The head and shoulders pattern is one of the most important patterns that every foreign currency trader should know. This is known as a reversal pattern seen in uptrends.

A reversal pattern is one of the main groups of chart patterns where we predict that the current trend will change. When there is an uptrend where the currency is appreciating, a reversal pattern hints that the price will depreciate soon.

The Pattern

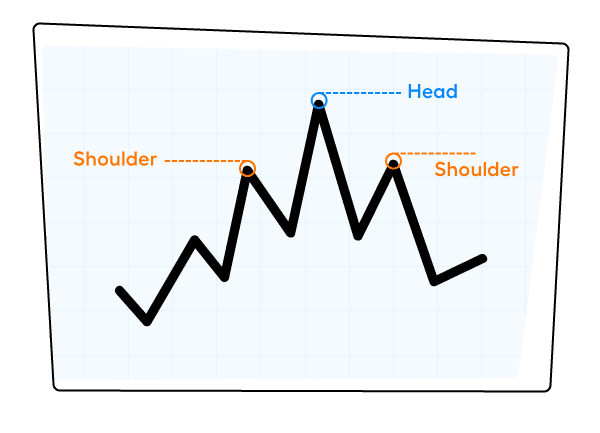

The head and shoulders is a relatively simple chart pattern to spot. Since it's a trend reversal formation that hints at the change of trajectory on the chart, it's essential to keep an eye out for it.

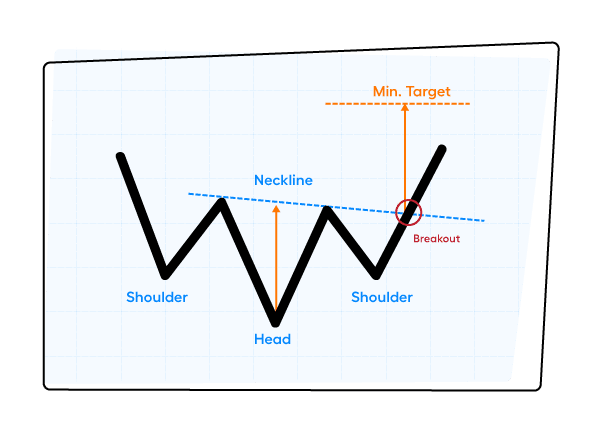

The pattern consists of three major peaks: one head and two shoulders. A shoulder appears as a peak from left to right and goes into a trough or a valley. It goes on an uptrend again to form the highest peak in the pattern, the head. Another downward slope follows the 'head,' then another peak known as the other 'shoulder.'

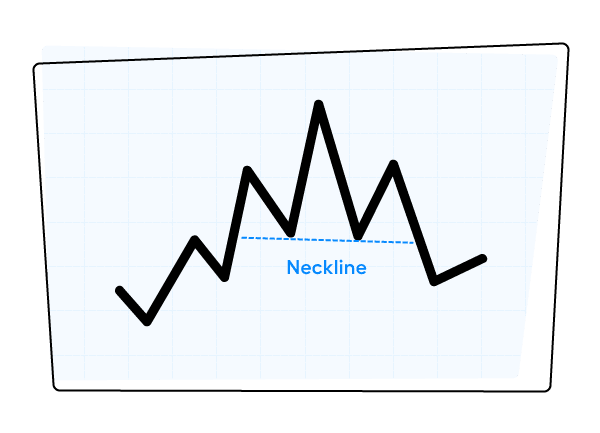

Form the neckline by connecting the lowest points of the two valleys on either side of the head. The signals tend to be more reliable when the neckline is sloping downwards instead of upwards.

