Installing Expert Advisors (EAs) on MT5 allows traders to automate their trading strategies. They enable traders to customize trading strategies and execute automatic trades based on predefined rules.

In this article, we will discuss how to install Expert Advisors on MT5.

What are Expert Advisors on MT5?

Expert Advisors in MetaTrader 5 (MT5) enable traders to set triggers for automating their trades. With EAs, traders can define specific rules and conditions for trade entry, exit, and management, streamlining their trading process. Traders can create custom EAs with MQL5, the MT5 programming language.

EAs execute trades automatically based on predefined parameters, including price levels, technical indicators, and time-based criteria. Before deploying an EA in live trading, traders can conduct backtesting using historical price data to evaluate its performance and gains under various market conditions. Additionally, MT5 provides tools such as a strategy tester, forward testing, and more to optimize EA parameters to maximize performance and gains.

What is the role of EAs in trading?

- EAs in MT5 automate trading strategies, allowing traders to execute trades automatically based on predefined rules and conditions.

- Traders can backtest their strategies with historical price data in MT5, assessing the viability and performance of their EAs under various market conditions before live trading.

- EAs offer flexibility for traders to customize and implement a wide range of trading strategies, including trend following, mean reversion, scalping, and more, tailored to individual preferences and market conditions.

- EAs enable 24/7 trading activity, even when the trader is offline, ensuring continuous market participation and the ability to capitalize on opportunities across different time zones.

Stepwise guide to install Expert Advisors on MT5

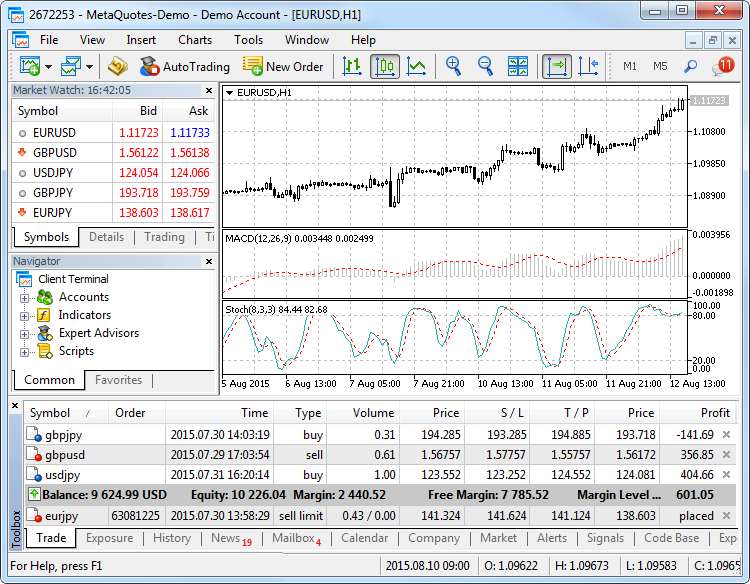

1. Launch MetaTrader 5 platform

Open the MetaTrader 5 platform on the computer.

2. Access the navigator window

After logging into the account, locate and click the ‘Navigator’ window. The trader can usually find it in the toolbar or by pressing Ctrl+N on their keyboard.

