Traders should choose a trading style aligned with their personality and goals. A trading style fosters emotional resilience and discipline, essential for navigating market challenges. By selecting a style that complements a trader’s strengths and preferences, one can maintain consistency, manage risk effectively, and

Let’s understand how traders can find a trading style that suits them.

What is a trading style?

A trading style is the approach or methodology a trader uses to make decisions in the financial markets.

Things to consider before choosing a trading style:

- Personality traits: Traders must assess their personality traits to determine which trading style aligns best with their natural inclinations and temperament. For example, those who thrive in fast-paced environments may gravitate towards day trading, while individuals who prefer a more relaxed approach may find swing trading more suitable.

- Time commitments: It is important to evaluate the amount of time available for trading daily or weekly. Short-term trading styles like scalping or day trading demand more active involvement, whereas longer-term ones like position trading require less frequent monitoring.

- Investible capital available: Some styles, like day trading, may require larger capital due to frequent transactions and margin requirements, while others, like swing trading, may be more accessible with less capital.

- Trading purpose/goal: Clarity regarding trading objectives and goals is essential. Individuals should determine whether they are trading for supplementary income, wealth accumulation, or as a hobby, as this will influence the trading style that best aligns with their goals and time horizon.

- Risk tolerance: Each trader must evaluate their tolerance for risk and volatility. Due to rapid price movements, certain trading styles, such as day trading or scalping, carry more risks. In contrast, longer-term styles may offer more stability but require patience during market fluctuations.

Top trading styles to consider

Scalping

Scalping involves executing numerous daily trades to capitalize on small price movements. It suits individuals with a high tolerance for stress, quick decision-making abilities, and the ability to handle rapid market fluctuations. Traders who prefer short-term gains and have excellent focus, discipline, and risk management skills may thrive in scalping. Factors such as access to real-time market data, low transaction costs, and fast execution speeds are essential to choose scalping as a trading style.

