🌐 Stay ahead in Forex trading! 📈 US data sparks inflation fears while central banks hold steady. What's next for currencies? Stay informed, stay sharp! 💼💰 #Forex #MarketAnalysis #StayInformed

Watch the video to learn more...

Navigating the Forex Markets: A Week Ahead Analysis

- Attention remains on US data following robust job numbers in March

- US Core CPI forecasted to decrease, but job growth raises inflation worries. Inflation uptick could bolster USD, leading to stock declines.

- RBNZ is likely to hold rates steady at 5.50% amid still elevated inflation.

- Bank of Canada expected to maintain rates at 5.00%, buoyed by rising oil prices.

- ECB set to keep rates at 4.50%, despite calls for rate cuts, as Eurozone inflation sits within target range.

The spotlight once again falls on the United States, where recent job numbers have stirred up questions about Federal Reserve policy.

Following a robust addition of 303,000 jobs in March, speculation abounds regarding the Federal Reserve's stance on interest rates.

While the job growth is impressive, it raises concerns about potential inflationary pressures.

This week, all eyes are on the Core Consumer Price Index (CPI), which is expected to show a decrease of 0.4%, contrasting with the previous month's figure of 0.3%.

Should inflation rear its head, we might witness a scenario where the USD strengthens, stocks retreat, and bonds rally.

Shifting our focus to central bank activity, the Reserve Bank of New Zealand (RBNZ) is anticipated to maintain its interest rates at 5.50%.

This decision seems prudent given the country's inflation rate, which although declining, remains above the target range at 4.7% as of Q4 2023.

Similarly, the Bank of Canada is expected to keep its rates unchanged at 5.00%, with the recent surge in oil prices likely providing support for this decision.

Across the Atlantic, the European Central Bank (ECB) is poised to keep its rates steady at 4.50%.

Despite mounting pressure from some analysts urging for rate cuts, the ECB seems inclined to maintain its current stance.

Notably, inflation in the Eurozone sits comfortably within the target range of 2-3%, resting at 2.4%.

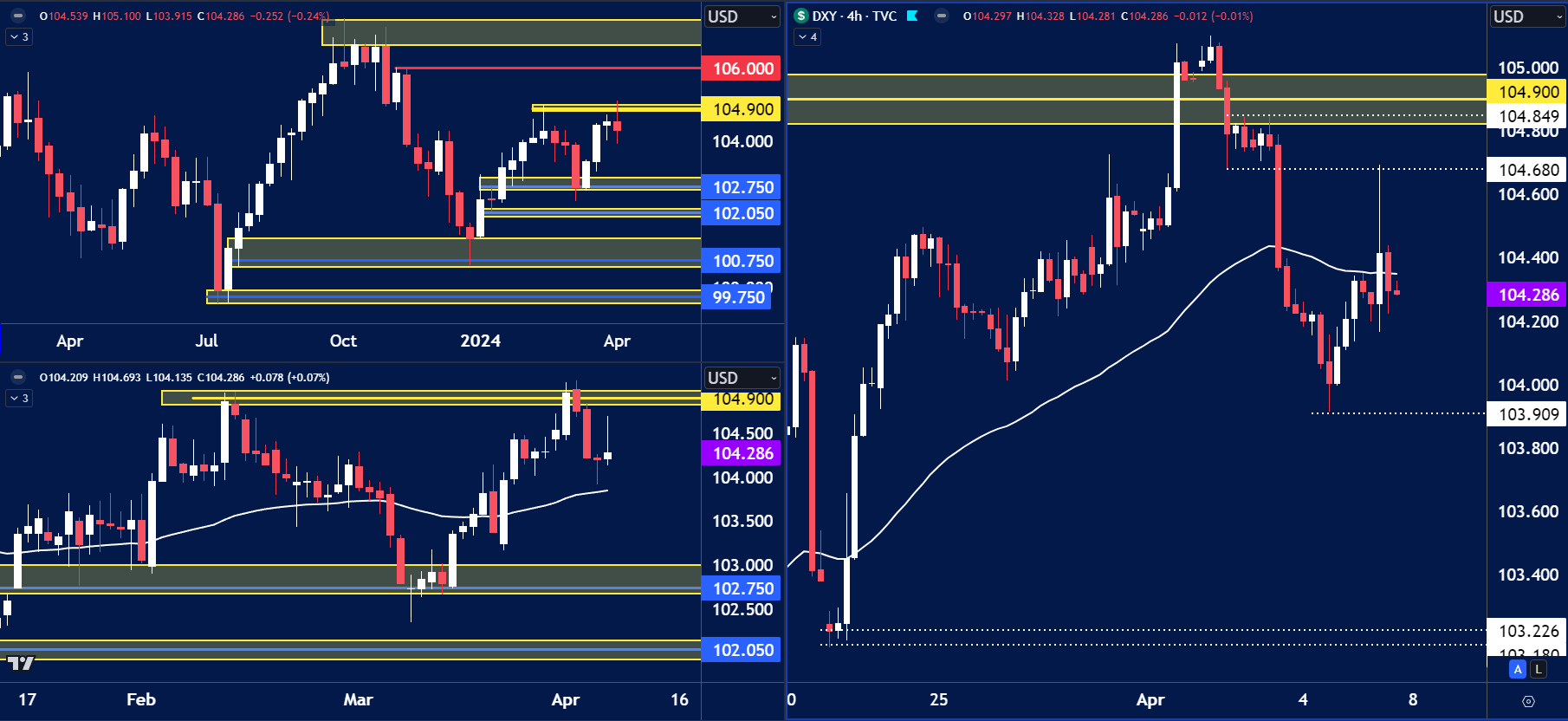

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- Price remains below the key weekly resistance level of 104.90.

- If the inflation rate climbs we could see this level tested once again.

- A break above would see price trade towards 106.00, a hold below 104.90 would see price trade towards 103.00.

EURUSD

The price on the chart has traded through multiple technical levels and some observations included:

- EURUSD rallied last week into the key daily swing highs of 1.0860.

- If USD strength enters the market price could retest the lows towards 1.0750

- A break of 1.0860 could lead to a rally towards 1.0950.

USDCAD

The price on the chart has traded through multiple technical levels and some observations included:

- Price currently holds below the key 1.3600 handle.

- A dovish stance from the BoC this week could see price trade above this level.

- If price holds below this level it could lead to some downside.

NZDUSD

The price on the chart has traded through multiple technical levels and some observations included:

- NZDUSD weekly chart shows price in a downward trend but finding support at 0.5950.

- This could see price trade towards 0.6050, a break above this level would offer opportunities to 0.6200.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.