The annual global silver market is a $5 trillion economy, with around 976 million ounces being the total global supply of silver. Studies suggest that the paper silver market is 250 times bigger than the physical silver market, proving silver to be a highly tradable commodity.

Applying the right silver trading strategies helps make the most out of one of the most popular commodities, and that is precisely what our article will cover.

What is silver trading?

Silver trading refers to speculating on the increasing and decreasing prices of silver in the commodities market. The most popular way to trade silver is through a Contract for Difference (CFD), where you can gain exposure to the silver market without actually owning the metal physically.

Top silver trading strategies that you can use

1. Range Bound Strategy

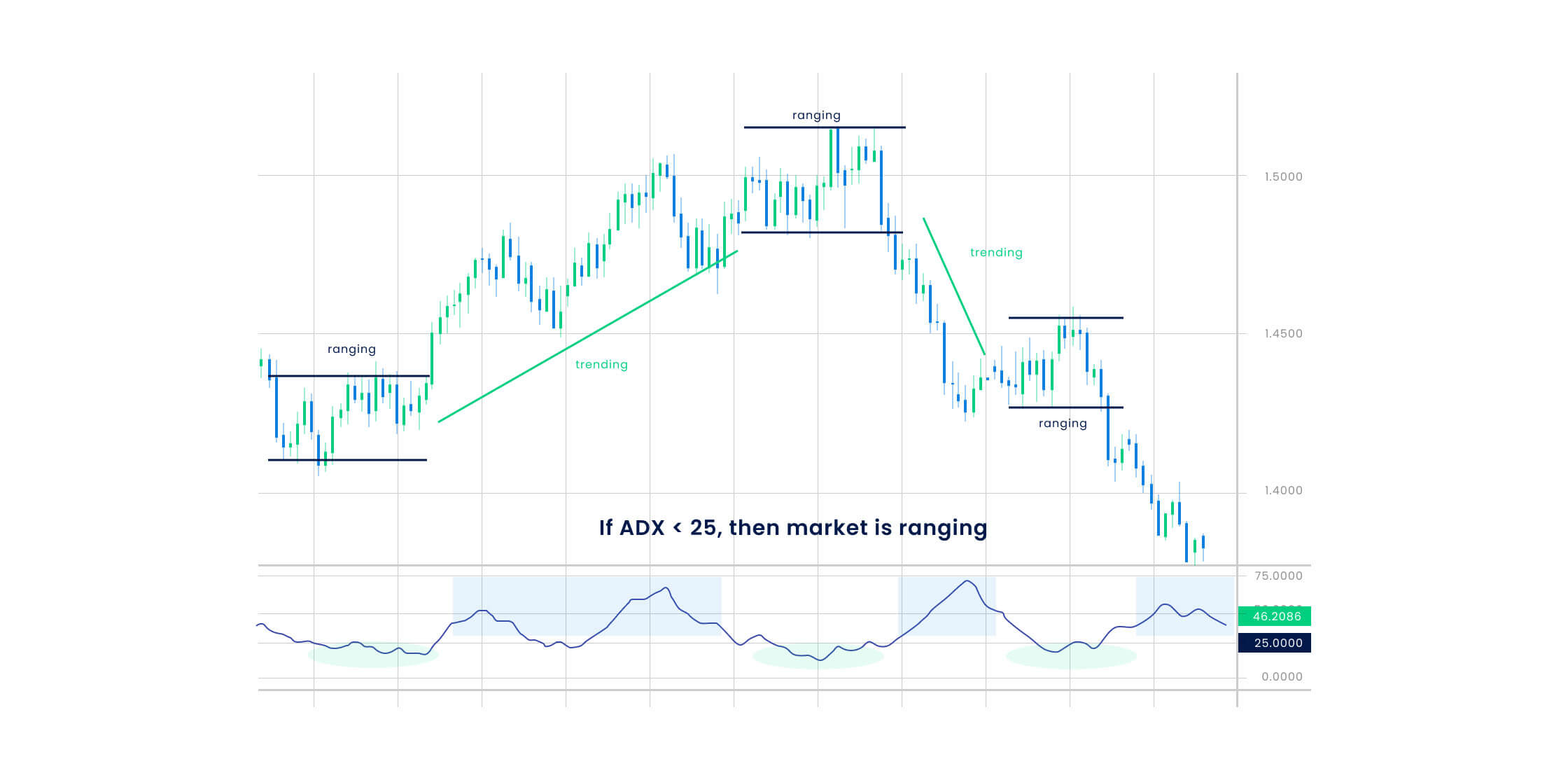

The Range Bound Trading Strategy is a method where you buy silver when its prices trade between a range (support and resistance level). The support level is where the falling prices stop falling and start rising, and the resistance level is where the rising prices stop rising and start falling.

To trade silver CFDs with this strategy, you can keep a close eye on the market and see if the market is showing a strong move in either direction or not. The uncertain momentum helps in identifying overbought and oversold silver market conditions.

- When silver trades near its support level, it indicates an oversold market condition and signals an ideal entry position due to an expected uptrend.

- When silver trades near its resistance level, it indicates an overbought market condition and signals an ideal exit position due to an expected downtrend.

2. Trend Trading Strategy

