Runaway gaps enable traders to understand market sentiment, trend continuation, and potential trading opportunities. These price gaps occur due to a sudden and significant imbalance between entry and exit pressure in the market. Traders must understand runaway gaps to confirm an existing trend's strength, identify potential entry points, and gauge the market psychology.

In this article, we will discuss everything around runaway gaps.

What is a runaway gap?

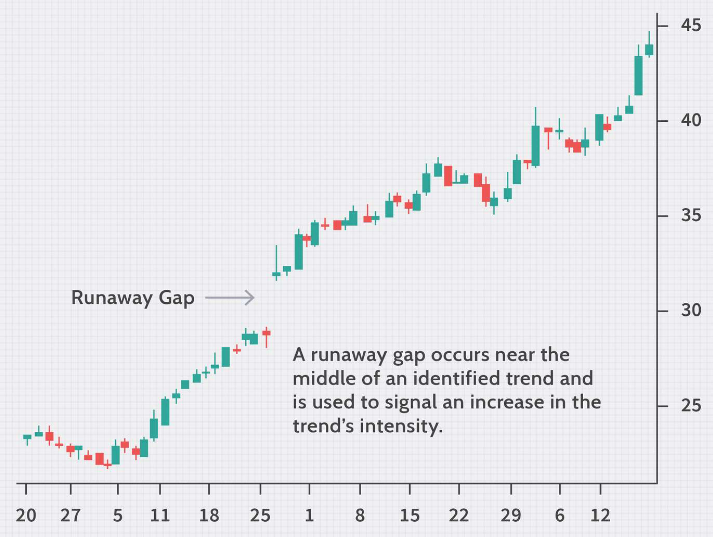

A runaway gap or continuation gap, is a price movement on a chart where there is a significant jump in price, leaving a clear space between the previous closing price and the opening price of the current candle. Runaway gaps occur when price breaks out of a given price pattern, which can be on the upside or downside.

It is a type of price gap that signifies a period of intense trading activity where no transactions occurred at prices between the closing and opening prices. Traders can use runaway gaps for technical analysis to identify gap signals and the direction of the trend in a given chart pattern.

Characteristics of a runaway gap

- Mid-trend occurrence: Runaway gaps appear in the middle of an established trend, be it an uptrend or downtrend. This placement signifies a continuation of the trend with increased momentum rather than trend reversals

- Significant volume: These gaps are often accompanied by a surge in trading volume. This high volume indicates increased long pressure (for a bullish runaway gap) or increased short pressure (for a bearish runaway gap) that fuels the price jump and creates the gap

- Continuation signal: The primary significance of a runaway gap lies in its role as a continuation signal. It suggests that the ongoing trend is likely to persist with added strength. This can be an indication to traders looking to capitalize on the trend's momentum

How does runaway gap differ from other types of gaps?

Runaway gaps vs breakaway gaps

Take a look at the top differences between breakaway and runaway gaps

Occurrence

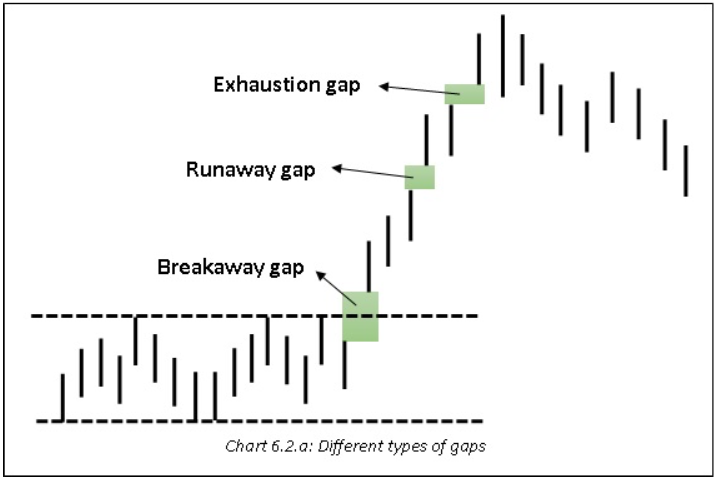

Runaway gap appears within an established trend (uptrend or downtrend). On the other hand, breakaway gaps occur at the end of a trading range or trend, potentially signaling a breakout in a new direction.

