AI has revolutionized various sectors, including finance and trading. With its ability to analyze vast amounts of data, identify patterns, and make predictions, AI is changing the dynamics of trading by providing powerful tools to traders. Incorporating AI into trading processes has opened up new possibilities, enabling traders to make more informed decisions, optimize trading strategies, and mitigate risks with less time and higher efficiency.

Note: Combining AI tools with human monitoring and judgment is critical. Traders should be aware of the limitations of AI and use caution when depending only on automated systems. Regular monitoring, thorough testing and ongoing evaluation is required to discover and address any potential flaws.

Furthermore, constant education and skill improvement are required for traders to understand the principles and procedures of underlying AI technologies fully. This allows traders to evaluate and validate the outputs of AI tools, allowing them to make informed decisions based on a combination of AI-driven insights and their own market expertise.

The top 5 AI tools in the market that can be used for trading

1. TrendSpider

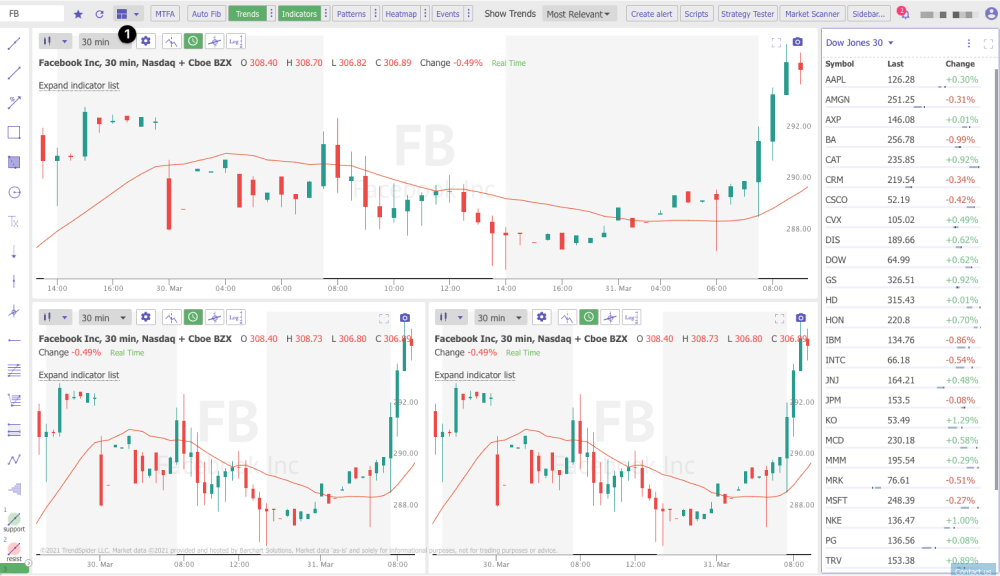

TrendSpider offers an advanced machine learning algorithm and stock market platform that automates the technical analysis process. The software allows users to define specific conditions that, when met, triggers actions such as comparing current prices to historical prices (to make trading decisions), automating transactions and more.

Traders have the ability to refine and optimize their strategies using the platform's Strategy Tester before deploying them as trading programs. With customizable features, TrendSpider's trading software operates across various timeframes. The all-in-one platform also provides scanning and screening capabilities, smart charts, dynamic price alerts, and other valuable features to enhance trade ideas and timing.

