Copy trading can be a useful strategy for those new to forex or lacking the time to conduct in-depth research. However, it's important to approach copy trading with caution. Traders must do thorough research before making any investment decisions.

Let's get right into understanding everything about copy trading in our guide.

What is copy trading?

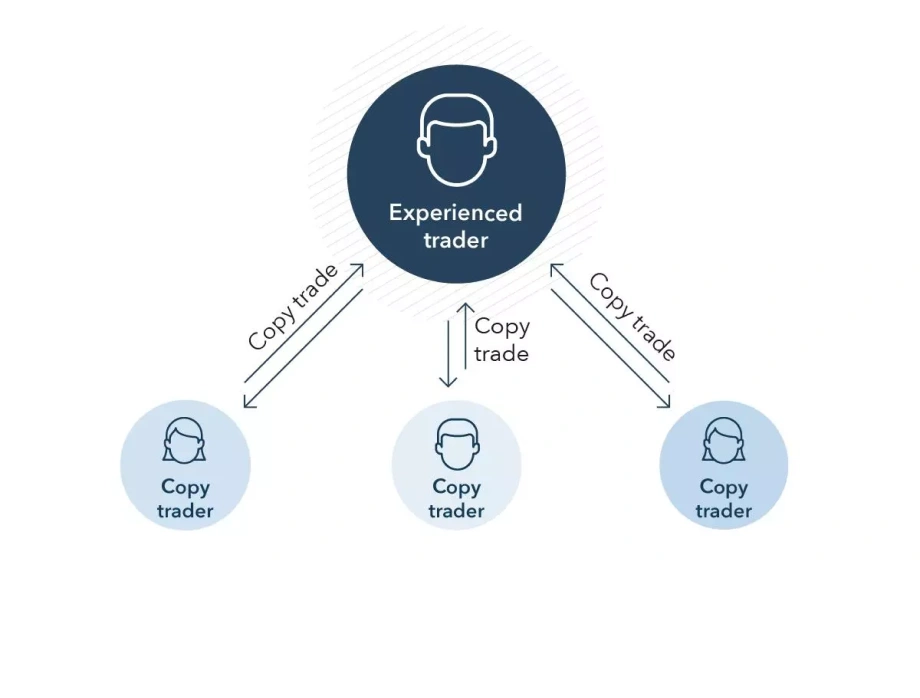

Copy trading allows traders to automatically imitate the orders of experienced traders. This allows less experienced traders to copy the trading expertise of these professionals without needing to conduct in-depth market analysis themselves.

It involves connecting a trader's account to a more experienced trader's account using a copy trading platform. When the experienced trader places a trade, the system automatically executes the same trade (or a proportional version) in the follower's account.

How does copy trading work?

Beginner traders find an experienced trader and start following them. The copy trading platform automatically replicates the expert trader’s orders in the follower’s account, mirroring the expert’s positions in real-time. When the expert trader trades a currency pair, the follower's account will do the same.

For example, if Trader A, an experienced forex trader, purchases one lot of EUR/USD, another trader using a copy trading platform to copy Trader A would automatically have the same trade in their account. Gains and losses are shared in proportion to the amount invested in the copy trading arrangement.

The trader can decide on the amount to be traded. They can also stop copying the trades any time. While copy trading offers the chance to gain from someone else's expertise, it still carries risks, as the copied trader's performance can fluctuate with market conditions.

Advantages and disadvantages of copy trading

Advantages

- Ease of use: Copy trading is designed to be user-friendly, making it accessible to traders of all levels. With minimal effort, one can gain from the expertise of seasoned professionals without needing extensive market knowledge or analysis

- Diversification: Following multiple traders can diversify a beginner trader’s portfolio and reduce risk. Exposure to various trading styles can mitigate the impact of market fluctuations

- Time-saving: Copy trading automates the process, freeing their time for other activities or research. Traders can focus on other trading aspects or professional/personal life while their investments are managed automatically

- Access to expertise: Learn from the strategies and insights of experienced traders. Gain from their proven performance and track record

- Automated trading: Automated execution of trades can improve speed, reducing the risk of emotional decision-making

Disadvantages

- Over-reliance on others: Placing too much trust in the performance of others can lead to a lack of personal responsibility. If the trader one follows experiences a significant drawdown, the follower's investments could be at risk

- Lack of control: The follower trader has little or no control over the trading decisions made by the trader they follow. Unexpected actions or choices may not align with the follower's risk tolerance or investment goals

- Performance variability: The performance of traders can fluctuate over time. Past performance is not indicative of future results, and there's always the risk of losses

- Limited customization: Copy trading often involves following a pre-determined strategy, limiting one's ability to tailor the trading approach to their specific needs or preferences

- Behavioral bias: Even experienced traders can be subject to behavioral biases that can impact their decision-making. Follower traders may inadvertently follow a trader who is making suboptimal choices

How to copy trade: step-wise guide

- Choose a platform: Select a trading platform that offers copy trading services. These platforms often have a directory of experienced traders from which to choose.

