With a new year around the corner and a new financial year that follows it, the stock market has compelling opportunities for traders to explore. As we explore the most popular stocks for 2024, its important to note that popularity is not an indication of profitability. It is based on volume and popularity of different stocks among traders.

Traders should also be aware of the risks associated with trading stocks, which can include liquidity risks, interest rate risks, taxability risks, and regulatory risks. Stocks can easily lose value when market conditions sour, which is why traders should implement necessary risk management measures.

This guide discusses the top 10 stocks you can invest in to start your 2024 out strong.

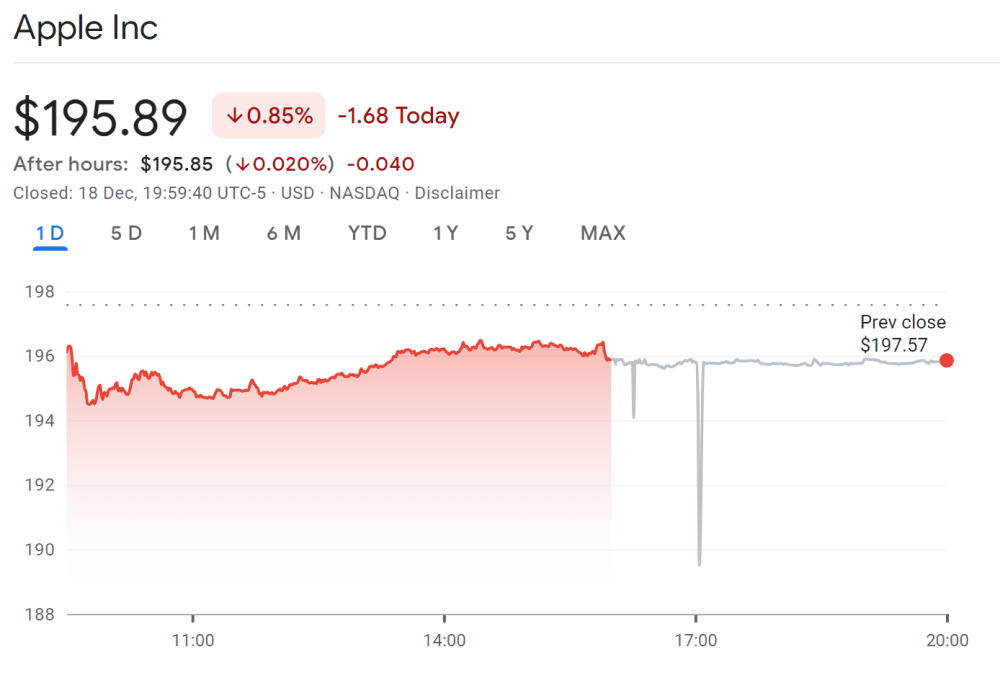

Apple

Founded in 1976, Apple is a technology giant known for its innovative consumer electronics, software, and digital services. With a market capitalization of $2.96 trillion as of November 2023, it is predicted to grow 91.245% in 2024 and reach a price of $364.093 from its current price of $190.64.

According to some analysts, the five-year price prediction is $1478.032 per share in 2029. Additionally, the potential high the stock could make in 2024 is $250, significantly more than the current 52-week high of $198.23.