2. Tickeron

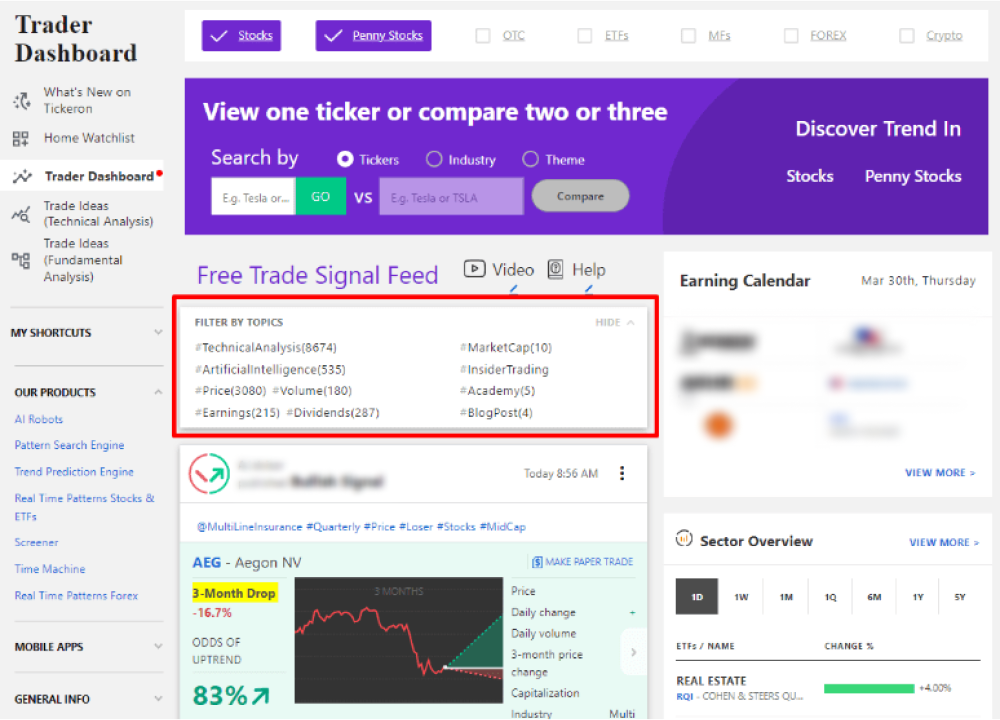

Tickeron is an all-in-one online trading software that combines the power of artificial intelligence AI algorithms with human intelligence, providing a comprehensive marketplace for trading and investing services. It caters to independent traders, self-directed investors, and those seeking professional advisors and management services. The tool offers a unique marketplace where experts and advisors can promote their services to a growing community of potential customers.

Tickeron has a feature known as the AI Robots. This feature provides real-time visibility into bought and sold trades, along with potential gains and stop-loss indicators. The AI Robots continually scan stocks and ETFs, presenting them in customizable fields for traders to choose from. These robots utilize real-time patterns and networks to identify trading opportunities and execute trades in automated trading rooms.

There is also the AI Trend Forecasting feature, which leverages historical price data to predict market trends, accompanied by confidence levels to assess the likelihood of success.

Additionally, users have the ability to customize confidence levels, allowing for more tailored risk management strategies. Other features of Tickeron include AI Active Portfolios, custom pattern search criteria, and customizable confidence levels, enhancing the trading experience for users.

3. SignalStack

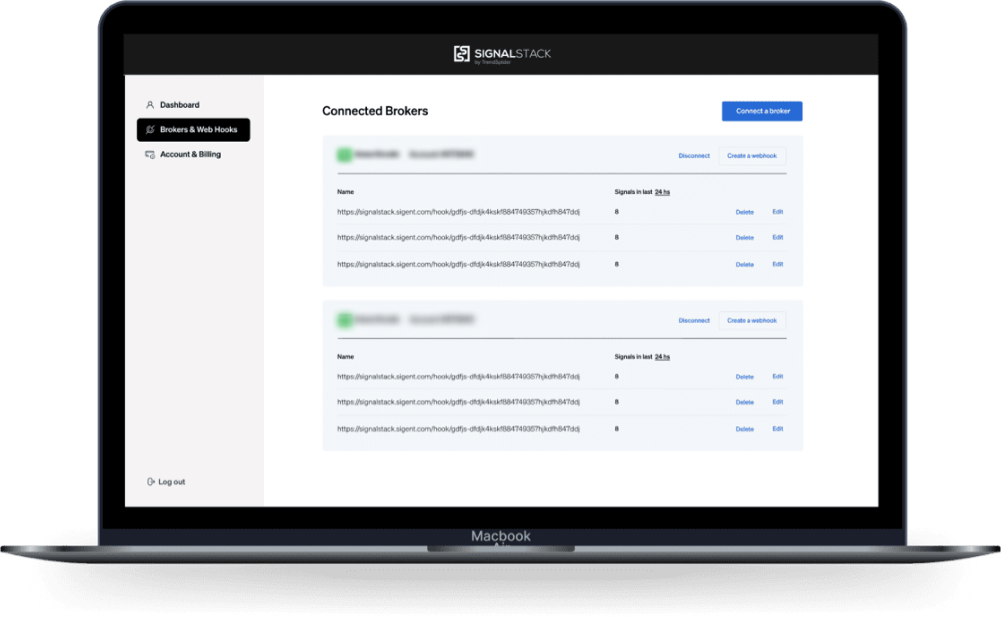

SignalStack seamlessly integrates with multiple brokers and automatically converts trading signals into orders, helping to eliminate slippage situations. Users can customize and automate technical analysis for their trading strategies. The platform

Its possible to place Market and Limit orders by adjusting the payload sent to SignalStack, eliminating the need for manual execution. The platform keeps detailed logs of all interactions with external brokers and can send automated alerts in the event of any exceptions. With no coding requirements, SignalStack simplifies the process for users to convert signals into orders with speed, minimizing slippage and optimizing trade execution.

