The headlines in the UK today surround unemployment, the claims vs the rate. The UK will face a series of data drops this week surrounding the labor market, inflation and consumer spending. This could be a tricky week to be a trader of the GBP with the data ready to disrupt the recent GBP weakness.

GBP/USD Rallies Despite Unemployment

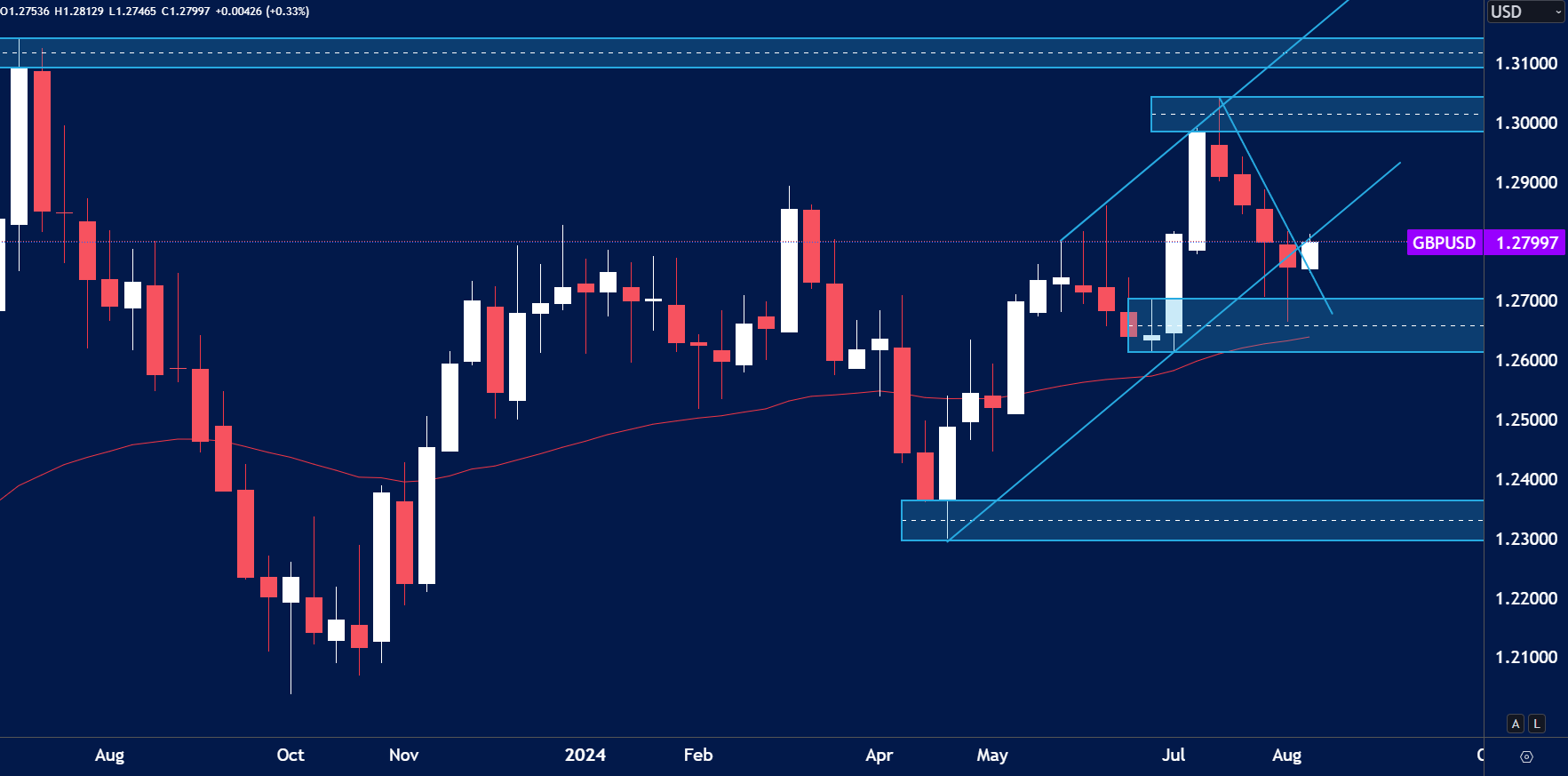

The GBP/USD price closed bearish for a fourth consecutive week last week, this came after the price rejected the key 1.3000 level. Current price however has seen a recent uplift largely due to the data which dropped at 7am BST. The Claimant Count Change which is the measure of people claiming employment benefits rose from 36.2k to an eye watering 135.0k. This is one of the largest jumps in a month since Covid in May 2020.

So why did the GBP/USD price rally? Well it comes down to the unemployment rate which surprisingly fell to 4.2%.

“The UK unemployment rate (for people aged 16 years and over) was estimated at 4.2% in April to June 2024, below estimates of a year ago, and decreased in the latest quarter.”-Office of National Statistics

This combined with the coming data this week could bring a bullish GBP despite some indicators saying otherwise.

Coming up on Wednesday 14th August is the Consumer Price Index (CPI) year on year figures which forecast a rise from 2.0% to 2.3%. If we see a number lower than 2.0% we could see GBP weakness continue, a rise could influence buying pressure. This is because market participants will price in the chances of a future cut from the Bank of England (BoE) as less likely.

On Thursday we will see the release of the Gross Domestic Product (GDP) for the month of July. This economic data point measures the change in total value of all goods and services produced by the economy. Two months of negative GDP is considered a technical recession, and this forecast shows a potential decline to 0.0% from 0.4%. So we are way off the mark for a ‘technical recession’.

Finally, Friday we see the release of Retail Sales month on month which is forecast to rise to 0.6% from -1.2%.

So a combination of these economic data points could point to a GBP that may be bullish for the week. From a technical point of view this could also be considered the same.

Despite the price of GBP/USD falling from 1.3000 largely impacted by the Commitment of Trader reports and seasonal analysis. The price has now come into a weekly zone of demand between 1.2700 and 1.2613. A zone of demand like this could be a good area for institutions to take some profits, adding fuel to potential for short term upside here for the GBP/USD.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.