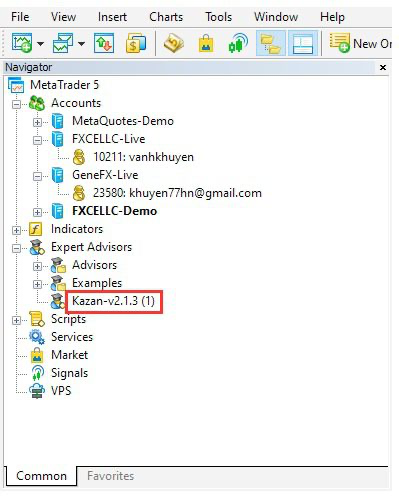

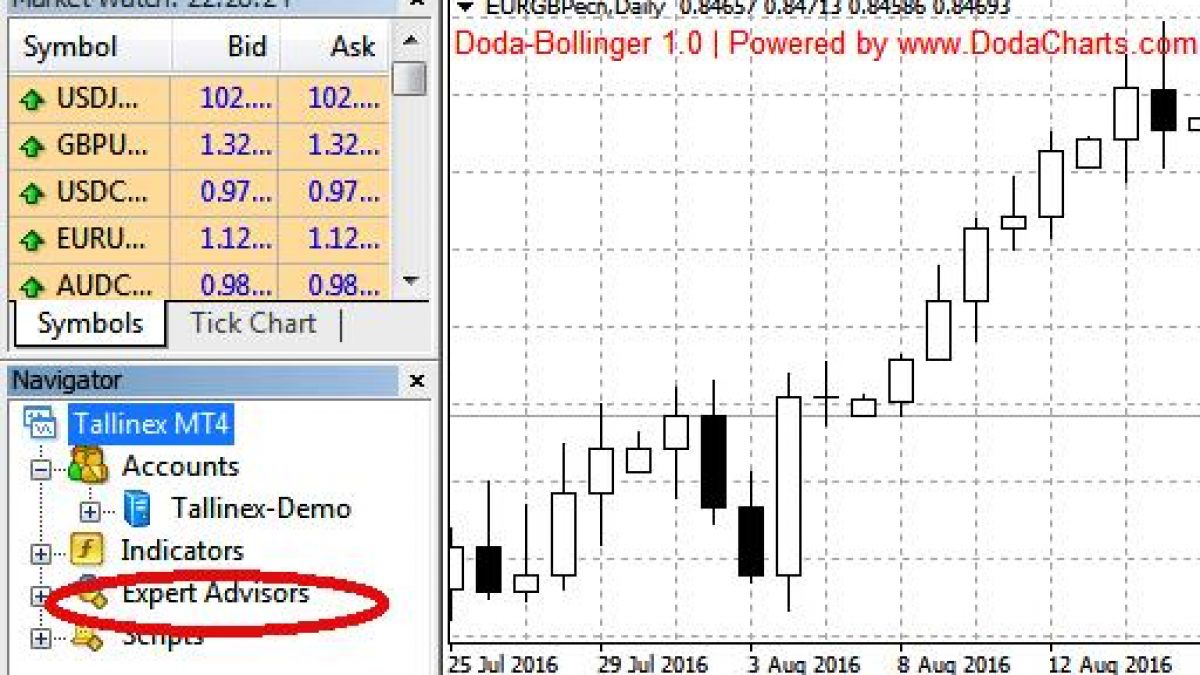

3. Open the Expert Advisors folder

The trader will see various folders within the ‘Navigator’ window, including Expert Advisors, Indicators, and Scripts. Expand the Expert Advisors folder by clicking on the small arrow or plus sign next to it to reveal its contents.

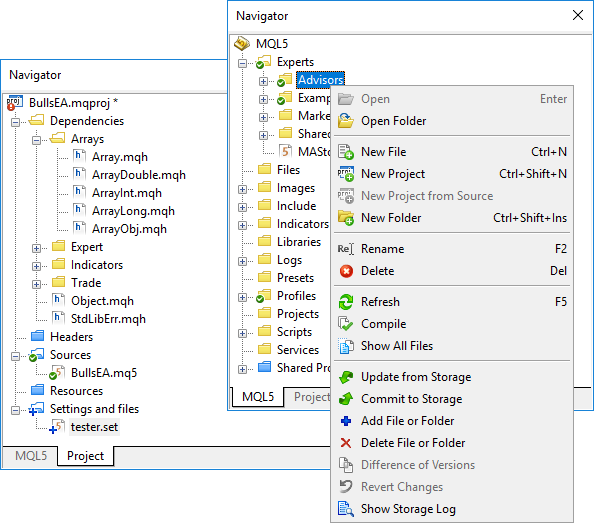

4. Copy or move Expert Advisor file

Expert Advisors are distributed as .ex5 files. Locate the desired EA file on the computer. Right-click on the EA file, and from the dropdown menu, select either Copy or Cut depending on whether the trader wants to keep a copy of the file in its original location.

5. Close the folder window

Once the trader has copied or moved the EA file, close the Expert Advisors folder window to return to the main MetaTrader 5 platform interface.