- Select a trader: Review the trader's performance history, trading style, and risk tolerance. Choose one whose strategy aligns with one's trading goals.

- Allocate funds: Decide how much capital one wants to allocate to copy trading. Some platforms have minimum investment requirements.

- Connect accounts: Link the trading account to the chosen trader's account. This connection allows the platform to automatically replicate their trades.

- Initiate copy trading: Choose the traders one wants to follow and allocate funds to each. Enable automatic copying of trades from the selected traders.

- Monitor and adjust: Regularly monitor the copy trading strategy's performance. Traders can adjust their allocation or change traders if needed.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

Top copy trading strategies

Dynamic trader adjustment strategy

The dynamic trader adjustment strategy involves regularly monitoring and adjusting the allocation of funds to different traders based on their performance. This strategy allows traders to capitalize on the strengths of individual traders while minimizing the impact of underperforming ones.

By continuously evaluating each trader's performance, one can identify those who consistently outperform the market or their peers. Traders can then increase their allocation to these top performers, potentially maximizing returns. Conversely, if a trader's performance declines, they can reduce their allocation or even remove them from the portfolio altogether.

This strategy requires active management and ongoing research. Traders should stay updated on market conditions, economic indicators, and the performance of individual traders. Additionally, one may need to adjust their allocation frequently to adapt to changing circumstances.

Expert selection strategy

The expert selection strategy identifies and follows highly experienced and reputable traders. One can increase their chances of achieving consistent returns by selecting traders with proven track records and a deep understanding of the market.

When choosing expert traders, consider factors such as their experience level, trading style, risk tolerance, and performance history. Look for traders who have demonstrated a consistent ability to generate gains over a prolonged period.

Once the trader has selected their expert traders, they can allocate their funds based on their performance and risk tolerance. This strategy can be less time-consuming than the dynamic trader adjustment strategy as it requires less frequent monitoring and adjustments. However, it's still important to periodically review the performance of the selected traders to ensure they continue to meet expectations.

Algorithmic trading strategy

The algorithmic trading strategy uses computer programs to execute trades based on predefined rules and algorithms. These algorithms can analyze vast amounts of data, identify patterns, and make trading decisions in less time than the human intent of making decisions.

Algorithmic trading can offer several advantages, including increased speed, accuracy, and objectivity. It can also help to reduce the impact of emotional decision-making. However, it's important to note that algorithmic trading is not without its risks. If the underlying algorithms are flawed or if market conditions change unexpectedly, the strategy could result in losses.

When considering an algorithmic trading strategy, it's crucial to carefully evaluate the algorithms used and the provider's track record. Additionally, one should clearly understand the risks involved and be prepared to manage potential losses.

Conservative approach strategy

The conservative approach strategy focuses on minimizing risk and preserving capital. This strategy is suitable for traders who prioritize risk management over potential returns.

When following a conservative approach, traders may choose to follow traders with a lower risk tolerance or those who use more cautious trading strategies. They may also allocate a smaller portion of their portfolio to copy trading and invest the remainder in more conservative assets.

While this strategy can help to protect one's capital, it may also limit their potential returns. It's essential to consider one's risk tolerance and investment goals carefully before choosing a conservative approach.

