GBP/USD Spikes as UK Inflation Declines: What It Means for the Market

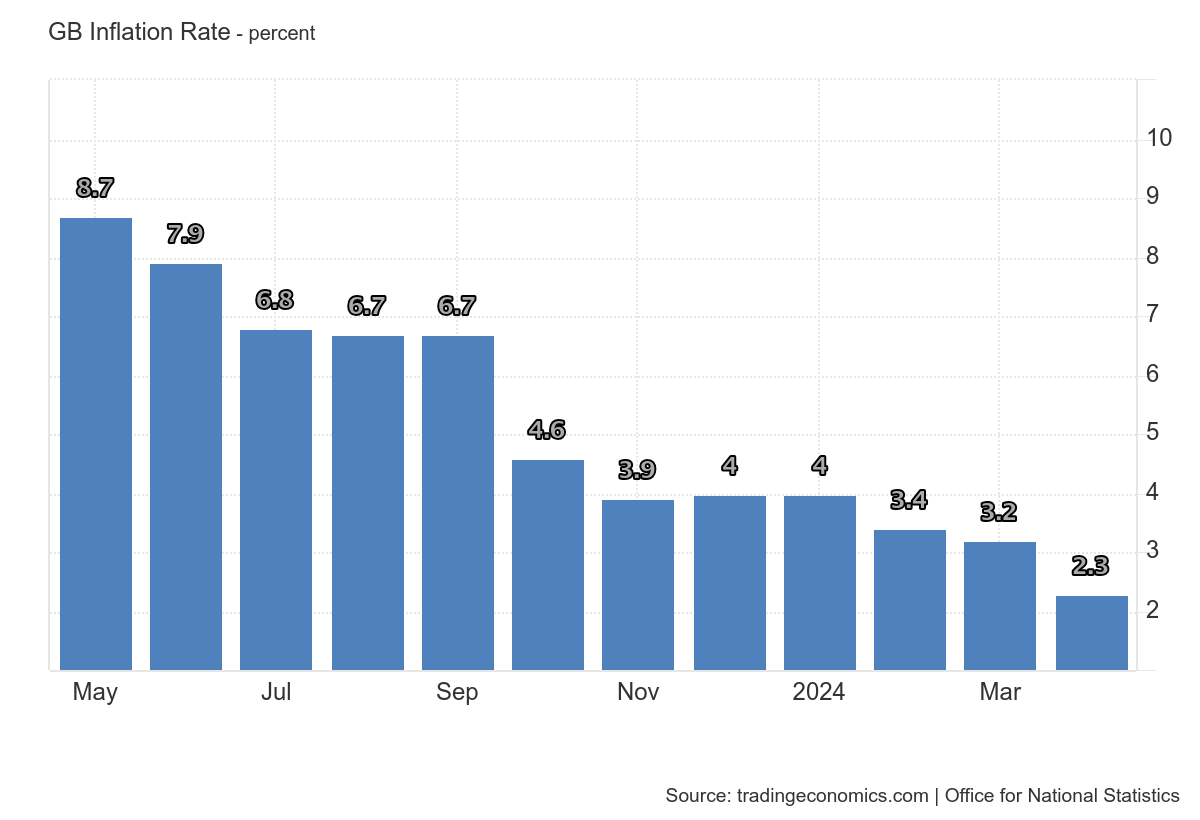

The GBP/USD pair saw a notable jump following the latest release of the UK Consumer Price Index (CPI) year-over-year data, which revealed that inflation has decreased to 2.3%. This news has significant implications for the market, particularly concerning the Bank of England's monetary policy.

Market participants now believe that this lower inflation rate reduces the likelihood of a rate cut by the Bank of England in June. A CPI closer to the 2% target would typically signal a more conducive environment for rate cuts. However, with the current figure at 2.3%, it appears that a rate cut is off the table for the time being.

Following the CPI announcement, the GBP/USD (often referred to as "cable") surged to a high of 1.2760. Despite this initial spike, the price soon reversed and moved back towards the levels seen during the Asia trading session. Should the price fall below the 1.2700 mark, it could signal a reversal of the overall bullish trend that has been forming in the GBP/USD market.

For traders, the key levels to watch are 1.2760 and 1.2700. A sustained move above 1.2760 could reinforce bullish sentiment, while a drop below 1.2700 might indicate a bearish reversal. As always, staying informed on economic indicators and central bank policies will be crucial for navigating the movements in the GBP/USD pair.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.