Traders who want to trade against or with the trend can use the arms index to identify the market trend’s strength. By analyzing TRIN values and trends, traders can identify potential reversals and make informed decisions on entry and exit points.

In this article, we discuss how to use the arms index to understand market sentiment.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

What is the arms index?

The arms index or the Trader’s Index (TRIN) is a market breadth indicator that measures the balance between advancing and declining stocks/currency pairs with respect to their volume. It helps a trader assess the market sentiment and identify potential reversal signals to place orders accordingly.

The TRIN can be calculated using the formula –

TRIN = (Advancing Volume/Declining Volume)/(Advancing Issues/Declining Issues)

It compares the ratio of advancing to declining stock/currency pair volumes with the ratio of advancing to declining stock/currency pair and issues.

Here,

Declining issues refer to the number of stocks/currency pairs falling in price, whereas advancing issues refer to the number of stocks/currency pairs rising in price.

-

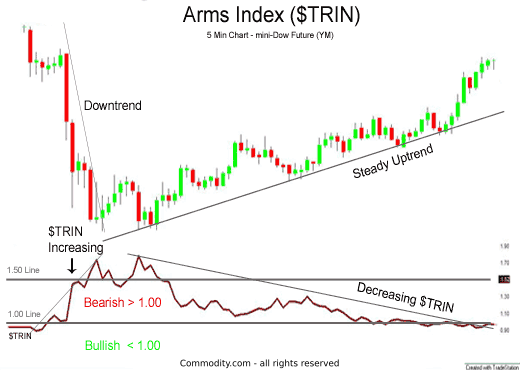

When the TRIN value is more than 1, it indicates that declining stocks/currency pairs are experiencing more volume than advancing stocks, suggesting a bearish trend or a potential market downturn

-

When the TRIN value is less than 1, it suggests that advancing stocks/currency pairs are experiencing more volume, indicating bullish sentiment or a potential market uptrend

How does arms index help speculate market sentiment?

Balances long and short pressure

The TRIN measures the market's overall entry vs exit pressure by comparing the volume of advancing and declining currency pairs. A high TRIN value indicates more exit pressure, suggesting traders short a trade and vice versa.

Signals overbought or oversold markets

When the value of TRIN is significantly above 1, it indicates an oversold market, which is due for a rebound. In this situation, traders can enter long trades to take advantage of the anticipated rising prices. Conversely, when the TRIN value is significantly below 1, it indicates an overbought market and bearish reversal, suggesting traders short a trade due to anticipated falling prices.

Monitors short-term sentiment changes

The arms index helps traders get a broader idea about market sentiment in the short run. This happens because the index reflects changes in investor behavior and market trends based on rising/falling prices.

Uncovers market strength or weakness

Traders can analyze TRIN values to understand the strengths or weaknesses of the market trend. A continuously high TRIN indicates that the market is weak, suggesting traders either hold onto their positions or take opposing ones. On the other hand, a low TRIN suggests a strong market trend, indicating traders should enter the trend in the same direction.

Highlights divergences from market index

TRIN can also reveal market divergences when its value is in the same direction as the index’s movement. This means that if the index is rising and the TRIN value is high, it indicates a weakness in the market trend and vice versa. This happens because a high TRIN suggests high exit pressure, but a rising index suggests high entry pressure, leading to a weak market trend.

Provides early reversal signals

Extreme TRIN values act as reversal signals. For example, a very high TRIN value indicates an entry opportunity if the market is oversold, while a very low TRIN suggests an exit opportunity if the market is overbought.

How to trade forex with TRIN?

Confirm market sentiment

Calculate the value of TRIN and use it with other indicators to validate market sentiment. For example, traders can combine the arms index with moving averages to confirm bullish or bearish trends.

Assess volume trends

Monitor any changes in the TRIN values in relation to volume trends. A sudden shift in TRIN with corresponding volume changes can signal stronger trade setups. This enables traders to enter the market trend with a long or short trade.

Identify overbought/oversold conditions

Use extreme TRIN readings to spot overbought or oversold conditions. This guides traders in making counter-trend trades or adjusting existing positions.

Integrate with price patterns

Combine TRIN readings with price patterns such as support and resistance levels to ensure that traders place close to accurate entry/exit orders.

Compare TRIN with forex pair

Analyze how TRIN values correlate with the movement of the chosen forex pair. For instance, if TRIN is high but the forex pair rises, it could signal a potential reversal.

Monitor market breadth

Track the TRIN values over multiple days to assess the market breadth and decide on the strength or weakness of current trends to place an order.

Adjust risk management

Use TRIN to adjust the risk management strategies. For example, if TRIN signals potential reversals, consider tightening stop losses or scaling back trade sizes.

Plan the trade

Finally, the trade strategy will be decided based on a TRIN analysis. For example, if TRIN suggests a potential reversal, plan to enter or exit a position accordingly.

Top 3 tips to trade forex with arms index

-

Set alerts for TRIN levels: Set alerts for specific TRIN levels to stay informed of significant market changes. This allows traders to react promptly to potential trading opportunities or risk management needs without constantly monitoring the market

-

Assess TRIN relative to historical averages: Understanding how current TRIN readings stack up against historical levels can help traders identify unusual market conditions and adjust their trading strategy accordingly

-

Evaluate TRIN during major news events: Pay close attention to TRIN readings around major economic news releases or geopolitical events. These events can significantly impact market breadth and TRIN values, providing insights into short-term market sentiment

Balancing the risks and advantages of the arms index

The arms index helps traders spot overbought or oversold conditions. However, it is also sensitive to short-term fluctuations and can lead to potential misinterpretations when used alone. Traders should combine TRIN with other indicators to improve trade accuracy and reduce risk.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.