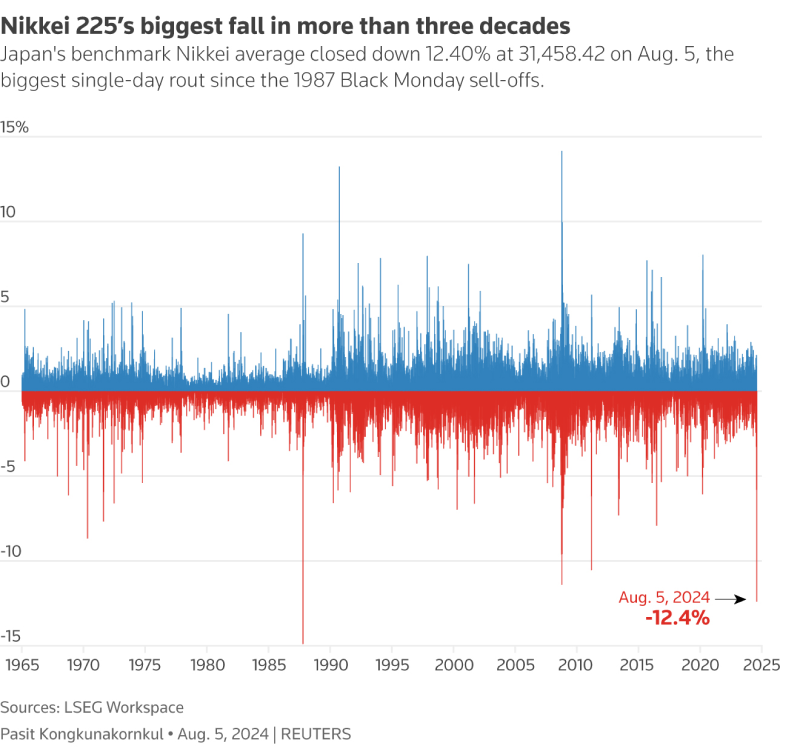

Japanese stocks plummeted dramatically in the first week of August, experiencing their biggest one-day loss since the 1987 market crash.

However, on 6th August 2024, the Japanese market rebounded sharply. This extreme volatility is due to a combination of factors, including concerns about a global recession, the weakening of the Japanese Yen, and recent changes in the Bank of Japan's monetary policy.

Key takeaways

- Comments from Federal Reserve officials indicate a potential for interest rate cuts and a focus on preventing a labor market downturn helped to calm investor fears

- The Japanese Yen continued fluctuating as investors adjusted their positions in carry trades. Overall, market sentiment remains cautious amid recession concerns

- Oil prices increased on Tuesday due to heightened tensions following an crisis on a US military base in Iraq

Market impact

A rebound market for Yen

Reassuring comments from central bank officials, a stronger-than-expected US ISM services report, and potential oversold conditions in the market will help the Japanese market rebound sharply further. This suggests that perceived risk and opportunity changes can quickly sway investor sentiment.

However, depending on the underlying health of the Japanese economy and global economic conditions, it may take time for the market to fully recover from these losses.

Spillover effect on the US market

The significant decline in the Japanese market contributed to a decline in the US market, highlighting the interconnectedness of global markets. Investors often hold assets in multiple countries, and a sell-off in one market can trigger a sell-off in others. Fears of a potential recession and the unwinding of carry trades further amplified the plunge.

However, even the US market showed signs of recovery alongside the Japanese market, with futures rising after the initial plunge. Overall sentiment remains cautious due to lingering recession worries and the uncertain global economic climate.

Selective purchasing for investors

The rebound in the Japanese market attracted some purchasing, particularly in large-cap technology stocks that had been hit hard by the collapse. This suggests that some investors are looking for opportunities to purchase beaten-down stocks. However, investors remain hesitant to fully commit capital back into the market until the economic outlook becomes more apparent.

Fed's on a dovish stance

The Fed president's openness to cutting interest rates if needed to prevent a labor market downturn calmed investor fears. This suggests that the Fed may prioritize economic growth and employment over inflation control, potentially easing pressure on interest rates. Lower interest rates tend to be positive for stock markets as they make borrowing cheaper for companies and can boost investor confidence.

While the Fed's comments helped markets recover, investors are still unsure if this is a sustained rally or a temporary reprieve before further market turmoil. The market is still pricing in a significant possibility of a 50 basis point rate cut by the Fed in September, which could impact future market movements.

What do experts say?

San Francisco Fed President Mary Daly stated, 'It is important to prevent the labor market from tipping into a downturn.' She added that she was 'open to cutting interest rates as necessary' and emphasized the need for a 'proactive' policy approach.

Some analysts also say that the Nikkei is rebounding from yesterday's sharp decline, supported by Fed official Mary Daly's comments, which have eased concerns about an overly aggressive interest rate cut next week.

Analysts also mention that "determining the bottom of such a significant market downturn is challenging, and investors will likely maintain caution before reinvesting inequities.” They add, "However, the USD/JPY currency pair has depreciated by 12% since its peak five weeks ago, reaching oversold levels. This makes the Yen susceptible to positive surprises in US economic data, potentially leading to a reassessment of recessionary expectations. Such a development could contribute to a stabilization of Japanese stocks".

Future outlook

Increased focus on domestic demand

The Japanese market, heavily reliant on exports, might shift its focus towards domestic consumption. Government policies could be implemented to stimulate domestic demand, leading to a more balanced economy.

Value investing

The recent plunge might have created opportunities for value investors to purchase quality stocks at lower prices. A recovery could generate significant returns for those who enter at the right time.

US recession

A confirmed US recession could likely trigger another plunge in global markets, including Japan. This could erase the recent gains and lead to further losses. Consequently, the Yen, often considered a less risky currency during times of economic uncertainty, could strengthen significantly, impacting Japanese exports and the overall economy.

Actionable insights for traders

- The rebound is promising, but caution is advised. This could be a short-lived rally before another downturn

- Focus on high-beta stocks and leveraged ETFs. These instruments tend to amplify market movements, offering the potential for significant gains in a rebounding market

- Consider short-term volatility plays. Options strategies or instruments that advantage from price swings can be used if one has a high-risk tolerance

Actionable insights for investors

- Consider value investing or Dollar-cost averaging. Target beaten-down stocks with strong financials and gradually invest small amounts over time to average out cost per share

- Focus on dividend-paying stocks. These stocks can provide a steady income stream during market volatility and can be a good hedge against inflation

- Diversify across sectors. While technology stocks led the rebound, consider investing in other sectors like healthcare, consumer staples, or financials for a more balanced portfolio

Conclusion

The Nikkei's 10% surge offers hope after Monday's historic plunge. Investors should be prepared for further fluctuations as uncertainties surrounding interest rates, inflation, and economic growth persist. While the market's resilience is impressive, it's essential to maintain a long-term perspective and avoid impulsive decisions based on short-term price movements.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.