Gold shines bright amidst rising US bond yields! 🌟 Despite the odds, prices rally, fueled by upcoming US data releases and Fed Chairman Powell's remarks. CoT reports hint at continued market uncertainty, while technical analysis suggests bullish momentum. Stay tuned for the latest twists and turns in the gold market! 💰✨ #Gold #MarketAnalysis #FinancialMarkets #Investing

Watch the video to learn more...

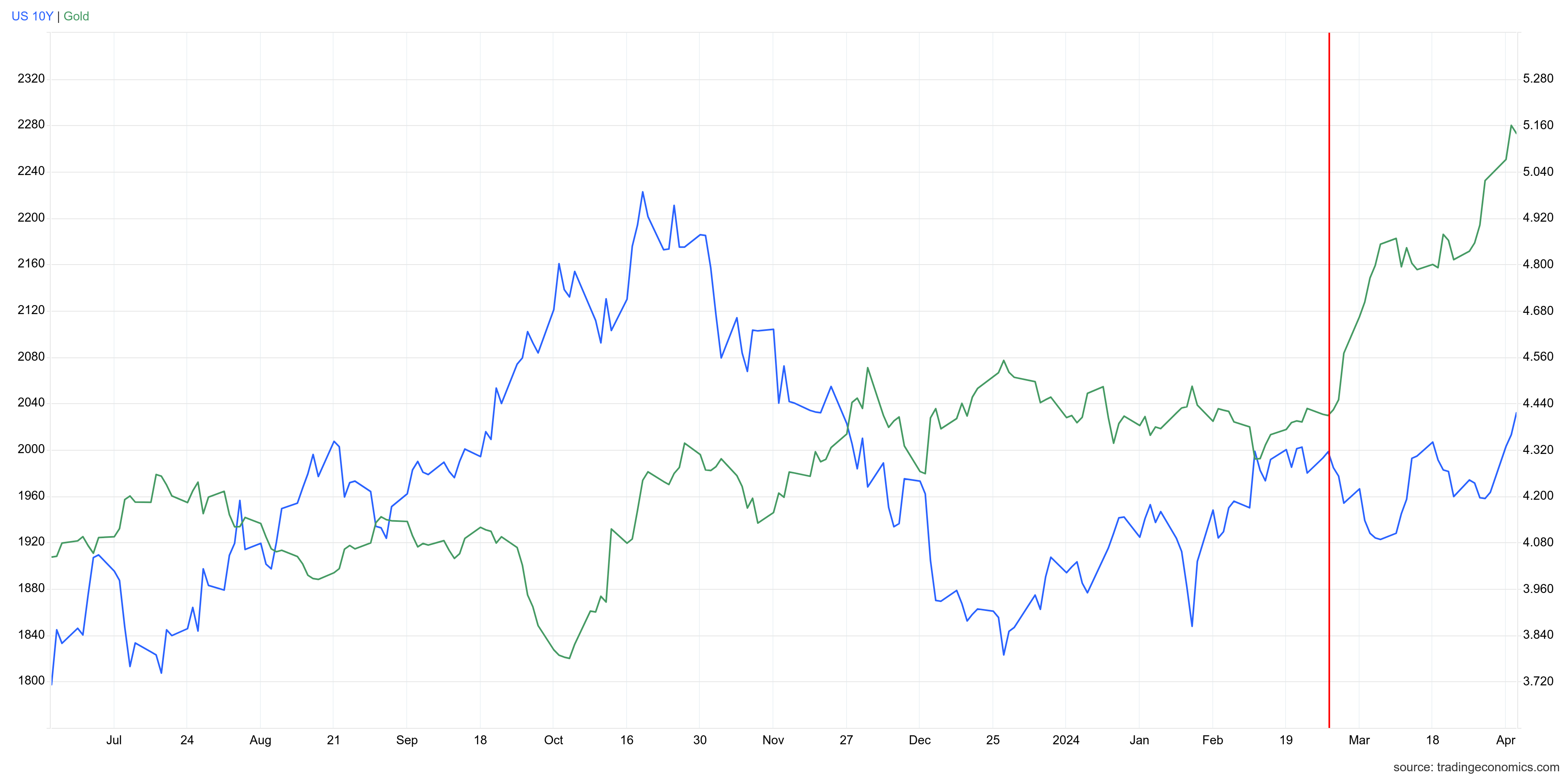

- Price of Gold rallies despite US Bond Yields breaking higher.

- US Data today including the Federal Reserve Chairman Powell could bring fresh volatility to Gold prices.

- CoT reports show a lack of aggressive selling from commercials which suggests a top in the market hasn't been achieved yet.

