Downloading historical data on MT4 is crucial for traders as it enables efficient technical analysis and informed decision-making. By understanding past price movements, traders gain insights into market behavior, refine strategies, and make trading decisions.

In this article, we take a look at how to download historical data on MT4 in a few easy steps.

Why download historical data in MT4?

Strategy backtesting: MT4 allows traders to backtest their trading strategies using historical data. The platform simulates trades using past price movements, providing insights into the viability and accuracy of a strategy.

Expert advisor (EA) functionality: EAs are automated trading algorithms in MT4 that require historical data for their functioning. EAs use past price information to generate trading signals and execute automated trades according to predefined rules.

Timeframe analysis: Traders often switch between different timeframes to get a comprehensive view of the market. Historical data is necessary for populating charts on various timeframes, enabling traders to analyze price movements over different periods and make well-informed trading decisions.

Offline mode: Traders who experience connectivity issues or prefer offline analysis rely on downloaded historical data. MT4 allows users to download historical price data for offline analysis, ensuring that traders can perform technical analysis and strategy development without an active internet connection.

Chart display: MT4 relies on historical price data to construct price charts. When traders open a chart for a particular financial instrument, the platform retrieves historical data to display the price movements over different timeframes. Charts would not be populated without historical data, hindering the visual analysis of price trends.

Technical analysis: Traders on MT4 heavily depend on technical analysis to make trading decisions. Historical price data is crucial for applying technical indicators, drawing trendlines, and identifying chart patterns.

Market analysis: Historical data is valuable for analyzing long-term market trends, understanding market behavior, and gaining insights into how different economic events or news releases have affected prices in the past.

Optimization: Traders may optimize their strategies by adjusting parameters based on historical data. This involves fine-tuning the settings of indicators or parameters of EAs to achieve better performance under different market conditions.

How to download historical data on MT4?

1. Launch MetaTrader 4

Begin by opening the MT4 trading platform on the computer. Once the platform is launched, the trader will need to select the desired currency pair or financial instrument for which they want to download historical data.

