Trend following strategies analyze and work on sustained market movements. They help traders make informed decisions based on the prevailing market direction, reducing the risk of losses from market reversals.

In this article, we will discuss the top trend trading strategies and how traders can place long or short orders according to them.

What is trend trading?

Trend trading is a trading strategy that follows the current direction of market trends to enter positions accordingly. Traders identify market trends and align their trades in the same direction, expecting the market to continue in the same direction.

Key principles of a trend trader

Use multiple indicators

Trend traders use more than one technical indicator to confirm market trends before they ride any particular trend. Trend traders can combine indicators such as moving averages with MACD or RSI to verify the strength of the trend. If both trading indicators confirm the trend direction, traders can enter the trade in the same direction.

Avoid early exits

Trend following traders usually avoid early or premature exits. This is because they understand that trends can last longer than expected, and moving out of them before they fade could lead to losses.

Manage emotions

To follow a market trend, traders control emotions such as fear and greed or FOMO, which usually leads to impulsive decision-making. Trends can take some time to form, especially in the short term. It is important that traders follow systematic and emotional trend trading, relying only on set criteria and rules.

Ignore market noise

Trend following traders concentrate on the broader market picture by ignoring short-term market noise and distractions. Noise can give a false picture of the current market price trend, so traders keep their focus on the primary trend only.

Identifying and confirming trends

How to identify trends in forex?

Identifying trends involves observing price movements over time to determine the market's direction. Here are some methods commonly used in forex trend trading to identify trends apart from technical indicators analysis which we will discuss later:

Trend lines

Trend lines are straight lines drawn on forex price chart patterns, connecting significant price points (like highs and lows). They help traders identify uptrends (when a series of higher lows is connected), downtrends (when a series of lower highs is connected), and horizontal trends (when horizontal highs and lows are connected). Traders need to connect at least two points to draw a trend line, whereas connecting three of them confirms the trend's validity.

Price action analysis

Price action refers to the movement of a currency pair's exchange rate plotted over a specific period of time. It is the foundation of all technical analysis.

-

Traders can identify an uptrend and enter long trades when the currency pair price makes higher prices in both highs and lows

-

Traders can identify a downtrend and enter short trades when prices create slower highs and lower lows

These price actions can be analyzed using different chart patterns, such as triangles, candlesticks, flags, and others, that indicate potential trend directions.

Fundamental analysis

Fundamental trend analysis refers to analyzing indicators like inflation, GDP, unemployment rate, and interest rates that drive currency trends. Any news and event impacting currency values can also define the market trend.

-

An uptrend is identified when there is a strong market sentiment with high GDP, low interest rates, low unemployment rates, and sustained inflation. In this situation, traders can enter long trades

-

A downward direction trend is identified when there is a strong negative market sentiment with low GDP, high interest rates, high unemployment rates, and high inflation. In this situation, traders can enter short trades

How to confirm trends in forex?

Once a trend is identified, confirming it before taking any trend trading action is essential. Here are some techniques for trend confirmation:

Volume analysis

Once the trend is identified, traders can look for volume to see if it is strong enough to continue. When a market trend is followed by increasing volume, it indicates strong trend strength, and traders can enter the trend.

For example, rising volume during an uptrend signals trend traders to enter long trades and vice versa. Volume oscillators like the Chaikin Money Flow (CMF) index help assess volume to support trend confirmation.

Multiple timeframe analysis

Traders can analyze a market trend across different timeframes (short, medium, and long-term) to ensure that it is an actual trend and not a false signal.

For example, if an uptrend occurs on a daily chart pattern supported by an uptrend on a weekly chart, traders can enter the uptrend and expect it to continue in the coming few weeks.

Fibonacci retracement levels

Fibonacci retracement levels help identify potential support and resistance levels during pullbacks within a trend. Traders can draw Fibonacci levels between two significant price points (high and low) and look for price reactions around 38.2%, 50%, and 61.8% levels to confirm trend strength.

Top trend following strategies

Moving average crossover trading strategy

The moving average (MA) crossover trend following strategy uses two moving averages (a short-term one and a long-term one) in both day trading and swing trading. This helps traders identify potential entry and exit signals based on the crossover of the two moving averages. The short-term moving average (SMA) can be a 10-period MA, whereas the long-term moving average (LMA) can be a 50-period MA.