Swing trading

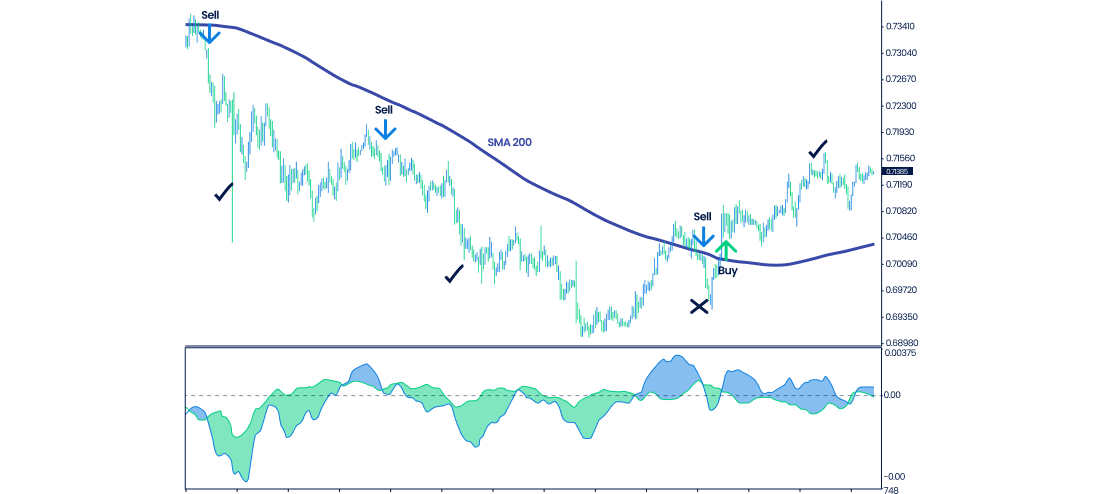

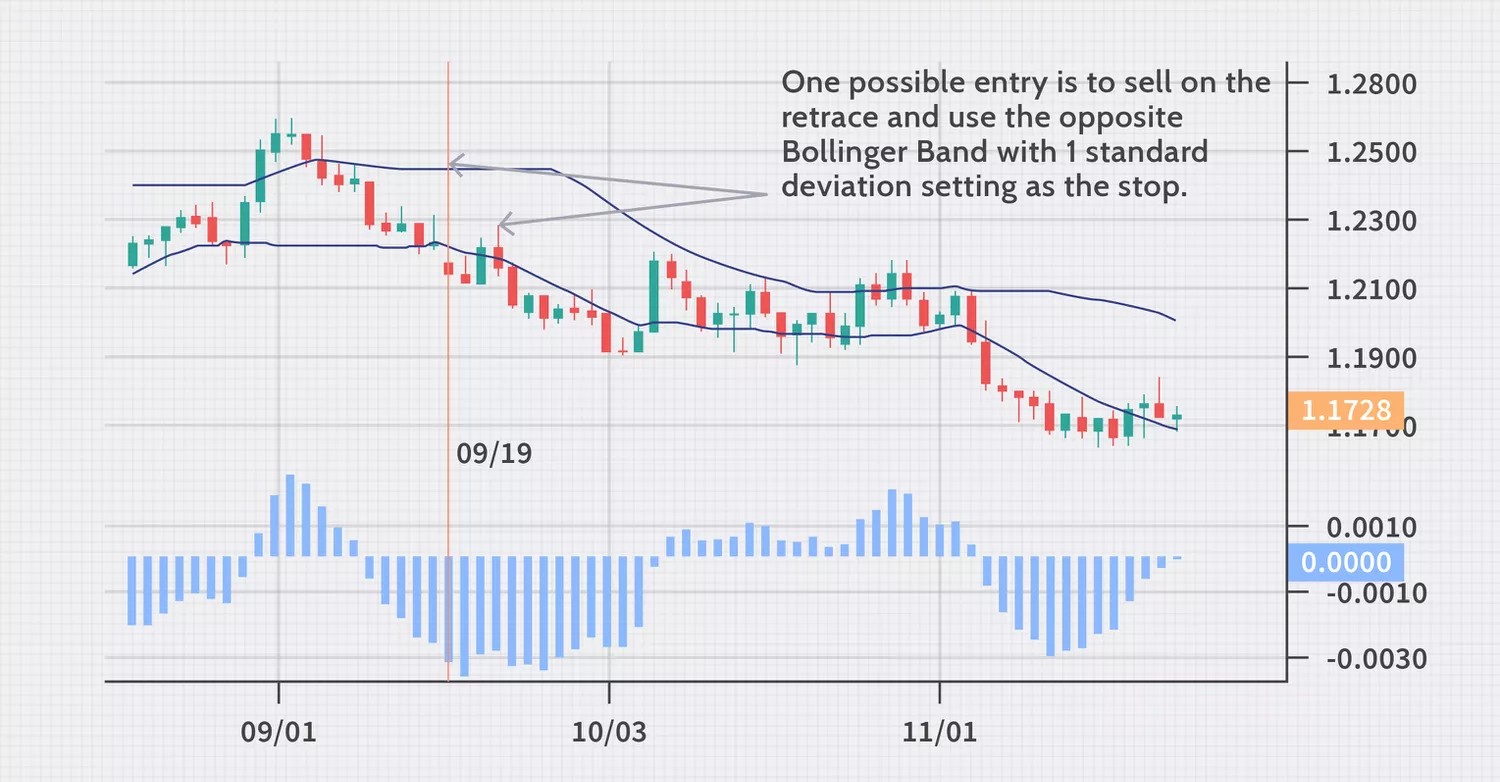

Swing trading involves holding positions for several days to weeks to capture more significant price swings within a trend. It is suitable for patient traders who can tolerate short-term fluctuations and are comfortable with less frequent trading activity. Traders who excel in technical analysis, trend identification, and risk management are well-suited for swing trading. Understanding market psychology, identifying support and resistance levels, and monitoring news events are crucial for swing trading.

Algorithmic trading

Algorithmic trading relies on automated systems to execute pre-programmed trading strategies based on mathematical models and algorithms. It is suitable for individuals with programming skills, quantitative analysis expertise, and access to reliable data sources. Traders who prefer a systematic approach, value efficiency, and can adapt quickly to changing market conditions with technical know-how may excel in algorithmic trading. Factors such as backtesting strategies, optimizing algorithms for performance, and managing technological infrastructure are critical for algorithmic trading.