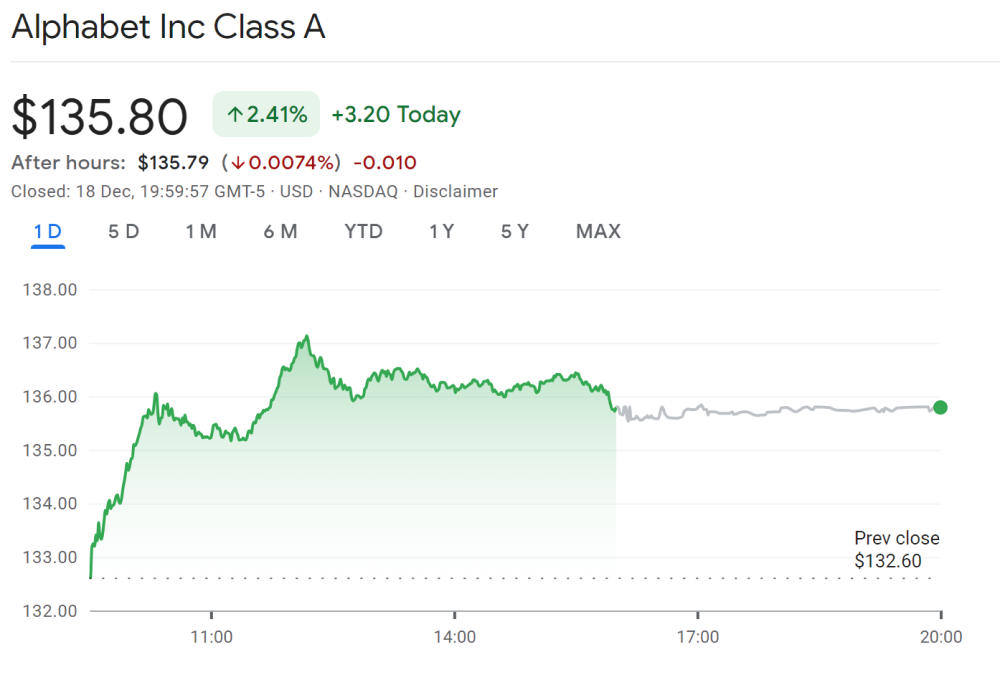

Alphabet

Established in 1998, Alphabet is Google's parent company, specializing in online search, advertising, cloud computing, and various other tech-related ventures. With a market cap of $1.72 trillion in November 2023, the company is predicted to grow by over 19.72% and reach a price of $163.95 from the current price of $138.62 as of November 2023.

According to some analysts, by 2029, the share price might even reach $863.92 and witness an upside of more than six times its current position in 2023. Additionally, by the end of 2024, the potential high that the stock could make is $163, more than the current 52-week high of $142.38 as of November 2023.

Churchill Downs

Churchill Downs has its roots dating back to 1875 and is a horse racing and entertainment company famous for hosting the Kentucky Derby. With a market cap of $8.87 billion in October 2023, the stock is predicted to grow by 20.29% and reach a share price of $145.25 by October 2024.

According to some analysts, the share price of Churchill Downs could reach $1386.31 by 2029.

Domino's Pizza

Domino's Pizza, originating in 1960, is a global pizza delivery and takeout chain recognized for its efficient delivery service and digital innovations. It had a market cap of $13.3 billion as of November 2023.

According to some analysts, if Domino's Pizza's upward trajectory continues, it could grow to $2752.58 by 2029, marking an increase of almost 400%. Analysts also predict that the stock could reach a high of $411.67 in 2024, a little higher than its current 52-week high, which is $409.95 as of November 2023.

Monster Beverage

Formed in 2002, Monster Beverage is a leading energy drink company, producing and marketing popular energy drink brands. With a market cap of $57.17 billion as of November 2023, its stock price is expected to witness a potential upside of 129.94% and reach the target price of $126.01 in 2024 from its current price of $54.45.

According to some analysts, by 2029, its share price could touch the price target of $564.42 and rise by almost ten times compared to 2023.

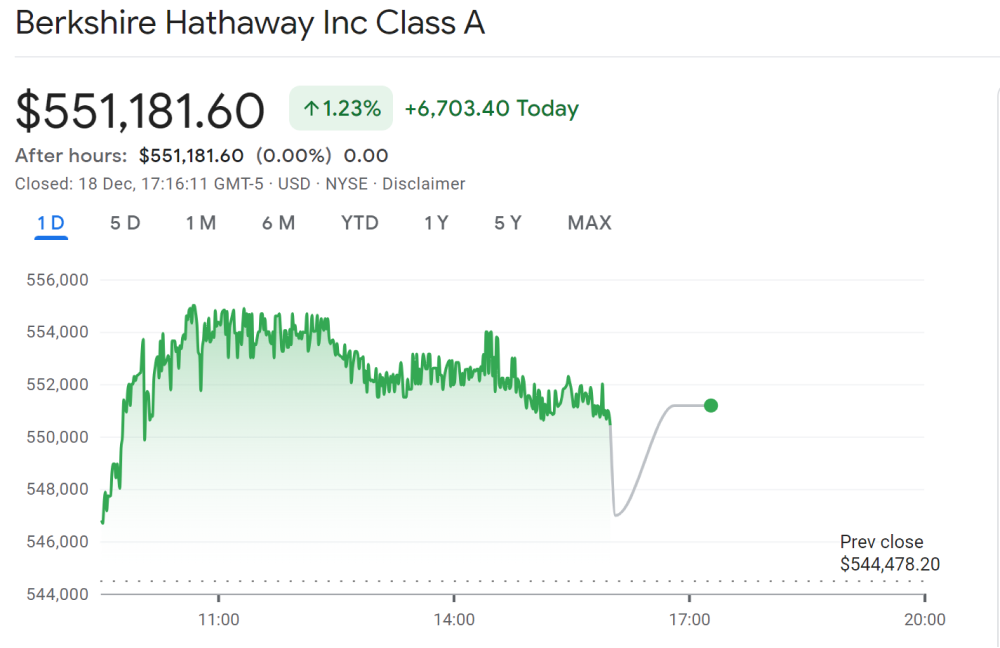

Berkshire Hathaway (Class B)

Berkshire Hathaway was formed in 1839 as a textile manufacturing company before transitioning into a conglomerate holding company. Today, it is led by Warren Buffett and focuses on diverse investments in various industries, including insurance, energy, consumer goods, and technology. Its long-time deputy chairman and investing legend, Charlie Munger, died recently.

