A McClellan Summation Index (MSI) can help traders get an overview of market sentiment. By monitoring the MSI, traders can better confirm market trends, spot emerging opportunities, and manage risks.

In this article, we will discuss everything about the McClellan Summation index and how to trade with it.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

What is the McClellan Summation Index?

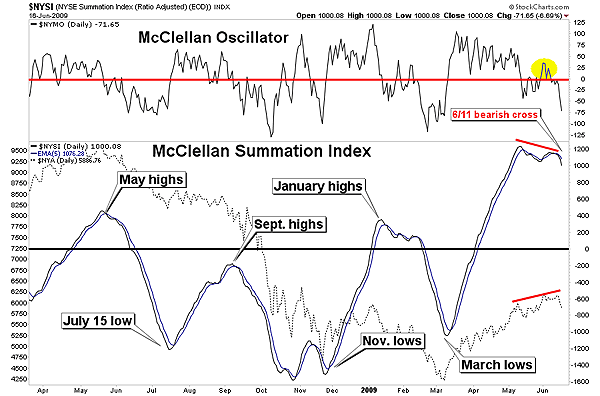

The McClellan Summation index is a market breadth indicator that measures the long-term cumulative sum of the McClellan Oscillator (MO). The McClellan oscillator tracks the difference between advancing and declining stocks/currencies. MO helps assess overall market strength and trends in the short term by reflecting the broader market’s bullish or bearish conditions. It was developed by Sherman and Marian McClellan.

MSI takes the difference between advancing and declining stocks/currency pair prices at the end of the trading day. The MSI then compares the total number of advancing and declining stocks/currencies with one another to measure the overall market strength.

-

Positive MSI (+1000 and above) signals a bullish market sentiment where more currencies advance than decline

-

Negative MSI signals (-1000 and below) a bearish market sentiment where more currencies decline than advance

How do I calculate the McClellan Summation index?

The McClellan Summation index is calculated by adding together the everyday values of the McClellan oscillator. Follow these steps to calculate the MSI through the McClellan oscillator –

1. Calculate the number of advancing and declining currencies for each day.

2. Consider the difference between the advancing and declining forex prices and calculate the 19-day EMA and 39-day EMA of the same

3. Subtract the 39-day EMA from the 19-day EMA. This will give traders the McClellan oscillator value.

4. Add the current day’s McClellan oscillator value to the previous day’s MSI value. This will be the new MSI value.

Current MSI formula = MSI(yesterday) + McClellan oscillator(today)

What indicators should I use with the McClellan Summation Index?

Bollinger bands

Bollinger bands is a technical indicator that can identify oversold and overbought market conditions by showing price volatility. When prices touch or move beyond the bands, it indicates potential reversals. The McClellan Summation Index, on the other hand, tracks market breadth and momentum as discussed.

A simultaneous indication of overbought conditions from Bollinger bands and a bearish crossover or negative reading from the McClellan index can confirm a market reversal. Conversely, oversold conditions with a bullish index reading suggest a potential upward reversal.

Relative Strength Index (RSI)

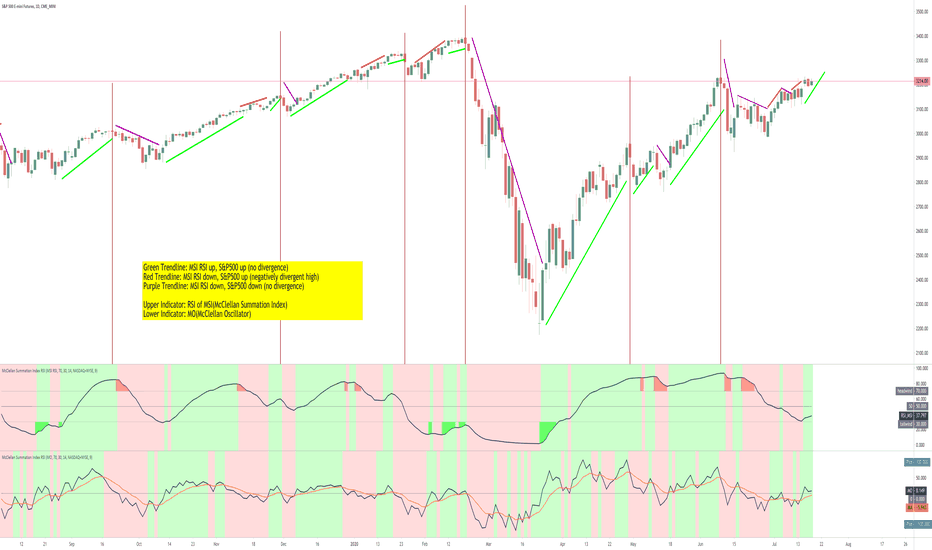

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. When combined with MSI, it increases the chance of market analysis accuracy.