High-frequency trading (HFT)

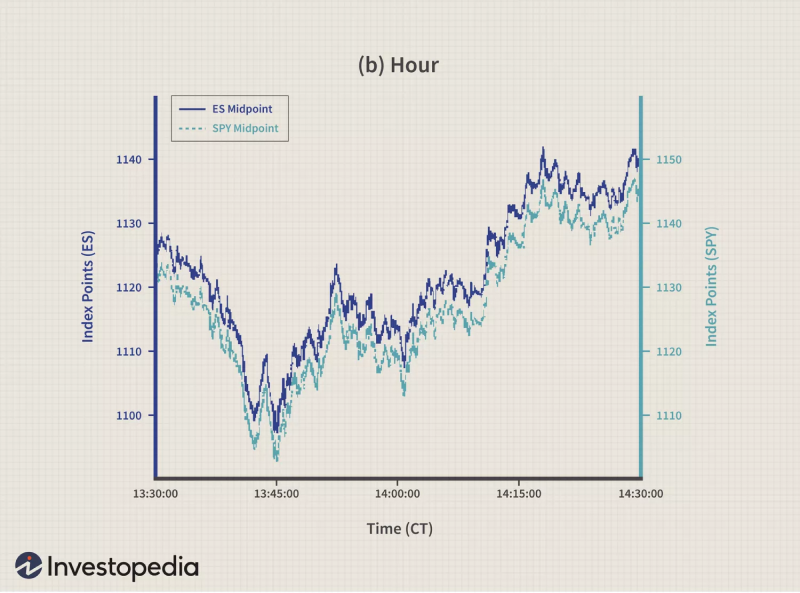

HFT involves executing a large number of trades within milliseconds, taking advantage of small price inefficiencies in the market. It is suitable for individuals with advanced technology infrastructure, low-latency connections, and expertise in market microstructure. Traders who thrive in fast-paced environments, have a deep understanding of market dynamics, and can handle high levels of risk may succeed in HFT. Access to co-location services, market data feeds, and advanced trading algorithms are essential for successful HFT.

Fundamental trading

Fundamental trading analyzes economic data, company financials, and other fundamental factors to make trading decisions. It suits individuals with a strong understanding of macroeconomic trends, industry dynamics, and company fundamentals. Traders who excel in research, critical thinking, and interpreting news events may find it proper to choose fundamental trading as their trading style. Factors such as staying updated on economic indicators, earnings reports, and central bank policies are crucial for fundamental trading.

Arbitrage trading

Arbitrage trading involves exploiting price discrepancies between different markets or assets to generate gains with minimal risk. It is suitable for individuals with access to multiple trading venues, fast execution capabilities, and knowledge of market inefficiencies. Traders who are detail-oriented, analytical, and keen to spot pricing anomalies may excel in arbitrage trading. Monitoring bid-ask spreads, transaction costs, and market liquidity are essential for accurate arbitrage trading.

Momentum trading

Momentum trading involves trading assets based on the strength of recent price trends. It suits individuals who can identify and capitalize on momentum shifts and manage risk during volatile market conditions. Traders who excel in technical analysis, trend following, and risk management may thrive in momentum trading. Identifying trend reversals, setting appropriate stop-loss levels, and managing position sizes are critical to choosing momentum trading as one’s trading style.

