Trading EUR/GBP requires the right strategies that align with trading goals and the currency pair’s overall performance.

There are also significant risks that need to be considered, such as exchange rate volatility, sensitivity to political events like Brexit, impact from economic data releases, and potential liquidity gaps during low-volume periods, all of which demand careful risk management.

This article discusses the top strategies to trade the EUR/GBP.

What is the Euro/British Pound?

The Euro/British Pound (EUR/GBP) is a currency pair in the forex market, representing the exchange rate between the Euro (EUR) and the British Pound (GBP). It tells a trader how many British Pounds they need to purchase one Euro.

History of the Euro/British Pound

The British Pound's history dates back to 775 AD and is one of the oldest currencies. On the other hand, the Euro is a relatively modern currency, coming into existence in 1999.

EUR/GBP's history is marked by fluctuations, notably influenced by events like Brexit. The GBP weakened by3% against the Euro during the Brexit process, leading to a significant rise in the exchange rate from around0.70 in 2015 to over 0.90 by 2020. The volatility continued for EUR/GBP as a currency pair and spun the forex pair, leaving the Pound15% weaker than the Euro since 2016. Economic data, interest rates, politics, and investor sentiment have impacted the pair's performance over the years.

Note: Past performance is not a reliable indicator of future performance.

Top strategies to trade EUR/GBP

Scalping

Scalping is a high-intensity trading strategy designed to capitalize on short-term price movements in the EUR/GBP currency pair. Scalpers seek to make multiple, rapid trades within very short timeframes, often seconds to minutes.

To effectively scalp EUR/GBP, traders need access to a reliable and fast-execution trading platform that provides real-time price charts and news updates. Scalpers rely heavily on technical analysis, employing indicators like Moving Averages, Stochastic Oscillators, or Relative Strength Index (RSI) to identify fleeting market trends.

Since timing is critical in scalping, scalpers often concentrate their efforts during the most liquid trading hours, which usually occur during the overlap of the London and European trading sessions.

Since scalping involves a higher frequency of trades, risk management is paramount. Scalping carries a heightened risk due to its rapid trading nature. So, traders should set tight stop-loss orders to limit potential losses and aim for small, quick gains.

Swing trading

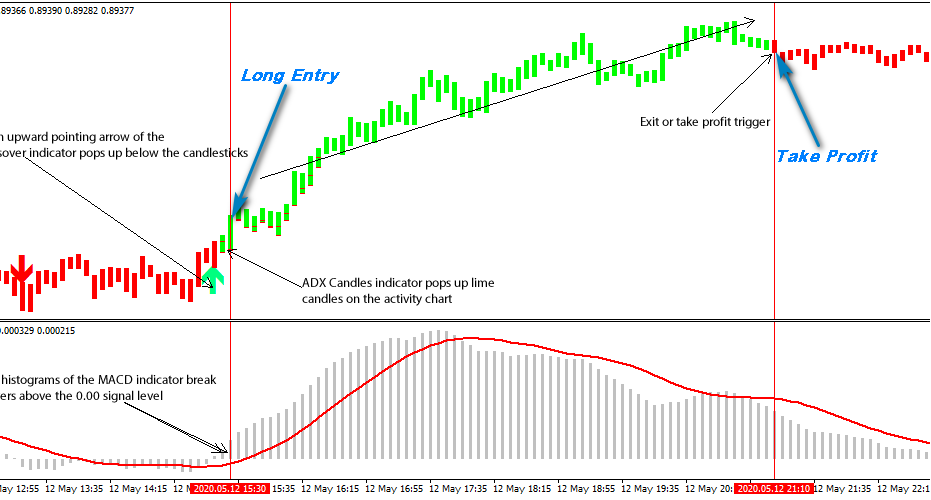

Swing trading adopts a medium-term perspective when trading the EUR/GBP currency pair, with positions typically held for several days to weeks. This strategy aims to capture price movements within the broader trend of the currency pair. Swing traders analyze EUR/GBP using technical and fundamental analysis. They search for chart patterns such as head-and-shoulders, flags, or triangles and employ technical indicators like the Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI) to confirm potential reversals or continuation of trends.

Unlike scalpers, swing traders do not require constant monitoring of the market. They enter trades based on their analysis and set trailing stop-loss orders to protect gains as the trade takes place.

The main risks in swing trading, including market volatility, unexpected news events, and potential overnight gaps, can lead to losses if not managed effectively, necessitating continuous vigilance and risk mitigation.

Breakout trading

Breakout trading focuses on identifying crucial price levels, such as support and resistance, and entering trades when the EUR/GBP currency pair exceeds these levels. Traders employing this strategy look for consolidation patterns on the EUR/GBP chart, such as triangles or rectangles, which indicate a period of market indecision. Breakout traders place pending orders just above resistance levels or below support levels, speculating that when the price breaks through, it will experience a significant and sustained movement.