Furthermore, SignalStack facilitates direct connection to a broker's account without requiring any code. It also provides WebHook alerts, allowing easy integration with third-party trading platforms.

4. Algoriz

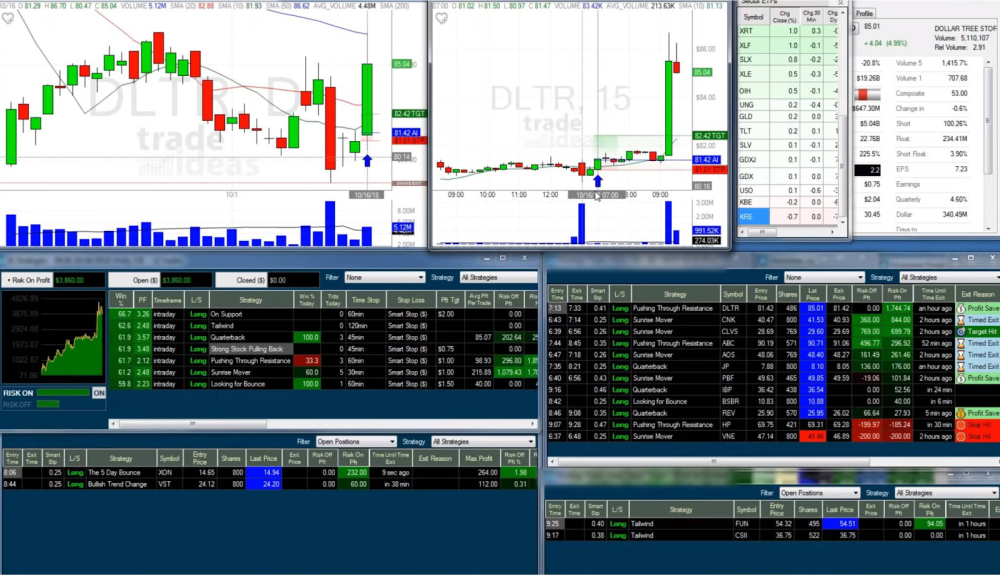

Algoriz is an AI-based trading solution that simplifies the development, backtesting, and automation of diverse trading strategies across multiple equities, cryptocurrencies, and more. Users can seamlessly connect their broker accounts to trade various stocks.

It has a simulated matching engine that lets traders practice trading strategies without using real money. This enables traders to practice the real-time market with virtual money. The platform also offers automated trading algorithms and tools to help traders find effective trading opportunities.

Its user-friendly interface allows individuals with limited programming knowledge to create and test algorithms seamlessly. With over 10,000 strategies available on the platform, users can leverage broker data or Algoriz's database to build their trading strategies.

5. Stock Hero

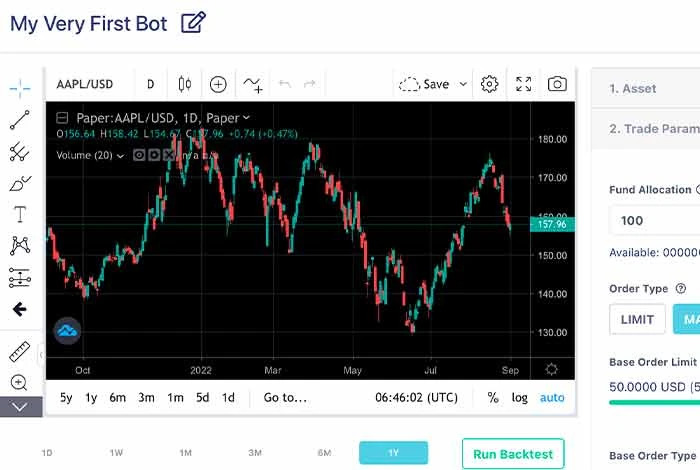

StockHero is a platform that provides automated and algorithmic trading functionalities to its users. It operates by trading directly from an existing brokerage account through an API connection. This approach ensures convenience and flexibility, allowing users to leverage StockHero's features while maintaining control over their funds and utilizing their preferred brokerage account.

The platform also offers a simulated paper exchange for a no-financial-risk strategy testing, followed by the deployment of trading bots into the real trading world. Without the need for coding, users can create, test, and deploy bots within minutes with this platform.

StockHero also automatically utilizes candlestick data from multiple brokerages and evaluates trade signals based on each candlestick's open value. The platform's cloud-based infrastructure ensures faster execution and minimizes potential trade lag.

The future of trading with AI tools

AI tools have significantly transformed the trading sector by providing traders with advanced capabilities, data-driven insights, and automated processes. These tools have enhanced decision-making, improved efficiency, and optimized trading strategies, leading to increased trading success. While these innovations provide significant advantages, traders and should know potential risks and implement proper risk-mitigation measures.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.