Contrarian trading

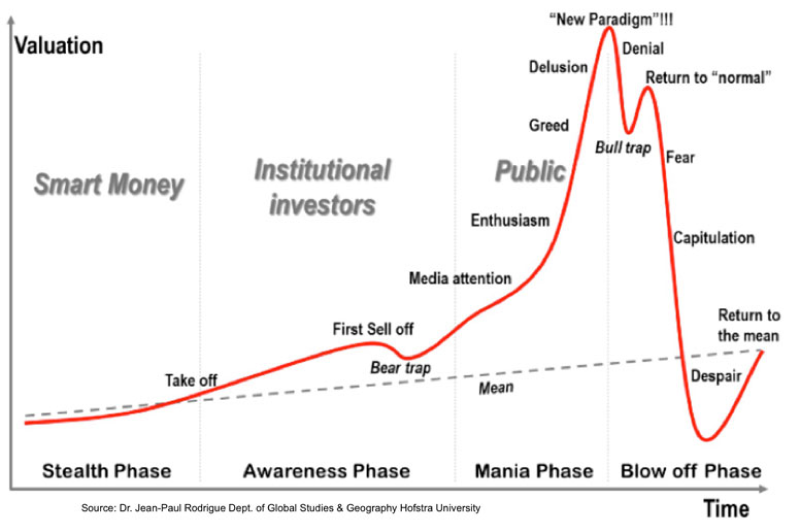

Contrarian trading involves taking positions opposite prevailing market sentiment, and speculating on reversals or corrections. It suits individuals with solid risk management skills and the ability to withstand short-term market fluctuations. Traders who can identify overbought or oversold conditions, interpret sentiment indicators, and patiently wait for trend reversals may succeed in contrarian trading. Understanding market psychology, interpreting sentiment data, and timing entry and exit points are crucial for proper contrarian trading.

Choose the trading style that fits one’s trading personality and goals

Choosing the right trading style facilitates a deeper understanding of market dynamics and enhances the ability to capitalize on opportunities that align with one's trading plan. Conversely, failing to select a suitable trading style may lead to emotional stress, inconsistent performance, and increased susceptibility to making costly trading errors, ultimately undermining long-term gains and confidence in one's abilities.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

What is a trading style, and why does it matter?

A trading style refers to a trader’s approach to decision-making in financial markets. It influences factors such as risk management, time commitment, and strategy selection. Choosing a suitable trading style can help traders align their approach with their objectives and market experience.

How can traders determine a suitable trading style?

A suitable trading style depends on factors such as time availability, risk tolerance, and preferred market conditions. For instance, individuals comfortable with rapid decision-making may explore short-term strategies, while those preferring a structured, longer-term approach may opt for position trading.

What role does risk tolerance play in selecting a trading style?

Risk tolerance helps determine which strategies may be appropriate for a trader. Short-term strategies often involve frequent trades and exposure to price fluctuations, while longer-term strategies may focus on gradual market trends with less frequent trade execution.

How do time commitments affect the choice of a trading style?

The amount of time available for trading is a key factor. Strategies such as day trading require continuous monitoring, whereas approaches like swing or position trading may involve fewer market interactions.

Can trading objectives influence the choice of a trading style?

Yes, trading objectives—such as capital preservation, portfolio diversification, or market participation—may impact the selection of a trading style. Each approach varies in terms of trade frequency, risk exposure, and analytical requirements.

What is the difference between scalping and swing trading?

Scalping involves executing frequent trades to capture small price movements, often within short time frames. Swing trading, in contrast, focuses on holding positions for multiple days to capitalize on broader price trends. Both approaches require different risk management considerations.

What skills are relevant for algorithmic and high-frequency trading?

Algorithmic trading involves developing automated strategies based on pre-defined criteria, requiring technical skills such as programming and data analysis. High-frequency trading (HFT) often relies on specialized technology and infrastructure to execute trades at high speeds.

What distinguishes fundamental trading from other styles?

Fundamental trading focuses on macroeconomic trends, corporate financials, and economic indicators to assess market conditions. Unlike technical trading, which prioritizes price patterns and charts, fundamental trading considers broader economic and financial factors.

Is arbitrage trading accessible to all traders?

Arbitrage trading typically requires advanced market knowledge, access to multiple trading platforms, and specialized technology. It is often employed by experienced traders who can identify pricing inefficiencies across markets.

How can traders manage emotional stress when choosing a trading style?

Selecting a trading style that aligns with one’s risk tolerance and time availability may help manage stress. Establishing a structured approach, implementing a risk management plan, and maintaining discipline can contribute to a more stable trading experience.

Can traders incorporate multiple trading styles?

Some traders integrate different styles based on market conditions and personal preferences. For example, a trader may use longer-term strategies for portfolio management while engaging in shorter-term trades under specific market conditions. Ensuring consistency with risk management principles remains important.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.