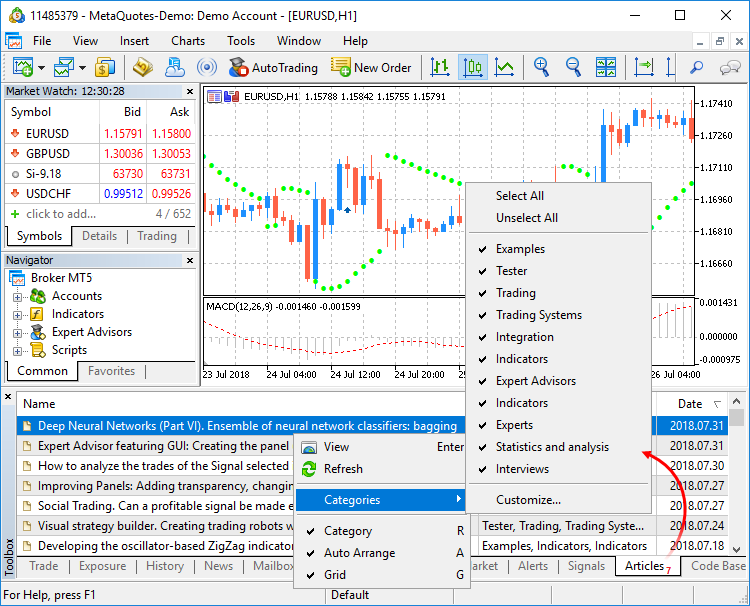

6. Refresh the navigator window

Right-click anywhere within the navigator window to open a context menu. From the context menu, select Refresh to update the list of Expert Advisors and other components.

7. Locate the installed Expert Advisor

Navigate to the Expert Advisors folder in the navigator window to verify that the copied or moved EA is visible and accessible.