-

The SMA crosses the LMA from above and signals a potential uptrend, providing traders with long opportunities. This is also known as a golden cross

-

The SMA crosses the LMA from below and signals a potential downtrend, providing traders with short opportunities. This is also known as a death cross

Bollinger bands

Bollinger bands are momentum indicators that also consist of a moving average, like the moving average crossovers. This MA line is known as the middle band. However, it also consists of two standard deviation lines, known as an upper band and lower band, which are placed two price points above and below the moving average line.

-

When the currency pair price trades near the upper band, it suggests the market trending upward and signals traders to trade the trend with a long order

-

When the currency pair price trades near the lower band, it suggests a strong downtrend and signals traders to trade the trend with a short order

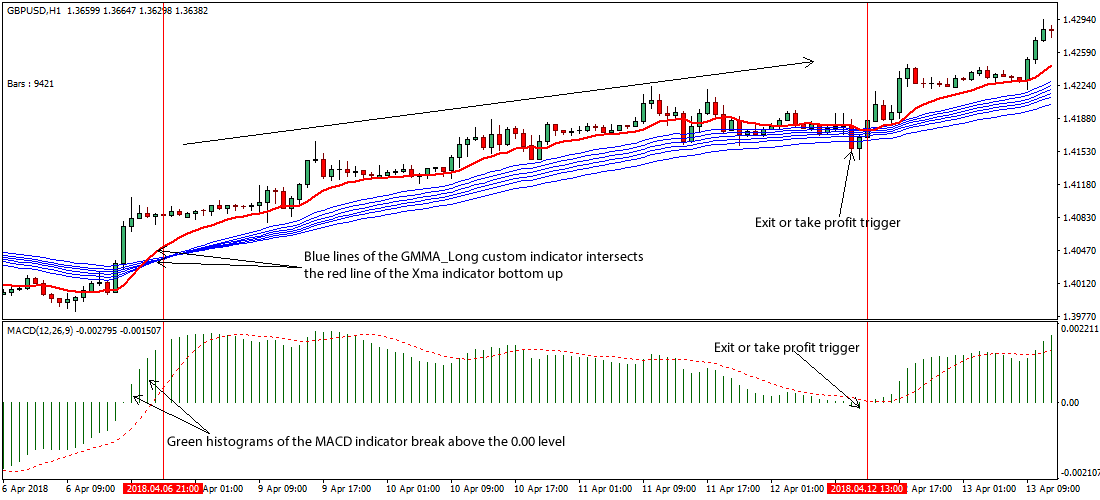

MACD trend following strategy

The moving average convergence divergence (MACD) is a momentum indicator that can identify the direction of forex trends and trend reversal points. It comprises two moving averages and a histogram that shows the difference between them. The signal line is a 9-period exponential moving average (EMA), and the MACD line is a 12-period EMA.

The MACD histogram shows the strength and direction of the trend. Larger bars indicate stronger momentum, while smaller bars suggest weakening momentum.

-

When the histogram bars are above the zero line, it indicates a bullish trend (uptrend), signaling traders to enter long trades

-

When the histogram bars below the zero line, it indicates a bearish trend (downtrend), signaling traders to enter short trades

Parabolic stop and reverse (SAR) trend trading strategy

The parabolic SAR is a trend following indicator which provides trend traders with potential entry and exit price levels based on the forex price movements. It does so by placing dots above and below the forex prices to indicate the trend direction.

In a downtrend, traders can notice the dots placed above the price. In an uptrend, they are placed below the price. Any changing trend shifts the positions of these dots. The indicator also consists of an acceleration factor, determining the rate at which the SAR follows the price. It usually starts at 0.02 and increases to 0.2.