Signal

Runaway gap is a continuation of the existing trend with increased momentum. On the other hand, the breakaway gaps are potential trend reversals or breakout from a trading range.

Volume

A runaway gap is often accompanied by significant volume. On the other hand, in breakaway gaps, volume can be high, but it may not always be as pronounced as with runaway gaps.

Runaway gap vs exhaustion gap

Here are the top differences between runaway gaps and exhaustion gaps:

Occurrence

The runaway gap appears within an established trend. In contrast, exhaustion gaps occur near the end of a strong trend, potentially signaling a weakening trend and a possible reversal.

Signal

The runaway gap continues the existing trend, but the exhaustion gap is a potential trend reversal due to the exhaustion of entry or exit pressure.

Volume

The runaway gap is accompanied by significant volume. However, in an exhaustion gap, volume can be high but may start to taper off compared to the peak of the trend.

How to identify a runaway gap?

Here are the top ways to identify when runaway gap occurs:

Analyze the price chart

Look for a clear gap between the previous closing price candle and the opening price candle of the current session.

Measure the gap size

While there's no strict definition, a runaway gap typically represents a significant price jump compared to the average daily or session range.

Check trading volume

Runaway gaps are often accompanied by a surge in trading volume. High volume supports the idea of a substantial move driven by strong long or short pressure.

Assess the trend continuation

Look for runaway gaps or continuation gaps that occur within an established uptrend or downtrend. This strengthens the case for the gap, signaling a continuation of the trend with increased momentum.

Confirm market sentiment

While not essential, analyzing recent news events or economic data releases can provide context to the runaway gap. For example, strong economic data might support a bullish runaway gap in a currency pair and vice versa.

Use technical indicators

While not a substitute for the core characteristics, some technical indicators like moving averages or Relative Strength Index (RSI) can offer additional confirmation of the trend and its potential continuation. Keeping technical analysis as an important part of the trading strategy ensures traders can identify right when a breakaway gap occurs.

How to trade with a runaway gap?

1. Identify a runaway gap

Use the techniques mentioned earlier to identify a clear runaway gap on the forex chart. Look for a significant price jump, empty space on the chart, and occurrence within an established trend.

2. Confirm volume and trend

Ensure the runaway gap is accompanied by a surge in trading volume, supporting the strength of the price movement. Verify that the gap appears within a well-defined uptrend (for a long trade) or downtrend (for a short trade).

3. Plan entry point

There are two common approaches for entry:

- Enter after a pullback following the runaway gap. This allows for a slight price retracement before entering the trade, potentially offering a better risk-reward ratio

- Enter at the opening of the gapping candle (assuming it aligns with the trend direction). This approach aims to capture the initial momentum of the trend continuation

4. Set stop-loss orders

Place a stop-loss order below the low of the runaway gap for long trades and above the high of the gap for short trades. This helps limit potential losses if the trend doesn't continue as expected.

5. Monitor the trade post-gap

Keep an eye on the trade after entry. The price may experience some volatility, so be prepared to adjust the stop-loss if necessary.

6. Taking gains

There's no single right exit strategy. Traders can opt for a gain target based on their technical analysis or a predetermined risk-reward ratio. Some traders also choose to exit based on price action, such as a reversal signal or a break of support or resistance levels.

Identifying runaway gaps for trade entries in forex

Runaway gaps signal trend continuation with a surge in price and volume. However, Runaway gaps represent areas where no trading occurred at those specific prices. This lack of liquidity can lead to wider spreads and potentially larger slippage when entering or exiting trades around the gap zone. The trend might not continue despite the gap, potentially leading to losses if a trader enters based solely on the gap.

Hence, traders should combine runaway gaps with other technical indicators when trading gaps for confirmed signals and manage risk with stop-loss orders due to the inherent volatility.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.