The Moving Average (MA) indicator helps traders make more effective trading decisions by smoothing out current price data through computed averages. It helps eliminate small price movements that occur in the short term or due to random fluctuations, which lets you analyze larger price movements more accurately.

MAs can predict if the market’s behavior will be bearish or bullish, and tell you the overall market sentiment. By learning the top MA indicators, you can identify ideal entry and exit points:

The Exponential Moving Average (EMA)

The EMA is a trading indicator used to identify a major uptrend or downtrend trend in the market. It places higher weight on the most recent data points and gives you the average of current prices. Essentially, it tracks the currency pair prices over time and allots weights to each of them.

Here is one way you can use EMA in trading:

1. In the 15-minute chart, use three types of EMAs: a 5-period EMA, a 20-period EMA, and a 50-period EMA.

2. As soon as you see the 5-period EMA cross the 20-period EMA from below, along with the price above the 50-period EMA, you may consider going long. You can place the stop-loss order right below the 20-period EMA to protect yourself against any unexpected losses.

3. If you wish to sell, wait for a 5-period EMA crossing the 20-period EMA from above, along with the current price below the 50-period EMA.

4. You may take it as a sign to exit the market when the 5-period EMA falls below the 20-period EMA in a long position.

5. If you are shorting the trade, you may choose to exit when the 5-period EMA goes above the 20-period EMA. This is because the 20-period EMA is considered the most ideal price point that enables you to make entry and exit points in a market. Along with that, the 50-day moving average allows you to compare price points.

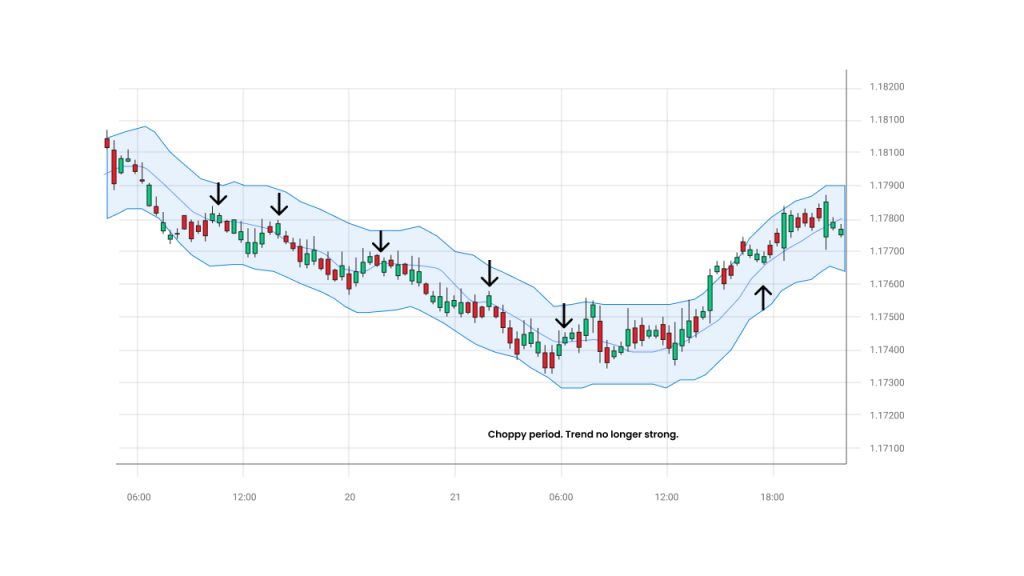

Moving Average Envelopes

Moving Average Envelopes are another technical trading indicator based on percentages, and are set below and above the MA of the currency pair. It consists of the MA and a percentage deviation either subtracted from or added to it. It mainly gives you the indication of an oversold or overbought market. The moving average envelope works best within a 10 to 100-day period. During day trades, the envelopes or deviations are generally less than 1%.

When you have an envelope percentage set, you can easily identify the direction in which the market is moving:

- If the market is falling, this signals that traders should exit the market

- If the market is rising, traders take this as a sign to buy more of the currency pairs

Moving Average Ribbon

A Moving Average Ribbon refers to a sequential series of MAs to create a ribbon. This indicator can help you confirm an uptrend:

- When the currency pair price is above the moving average ribbon, and the MAs are in an upward angle, an uptrend is confirmed.