The Trend Trading Strategy refers to trading silver along with the current market trend. It provides you with a strong market momentum with a future expectation of the market trending in the same direction. In this strategy, you can compare the current prices with the historical prices and past trends to forecast future market direction. Based on the present and past trends, you can place your orders accordingly.

- When the market is trending upwards, it indicates a continued uptrend and signals traders to place long orders.

- When the market is trending downwards, it indicates a continued downtrend and signals traders to place short or sell orders.

3. Gold-Silver Ratio Trading Strategy

The Gold-Silver Trading Strategy refers to monitoring the prices of gold in order to anticipate the future market movement of silver. The Gold-Silver ratio is how many ounces of silver can be traded to attain a single ounce of gold at the prevailing market prices.

- If the ratio starts to increase drastically, it means that the silver market is in an uptrend now as more silver is required for the same amount of gold, leading to a price appreciation.

- If the ratio starts to decrease drastically, it means that the silver market is in a downtrend now as less silver is required for the same amount of gold, leading to price depreciation.

The gold and silver prices are highly correlated as both of them are precious metals and act as safe-haven assets for investors. The positive correlation indicates to investors that a jump in gold prices will eventually lead to a jump in silver prices as well.

- An increase in the price of gold indicates an increase in silver prices as well, signaling a continued uptrend and providing ideal entry price levels.

- A decrease in the price of gold indicates a decline in silver prices as well, signaling a continued downtrend and providing ideal exit price levels.