To increase the probability of successful trades, breakout traders may also use additional technical indicators or volume analysis to confirm breakouts.

One of the primary risks in breakout trading is the possibility of false breakouts, where the price briefly breaches a level but then reverses. Therefore, setting stop-loss orders at logical levels and employing trailing stops to protect gains as the trade progresses is essential.

Trend following

Trend following is a strategy where traders aim to capitalize on the prevailing direction of the EUR/GBP exchange rate. It involves analyzing historical price movements to identify whether the market is in an upward (bullish) or downward (bearish) trend. Technical indicators such as moving averages, which smooth out price data over a specific time period, or trend lines drawn on charts help confirm the trend's direction.

Traders seek to enter positions that align with the identified trend, expecting it to continue. For example, in a bullish trend, traders might look to purchase the pair when prices dip slightly, anticipating that the upward momentum will resume.

One significant risk in trend following is the potential for false signals, where traders might enter or exit positions prematurely due to short-term reversals or sideways market movement within an overall trend. Additionally, sudden trend reversals, often triggered by unexpected events or shifts in market sentiment, can catch trend-following traders off guard, leading to losses.

Range trading

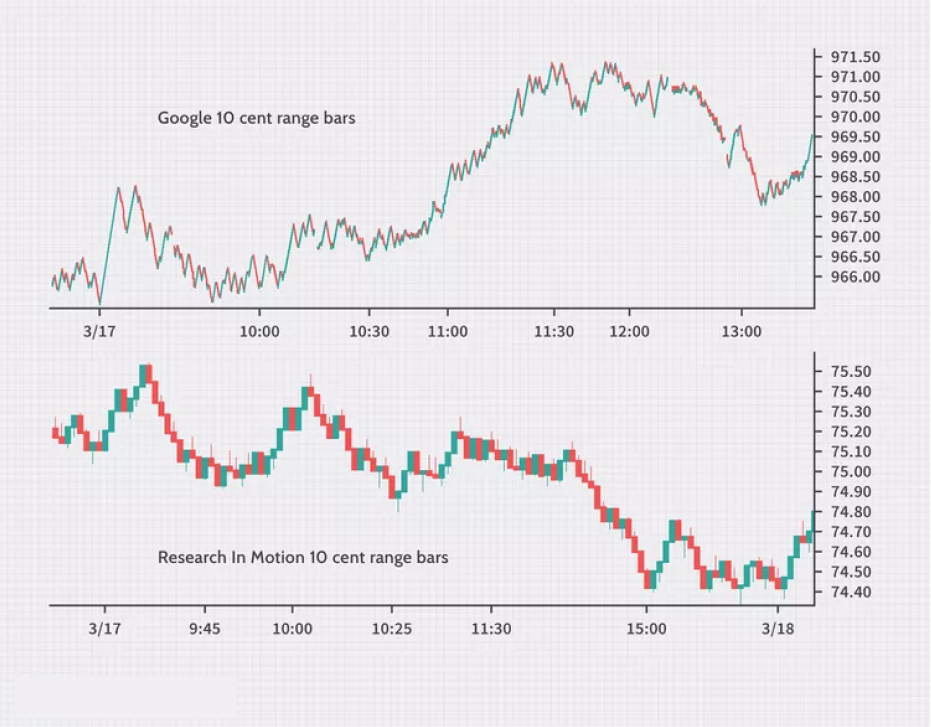

Range trading involves identifying specific price levels within which EUR/GBP moves. These levels are typically defined as support (the lower boundary) and resistance (the upper boundary). Traders aim to enter a trade when the price nears support and exit it when it approaches resistance, expecting the currency pair to oscillate within this defined range.

Technical tools like Bollinger Bands, which depict price volatility, and the Stochastic Oscillator, which gauges overbought and oversold conditions, can help traders pinpoint potential entry and exit points. Range traders aim to gain from price fluctuations within this established trading range.

Range traders face the risk of false breakouts, where prices briefly breach support or resistance levels before returning to the established trading range. Adapting to changing market conditions is crucial because well-defined trading ranges can evolve, potentially leading to losses if traders fail to adjust their strategies accordingly.

Moreover, prolonged periods of low volatility can reduce the frequency of trading opportunities and the gain potential for range traders, emphasizing the importance of carefully selecting trading ranges based on current market dynamics.