2. Open the chart

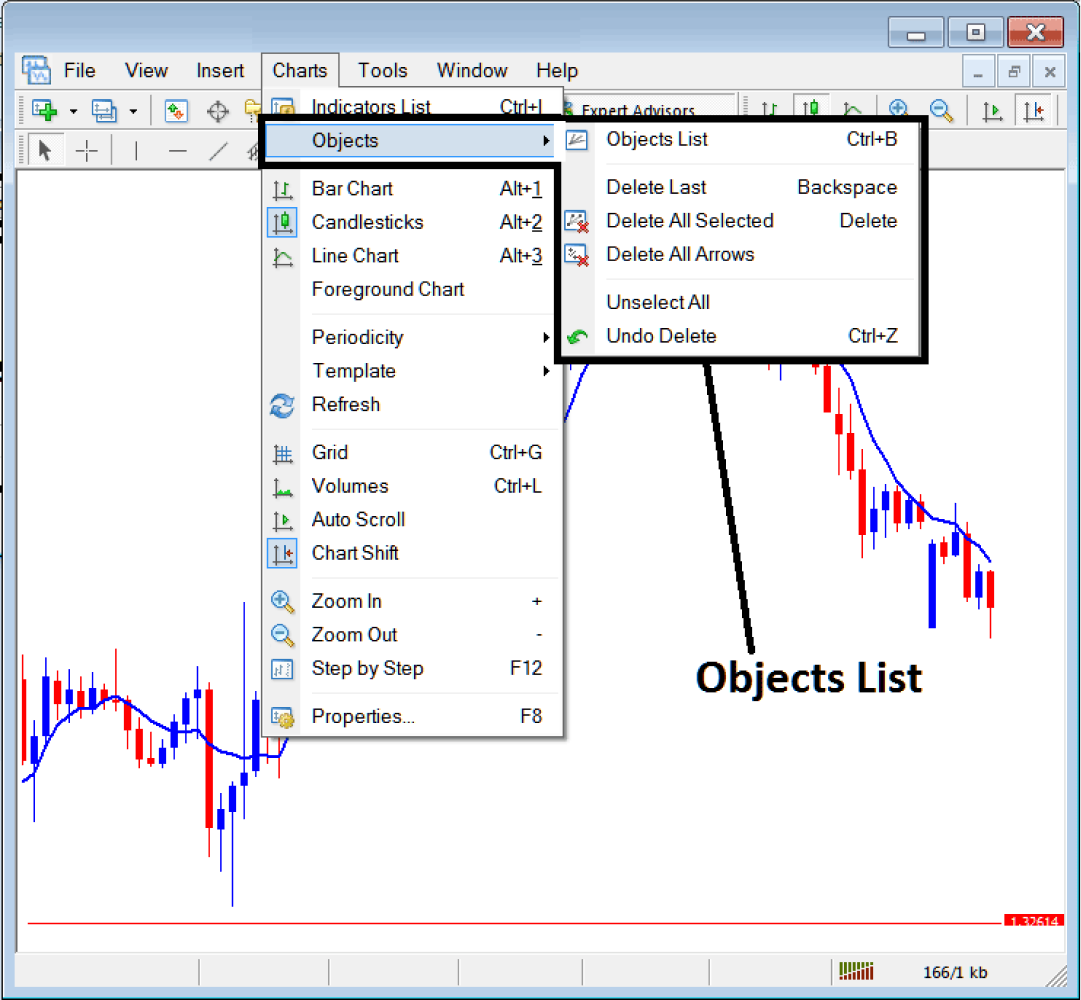

Navigate to the Charts menu and select the currency pair one is interested in. Right-clicking on the chart will provide a menu where traders can choose the Properties option. In the Properties window, navigate to the Common tab and ensure the Offline Chart option is checked. This step is crucial for downloading historical data for offline analysis.

3. Activate the chart

After checking the Offline Chart option, close the Properties window and open the offline chart. To do this, go to the File menu, select Open Offline, and choose the desired currency pair's offline chart. This step is necessary to initiate the download of historical data.

4. Download historical data

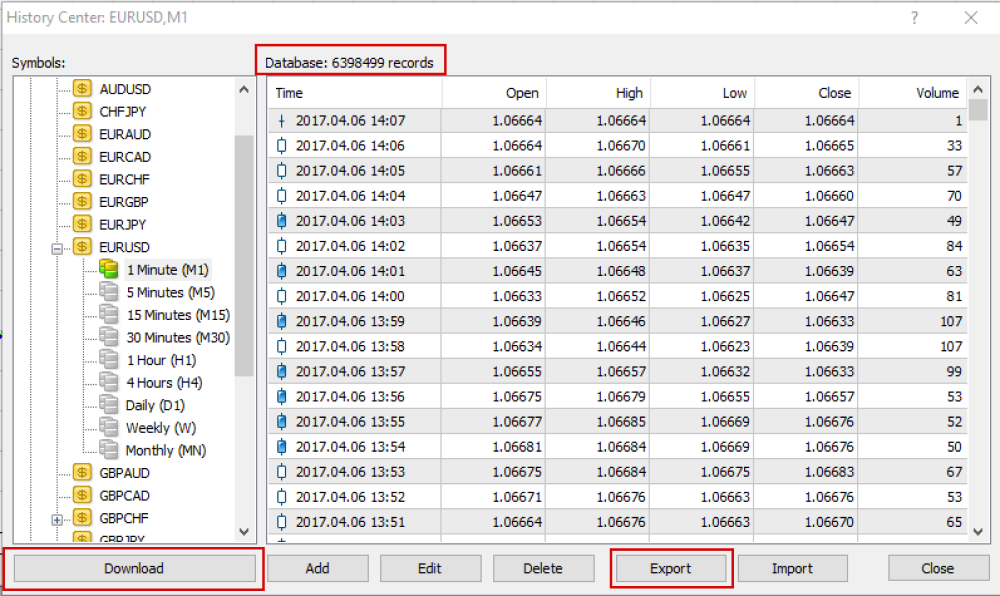

Once the offline chart is open, right-click on the chart, and from the menu, select History Center or press F2 on the keyboard. The History Center is the hub for downloading historical data in MT4.

