The Forex market is mostly ruled by interest rates. After all, one of the biggest factors that determine the perceived value of a currency is its interest. When the return on a currency pair is higher, greater interest is accrued on it. For traders, this can mean higher profits.

Any changes in the Forex interest rate either work for or against you. For example, if the interest rates for a currency pair increase, the value of that pair also increases, making you earn more profit from it. On the other hand, when a currency pair’s interest rate suddenly falls, its value falls along with it, leading to you bearing a loss.

So how do you make interest rates work in your favour? It all starts by understanding how interest rates work and how you can predict interest rate changes.

What happens when interest rates change?

When an interest rate of a currency increases, it also increases in demand because it offers a higher return than other currencies. On the other hand, when a currency pair’s interest rate falls, most traders move to sell it against a stronger currency to avoid big losses.

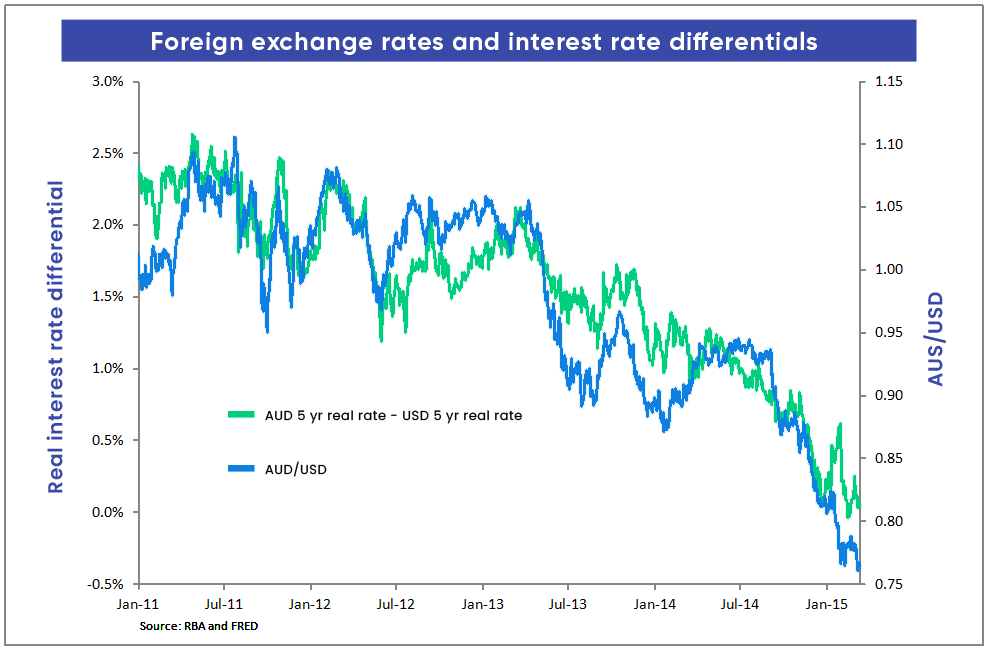

Interest rates of a currency increasing over a certain period causes a trend against other currencies. This is because the currency with a higher interest rate gets favoured by more traders.

However, interest rates are just as volatile as the Forex market. Anything that happens on a global level can shake them, which is why it's important for traders to think critically before making a trade solely based on fluctuating rates of interest.

Who controls interest rates in the Forex market?

Interest rate changes made by global central banks influence the Forex market the most. Each of the eight global central banks has a board of directors who control all monetary policy decisions of their respective countries along with the short-term ROI.

