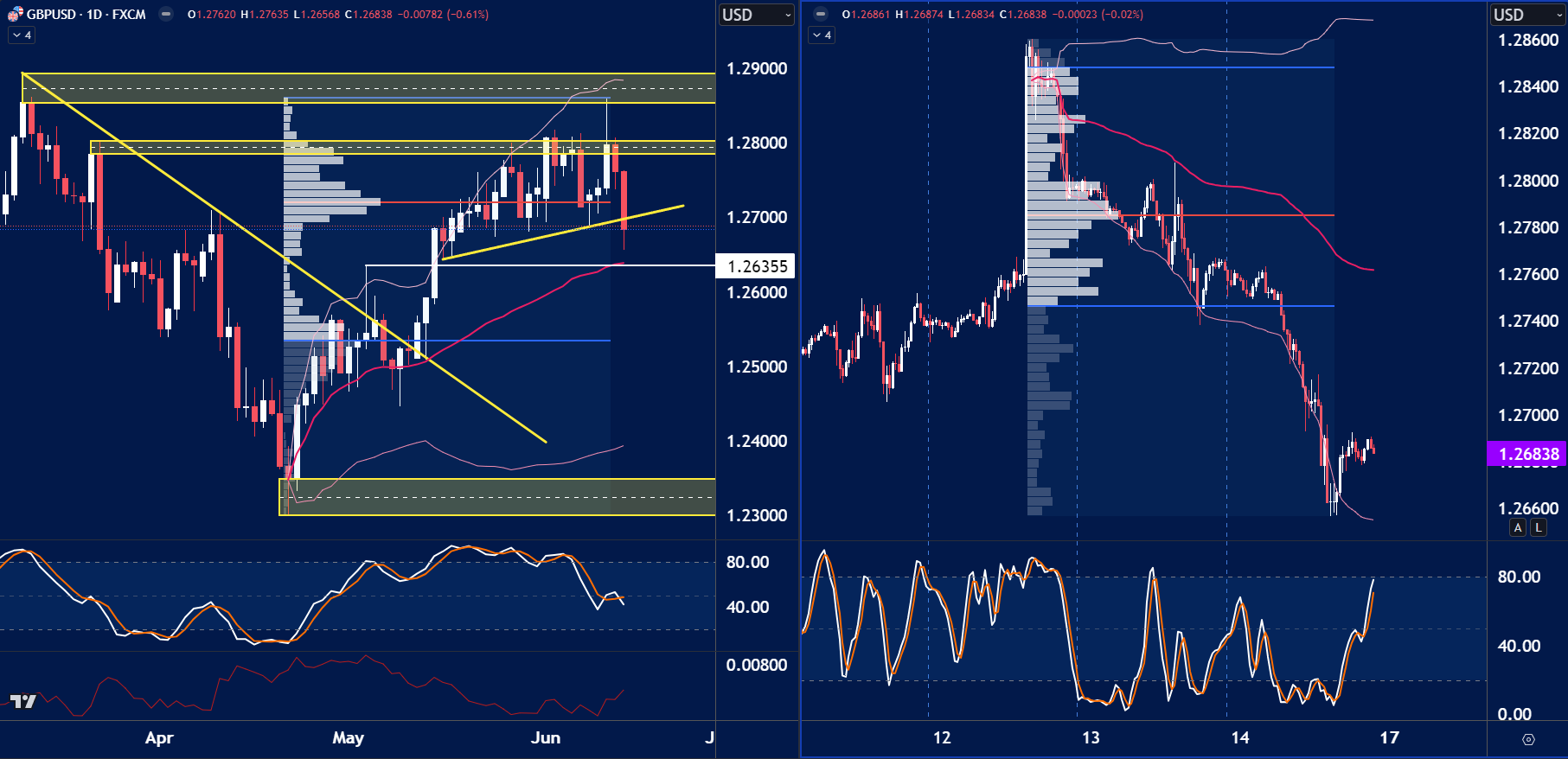

GBPUSD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the GBPUSD or ‘cable’ failed to close above the 1.2800 briefly touching the higher prices of 1.2875 before declining.

- A strong support level is close by with previous resistance of 1.2635 turning into support. This level holds confluence with an anchored VWAP from the lows that formed in April.

- Traders looking to continue the short play here though would need the price to move higher towards resistance volume levels of 1.2740 and above.

