Managing risks and optimizing gains becomes easier when traders know how to trade with different volumes. By adjusting volume, traders can scale positions based on market conditions, account size, and risk tolerance.

Let’s look at how to change the trade volume on MetaTrader.

What different lot sizes are available on MetaTrader?

Standard lot

A standard lot in trading represents 100,000 units of the base currency in a currency pair. For instance, in the EUR/USD pair, a standard lot would equal 100,000 Euros. Each pip movement in a standard lot is typically worth about $10, though this may vary slightly depending on the currency pair.

Due to its large size, the standard lot requires significant capital and is typically used by more experienced traders with larger trading accounts. It offers more potential gain but also comes with higher risk.

Mini lot

A mini lot consists of 10,000 units of the base currency, one-tenth the size of a standard lot. In the case of EUR/USD, a mini lot would equal 10,000 Euros. The value of each pip in a mini lot is usually about $1, making it a more manageable option for traders than a standard lot.

Mini lots balance risk and reward, making them suitable for traders with smaller accounts or those who wish to reduce their exposure while still gaining from price movements in the market.

Micro lot

A micro lot contains 1,000 units of the base currency. For EUR/USD, a micro lot would be equivalent to 1,000 Euros. The value of each pip in a micro lot is approximately $0.10, which makes the financial impact of price movements much smaller than in mini or standard lots.

Micro lots are ideal for beginner traders or individuals who wish to practice trading with minimal risk. They are also a good choice for those testing strategies in real market conditions without risking large amounts of capital.

Nano lot

A nano lot is the smallest lot size, representing just 100 units of the base currency. For EUR/USD, a nano lot would equal 100 Euros. The value of each pip in a nano lot is very small, typically around $0.01.

Step-wise guide to changing a trade's volume on MT

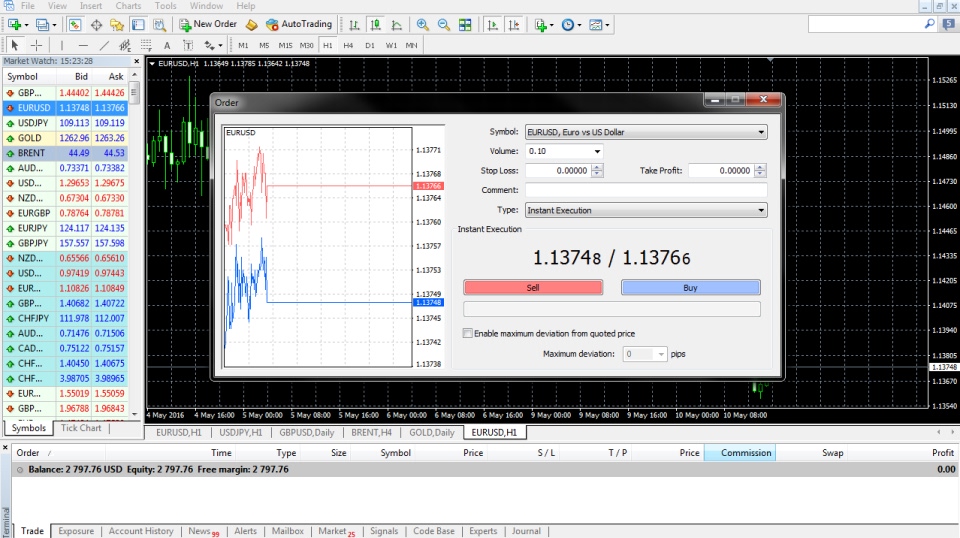

1. Open MetaTrader 4/5

The trader should launch the MetaTrader 4/5 platform on their computer or mobile device and ensure they are logged in to their trading account.

2. Access the trade window

Locate the Trade tab or window in MT5. This section displays open positions and allows for managing existing trades or placing new ones.

3. Select the instrument

The trader must choose the financial instrument they wish to modify. If they are adjusting an existing trade, they should locate the position in the list of open trades.

4. Modify the trade

The trader should right-click on the open position they want to adjust and select Modify or Delete Order. This action will open a window where the trader can modify the trade parameters, including the lot size.

5. Adjust lot size

The trader should locate the field labeled Volume, Lots, or something similar in the modification window. The trader can then enter the new lot size (trade volume) they wish to use for the position.

6. Review and confirm

The trader should double-check all other trade settings, including stop-loss and take-profit levels and any other conditions, to ensure they align with their strategy. After reviewing the details, they should click Modify or OK to confirm the changes.

Top considerations while changing trade volume

Broker's lot size rules

Brokers impose specific rules on lot sizes, such as minimum and maximum volume for each trade. Traders must be aware of their broker's limits to avoid order rejections or violations. Understanding these rules ensures that trade modifications, including lot size adjustments, comply with broker requirements and prevent issues during execution.