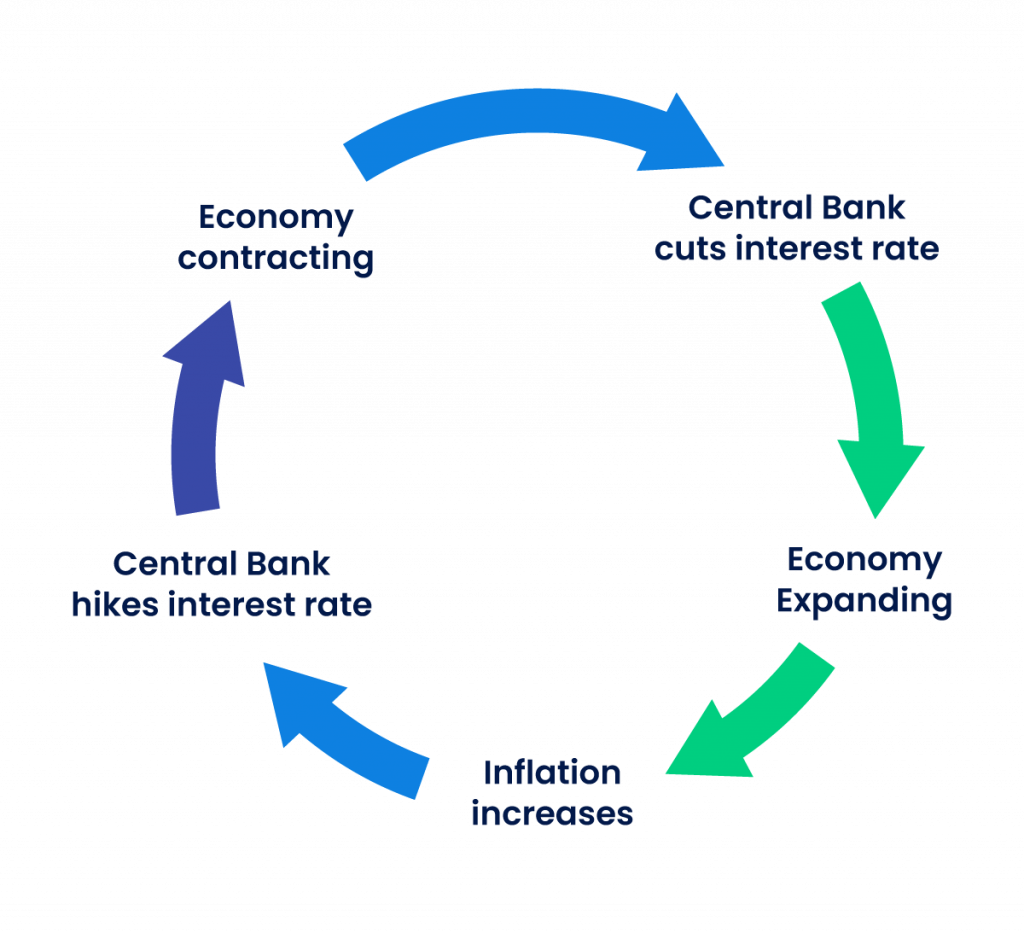

Central banks can hike up rates to control inflation or cut them down to encourage lending processes or inject cash flow into the economy. This results in changes in the currency pair values in the Forex market.

How to predict interest rate changes

Indicators that affect interest rate changes vary globally. Improving indicators or optimistic predictions reveal that the economy is performing well. This causes interest rates to subsequently go up. However, if the indicators or projections show weak results, it leads to a drop in interest rates to encourage borrowing and increase economic cash flow.

The two leading predictive indicators are major economic announcements and forecasts.

Major announcements

Central bank leaders make major announcements that are oftentimes overlooked. However, these announcements play a vital role in predicting interest rate movements. Major economic announcements provide insights as to how the bank is viewing the currency inflation, economic condition, and future prospects of the same.

Whenever central bank leaders give a positive statement, traders can anticipate particular currencies to witness increasing rates. In such a situation, traders should focus and prepare to buy certain currencies at the right time.

Forecast analyses

Interest rate changes can also be predicted through forecast analyses. Banks, brokerages, and seasoned traders are primarily aware of the changes in interest rates because they are anticipated almost every time.

You can take forecasts that are numerically close to each other, average them out, and get a hold of a more accurate prediction.

If you see a currency pair’s interest rates falling, it is better to stay away from that pair. Alternatively, consider investing in pairs with increasing rates for possible higher returns.

Why and how do interest rates affect Forex trading?

Let’s do a recap of all that we’ve learned so far:

Since traders follow the highest returns available, interest rates have a massive impact on the capital flow of any country. If the interest rate of a particular currency increases, foreign investments also increase. Whenever a foreign capital enters a new country, it needs to be converted into the local currency. This drastically raises the demand for the local currency – increasing its price and strength.

When a currency has a high interest rate, the cost of borrowing increases. This makes it challenging for businesses to invest in profitable operations.

If businesses cannot generate profit to cover rising interest costs, their funds will be resting in a bank with no takers. This would lead to interest rates falling, resulting in capital outflows. The decrease in local currency demand will lead to Forex rates falling even more.

Any increase in interest rates will have a positive and direct correlation with Forex rates. When the central bank increases interest rates, their currency value in the Forex market also increases.

Conclusion

Interest rates directly affect currency values in the Forex market. Higher rates mean higher demands, which means that the value of a currency is also higher. The same concept applies if rates are lower.

Following news updates, analysing central bank actions, and being up-to-date with the global economy should be one of your priorities as a Forex trader. By doing this, you can maximise your trades from fluctuating interest rates in the market.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.