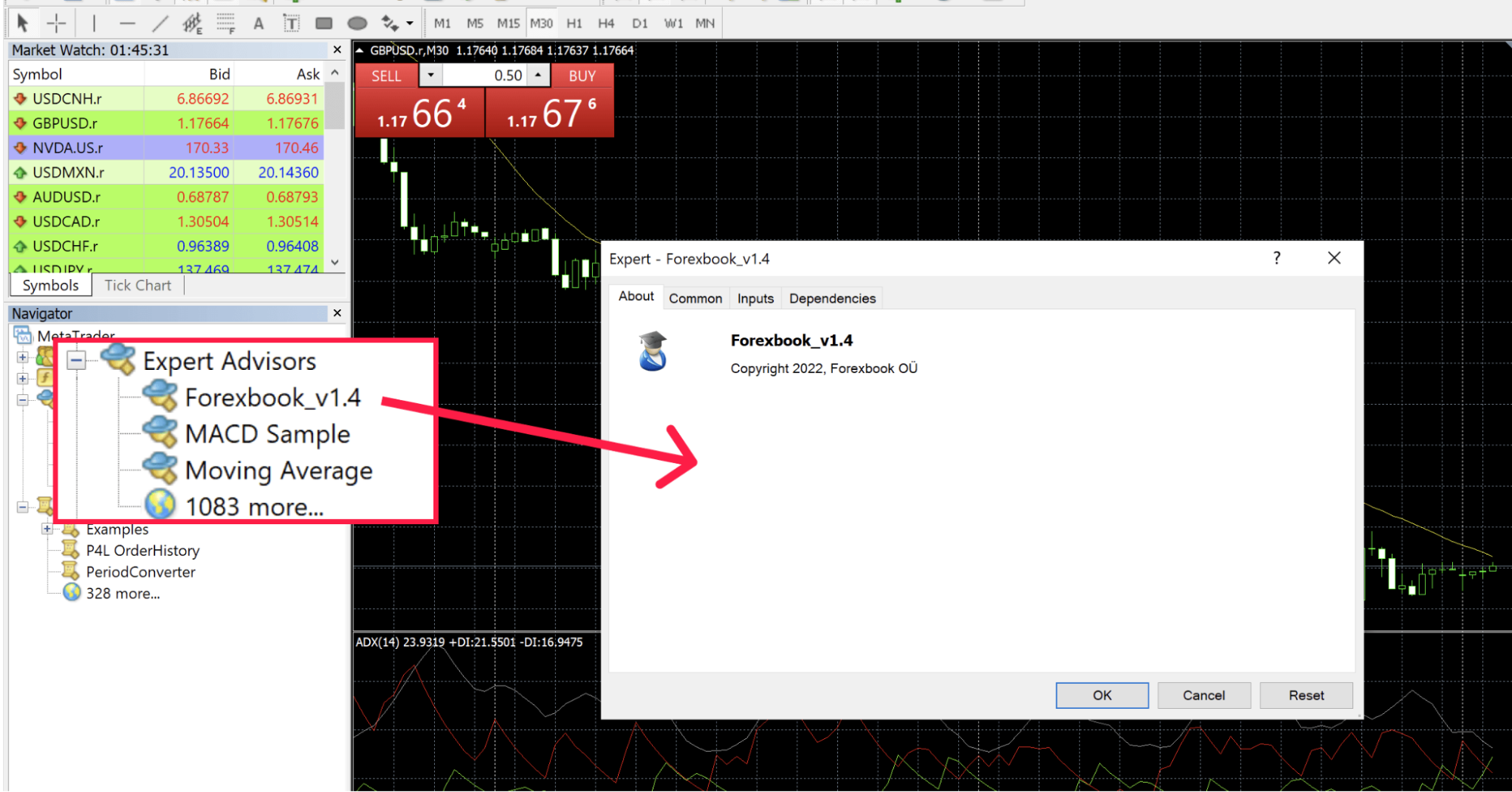

8. Apply the Expert Advisor to a chart

Drag and drop the EA from the navigator window onto the desired chart to apply the EA to a specific chart. Alternatively, right-click on the EA in the navigator window and select Attach to a chart from the dropdown menu.

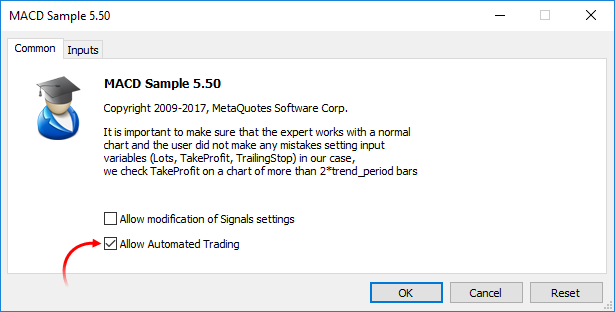

9. Configure Expert Advisor settings

After attaching the EA to a chart, a settings window will appear, allowing the trader to configure parameters such as lot size, stop-loss, take-profit, and other trading conditions. Adjust these settings according to one’s trading strategy and preferences.

10. Enable automated trading

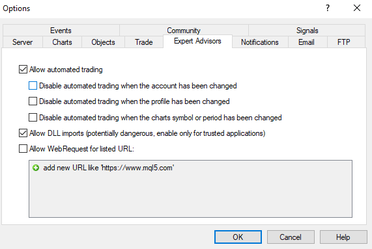

Ensure that the Auto Trading button is enabled in the toolbar at the top of the platform. It allows the EA to execute trades automatically based on its programmed logic.

