The Guppy Multiple Moving Average (GMMA) in forex trading provides insights into market trends, helps identify support and resistance zones, and generates clear entry and exit signals. This helps traders make better trading decisions.

In this article, we will learn all about GMMA in depth.

What is Guppy Multiple Moving Average?

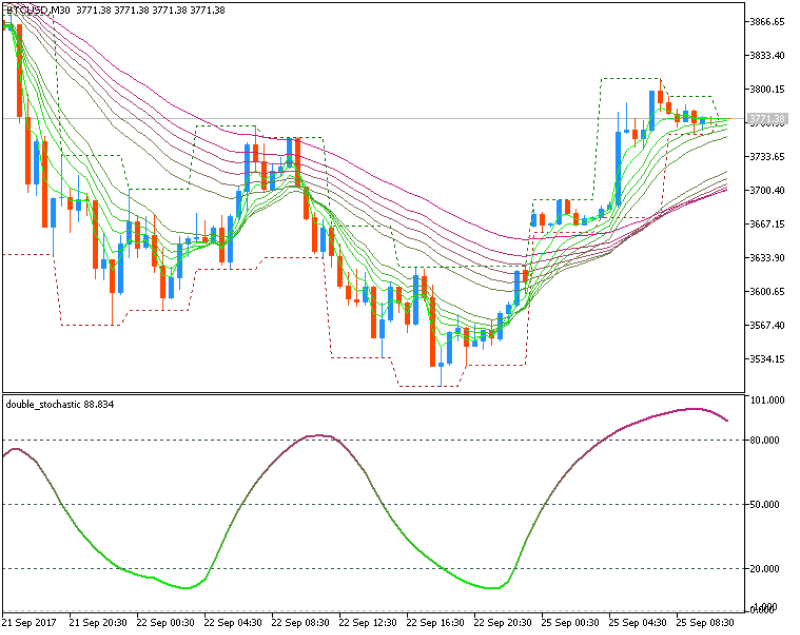

The Guppy Multiple Moving Average (GMMA) is a technical analysis indicator consisting of two sets of moving averages that provide insights into the behavior of traders and market trends.

- The first set of moving averages, known as the short-term group, includes relatively short-term moving averages (3, 5, 8, 10, or 12 periods). These moving averages aim to capture the behavior of short-term traders and provide indications of short-term market sentiment.

- The second set of moving averages called the long-term group, consists of longer-term moving averages (such as 30, 40, or 50 periods). These moving averages reflect the behavior of longer-term investors and offer insights into broader market trends.

By plotting both sets of moving averages on a chart, traders can identify potential trend changes, market strength, and support/resistance levels. The convergence or divergence of the short-term and long-term moving averages can signal shifts in market sentiment and potential trading opportunities. The GMMA is also used to confirm trends, determine entry and exit points, and assess overall market direction.

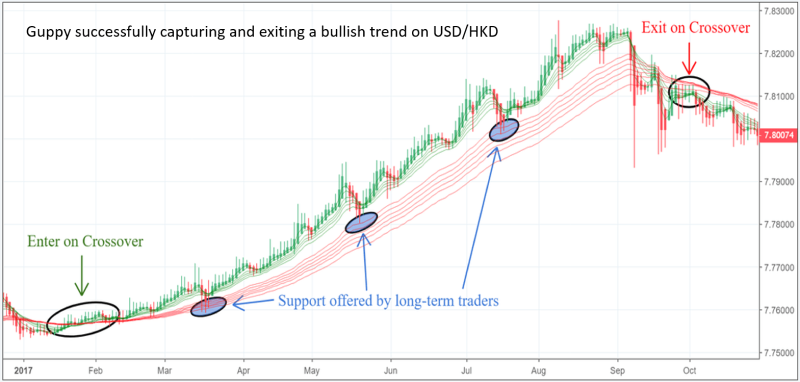

- Traders can place long orders when the short-term moving averages cross above the long-term moving averages. This crossover indicates a potential shift towards bullish sentiment and suggests that short-term momentum is building in favor of an upward trend.

