As we dive into the week of July 22nd, the forex market is buzzing with anticipation. Key economic indicators and central bank decisions are on the horizon, offering potential trading opportunities. Here’s a snapshot of what to watch for in the forex market this week.

Forex Week Ahead Analysis

Manufacturing and Services PMIs: Europe, UK, and US

This week, market participants will closely monitor the release of Manufacturing and Services PMIs from Europe, the UK, and the US. These indicators provide insight into the economic health and business conditions in these regions.

The Eurozone, in particular, will be looking at the German Manufacturing PMI. Germany, as the largest economy in the Eurozone, has seen a year of underwhelming performance in its manufacturing sector. Traders will be eager to see if there are signs of growth that could boost the Euro.

Bank of Canada Interest Rate Decision

In central bank news, the Bank of Canada is in the spotlight with a forecasted interest rate cut of 25 basis points, bringing the rate down to 4.50%. The market consensus is strong for this change, driven by the need to address the rising unemployment rate in Canada. This potential rate cut could weaken the Canadian dollar, offering trading opportunities against stronger currencies.

US CORE PCE Price Index

On Friday, the release of the CORE PCE Price Index m/m will be a critical event. This index is the Federal Reserve’s favored gauge for inflation. It is expected to come in slightly higher at 0.2%, up from the previous 0.1%. A higher reading could signal persistent inflation, leading to speculation of a more hawkish stance from the Fed and potential USD strength. Forex traders should be prepared for volatility in USD pairs around this release.

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- The USD Index weekly chart shows the price closing back above the key $104.00 lows.

If the price can sustain above this support we could see a move higher towards $105.00 this week. - If however the price consolidates it could show a lack of intent by buyers at these levels and price may reconsider a move back below the support of $104.00.