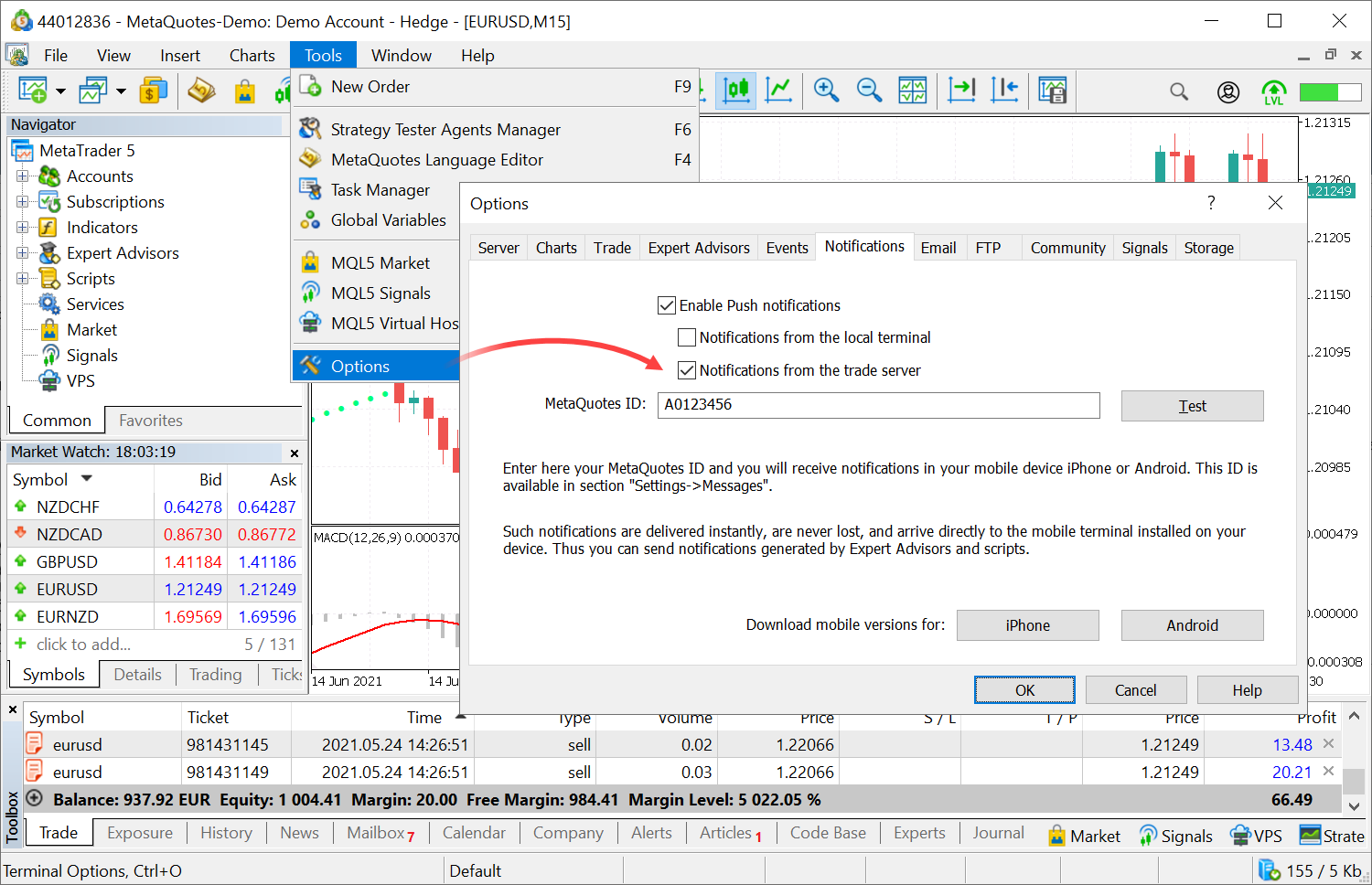

11. Confirm permissions

In some cases, the trader may need to confirm permissions or allow external programs to run on their MetaTrader 5 platform. Follow any on-screen prompts or dialogs to grant necessary permissions for the EA to function properly.

12. Monitor Expert Advisor performance

Monitor the terminal window for trade notifications, including entry and exit points, gain/loss updates, and error messages. Use the experts and journal tabs within the terminal window to monitor the EA's activity and performance.

13. Adjust expert advisor settings if needed

Review the EA's performance regularly and adjust its settings as necessary. Use the inputs tab in the EA properties window to modify parameters such as stop-loss, take-profit, and other trading conditions. Optimize the EA to adapt to changing market conditions and improve its overall performance.

Managing trading risks with EAs

Using EAs on MT5 for trading can offer diversification and increased trading opportunities. However, it also poses risks such as overtrading, conflicting strategies, and system resource overload. Managing multiple EAs requires careful monitoring to prevent excessive drawdowns and optimize performance. Hence, striking the right balance between diversification and risk management is essential when using various EAs in trading.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

What are Expert Advisors (EAs) on MT5?

Expert Advisors are automated trading tools in MT5 that execute trades based on predefined rules and conditions. They help streamline trading strategies using the MQL5 programming language.

How do I install an Expert Advisor on MT5?

To install an EA, copy the .ex5 file, paste it into the Expert Advisors folder in MT5's navigator window, refresh the navigator, and attach the EA to a chart.

Can I backtest an Expert Advisor on MT5?

Yes, MT5 includes a strategy tester that allows traders to backtest EAs using historical price data to evaluate their performance under various market conditions.

How do I enable automated trading for an EA in MT5?

Click the Auto Trading button on the toolbar to enable automated trading, allowing the EA to execute trades automatically based on its programmed logic.

How can I customize the settings of an Expert Advisor?

After attaching an EA to a chart, a settings window will appear where you can adjust parameters like lot size, stop-loss, take-profit, and other trading conditions.

What are the benefits of using Expert Advisors on MT5?

EAs automate trading strategies, provide 24/7 market participation, enable backtesting, and support a wide range of strategies like scalping, trend-following, and more.

What are the risks of using multiple Expert Advisors?

Using multiple EAs can lead to overtrading, conflicting strategies, excessive drawdowns, and system resource overload. Proper risk management and monitoring are essential.

Where can I find the installed Expert Advisor on MT5?

Installed EAs are listed in the Expert Advisors folder in the navigator window. You can verify their presence by refreshing the navigator window.

How do I monitor the performance of an EA on MT5?

Monitor performance through the terminal window, using the Experts and Journal tabs to review trade activity, error messages, and overall performance.

What should I do if an EA isn't executing trades?

Ensure that Automated Trading is enabled, confirm permissions for external programs, and check the settings to verify that the EA is correctly configured for the selected chart.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.