- Traders can opt to place short orders when the short-term moving averages cross below the long-term moving averages. This crossover signals a potential shift towards bearish sentiment and indicates that short-term momentum is favoring a downward trend.

How to calculate GMMA?

Select timeframes

Determine the short-term and long-term timeframes to be used for the analysis. Common choices include short-term EMAs ranging from 3 to 12 periods and long-term EMAs ranging from 30 to 50 periods.

Calculate short-term EMAs

For each selected short-term timeframe, calculate the Exponential Moving Average (EMA) using the closing prices of the specified number of periods. The formula for EMA is:

EMA = (Closing Price - Previous EMA) * (2 / (N + 1)) + Previous EMA,

where N is the number of periods.

Calculate long-term EMAs

Similarly, calculate the Exponential Moving Average for each selected long-term timeframe using the same formula but with a longer period.

Plot the EMAs

Once the trader has calculated the short-term and long-term EMAs, they need to plot the EMAs on the price chart. Short-term EMAs are plotted in one color, while long-term EMAs are plotted in another color for visual distinction.

Repeat for each period

Repeat the steps from number 2 to 4 for each selected period, ensuring that the trader calculates and plots the short-term and long-term EMAs for all desired timeframes to get the entry/exit price levels.

Strategies to use with the Guppy Multiple Moving Average

Trend following strategy

The trend following strategy with the Guppy Multiple Moving Average is an approach to capitalize on sustained price movements in the direction of the prevailing trend. Traders employing this strategy monitor the alignment of short-term and long-term moving averages to identify and participate in established trends.

- When short-term EMAs consistently remain above long-term EMAs, indicating an uptrend, traders consider entering long positions to ride the upward momentum.

- When short-term EMAs consistently dip below long-term EMAs, signaling a downtrend, traders may initiate short positions to gain from downward price movements.

This strategy captures substantial portions of trending moves while minimizing exposure to counter-trend fluctuations, leveraging the clarity provided by the GMMA in identifying and confirming existing trend direction.

The risk of this strategy lies in the potential for false signals during periods of choppy price action, leading to losses if trends fail to materialize as expected.

The pullback trading strategy with the GMMA involves trading temporary retracements within the context of an established trend. Traders employing this strategy patiently wait for short-term EMAs to temporarily dip below long-term EMAs during an uptrend or rise above them during a downtrend, signaling a temporary reversal against the prevailing trend. These pullbacks present opportunities to enter positions at more favorable prices, anticipating a continuation of the broader trend.

- During an uptrend, traders may view pullbacks as purchase opportunities, aiming to enter long positions at relatively lower prices.

- During a downtrend, temporary rallies above long-term EMAs may present exit or short trade opportunities.

This strategy capitalizes on short-term reversals within the context of a broader trend, using the GMMA's ability to identify favorable entry points during temporary retracements.

The risk associated with this strategy is the possibility of mistaking pullbacks for trend reversals, leading to premature entries or exits and potential missed gains or losses.