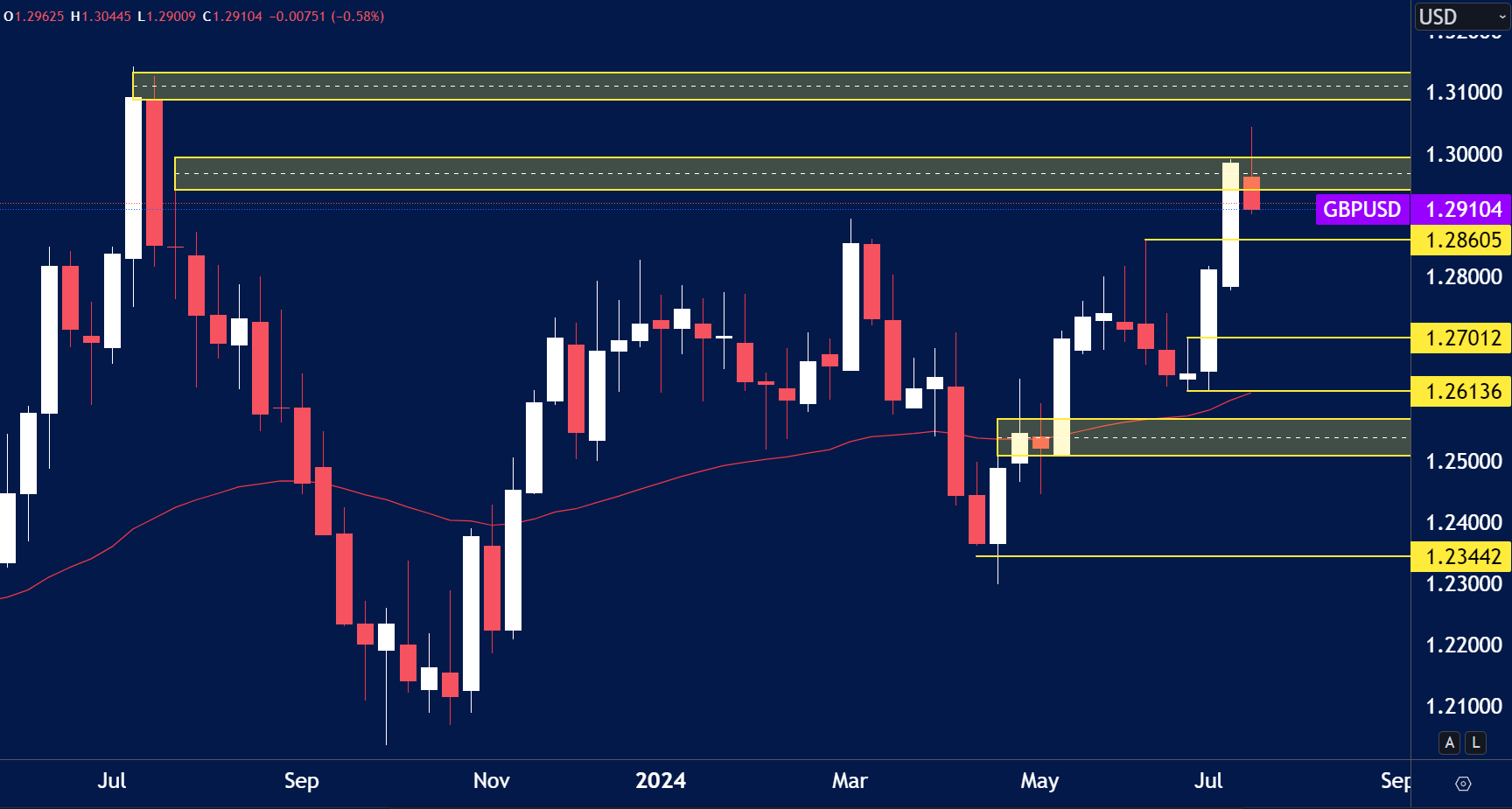

GBP/USD

The price on the chart has traded through multiple technical levels and some observations included:

- The GBP/USD price failed to close above the 1.3000 handle, this could be profit taking from the traders that were long from the 1.2600 lows.

- If that is the case then we could see a move towards 1.2800 this week.

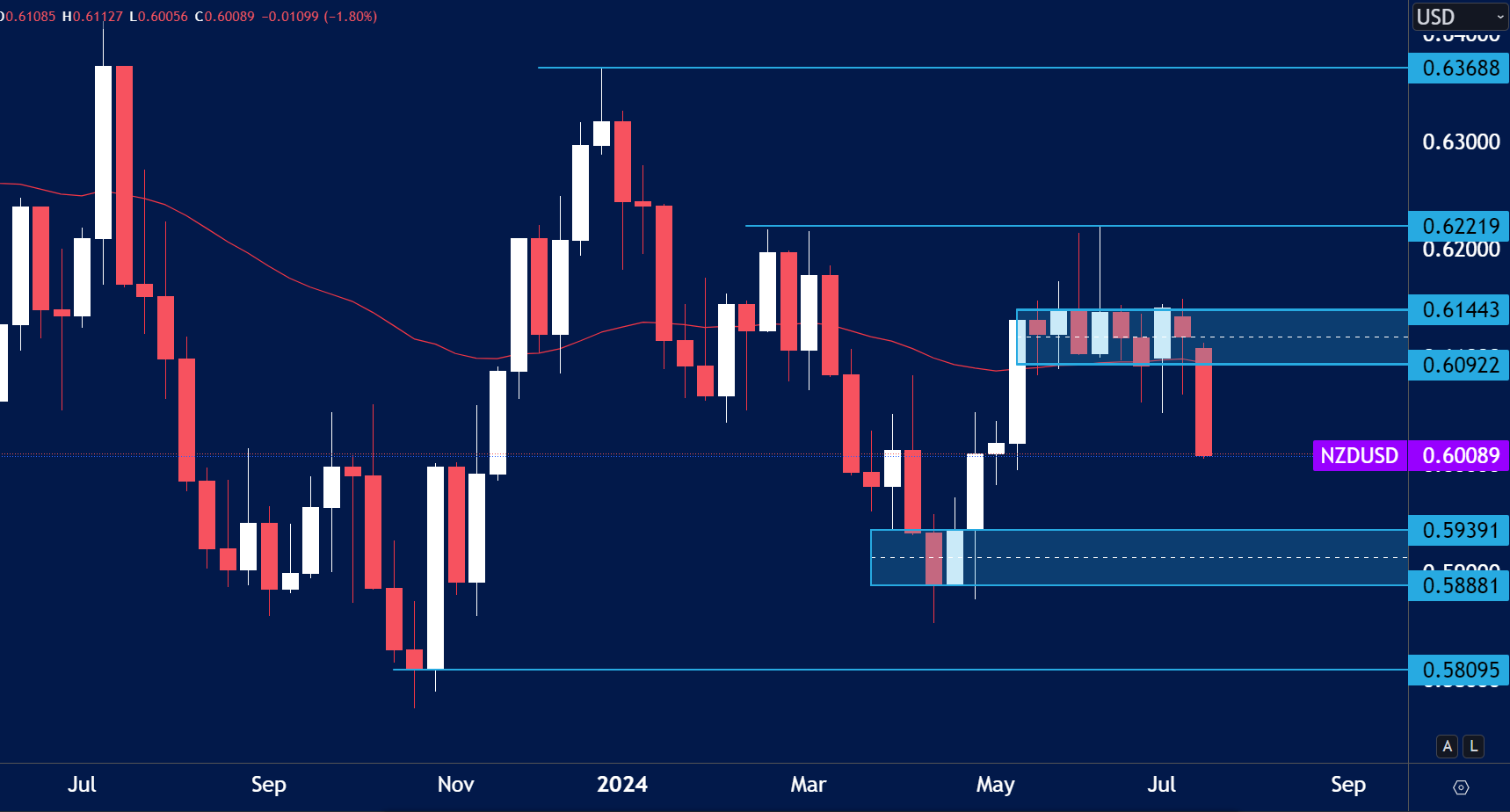

NZD/USD

The price on the chart has traded through multiple technical levels and some observations included:

- The New Zealand dollar is the weakest currency as of now, and if this continues we could see NZD/USD fall aggressively on any USD strength.