News trading

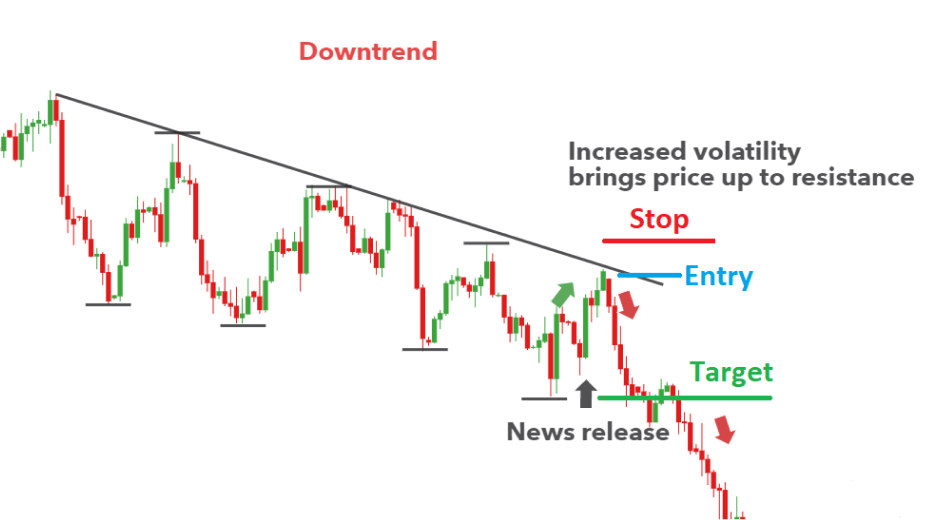

News trading leverages the impact of economic events and geopolitical developments on EUR/GBP. Traders closely monitor economic calendars for scheduled announcements, such as central bank interest rate decisions, GDP releases, or significant political events like elections or trade negotiations. When important news is released, it can lead to sudden and sharp price movements in the currency pair.

News traders aim to capitalize on these price swings by quickly entering positions in the direction they anticipate the market will move in response to the news. Effective news trading requires staying well-informed about economic and geopolitical developments and being prepared to act swiftly to seize trading opportunities created by news releases.

The trading strategy carries the risk of slippage during periods of high volatility following news releases, as traders may struggle to execute orders at their desired prices. Additionally, news-driven price movements can be erratic and short-lived, leading to whipsaws, where the market quickly reverses direction, potentially resulting in losses if stop-loss orders are not set effectively.

Risks of trading EUR/GBP

- Brexit uncertainty: Any further developments in Brexit agreements could introduce uncertainty and volatility into EUR/GBP performance. Negotiations, agreements, or disputes between the UK and the EU can lead to sudden and unpredictable price swings. Additionally, regulatory changes stemming from Brexit can impact economic stability, causing traders to closely monitor the evolving landscape of UK-EU relations.

- Interest rate changes: Changes in interest rates by the Bank of England (BoE) or the European Central Bank (ECB) can significantly impact the EUR/GBP exchange rate. Interest rate hikes in the UK may strengthen the Pound, while rate cuts can weaken it, affecting trading positions.

- Political events: Political developments in the UK and the Eurozone can introduce heightened risk. Leadership changes, whether through elections or other means, can lead to policy shifts that affect the economy and, consequently, the currency pair. Moreover, referendums and elections that impact Brexit or Eurozone integration can create significant market volatility, necessitating vigilance from traders.

- Currency pegs: The Pound is not part of the Eurozone, but some currencies in the EU are pegged to the Euro. This can create interdependencies and potentially affect EUR/GBP due to economic issues or spillover effects within the Eurozone.

- Black swan events: Unexpected and rare crises, often called black swan events, can make currency markets extremely volatile, including EUR/GBP. Such events, which can range from natural disasters to global health crises like pandemics, have the potential to generate extreme and unpredictable market reactions.

- Capital flow risk: The flow of capital between the Eurozone and the UK poses a risk to EUR/GBP. If the UK becomes an attractive destination for foreign investments, the demand for the Pound can rise, leading to EUR/GBP depreciation. Conversely, if capital is repatriated from the UK or if investment trends favor the Eurozone, it can strengthen the Euro, potentially causing EUR/GBP appreciation. This capital flow risk introduces volatility and unpredictability into the currency pair.

- Trade disruptions: Positive developments like favorable trade deals can boost economic sentiment and potentially lead to a relatively stable EUR/GBP. However, the risk lies in trade disruptions, such as tariffs or supply chain disruptions, which can undermine economic confidence in both the Eurozone and the UK. These disruptions have the potential to weaken both the Euro and the Pound, causing unpredictable fluctuations in EUR/GBP.

- Eurozone debt concerns: Eurozone's debt concerns can affect EUR/GBP. If worries about excessive debt levels arise, investors may seek a shift to the British Pound, leading to EUR/GBP depreciation.

Navigating through the EUR/GBP trading process

Trading the EUR/GBP offers benefits like liquidity, the potential for gains from volatility, and diversification. However, it carries risks, including political uncertainties like interest rate changes and market volatility.

Sign up for a live account or try a demo account on Blueberry. today.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.