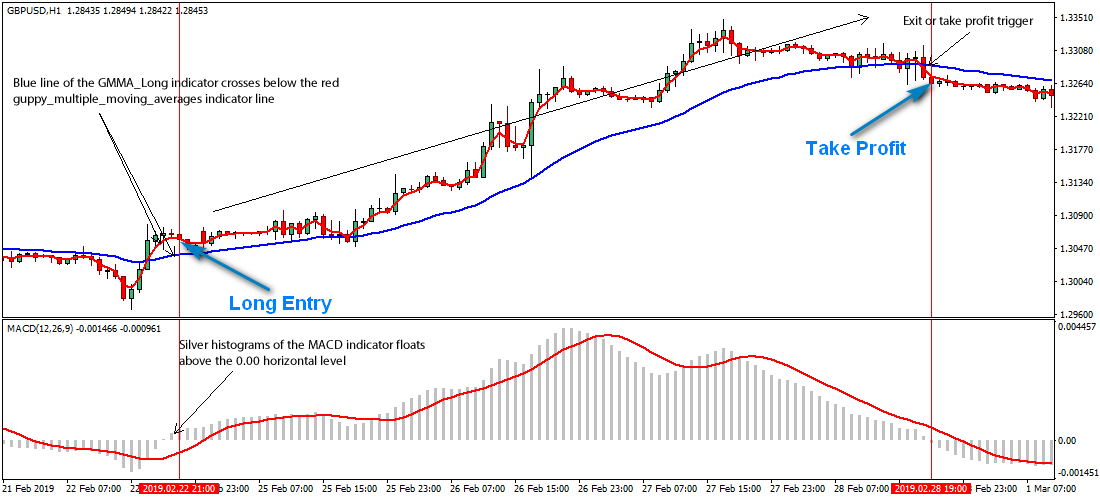

Crossover trading strategy

The crossover trading strategy with the GMMA relies on the identification of moving average crossovers as signals for potential shifts in market sentiment and trend direction. Traders employing this strategy monitor the relationship between short-term and long-term moving averages, entering positions based on the occurrence of crossover events.

- When short-term EMAs cross above long-term EMAs, traders interpret it as a bullish signal, signaling a potential uptrend.

- When short-term EMAs cross below long-term EMAs, it indicates bearishness, prompting traders to consider short positions.

With the help of this strategy, traders can capture the initial stages of new trends by entering positions at the onset of moving average crossovers, by identifying the directional changes through GMMA.

One risk associated with this strategy is the possibility of false signals during periods of choppy price action, leading to potential losses if crossovers do not accurately predict trend reversals or continuations.

Breakout trading strategy

The breakout trading strategy with the GMMA involves capitalizing on decisive price movements that break above or below the clustered short-term and long-term moving averages, signaling the emergence of new trends. Traders employing this strategy monitor price action relative to the moving average clusters, waiting for instances where price breaks decisively above or below these levels. Such breaks indicate potential shifts in market dynamics and the initiation of new trends.

- During an uptrend, traders may enter long positions when price breaks above the moving average cluster.

- During a downtrend, short positions may be initiated when price breaks below.

This strategy identifies the early stages of new trends by riding momentum as prices move away from consolidation phases, by identifying breakout events via GMMA.

A risk associated with this strategy is breakout failures where price quickly reverses after breaking above or below the moving average clusters, resulting in losses for traders who entered positions based on false breakout signals.

Divergence trading strategy

The divergence trading strategy with the GMMA involves identifying discrepancies between price action and the movements of the GMMA, signaling potential reversals or shifts in momentum. Traders employing this strategy observe instances where price makes higher highs or lower lows while the corresponding GMMA fails to confirm these movements. This divergence suggests weakening trend momentum and potential trend reversal.

Traders may enter counter-trend positions based on these divergence signals, anticipating a reversal in the prevailing trend. This strategy aims to capitalize on trend exhaustion and impending reversals by entering positions opposite to the prevailing trend.

- In response to bullish divergence, traders usually opt for long positions. This occurs when the price decreases while the GMMA indicates higher lows, suggesting a potential upward reversal.

- When bearish divergence is observed, indicating higher highs in price alongside lower highs in the GMMA, traders usually choose short positions, anticipating a downturn.

The risk associated with this strategy is the possibility of mistaking temporary deviations in price action and GMMA movements for significant trend reversals, leading to potential losses if trends continue without reversal.

Mean reversion strategy

The mean reversion strategy with the GMMA involves identifying deviations of price from the moving average clusters and anticipating a return to the average levels. Traders employing this strategy monitor price movements relative to the clustered short-term and long-term moving averages, identifying instances where price moves significantly above or below these levels. Such deviations are interpreted as overextensions, signaling potential reversions towards the mean.

- During an uptrend, traders may enter short positions when price moves significantly above the moving average cluster, anticipating a correction or retracement back to the mean.

- During a downtrend, long positions may be initiated when price moves significantly below the moving average cluster.