-

Traders can enter a long trade when SAR dots move below the price, indicating an uptrend

-

Traders can enter a short trade when SAR dots move above the price, indicating a downtrend

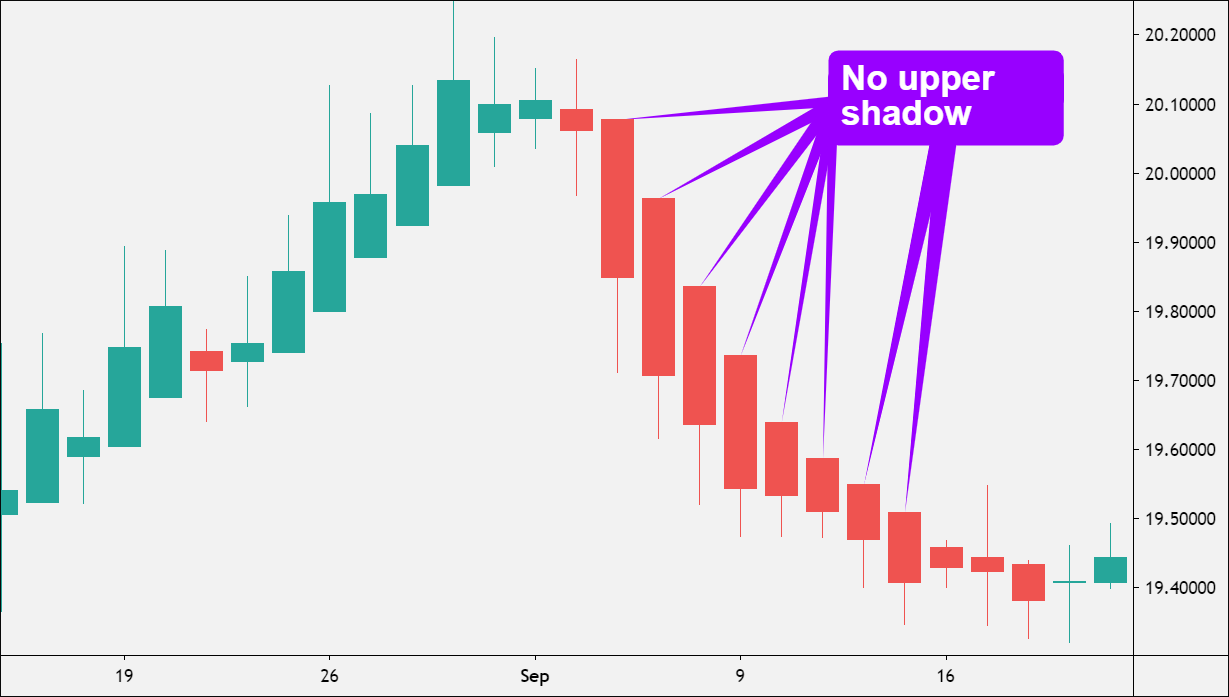

Heikin-ashi candlestick trend trading strategy

Heikin-ashi is a candlestick trading strategy that filters the market noise to provide a better view of the market trend. It smooths price data and makes identifying the current trend direction easier. Heikin-ashi candlesticks are calculated using average price data.

-

Traders can identify an uptrend when there are consecutive Heikin-ashi candles with no lower wicks and a long body

-

Traders can identify a downtrend when there are consecutive Heikin-ashi candles with no upper wicks and a long body

DMI and ADX trend trading strategy

The directional movement index (DMI) trend following strategy is a trend following tool that uses two primary lines—the Plus Directional Indicator (+DI) and the Minus Directional Indicator (-DI)—to determine the direction and strength of a trend. The Average Directional Index (ADX) is often used alongside DMI to gauge the trend's strength.

-

The plus directional indicator (+DI) measures the upward price momentum strength by calculating the difference between the current high and previous high. A positive difference signals traders to enter a long trade in the upward trend

-

The minus directional indicator (-DI) measures the strength of the downward price momentum by calculating the difference between the previous low andthe current market price low. A positive difference signals traders to enter a short trade in the downtrend

-

Average directional index is calculated by taking the Moving Average of the Absolute Value of (+DI - -DI) / (+DI + -DI). It measures the trend's strength irrespective of the direction and lets traders know if there are trending markets or not