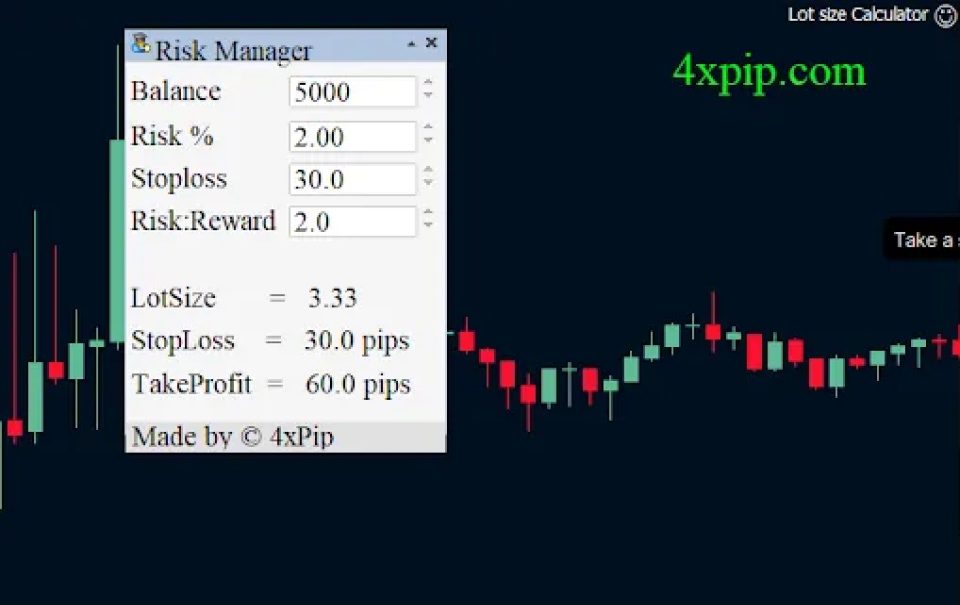

Account balance

The trader's account balance directly affects the lot size they can trade. A larger lot size requires more margin, so traders must ensure they have sufficient funds to support the position. Trading beyond the account balance can lead to margin calls or position liquidation, risking financial stability.

Trade rules compliance

When adjusting trade volume, traders must ensure the new lot size complies with broker requirements and personal risk management rules. For instance, increased volume may necessitate adjusting stop-loss or take-profit levels to maintain an acceptable risk-to-reward ratio, preventing unintended exposure.

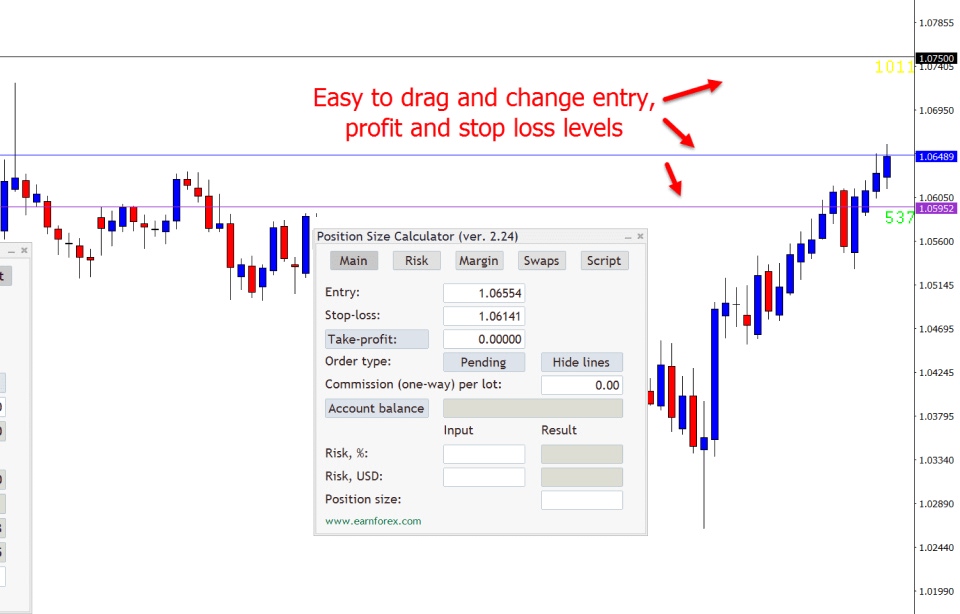

Position size calculator

A position size calculator helps traders determine the ideal lot size based on account balance, risk tolerance, and stop-loss distance. It calculates how much asset to trade to maintain consistent risk management. This tool prevents overleveraging and ensures positions are sized appropriately to avoid unnecessary risk in trades.

Changing trade volume on MT4/5 in a few clicks

Trading with MT4/5 in a few clicks offers traders ease and efficiency, allowing them to quickly adjust lot sizes and manage trades with precision. The simplicity of changing volume empowers traders to fine-tune their strategies, improving risk management and optimizing trading decisions. This streamlined process enhances overall trading performance.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.