- A downtrend is confirmed when the currency pair prices are below the MA ribbon, with the MAs angled downward.

The moving average ribbon strategy is formed with 8-15 EMAs, including short and long-term averages plotted together. The ribbon indicates the trend’s direction and strength. If the angle of the MAs is steeper, making the ribbon wider, it shows a strong market trend. This could either be an uptrend or a downtrend.

Moving Average Convergence Divergence (MACD)

The MACD is an indicator that shows the relationship between two moving averages of a currency pair.

It can be calculated by deducting the 26-period EMA from the 12-period EMA. Whenever the MACD crosses the signal line from above the signal line, traders can opt to go long. Alternatively, a MACD crossing below the signal line can be taken as a sell signal.

Here is how you can trade with the MACD indicator:

- If you are going long, you may exit as soon as the MACD falls below the signal line.

- If you are going short, you may exit as soon as the MACD comes back up to the signal line.

- The stop-loss order should be placed right below the most recent low swing in a long trade.

- When you are shorting, the stop-loss order should be placed above the current high swing.

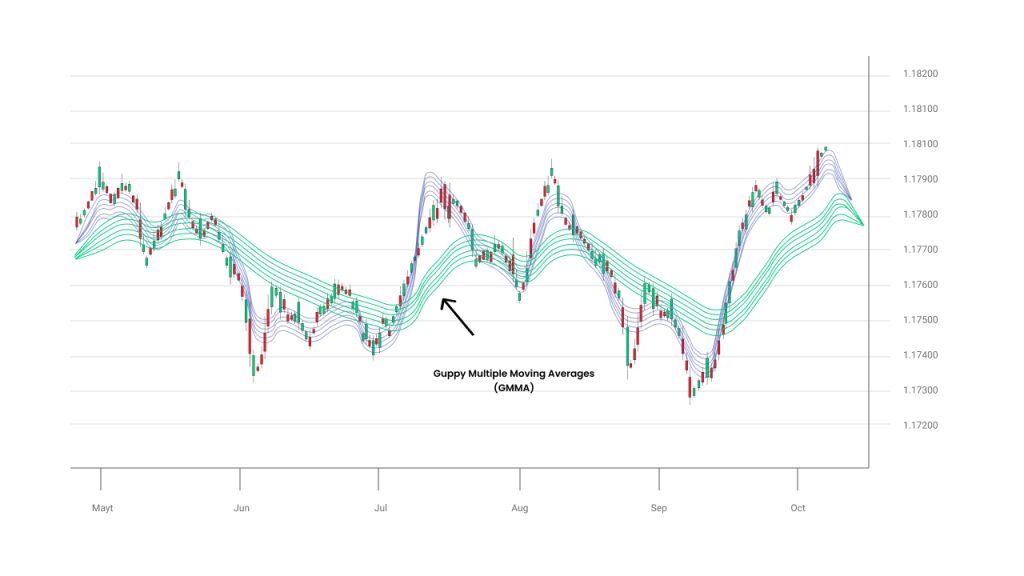

The Guppy Multiple Moving Average (GMMA)

The GMMA is an indicator that helps you identify market trends, opportunities, and breakouts in the currency pair’s prices. It does so by combining two different sequences of MAs calculated in different time periods. The first set indicates the direction and market sentiment of short-term traders, while the second set indicates long-term trading activities.

- The gap between the two MAs indicates the trend’s strength. A wide gap shows a strong trend. Whereas, a narrow gap shows a weak trend.

- When short and long-term MAs cross, it indicates a trend reversal.

- Whenever the short-term MA crosses the long-term MA from above, it indicates a bullish reversal.

- When the short-term MA crosses the long-term MA from below, it indicates a bearish reversal.

Maximize your trades using moving averages

Moving average indicators are used by traders to make the most out of their trades. Combining indicators in confluence can also help in improving your trading strategy in the long run. Blueberry has an industry-standard trading platform that comes with tools and charts you can use together with your chosen moving average indicators.

Sign up for a live account today to get started.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.