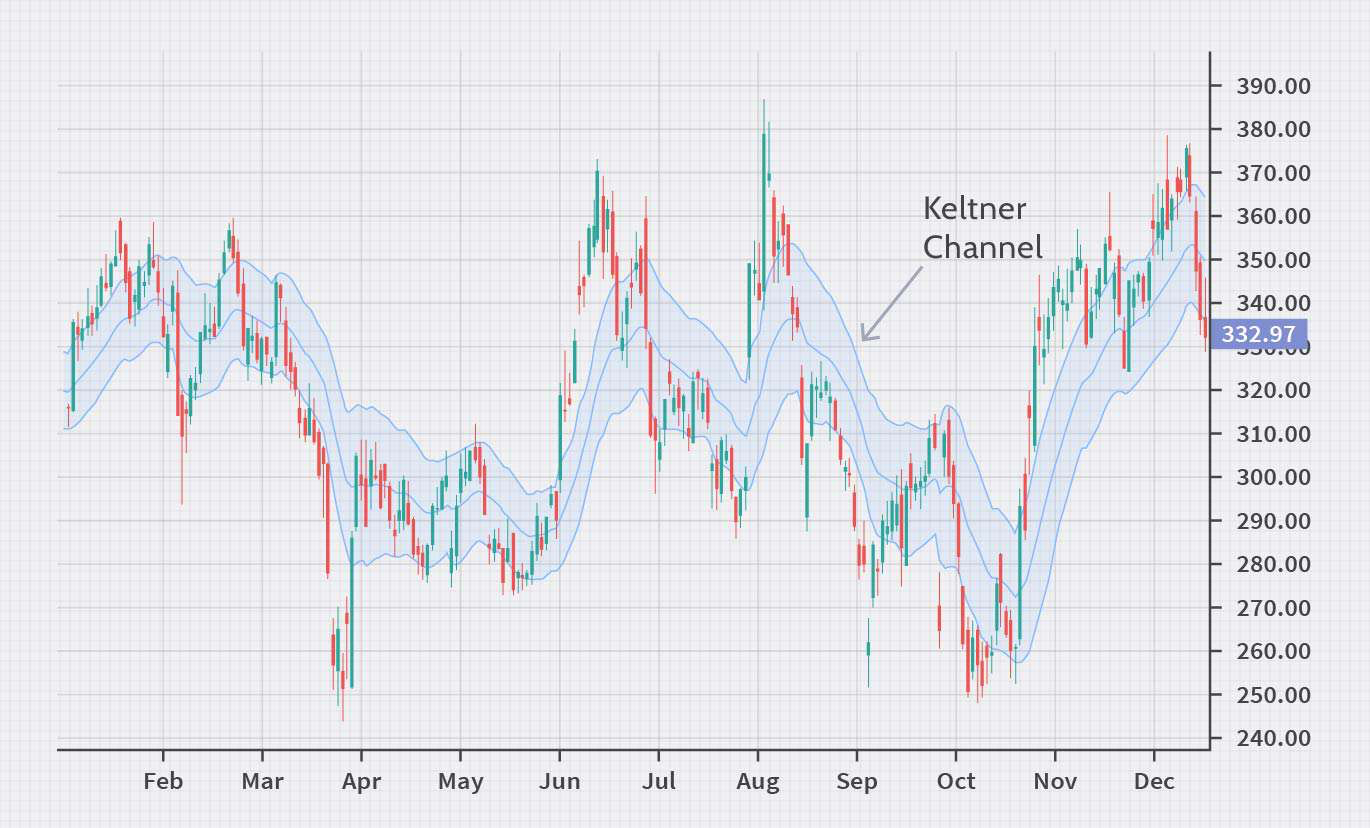

Keltner channel trend trading strategy

The Keltner channel is a volatility indicator that helps trend traders identify price trends by signaling overbought and oversold market conditions. It consists of a central moving average and two outer bands set at a multiple of the average true range from the central MA.

