The put/call ratio (PCR) helps traders understand the ongoing market sentiment. The ratio reveals if the traders in the market are overly bearish or bullish, helping individual market participants enter or exit the market accordingly.

This article will discuss how traders can use the put/call ratio to gauge market sentiment.

What is the put/call ratio?

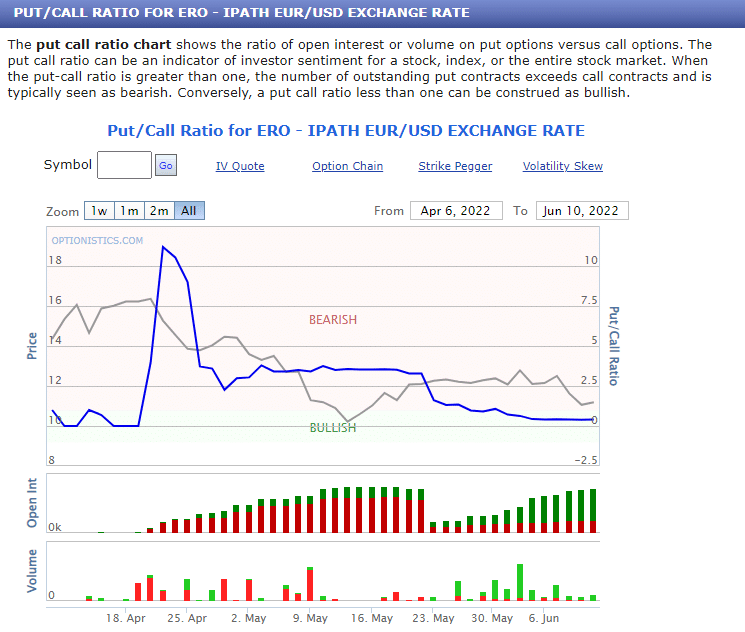

The put/call ratio (PCR) gives traders the overall market sentiment. The ratio is derived by dividing the total number of put options traded by the total number of call options traded.

A call option refers to a financial contract that gives the trader the right but not the obligation to purchase a financial asset at a specific price and timeframe. In contrast, a put option is a financial contract that gives the trader the right but not the obligation to exit a financial asset at a specific price within a certain timeframe.

- When the PCR is less than 1, the low ratio indicates that the market is bullish. Here, more call options are being traded compared to put options.

- When the PCR equals 1, the market is neither bullish nor bearish. Here, the number of both call and put options being traded is the same.

- When the PCR is more than 1, the high ratio indicates the market is overly bearish. Here, more put options are being traded compared to call options.

What is the formula for the put/call ratio?

Put/Call Ratio (PCR) = Volume of Call Options/Volume of Put Options

Let’s understand this with an example. Suppose the volume of put options is 7000, and the volume of call options is 14000.

The put/call ratio would be = 7000/14000 = 0.5

Since the value is less than 1, it suggests a bullish signal in the market, as more call options are being traded than put options.

What does the put/call ratio signal?

Oversold/overbought market conditions

The put/call ratio can help traders identify oversold and overbought market conditions, leading to reversing signals.

- When the put/call ratio reaches a significantly high level, it indicates that traders are heavily entering put options and predicting a decline. This might lead to a contrarian purchase opportunity, further leading to a bullish trend reversal.

- An overbought condition can be identified when put/call ratio values are too low. In this situation, traders mostly purchase call options as they expect a further uptrend. However, this might lead to a market correction, and the market might reverse to a downtrend.

Contrarian indicator

As discussed above, the put/call ratio provides traders contrarian signals in extreme market conditions. It suggests that any extreme market sentiment can precede market reversals.

A high (low) put/call ratio, which indicates bearish (bullish) sentiment, is viewed by contrarian traders as an entry (exit) signal from an option since they feel the market sentiment has become too pessimistic (optimistic) and can reverse towards an uptrend (downtrend) anytime.

Volatility signals

The put/call ratio also indicates volatility, as any sudden changes in the PCR value can coincide with increased volatility periods. This reflects a higher trader/investor uncertainty in the market. A rising (falling) put/call ratio might indicate growing (decreasing)market volatility as more traders purchase put (call) options, foreseeing a potential downtrend (uptrend).

How to trade with the put/call ratio?

Access put/call ratio data

Accessing put/call ratio data enables traders to trade accurately. Traders can get the volume data via financial news websites, options exchanges, brokerage platforms, and more.

Calculate the put/call ratio

Understand the PCR and how to calculate it using the formula discussed above.

Analyze the ratio

After calculating, analyze the PCR to understand the ongoing market sentiment and potential trading opportunities. Traders can compare the current put/call ratio with historical averages to identify whether the current sentiment is normal or extreme. Orders can be placed accordingly.

Establish a threshold

Traders should establish particular put/call ratio thresholds to signify what a given ratio value means: bullish, bearish, or neutral. Thresholds can vary based on the type of market and currency being traded and particular trading strategies.

Integrate with other indicators

Put/call ratio is suited to be used with other indicators to obtain more accurate market signals. Technical indicators like RSI, moving averages, and Bollinger bands can confirm signals from the PCR.

Develop trading signals

Traders can identify entry and exit points based on put/call ratio values and other technical indicators.

If the PCR value is more than 1 and RSI is less than 30, the market is bullish. This signals traders to enter a long position

If the PCR is less than 1 and RSI is more than 70, it indicates a strong bearish sentiment. This signals traders to enter a short position

This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

Risks and advantages of using put/call ratio in trading

Risks

Limited to options market insights

The put/call ratio mainly reflects the sentiments of the options market, so it may not be as viable for other markets. This can also lead to misleading signals, especially when used alone.

False signals

The put/call ratio can sometimes produce false signals, especially when market volatility is too low or the market is manipulated. This can lead to traders entering or exiting positions incorrectly, which can lead to losses.

Low liquidity issues

When markets for specific financial assets are illiquid with overly bearish sentiment and low trading volumes, the put/call ratio can provide inaccurate sentiment readings. Limited activity in the financial market can also skew the put/call ratio, making it less reliable.

Advantages

Betters trade timings

Traders can use the put/call ratio to better time their trades, as the PCR provides insights into overall market sentiment. With PCR, traders can quickly identify the entry and exit points in continuing and reversing markets.

Helps identify market extremes

The PCR is especially useful in indicating market extremes like overbought and oversold conditions. Extreme PCR values can also act as market tops and bottoms, providing traders with opportunities to enter or exit positions before the current market trend reverses.

Useful for contrarian trading

The put/call ratio helps traders work against the overall market psychology by going against the ongoing market sentiment. With the help of the put/call ratio, contrarian traders can capitalize on emotional biases.

Place a trade by using the PCR with other technical indicators

The put/call ratio helps traders identify potential market reversals even in extreme market conditions.

However, due to limited market insights, it can also produce false or misleading signals. Hence, traders must balance PCR signals with other technical indicators and wait for the latter to provide a market signal that aligns with PCR signals before making a trading decision.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.