- Now the price has traded through the key range we could expect a push towards 0.5940.

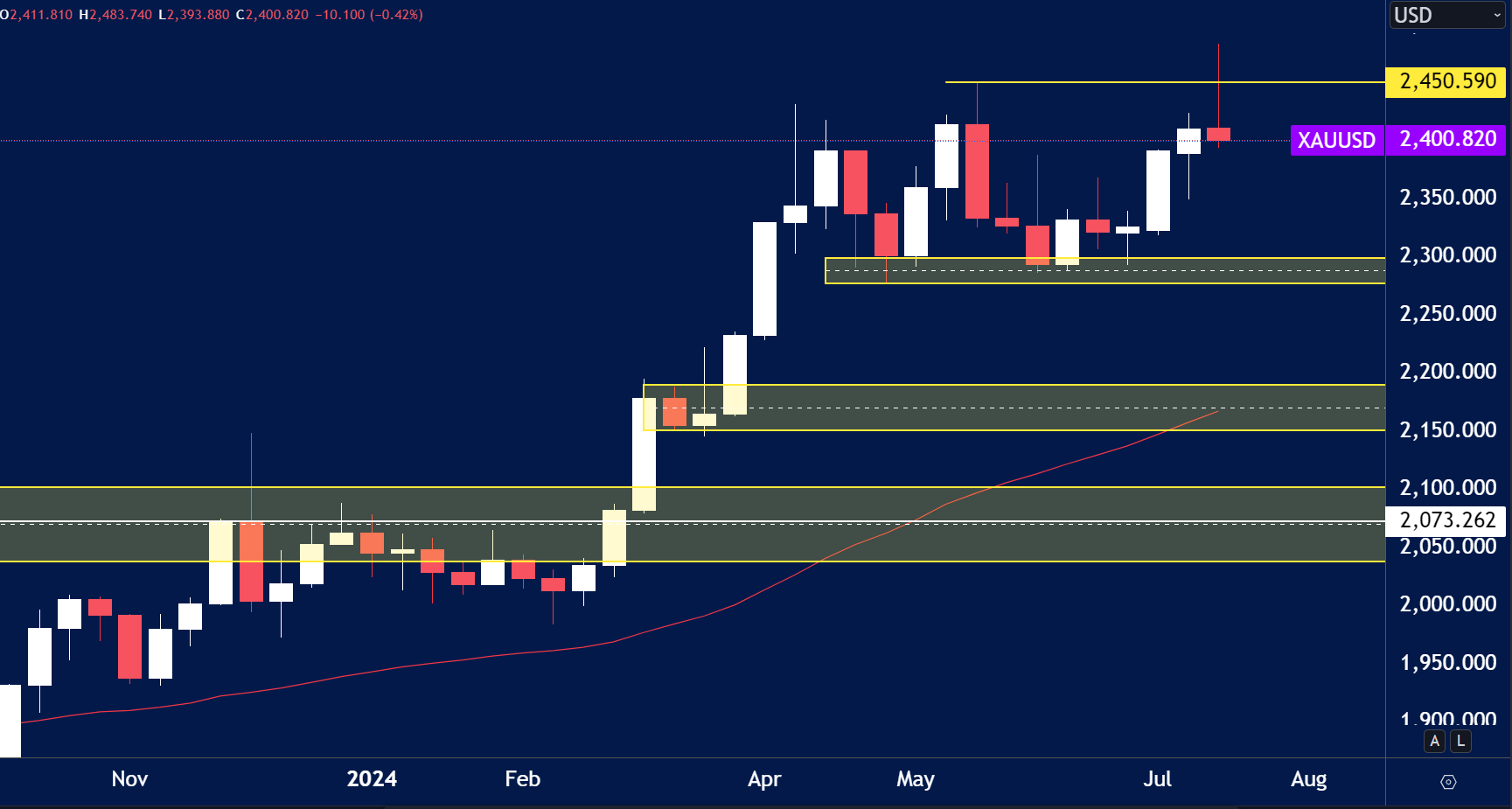

GOLD

The price on the chart has traded through multiple technical levels and some observations included:

- The Gold prices failed to close above the previous highs of $2,450 last week despite a new high forming.

- This could be profit taking by the institutions and could put doubt in buyers minds going into this trading week. If price trades lower here we could retest the weekly swing lows around $2,300.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.