It had a market cap of $783.45 billion in November 2023.

According to some analysts, the stock price could rise to $627.28 in 2024 and reach a price target of $689 by the end of 2029.

Anheuser-Busch InBev

Built in 2008, Anheuser-Busch InBev is the world's largest brewing company, producing and distributing a wide range of beer and other alcoholic beverages. It had a $124.19 billion market cap in November 2023.

According to some analysts, its stock could increase by 84.44% in 2024 and reach a price of $114.41 from its current price of $62.03 in November 2023.

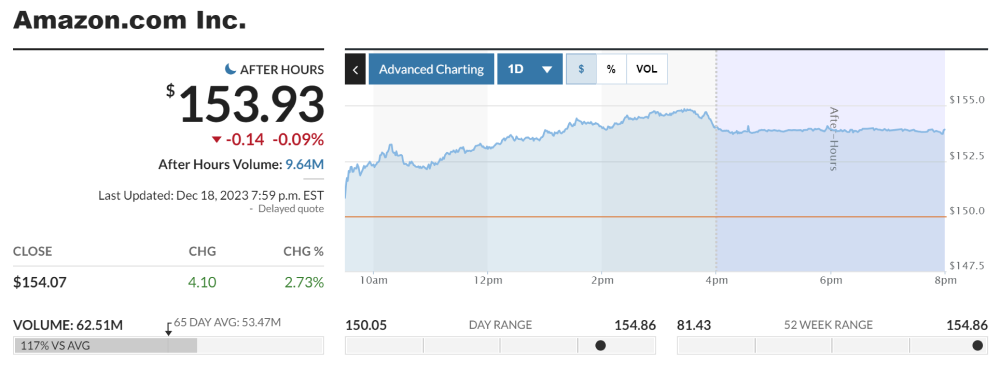

Amazon

Founded in 1994, Amazon is an e-commerce and technology giant offering various products and services, including online retail, cloud computing, and streaming. It had $1.539 trillion market cap as of November 2023.

According to some analysts, its stock price is forecasted to increase by 85.367% in 2024 and reach a predicted price of $266.74 from its current price of $143.61.

VISA

VISA, established in 1958, is a global payments technology company facilitating electronic funds transfers and digital transactions. The company had a market cap of $521.28 billion in November 2023.

According to some analysts, it is predicted to increase by 17.80% and reach the price target of $297.12 from its current price level of $250.03. Analysts also predict that by 2029, the stock price could also reach $673.86 and witness an increase of 167.16% overall.

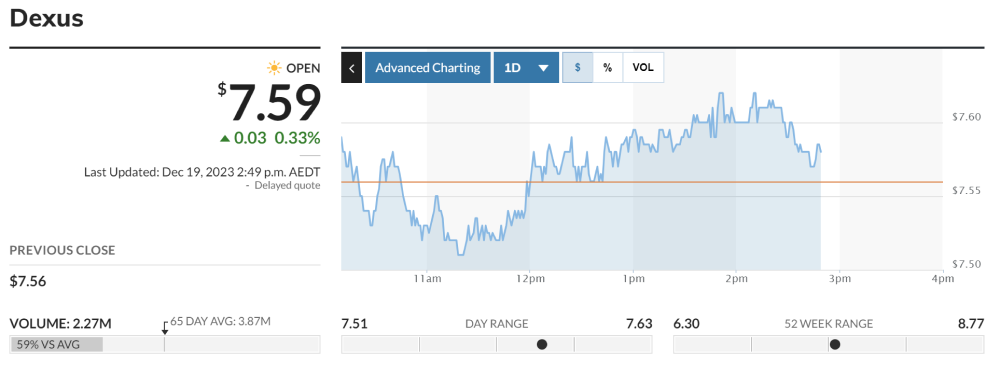

Dexus

Founded in 1984, Dexus is an Australian real estate investment trust (REIT) specializing in owning, managing, and developing office, industrial, and retail properties. It had a $4.87 billion market cap as of November 2023.

According to some analysts, it could reach the price target of $9.18 and mark an increase of around 8% in the first quarter of 2024 from its current price of $6.88. Its earnings per share for retail investors could grow by $42.8 per annum starting in 2024.

Diversifying stock portfolio in 2024

As we navigate the evolving market, the above stocks will help traders expand their portfolios and make informed trading decisions in 2024. Our analysis aims to evaluate potential growth trajectories for the mentioned stocks clearly. It's important to note that past performance does not guarantee future results. There are a lot of other factors that traders should consider when trading the stock market.

*Past performance is not a reliable indicator of future performance.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.