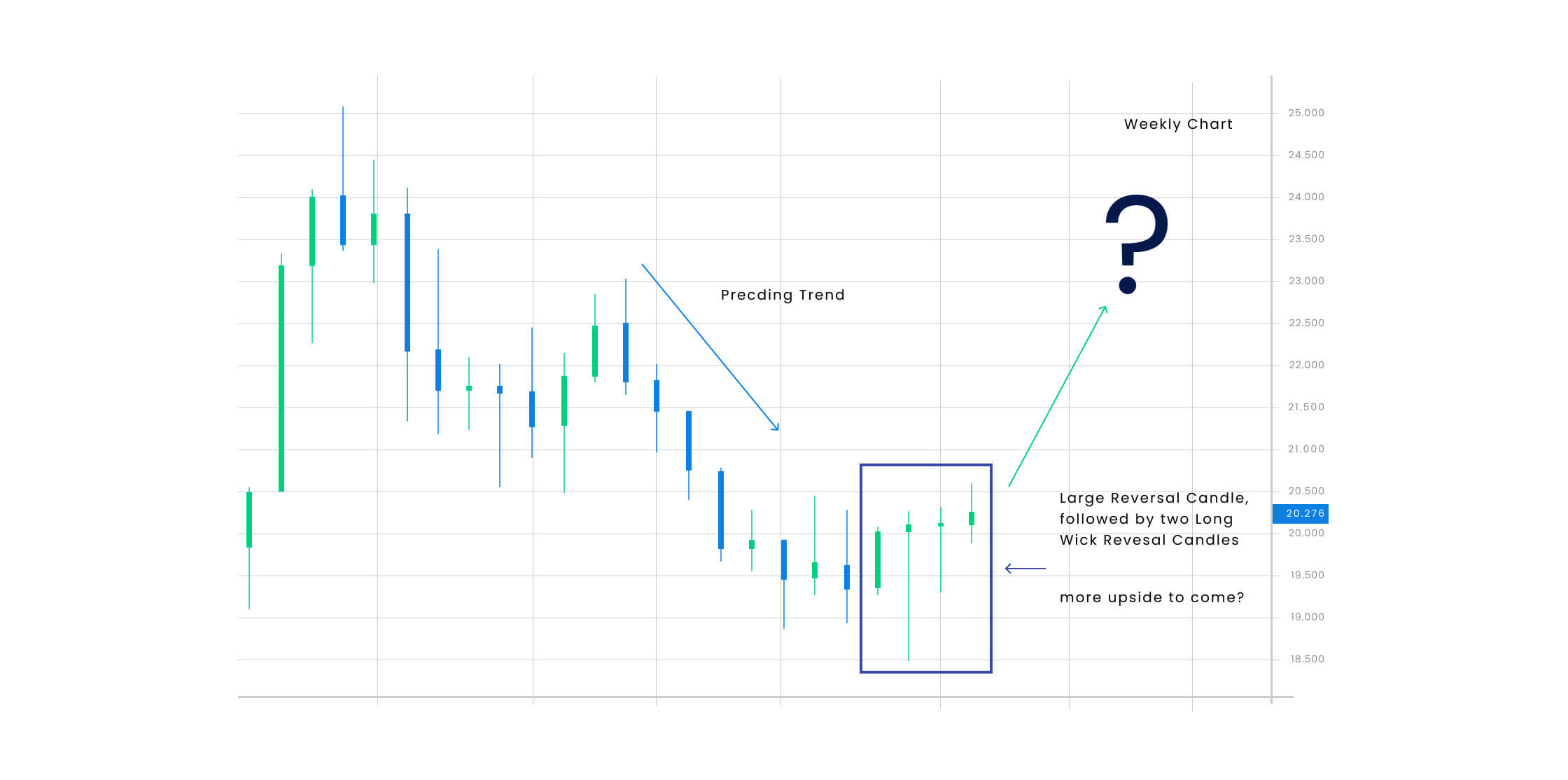

4. Silver Swing Trading

Silver Swing Trading Strategy refers to holding onto silver CFDs over a few days or weeks to benefit from the short-term trends. As silver is a highly volatile commodity, you can keep a close eye on the market momentum and predict the upcoming price trend based on the current trend to place orders accordingly. Silver prices can fluctuate as much as 10% or more every week, enabling traders to do short or long trades as per current market movements.

- If there has been a continued uptrend in the market, traders can long the trade with an expected rise in prices in the short term.

- If there has been a continued downtrend in the market, traders can short or sell the trade with an expected fall in the prices in the short term.

Pair trading refers to opening a short or long position in a commodity or other financial asset that is highly correlated to silver like copper, gold, platinum, AUD and YEN.

- Silver is highly correlated to gold, copper and platinum because all of them are precious metals belonging to the same industry. An increase in the price of one leads to strengthening the industrial value of all, leading to a rise in the price of others as well.

- Silver is highly correlated to currencies like AUD and YEN because both countries are among the highest precious metal producers worldwide.

Pair Trading as a strategy enables you to buy or sell an asset correlated to silver by opening an opposite position in the same. It provides you with an opportunity to benefit in both rising and falling markets. Pair trading also protects you against risks when the silver markets move against your trade.

- During a downtrend, open a short position in the correlated assets when you have a long position in silver CFDs.

- During an uptrend, open a long position in the correlated assets when you have a short position in silver CFDs.

Start trading the safe-haven white metal via CFDs

Trading silver via CFDs is a lucrative way to enter the silver market without actually having to own any of it.

Blueberry. offers silver CFD trading at competitive spreads and significant leverage to help you kickstart your trading journey!

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.