Making the calls

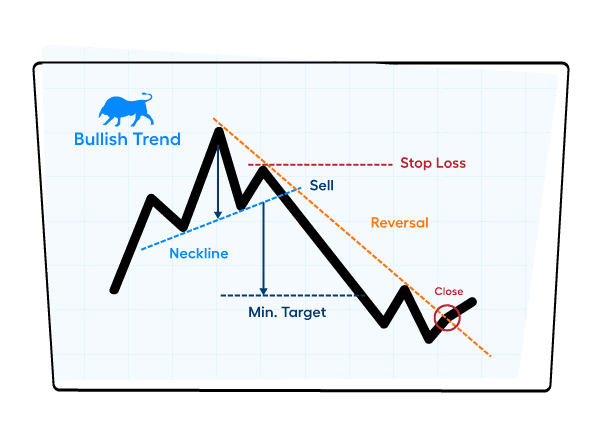

The head and shoulder pattern serves as a guide for your trading decisions in moving forward.

To compute for the price change and how far it will move after breaking the neckline, measure the head's highest peak and the neckline.

This distance is how far down the trendline is expected to plummet after it moves beyond the neckline. Typically, an entry order is opened below the neckline to be able to profit later on.

Since we expect the price to go even further down the neckline, you should move far enough to cover the size of the distance you've measured between the neckline and the top of the head.

Bear in mind that in forex trading is not static. The chart could keep moving even after it reaches the target. Still, it's essential to be happy with the profit you make and know the risks before you decide to make a move to cut your losses.

To prepare you for live trading, you can practice trading head and shoulders pattern with a free $50,000 demo fund. This is a good way for beginner traders to apply the knowledge that you have without risking your capital.

Reading inversions

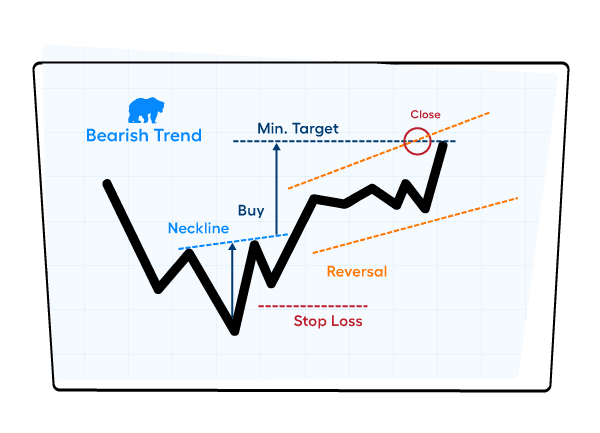

Interestingly, the head and shoulders pattern can also appear inverted in charts. It would look upside-down, with the head and shoulders forming troughs instead of peaks. The head is the lowest among the three valleys, between the shoulders.

For the inversion, the neckline is on the upper part of the chart, between the head and the shoulders. Unlike the conventional head and shoulders, we see the inverse on an extended downtrend instead of an uptrend.

Since the inverse of the head and shoulders pattern occurs on a downtrend, this means that you should expect the price to appreciate after you see the pattern.

Making the calls for inversions

Although they're inverses of one another, making calls for the inversion is similar to making calls for the head and shoulder pattern.

To calculate the target, measure downwards instead of upwards from the head's top to the neckline.

Once you make a projection, you can place a long entry above the neckline because you need to cover the distance the price is expected to move once it breaks the neckline—which is the distance you've measured between the head and the neckline. Once the chart moves and you hit your target, you can enjoy the profits you've made.

Advanced Techniques

There are more advanced techniques to eliminate most of the risk involved in going into an open position based on either a head and shoulders pattern or the inverse of it. To minimize the risk, you should look at the slope and how even the shoulders are or other indicators that may confirm a trend reversal. There's a wealth of information, both online and offline, as to the safeguards of making sure that the readings are reliable enough to make a reasonable projection.

The head and shoulders pattern and its inverse are two of the most fundamental chart patterns that every trader will benefit from knowing how to spot—anticipating inversions or changes in the current trend by telltale signs such as this inversion pattern is important to assure profit and chase after the best value possible. We hope this article helped you familiarize yourself with the head and shoulders pattern.

If you would like to ease into forex trading to try out trading heads and shoulders first before going all in, you can open a live account at Blueberry. for as low as $100 funding in your account. Our customer support team will be there to give you 24/7 support.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.