Top trading tools to use during copy trading

Performance tracking tools

- Gain/loss analysis: Track the gains of one's copy trading activities over time

- Risk metrics: Monitor key risk metrics like drawdown and Sharpe ratio to assess the risk-adjusted returns

- Comparison tools: Compare the performance of different traders and strategies to identify the most promising options

News and analysis tools

- Economic calendars: Stay informed about upcoming economic events that can impact market volatility

- Market analysis: Access expert analysis and commentary on market trends and developments

- Fundamental data: Monitor key economic indicators and financial data that influence currency prices

Charting tools

- Technical analysis: Use charting tools to identify patterns, trends, and support/resistance levels

- Indicators: Employ technical indicators like moving averages, RSI, and MACD to make informed trading decisions

- Customizable charts: Create personalized charts to visualize market data in a way that suits one’s preferences

Copy trading platform features

- Trader profiles: Evaluate the profiles of potential traders, including their experience, trading style, and performance history

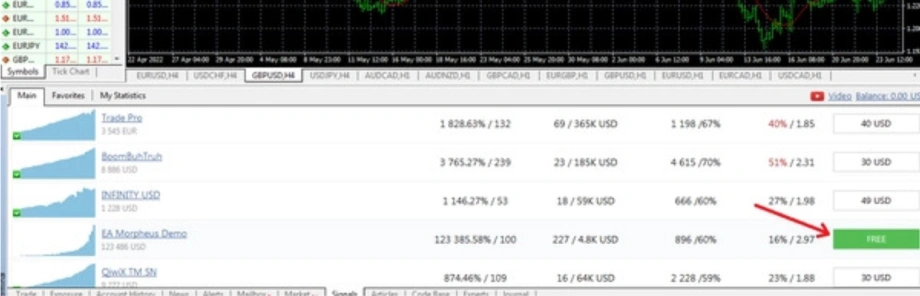

- Performance rankings: Utilize platform-provided rankings to identify top-performing traders

- Customization options: Choose a platform that offers customization options to tailor one's copy trading experience

Can one copy a trade on MT4?

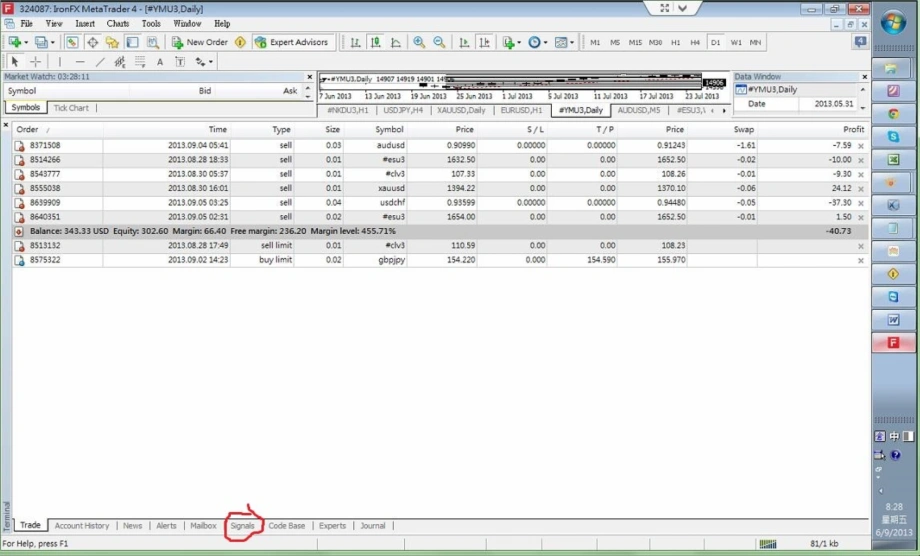

Yes, traders can conduct copy trading on MT4; here's how –

1. Download and install the MetaTrader 4 platform on a computer. Create a live trading account with a broker that supports MT4, which will be used to execute the copied trades.

2. Access the Signals tab by navigating to the Toolbox section at the bottom of the MT4 platform and locating the Signals tab.