If the RSI indicates an overbought market condition and the MSI starts declining, it is a signal that there is downtrend reversal and traders can place short orders. Whereas, if the RSI is oversold and the MSI is increasing or giving positive values, it indicates a long opportunity with strong market optimism.

Moving Average Convergence Divergence (MACD)

Moving average convergence divergence and MSI combine trend and market breadth insights to produce more accurate results about market sentiment. The MACD crossover signals momentum shifts, indicating potential reversals when MACD and prices diverge.

When the MACD shows bearish divergence alongside a declining McClellan index, it confirms a weakening market, signaling short opportunities. Conversely, bullish MACD signals and a rising McClellan index indicate market strength, signaling long opportunities.

How do I trade forex with the McClellan Summation Index?

Choose currency pairs to analyze

Select forex currency pairs aligning with one’s trading style and risk tolerance. Conduct technical analysis before analyzing with the MSI.

Calculate the McClellan oscillator

Most trading platforms already have a built-in function to calculate the McClellan oscillator using the 19-day and 39-day EMAs of the advance-decline line.

Calculate the McClellan Summation index

Calculate the daily McClellan oscillator values, which are the difference between the 19 and 39-day EMA of the daily net advances of the declining and advancing currency pairs.

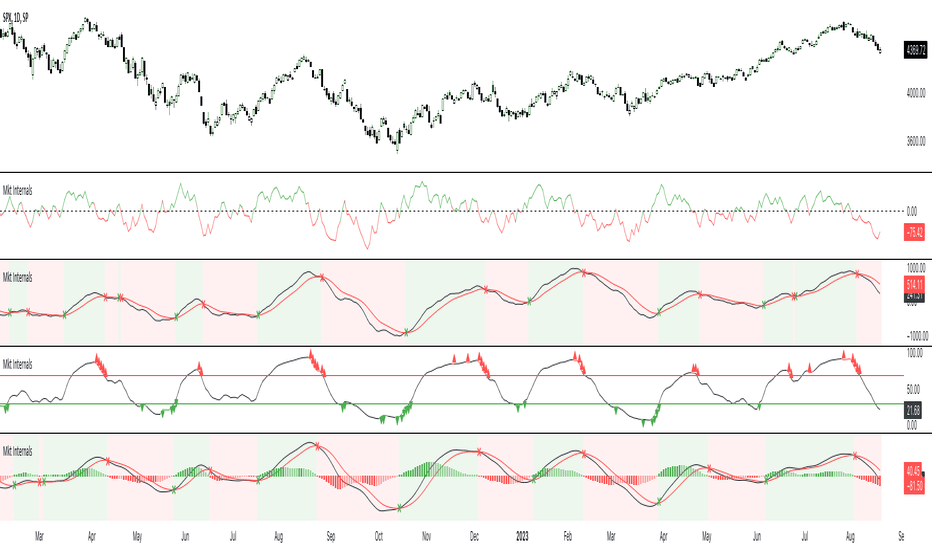

Identify bullish and bearish signals

Identify a rising MSI to confirm a bullish trend and a falling MSI to confirm a bearish trend. Any divergence between MSI and forex prices signals potential trend reversals.

Confirm trading signals

As part of the trading strategy, confirm the strength of the trading signal given by MSI using technical indicators such as RSI, MACD, Bollinger bands, and more.

Determine entry and exit points

Enter long trades near support with a rising MSI and exit near resistance with a falling MSI. To limit losses, set stop-loss orders just below support in an uptrend and above resistance in a downtrend.

Monitor market conditions

Stay informed about external market factors like political events, economic events, central bank policies, and more, as that can affect the declining and advancing currency pairs. Traders can enter long trades when there is positive news, which leads to rising MSI and vice versa.

Execute trades based on MSI signals

Place a long entry order when the MSI is increasing and exit orders when it is decreasing. Short trades can be placed when the MSI is decreasing and exited when it is increasing.

Look for any bullish divergence between MSI and forex prices, where MSI is increasing, and prices fall to enter long trades. Look for a bearish divergence, where MSI is falling and prices are increasing, to place short trades.

Navigating the advantages and risks of the McClellan Summation index

The MSI offers a long-term view of the overall market breadth of the financial markets. However, since it is a lagging indicator, it is susceptible to producing delayed signals. It is very sensitive to market volatility, which may lead to false signals. Hence, any signal by the MSI should be confirmed with technical analysis before a trader acts upon it.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.