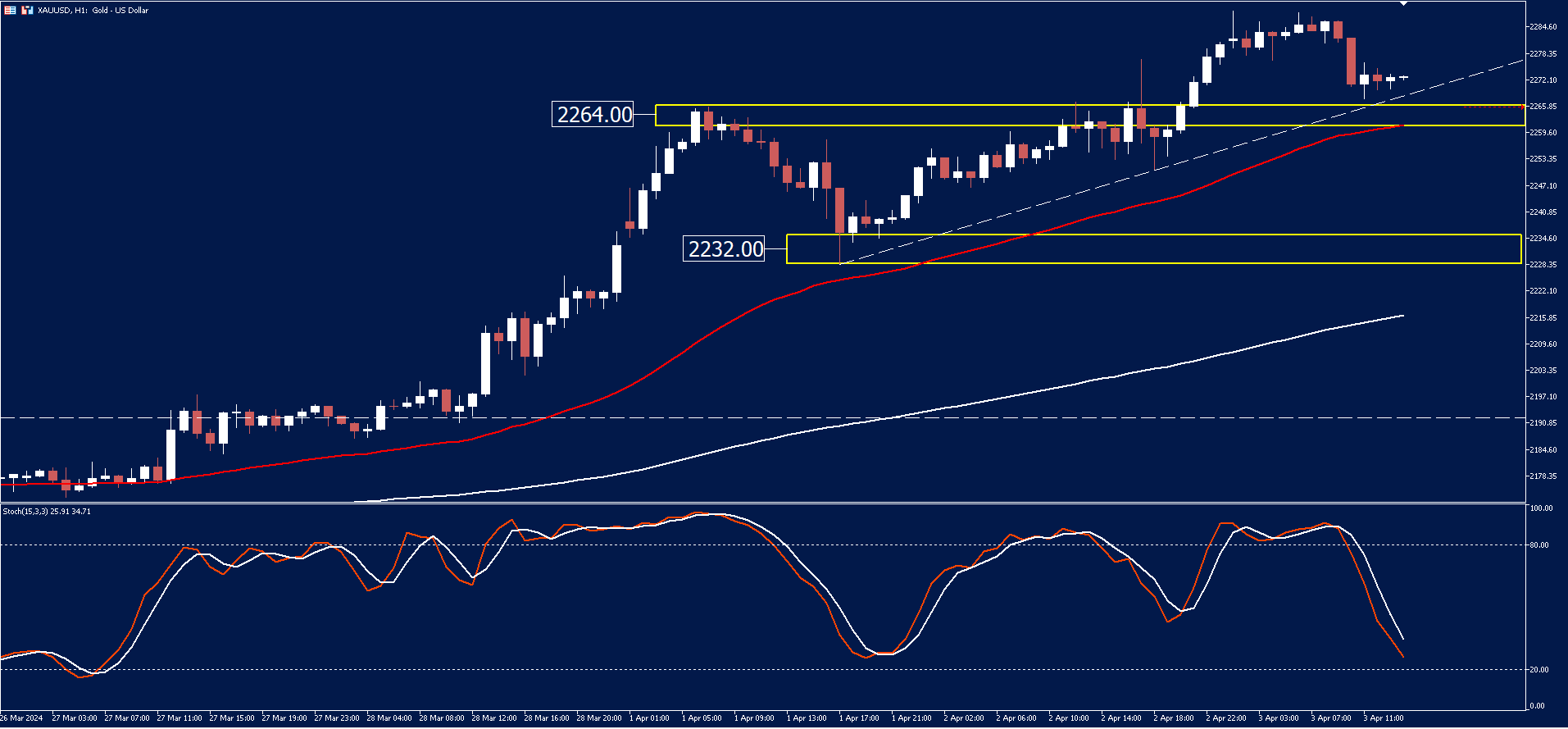

- Technical analysis shows price making new highs, with support shown on the H1 time frame at $2264.00. Price remaining above this level could remain bullish, a break below would see a short term pullback form.

Despite the upward trajectory of US bond yields, gold prices have managed to rally. This unexpected resilience has left many investors intrigued and searching for answers. Could this be a sign of shifting market dynamics? Or perhaps it's a reflection of broader economic sentiment?

One factor to consider is the upcoming release of US data, including remarks from Federal Reserve Chairman Powell. These events have the potential to inject fresh volatility into gold prices.

Delving deeper into market sentiment, the Commitment of Traders (CoT) reports provide valuable insights. Despite the rally in gold prices, there's a notable absence of aggressive selling from commercial entities. This suggests that a definitive top in the market has yet to be reached.

From a technical standpoint, the charts tell an intriguing story. Price action has been bullish, with gold making new highs. On the H1 time frame, support is evident at $2264.00. As long as the price remains above this level, the bullish bias is likely to persist. However, a break below could signal a short-term pullback in the market.

GOLD

The price on the chart has traded through multiple technical levels and some observations included:

- Gold rallied again last week as expected.

- CoT reports highlight that commercials are not yet at extreme levels of selling, so a top in Gold is unlikely to form just yet.

- Price could find support at previous highs at the $2226.00 levels.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.