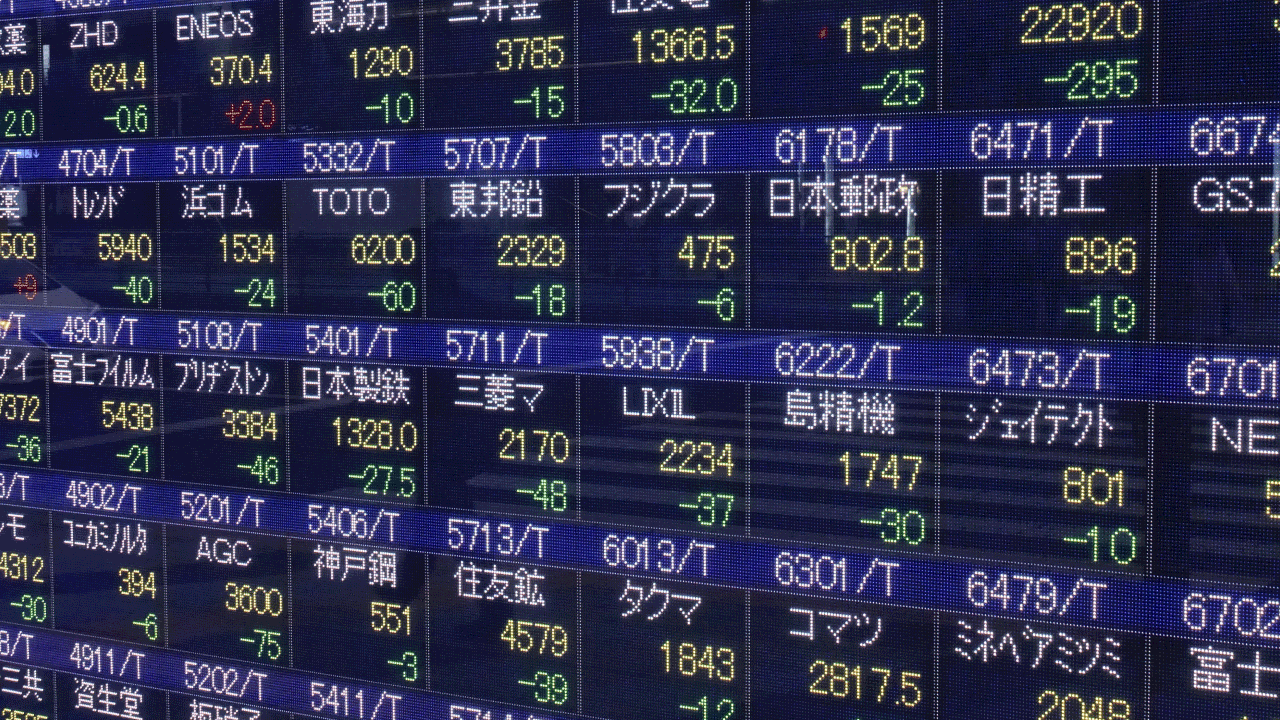

Investing in the Tokyo Stock Exchange (TSE) from Vietnam can offer lucrative opportunities. But, just like with any other investment, it is important to understand and manage the risks involved when trading the TSE.

In this article, we take a comprehensive look into the insights and strategies to manage risks when investing in the TSE from Vietnam.

1. Understand market volatility and risk

Market volatility is a major factor when investing in any stock exchange, and the TSE is no different. It is essential to understand the reasons behind market volatility and how it impacts trades

Volatility presents both opportunities and risks. Regularly monitoring the market and staying well-informed about economic indicators, company news, and market trends can allow traders to make more informed decisions and react to changing market conditions.

2. Conduct a fundamental analysis

Fundamental analysis involves examining various factors that can influence the value of a stock, such as a company's financial statements, industry trends, management effectiveness, and competitive positioning.

By thoroughly analyzing these factors, traders can gain insights into the true value of a stock and assess the potential risks associated with investing in it. Fundamental analysis can help traders identify stocks that may have been undervalued or overvalued, allowing traders to make informed decisions and manage their exposure to market risks more effectively.

3. Use diversification as a risk management strategy

Diversification involves traders spreading their investments across different sectors, industries, and asset classes, to reduce risks associated with a single investment.

The idea is to create a well-balanced portfolio of individual stocks, bonds, and other investments.

For example, as a trader, one can include Japanese stocks from the pharmaceutical and automobile industry as part of their risk management efforts. This ensures that if, in any situation, the pharmaceutical industry suffers, the automobile industry is not directly impacted.

Instead of investing in multiple individual stocks, the Vietnamese investors can trade the Nikkei 225 which is the benchmark stock index of Tokyo Stock Exchange. It includes 225 companies from different companies from different industries across the country. Traders can trade Nikkei 225 CFDs which would allow them to speculate on price movements without owning the underlying asset.

This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

4. Set realistic risk and reward expectations

It is crucial to have realistic expectations regarding risk and reward. This begins by determining one's risk tolerance, which is influenced by factors such as the trader's financial goals, time horizon, and personal circumstances.

Understanding risk tolerance levels allows traders to strike a balance between seeking higher returns and preserving capital. It involves conducting thorough research, diversifying portfolios, and regularly reviewing investments to ensure they align with the said risk tolerance levels and financial goals. It's important to avoid succumbing to impulsive or emotionally-driven investment decisions, as that can lead to undue risk-taking.

5. Stay well informed about the Japanese market

Traders should stay updated on key factors that can impact the Japanese economy, such as government policies, monetary decisions by the Bank of Japan, geopolitical events, and sector-specific developments. Keeping up with the latest news, economic indicators, and market trends specific to Japan enables traders to make informed decisions related to the Japanese market.

Additionally, staying informed about the Japanese market helps traders anticipate market sentiment and investor behavior, enabling them to adjust their strategies accordingly.

6. Use risk management tools like stop-loss orders and hedging

Integrating risk management tools into a trading strategy decreases the risk associated with a portfolio. Traders can use stop-loss orders, to limit potential losses by automatically selling a stock when it reaches a predetermined price level. This way, traders can protect their capital and minimize the impact of unexpected market movements.

Additionally, traders can also explore hedging strategies to protect themselves against currency or stock risks associated with foreign investments. Hedging strategies can involve purchasing put options or utilizing stock futures, which can enable traders to mitigate the adverse effects of fluctuating stock prices.

7. Signing up with reliable brokers

Signing up with reliable brokers offers investors reliable opportunities to participate in the Japanese stock market. Brokers can provide access to several investment opportunities like stocks, CFDs, derivatives and more.

By partnering with these brokers, investors can gain valuable insights, research reports, and market analysis, enabling them to make informed investment decisions.

8. Not risk more than 1% of capital on a single position

When investing in the Tokyo Stock Exchange (TSE) or any other stock market, it's important to be careful and not risk more than 1% of the total capital on a single position.

Limiting risk exposure to 1% of the total capital means that even if an investment were to experience an unexpected downturn or perform poorly, the potential loss would be relatively contained and would not significantly impact the trader's overall portfolio.

Implement the risk management strategies for investing in the TSE from Vietnam

When investing in the Tokyo Stock Exchange from Vietnam, it is crucial to prioritize risk management. By managing risk efficiently, Vietnam investors can navigate the TSE with confidence, increase the likelihood of achieving their investment goals, and safeguard their assets.

Sign up for a live account or try a demo account on Blueberry. today.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.