All eyes turn to the US CPI release coming up tomorrow 1.30pm GMT.

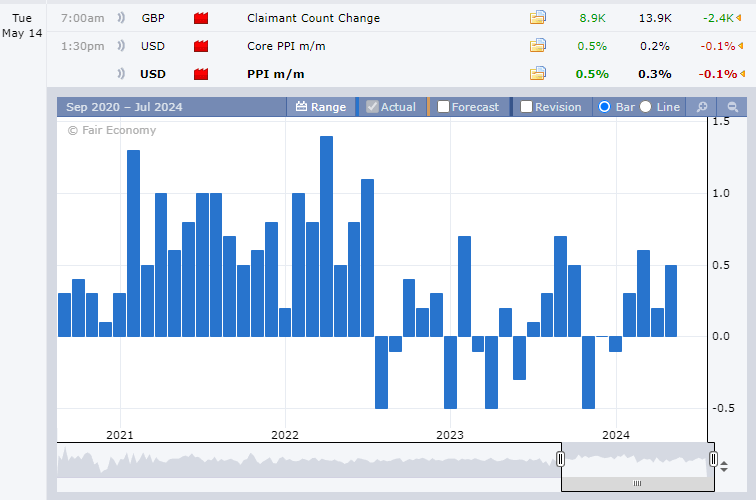

With the US Consumer Price Index (CPI) report looming on the horizon, investors are taking stock of recent economic indicators and gearing up for potential market shifts. The latest Producer Price Index (PPI) data provided a mixed bag of surprises, initially spiking at 0.5% but dampening enthusiasm with downward revisions from previous figures.

As anticipation builds for the CPI release, the focus is on expectations and potential revisions. Analysts foresee a slight decrease, but uncertainties linger amidst the backdrop of persistent inflationary pressures. However, recent developments in the labor market, including a dip in Non-Farm Payroll (NFP) numbers, offer a glimmer of hope for stabilizing inflation rates.

In assessing potential outcomes, market participants are considering a range of scenarios. A CPI uptick to 3.7% or higher could strengthen the USD while weakening stocks. Conversely, a modest decline closer to 3% might lead to USD depreciation and bolster equities.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.