-

Traders can enter long positions when the forex price stays above the upper band, indicating a strong uptrend

-

Traders can enter short positions when the forex prices stay below the lower band, indicating a strong downtrend

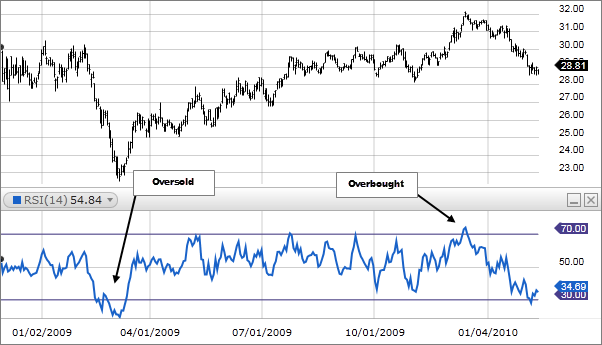

Relative strength index

Relative strength index (RSI) measures how quickly the currency pair prices change. It is mostly used to identify overbought and oversold conditions but can also help trend following traders enter current market trends. It is calculated using the average gains and losses over a specified period (usually 14 periods) and ranges from 0 to 100.

-

The RSI dips below 30 in a strong uptrend and signals traders the opportunity to enter a long trade

-

The RSI moves above 70 in a strong downtrend and signals traders the opportunity to enter a short trade

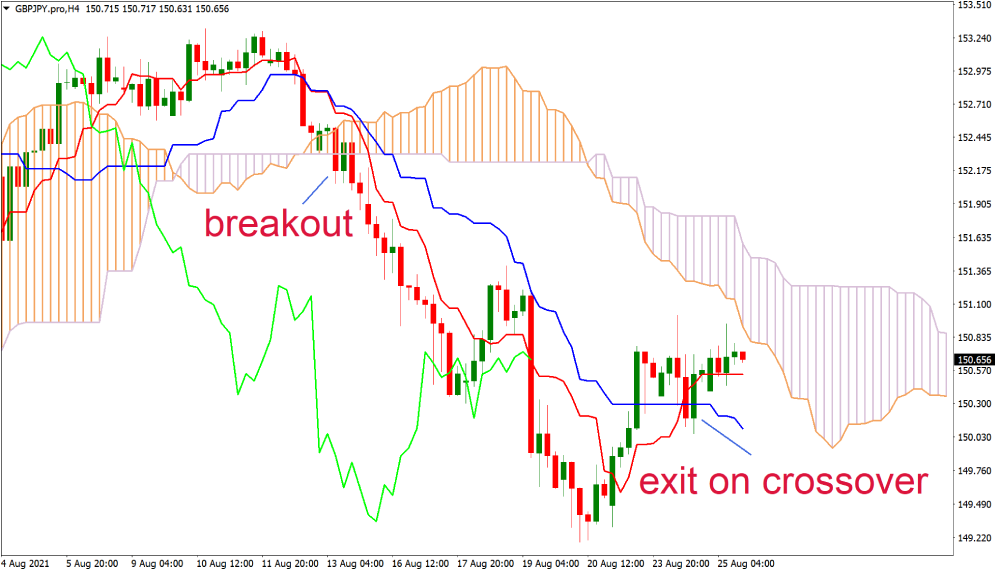

Ichimoku cloud strategy

The Ichimoku cloud trading strategy provides traders with information about the trend's direction, the support and resistance level in the market, and overall momentum. It consists of five main lines: a short-term MA (tenkan-sen), a long-term MA (kijun-sen), support and resistance (Senkou span A and B), and prices 25-periods back (Chikou span).

-

A strong uptrend is indicated when the currency pair price moves above the Ichimoku cloud and the Tankan-sen crosses above the Kijun-sen. Here, traders can enter a long trade

-

A strong downtrend is indicated when the currency pair price moves below the Ichimoku cloud and the Tankan-sen crosses below the Kijun-sen. Here, traders can enter a short trade

A thicker cloud indicates stronger support or resistance levels, which allows traders to place orders against the current trend.

Navigating through the pros and cons of trend following strategies

Trend trading strategies provide traders with price points that capitalize on established market trends. By focusing on current market movements, they help maintain trend trading disciplines.

However, trend following strategies can also give false trading signals due to sideways trends or choppy markets. Since trading signals are based on historical price movements, they may also lag sometimes, leading to delayed entries. Hence, traders must ensure that they combine different trend following technical indicators to get a confirmed signal before entering the direction of the trend.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.