5. Select the data source

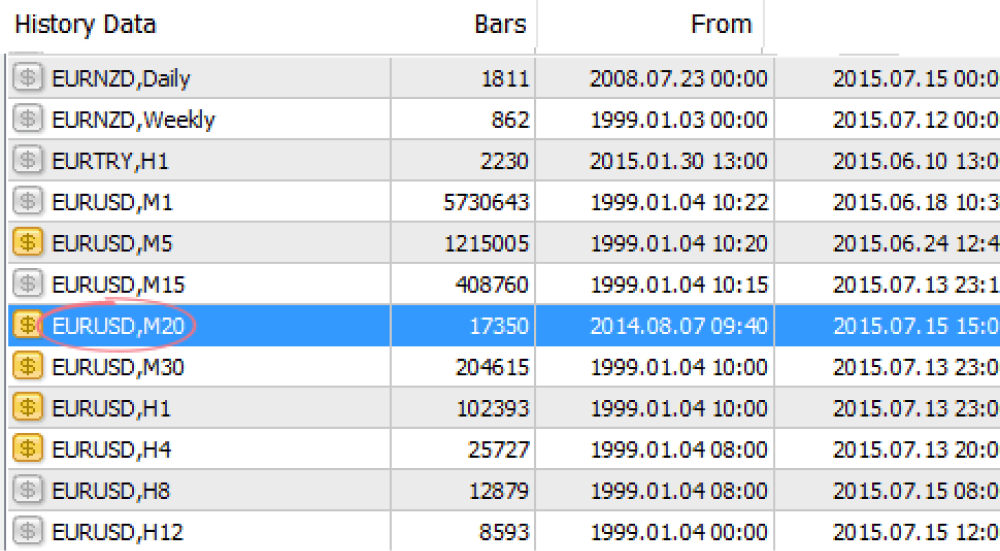

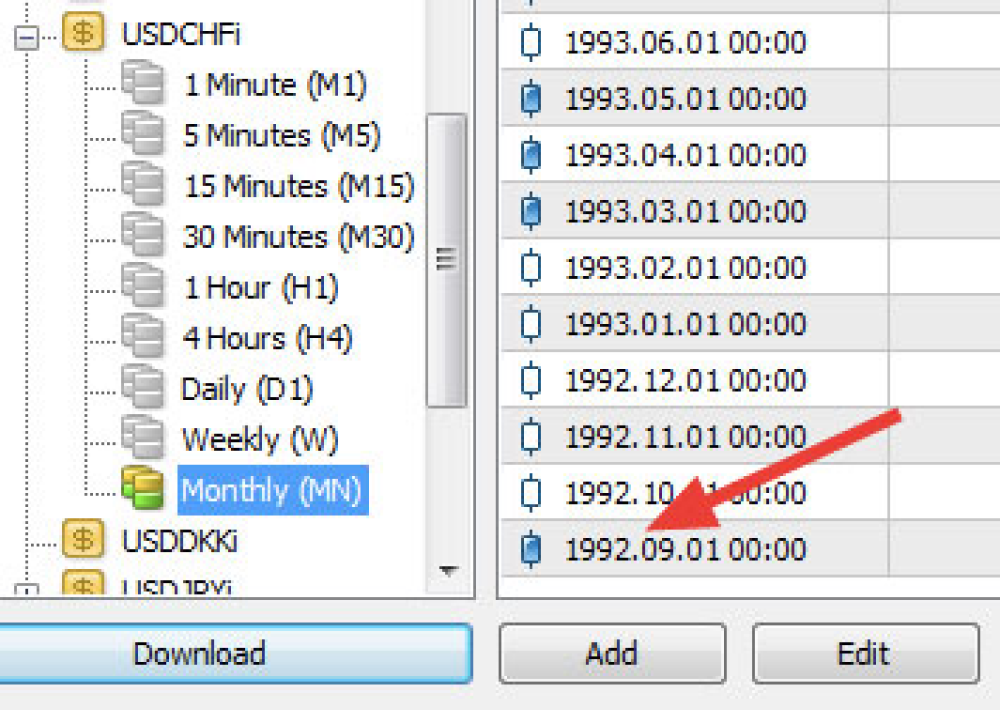

In the History Center, traders will find a list of available currency pairs. Select the currency pair one is interested in, and a list of available timeframes will appear. Choose the timeframe that aligns with the trader's analysis or backtesting requirements.

6. Download data

With the desired currency pair and timeframe selected, click on Download. MT4 will start retrieving historical data from its server for the specified timeframe and currency pair. The download time may vary based on the amount of data being retrieved and the speed of the internet connection available.

7. Confirm data download

Once the download is complete, the trader will receive a confirmation message. Close the History Center window, and the trader will find that the offline chart is now populated with historical price data. The length of historical data available depends on the broker and the specific timeframe selected.

8. Adjust timeframes

To ensure one has a comprehensive dataset, repeat the process for different timeframes. This allows traders to analyze price movements across various periods, facilitating a more thorough understanding of market trends.