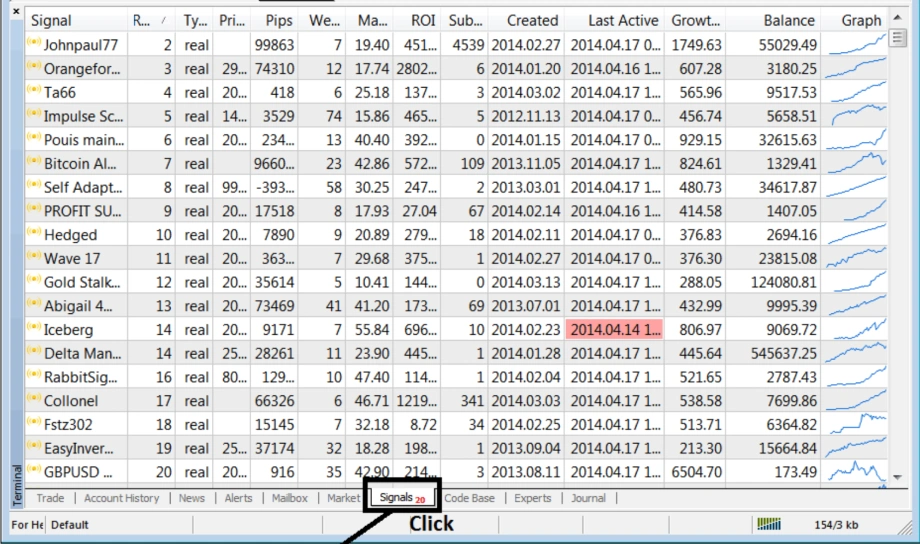

3. Use the search bar and filters to explore signal providers that align with one's trading style and risk tolerance. Consider factors such as gains, trading frequency, and the provider's reputation.

4. Choose a signal provider whose strategy fits one's trading goals. Review their performance history, trading statistics, and risk management approach. Click the Subscribe button and follow the on-screen instructions, providing login details if necessary.

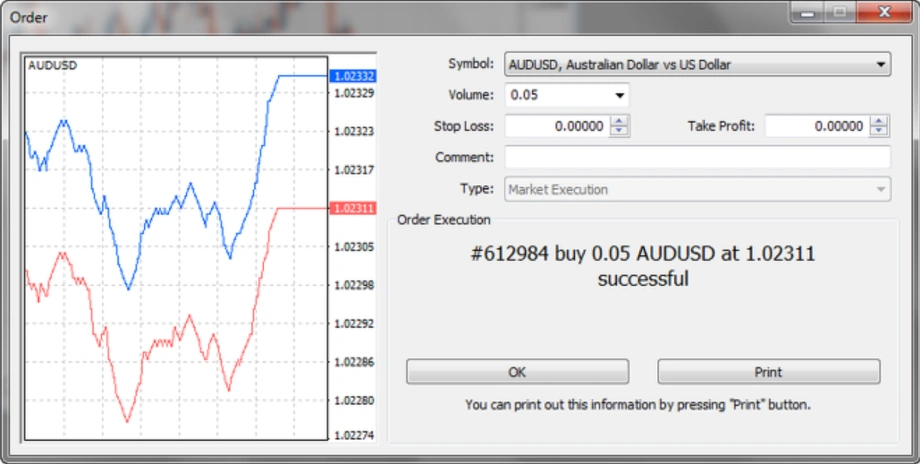

5. Customize trade settings by adjusting parameters such as trade size, leverage, stop-loss, and take-profit levels to match one’s risk tolerance and objectives. Once preferences are set, the platform will automatically begin copying the provider's trades to one's account.

6. Regularly monitor the performance of the copied trades and the signal provider's overall strategy. Make adjustments to trade settings or unsubscribe from the provider if their performance does not meet expectations.

Tips to copy trade successfully

- Limit capital allocation: When engaging in copy trading, it is essential to diversify investments across multiple traders to reduce the impact of any individual trader's underperformance. The investor should start with a smaller allocation and gradually increase it as confidence in the strategy grows. Avoiding excessive leverage is crucial to mitigate the risk of significant losses

- Engage with the trading community: Participating in online forums and communities can provide valuable insights and learning opportunities. The investor should seek advice from experienced traders and stay informed about market trends and news

- Utilize auto-copy features: Auto-copy features can streamline the trading process and save time. However, the investor must regularly monitor investments and make adjustments when necessary to ensure alignment with trading objectives

- Mix different trading strategies: Following traders with different trading styles can help diversify the portfolio and reduce risk. By combining strategies, the investor can manage risk more effectively and gain from a variety of approaches

- Blend risk profiles: The investor should combine traders with varying risk profiles to create a balanced portfolio. It is important to carefully consider the risk associated with each trader and allocate funds accordingly. Continuous monitoring of the portfolio's risk is necessary to make adjustments as needed

Navigating the pros and cons of copy trading in forex

Copy trading offers a convenient way for less experienced traders to learn from and gain alongside experienced ones. It can provide exposure to diverse strategies and markets.

However, relying solely on others can limit personal growth and understanding. Traders should actively research and analyze assets before copying trades, as past performance doesn't confirm future results.

Additionally, individual risk tolerance and financial goals may not align perfectly with the copied trader's strategy. Ultimately, a balanced approach, combining copy trading with research and analysis, can be useful for all traders – new and old.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.