This strategy aims to gain from corrections or retracements back to the moving average cluster, implementing the GMMA's indicator to identify overextended price movements.

The risk associated with this strategy is the potential for prolonged trends that defy mean reversion, leading to continued losses for traders who enter positions based on the expectation of price returning to the moving average cluster.

Adaptive strategy

The adaptive strategy with the GMMA combines multiple approaches depending on prevailing market conditions, adjusting trading tactics to align with the evolving relationship between short-term and long-term moving averages. Traders employing this strategy continuously monitor the behavior of the GMMA across various timeframes, adapting their trading tactics based on the current market environment.

During trending phases, they may employ trend-following techniques, while during choppy or ranging periods, they may switch to mean reversion or pullback strategies. This adaptive approach aims to maximize gains by aligning trading tactics with the current market environment, utilizing the GMMA indicator to navigate changing market conditions.

- When both the MAs are sloping upwards, it suggests a strengthening uptrend. Consider entering a long position when the slope becomes positive, indicating increasing bullish momentum and vice versa.

- Traders can switch to mean reversion or pullback strategies during choppy or ranging periods for short positions, adapting to GMMA behavior across time frames to maximize gains.

The primary risk associated with this strategy is the potential for misjudging market conditions and employing inappropriate trading tactics, leading to losses if strategies are not adjusted properly.

Risks of using the Guppy Multiple Moving Average strategy

- Lagging indicators: Moving averages are lagging indicators, meaning they react to price movements after they occur, which can result in delayed signals and missed trading opportunities.

- Whipsaw trades: Rapid changes in market conditions can lead to whipsaw trades, where moving average crossovers occur frequently but fail to generate gaining signals, resulting in losses.

- Parameter sensitivity: The effectiveness of the GMMA strategy can be sensitive to the selection of moving average periods, requiring careful calibration to optimize performance.

- Overfitting: Traders may be tempted to optimize the GMMA strategy excessively to historical data, risking overfitting and reduced effectiveness in real-time trading environments.

- Market disruptions: Sudden market disruptions, such as news events or unexpected volatility spikes, can lead to false signals and erratic behavior in the GMMA strategy, increasing the risk of losses.

Improve technical analysis with multiple averages

Using the GMMA in forex leads to strong trend identification and clear signals. However, using the GMMA independently may pose some risks such as false signals. Traders should combine and employ GMMA with other technical indicators such as RSI and Bollinger Bands for trend confirmation, support/resistance identification, and entry/exit decisions.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

What makes GMMA different from standard moving averages?

GMMA combines two sets of moving averages—short-term and long-term—to provide insights into both short-term trader activity and long-term investor sentiment. This combination offers a broader perspective on market behavior.

Can GMMA be used in volatile market conditions?

GMMA can provide useful insights in trending markets. However, its reliability may decrease in volatile conditions, as rapid price movements can lead to misleading signals.

How do traders use GMMA to identify trends?

Traders analyze the alignment and crossover of short-term and long-term moving averages within the GMMA to gauge potential market trends. These observations can help inform trading decisions but should be used cautiously.

Is GMMA effective as a standalone tool?

GMMA offers useful market insights, but it is often combined with other technical indicators, such as RSI or Bollinger Bands, to improve decision-making and reduce the risks associated with relying on a single tool.

What are the risks of trading with GMMA?

Trading with GMMA involves risks such as lagging signals, sensitivity to parameter adjustments, and susceptibility to false signals in unstable or choppy markets.

How can traders minimize false signals when using GMMA?

To minimize false signals, traders often pair GMMA with additional indicators for confirmation and avoid excessive parameter optimization, which can reduce its adaptability to changing market conditions.

What strategies align well with GMMA?

GMMA can complement various strategies, including trend-following, breakout trading, and pullback strategies. The choice of strategy depends on the specific market environment and the trader’s objectives.

Why is it important to adjust moving average periods in GMMA?

Customizing the moving average periods in GMMA allows traders to tailor it to their specific goals and market conditions, optimizing its applicability and effectiveness.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.

image source

image source