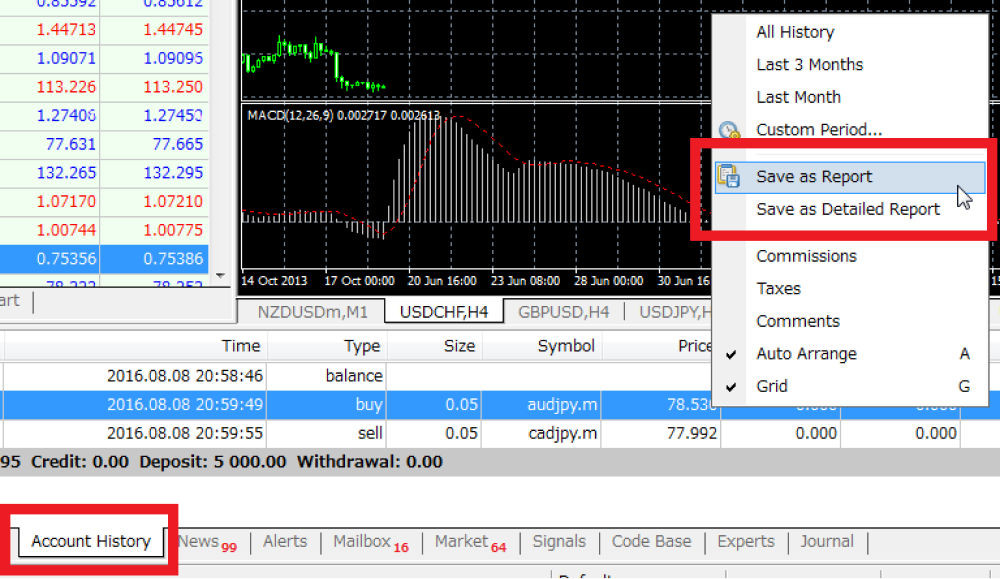

9. Save data for offline use

If the trader intends to perform offline analysis or backtesting without an active internet connection, it is essential to save the downloaded historical data. Right-click on the chart, go to Save As Report and choose a location on the computer to store the data. This step is crucial for maintaining access to historical data when offline.

10. Verify data accuracy

Before relying on historical data for analysis or backtesting, it is advisable to verify its accuracy. Check for any gaps or inconsistencies in the data that may impact the reliability of the trader's analysis. Quality historical data is crucial for making informed trading decisions.

Navigating the market future with historical data

The significance of downloading historical data on MT4 extends beyond strategy development and analysis. While it provides invaluable insights for traders, caution is warranted due to potential risks associated with data accuracy. Rigorous validation is essential, balancing the advantages of informed decision-making and the imperative of precise historical data.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.