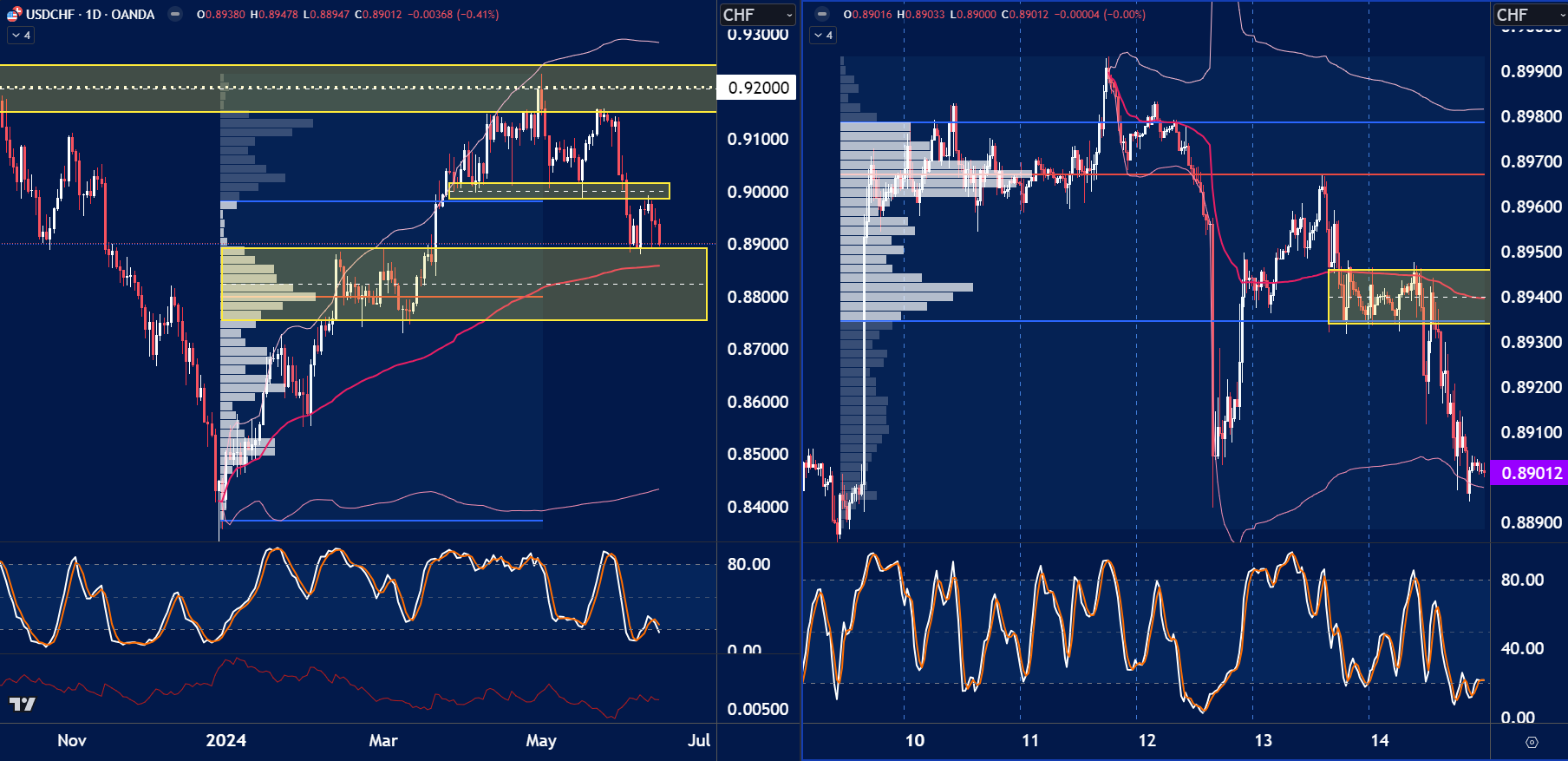

USDCHF

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USDCHF shows how strong the CHF has been of late.

- Price is approaching a daily timeframe volume zone between 0.8900 and 0.8800. This level could prove difficult to breach.

- Traders could look for rejections of this support zone or look for short ideas at higher levels of volume including 0.8940.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.