📈 Upcoming Forex Week Alert! Keep an eye on the AUD CPI, BOE Governor's speech, and key US CPI & PPI data. Will these shape your trading strategy? Stay ahead in the game! 💹🌍 #ForexTrading #TradingInsights #EconomicData #CurrencyWatch

Watch the video to learn more...

Forex Week Ahead Analysis

The upcoming week in the forex market is poised to be an eventful one, with key economic data and speeches that could significantly sway market sentiment and currency valuations. Traders and investors should closely monitor these developments to make informed decisions.

Australian CPI Data: A Crucial Indicator

A significant highlight of the week will be the release of the Australian Consumer Price Index (CPI) data on a year-over-year basis. The CPI is a critical indicator of inflation, reflecting the changes in the cost of living by measuring the price change of a basket of goods and services. The forecast suggests a slight decrease from 4.9% to 4.5%. This drop, if realized, could signal easing inflationary pressures in Australia, potentially influencing the Reserve Bank of Australia's monetary policy decisions. The Australian Dollar (AUD) could see fluctuations based on these results, as forex markets often react sharply to any changes in inflation indicators.

Bank of England Governor Bailey's Speech

Another key event to watch is the speech by Andrew Bailey, the Governor of the Bank of England. His address is highly anticipated as market participants will be looking for any hints or updates regarding the UK's monetary policy. The focus will be on his views about the UK's economic outlook, inflation, and interest rates. Any unexpected remarks or indications of future policy shifts could lead to significant volatility in the Pound Sterling (GBP).

US CPI and PPI Forecasts

From the United States, two important data releases are on the horizon – the Consumer Price Index (CPI) and the Producer Price Index (PPI), both measured on a month-over-month basis. The CPI, an essential measure of retail inflation, is forecasted to climb from 0.1% to 0.2%. Similarly, the PPI, which tracks changes in the selling prices received by domestic producers for their output, is expected to rise from 0.0% to 0.1%. These indicators are pivotal in assessing inflationary trends in the US economy, which in turn can influence the Federal Reserve's interest rate decisions. A higher-than-expected rise could strengthen the case for more aggressive monetary tightening, potentially impacting the US Dollar (USD).

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- Price traded towards the key resistance of 102.50 and failed to close above on the daily chart.

- This could show buyers failing to gain momentum above the 102.50 highs.

- A close above this level would be needed to see USD strength continue.

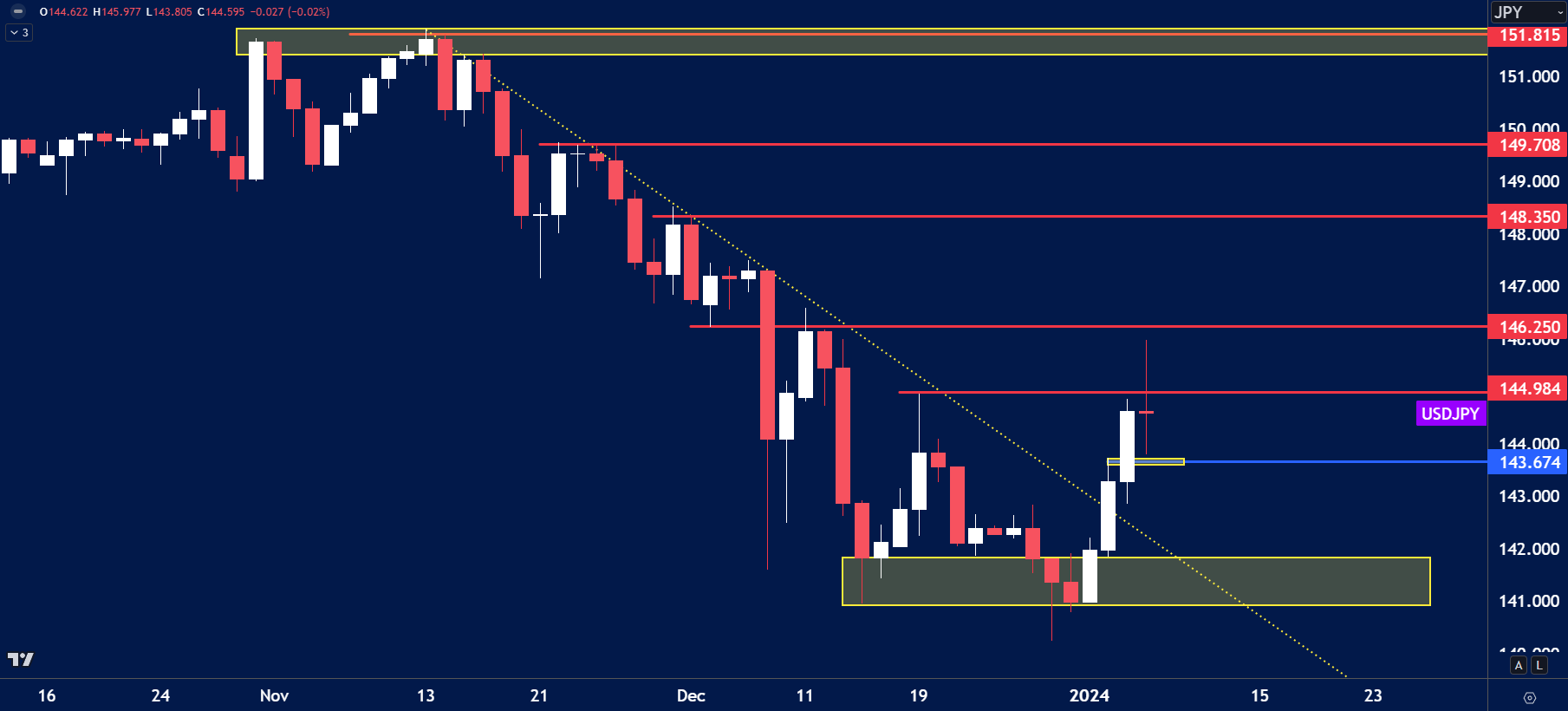

USDJPY

The price on the chart has traded through multiple technical levels and some observations included:

- JPY weakened significantly last week, which saw the USDJPY price rally from 141.00 to 145.00.

- Price has failed above the key resistance highs of 145.00, this could see price pull back this week.

- However, minor support can be found at 143.67, buying here could be the catalyst to see price trade higher.

GBPJPY

The price on the chart has traded through multiple technical levels and some observations included:

- Price of GBPJPY is largely in a trading range between 184.00 highs and 179.00 lows. The price is currently at the range highs.

- A breach of the range highs could signal a longer term bullish move back to the December 23 highs of 188.00.

USDCAD

The price on the chart has traded through multiple technical levels and some observations included:

- Price of USDCAD found support at the weekly range lows of 1.3200.

- Since then on the H4 time frame price has risen above the 50 moving average and is holding above 1.3300.

- Price of USDCAD could trade to the highs of the weekly range at 1.3900.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry today.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.